In the digital age, where screens dominate our lives, the charm of tangible printed products hasn't decreased. If it's to aid in education as well as creative projects or simply adding an element of personalization to your area, Rebate Under Section 10 can be an excellent source. In this article, we'll take a dive deep into the realm of "Rebate Under Section 10," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Rebate Under Section 10 Below

Rebate Under Section 10

Rebate Under Section 10 -

Gratuity received by an employee from their employer is exempt from tax under Section 10 10 of the Income Tax Act 1961 As per the latest amendment the exemption limit is up to Rs 20 lakhs

Under this Income Tax Act section tax rebate is given to salaried professionals Offers tax exemptions such as tuition fee for children s education travel allowance rent allowance

Rebate Under Section 10 include a broad selection of printable and downloadable documents that can be downloaded online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages, and more. The appealingness of Rebate Under Section 10 is their flexibility and accessibility.

More of Rebate Under Section 10

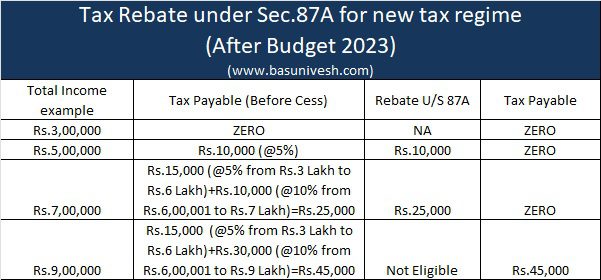

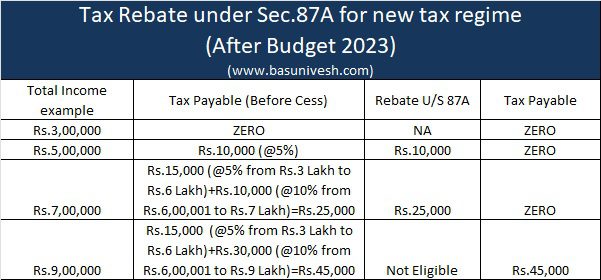

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

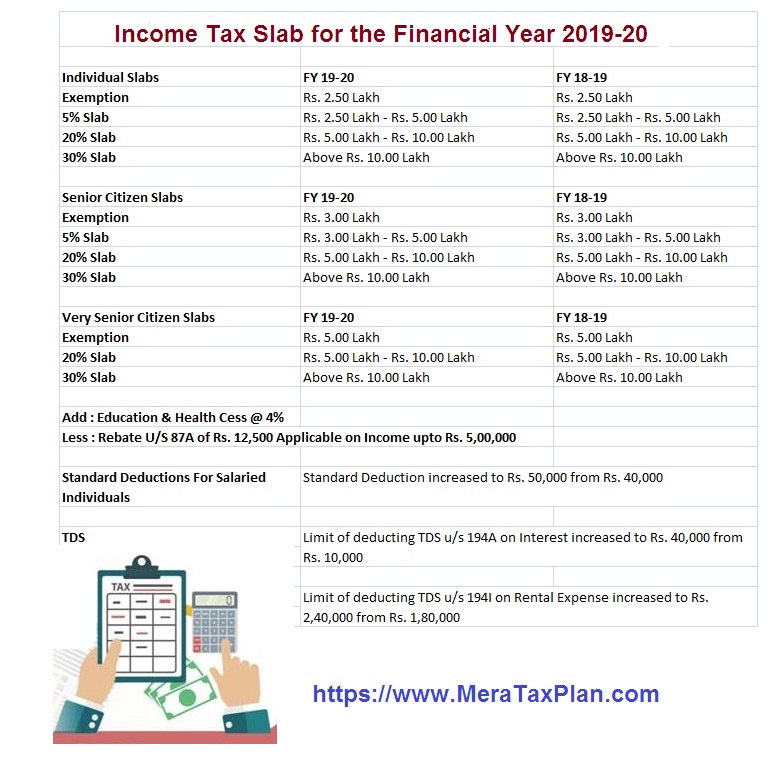

Who Is Eligible to Claim Exemption Under Section 10 of the Income Tax Act Usually people below the age of 60 are eligible to get a basic tax exemption limit of 2 50 Lakhs For senior

The tax rebate that is given to salaried people falls under this section of the Income Tax Act 1961 Here is a list of the exemptions Special Individuals Receiving Allowances Exempt

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize the design to meet your needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Benefits: Downloads of educational content for free cater to learners of all ages, making the perfect instrument for parents and teachers.

-

It's easy: You have instant access a myriad of designs as well as templates reduces time and effort.

Where to Find more Rebate Under Section 10

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

In Budget 2023 the exemption threshold for leave encashment was increased 8 fold from 3 lakhs to 25 lakhs for non government employees Thus at the time of retirement leave

However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly

We hope we've stimulated your interest in printables for free Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Rebate Under Section 10 designed for a variety goals.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, that range from DIY projects to party planning.

Maximizing Rebate Under Section 10

Here are some inventive ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Rebate Under Section 10 are an abundance with useful and creative ideas which cater to a wide range of needs and interests. Their accessibility and flexibility make them a great addition to any professional or personal life. Explore the plethora of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can download and print these documents for free.

-

Can I download free printing templates for commercial purposes?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Rebate Under Section 10?

- Certain printables could be restricted on their use. Be sure to read the terms and condition of use as provided by the author.

-

How do I print Rebate Under Section 10?

- Print them at home using either a printer at home or in a local print shop for top quality prints.

-

What software do I require to open Rebate Under Section 10?

- Most PDF-based printables are available in the format PDF. This can be opened using free software like Adobe Reader.

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A

Check more sample of Rebate Under Section 10 below

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Section 87A Income Tax Rebate Eligibility How To Claim It

What Is Rebate Under Section 87A And Who Can Claim It

https://www.bankbazaar.com/tax/special-allowance...

Under this Income Tax Act section tax rebate is given to salaried professionals Offers tax exemptions such as tuition fee for children s education travel allowance rent allowance

https://www.turtlemint.com/section-10-tax-exemptions

Section 10 of the Income Tax Act allows a list of exemptions which are available to tax payers both salaried as well as non salaried individuals You can claim an exemption

Under this Income Tax Act section tax rebate is given to salaried professionals Offers tax exemptions such as tuition fee for children s education travel allowance rent allowance

Section 10 of the Income Tax Act allows a list of exemptions which are available to tax payers both salaried as well as non salaried individuals You can claim an exemption

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

Section 87A Income Tax Rebate Eligibility How To Claim It

What Is Rebate Under Section 87A And Who Can Claim It

Section 87A Rebate For AY 2024 25 As Per Union Budget 2023 24

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate