In this digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Be it for educational use such as creative projects or simply adding an individual touch to your area, Recovery Rebate Credit For Married Filing Jointly have become a valuable resource. We'll take a dive to the depths of "Recovery Rebate Credit For Married Filing Jointly," exploring their purpose, where they are available, and how they can enrich various aspects of your lives.

Get Latest Recovery Rebate Credit For Married Filing Jointly Below

Recovery Rebate Credit For Married Filing Jointly

Recovery Rebate Credit For Married Filing Jointly - Recovery Rebate Credit 2021 For Married Filing Jointly

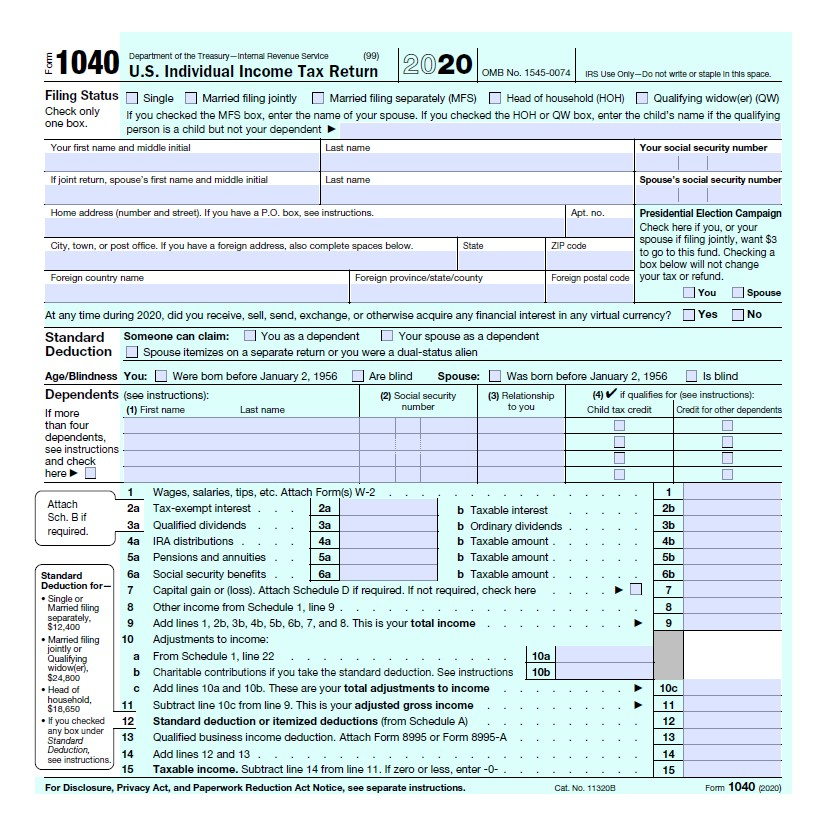

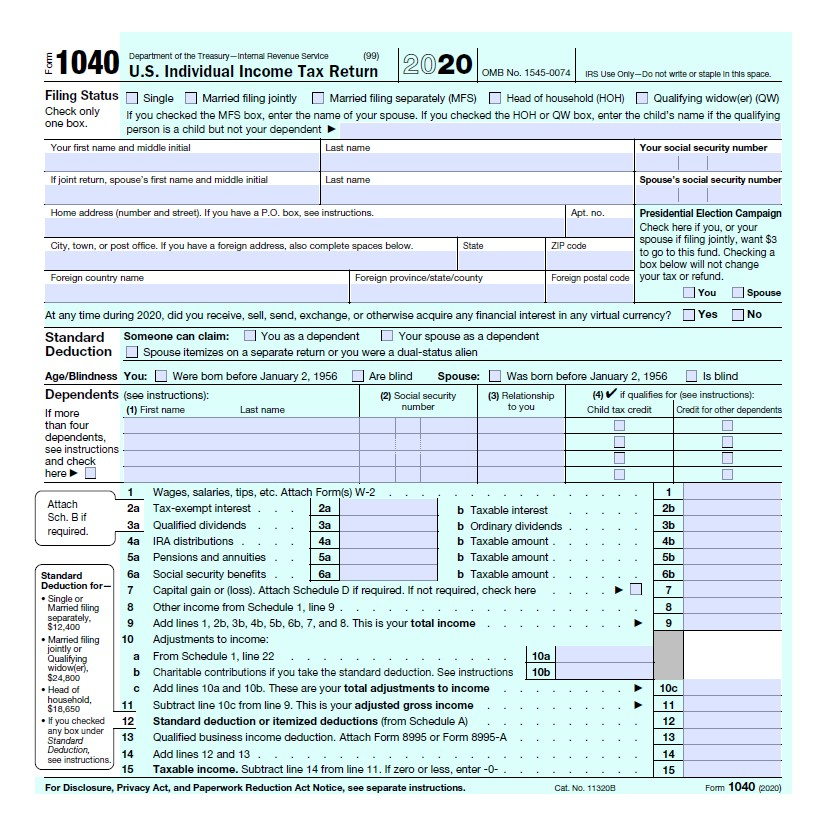

Web 2020 Recovery Rebate Credits for example with adjusted gross income of more than 75 000 if filing as single or 150 000 if filing as married filing jointly However the

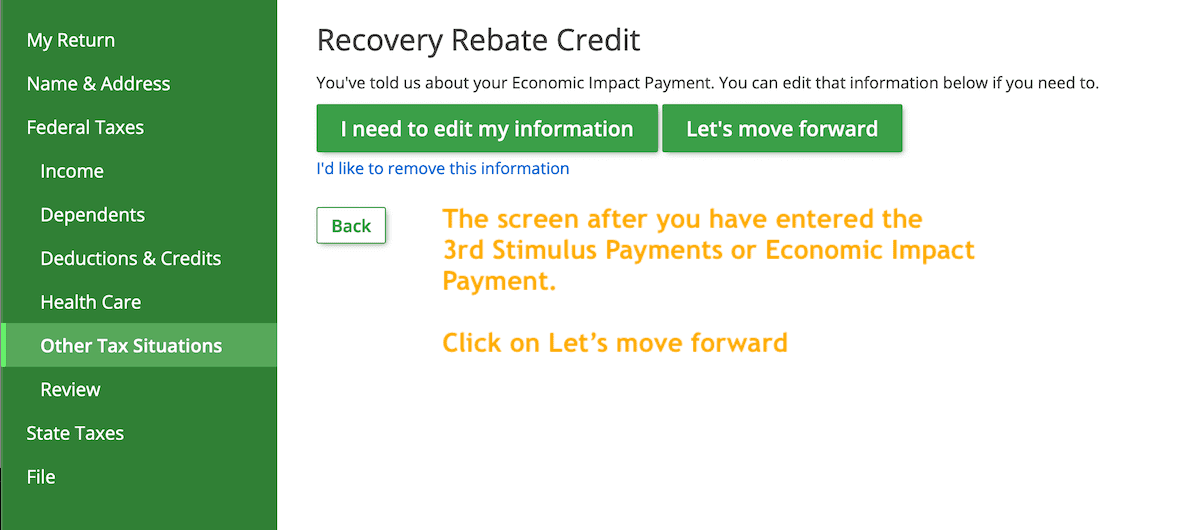

Web 13 janv 2022 nbsp 0183 32 Married persons who didn t receive the third Economic Impact Payment should determine their eligibility for the Recovery Rebate Credit when filing their 2021

Printables for free include a vast range of printable, free material that is available online at no cost. They come in many types, like worksheets, coloring pages, templates and much more. One of the advantages of Recovery Rebate Credit For Married Filing Jointly is their versatility and accessibility.

More of Recovery Rebate Credit For Married Filing Jointly

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

Web 10 d 233 c 2021 nbsp 0183 32 A7 If you are filing your 2020 return with your deceased spouse as married filing jointly you should enter 2 400 on line 5 of the worksheet and 1 200 on line 8 of

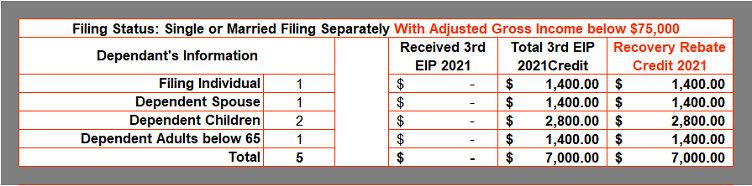

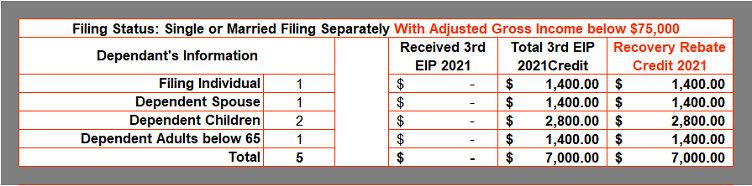

Web 14 janv 2022 nbsp 0183 32 In most cases the 2021 EIP or recovery rebate credit amount is 1 400 for each eligible individual or double that amount for married couples filing jointly where

Recovery Rebate Credit For Married Filing Jointly have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: They can make printables to fit your particular needs for invitations, whether that's creating them to organize your schedule or even decorating your house.

-

Educational Benefits: Educational printables that can be downloaded for free cater to learners from all ages, making them an essential instrument for parents and teachers.

-

Accessibility: Quick access to a variety of designs and templates reduces time and effort.

Where to Find more Recovery Rebate Credit For Married Filing Jointly

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Web 150 000 if married and filing a joint return or if filing as a qualifying widow or widower 112 500 if filing as head of household or 75 000 for eligible individuals using any

Web 31 janv 2023 nbsp 0183 32 This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns This letter provides the total

If we've already piqued your interest in printables for free We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Recovery Rebate Credit For Married Filing Jointly for various objectives.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing Recovery Rebate Credit For Married Filing Jointly

Here are some innovative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Recovery Rebate Credit For Married Filing Jointly are an abundance of practical and innovative resources for a variety of needs and hobbies. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the many options of Recovery Rebate Credit For Married Filing Jointly now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Recovery Rebate Credit For Married Filing Jointly really cost-free?

- Yes they are! You can print and download these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's all dependent on the usage guidelines. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright issues when you download Recovery Rebate Credit For Married Filing Jointly?

- Some printables may contain restrictions in their usage. Be sure to read the terms and conditions offered by the creator.

-

How do I print Recovery Rebate Credit For Married Filing Jointly?

- You can print them at home with either a printer at home or in the local print shops for the highest quality prints.

-

What software is required to open printables that are free?

- The majority of printables are in the format PDF. This can be opened with free programs like Adobe Reader.

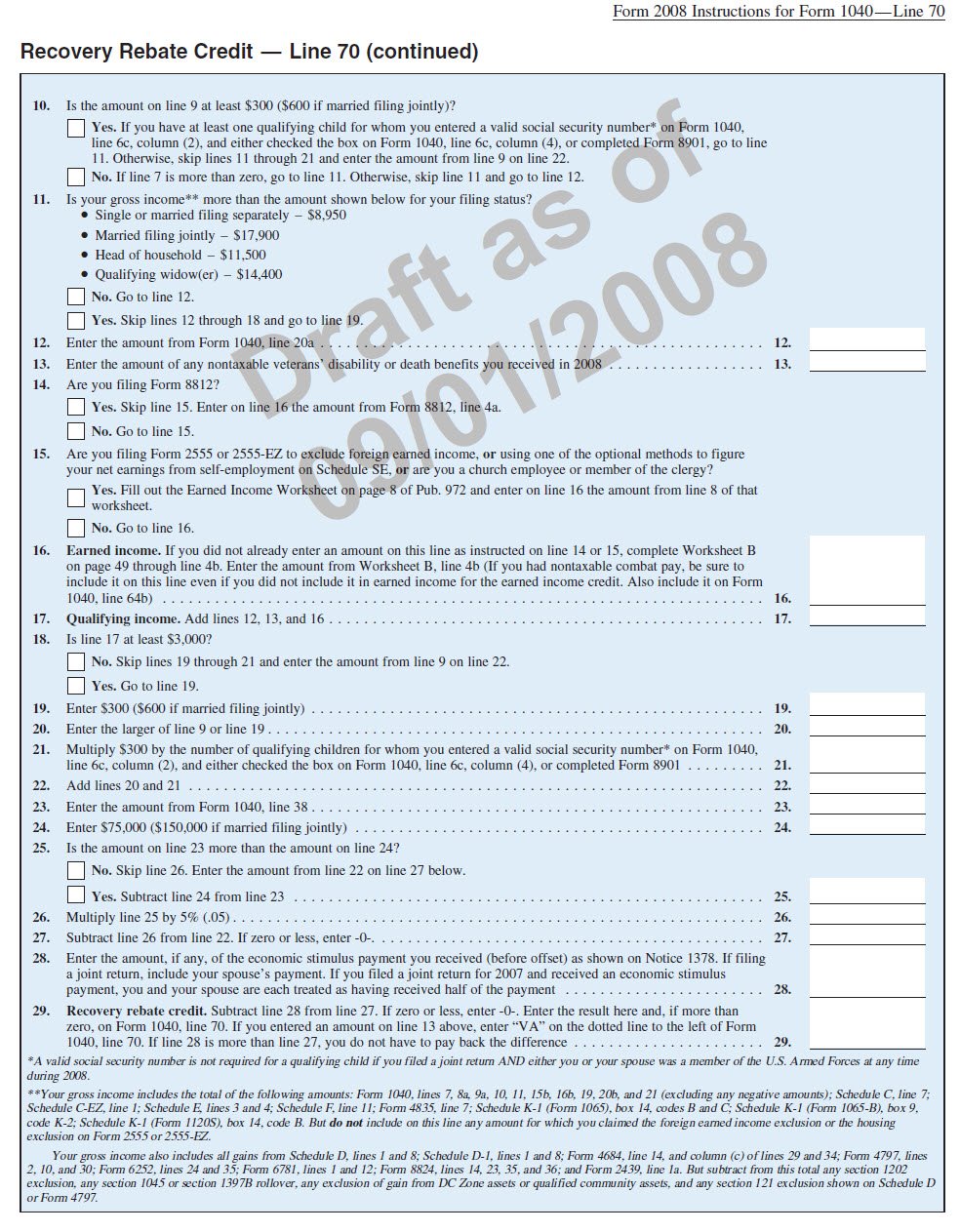

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Check more sample of Recovery Rebate Credit For Married Filing Jointly below

The Recovery Rebate Credit Calculator MollieAilie

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Strategies To Maximize The 2021 Recovery Rebate Credit

1040 Recovery Rebate Credit Drake20

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Recovery Credit Printable Rebate Form

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Married persons who didn t receive the third Economic Impact Payment should determine their eligibility for the Recovery Rebate Credit when filing their 2021

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

Web 13 janv 2022 nbsp 0183 32 Married persons who didn t receive the third Economic Impact Payment should determine their eligibility for the Recovery Rebate Credit when filing their 2021

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

1040 Recovery Rebate Credit Drake20

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Recovery Credit Printable Rebate Form

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit 2022 What Is It Rebate2022

Recovery Rebate Credit 2022 What Is It Rebate2022

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style