In a world when screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses and creative work, or simply to add an element of personalization to your space, Rebate U S 89 Of Income Tax Act have become an invaluable source. This article will take a dive deeper into "Rebate U S 89 Of Income Tax Act," exploring their purpose, where they are available, and how they can improve various aspects of your life.

Get Latest Rebate U S 89 Of Income Tax Act Below

Rebate U S 89 Of Income Tax Act

Rebate U S 89 Of Income Tax Act - Relief U/s 89 Of Income Tax Act, Relief U/s 89(1) Of Income-tax Act, Calculation Of Relief U S 89 Of Income Tax Act, What Is Rebate U/s 89, How Is Section 89 Rebate Calculated

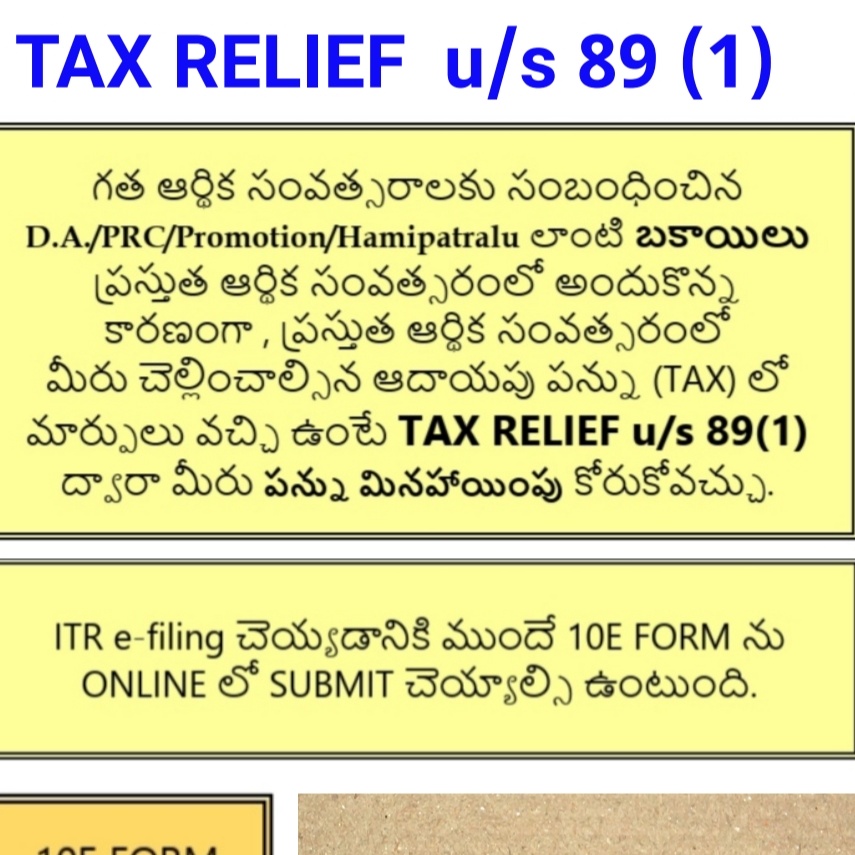

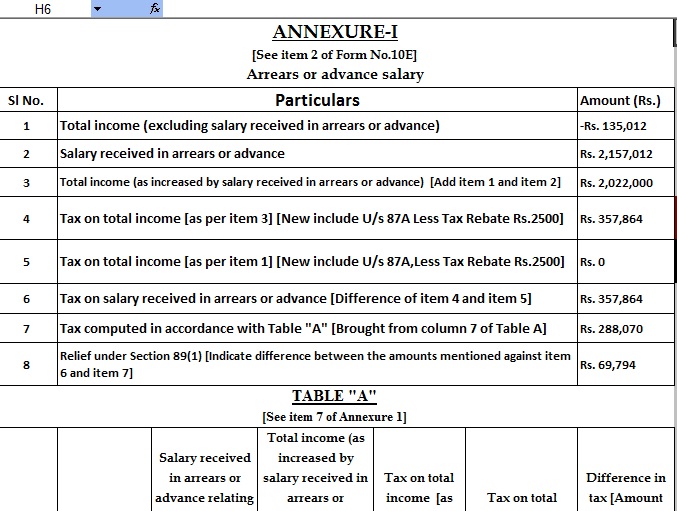

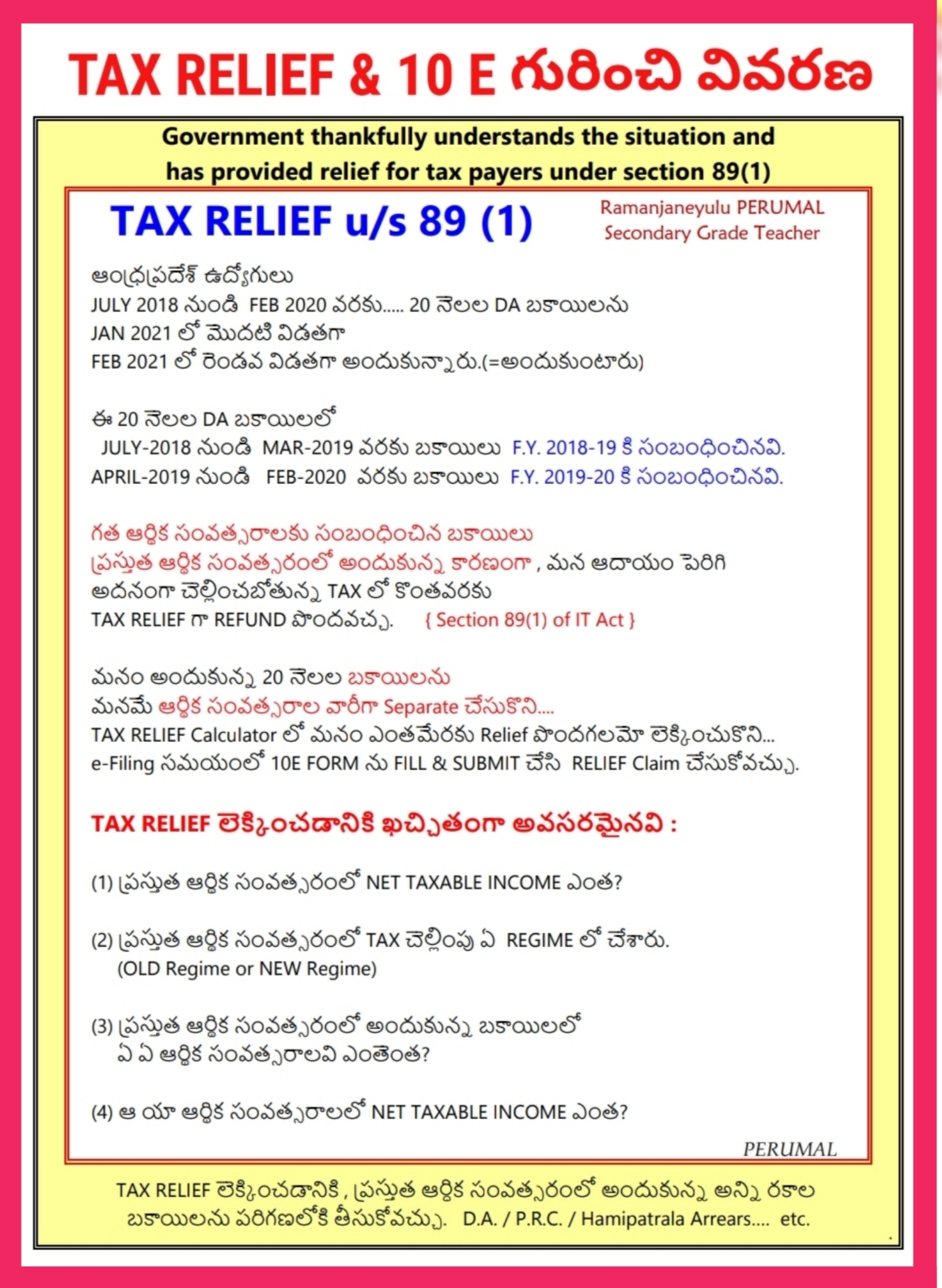

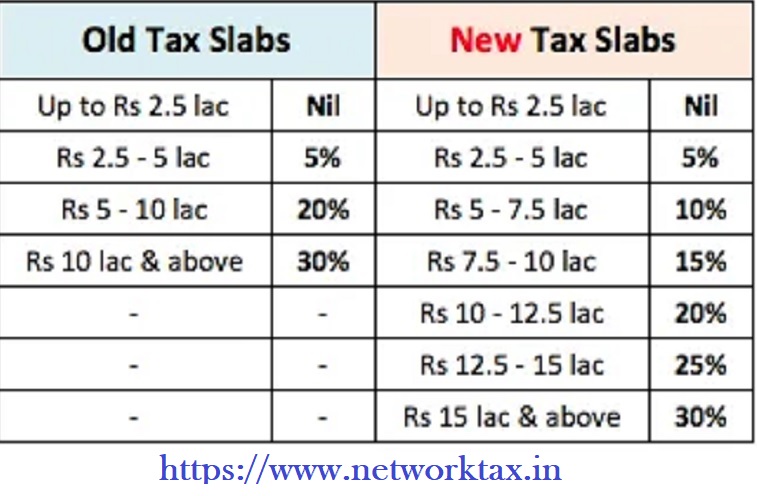

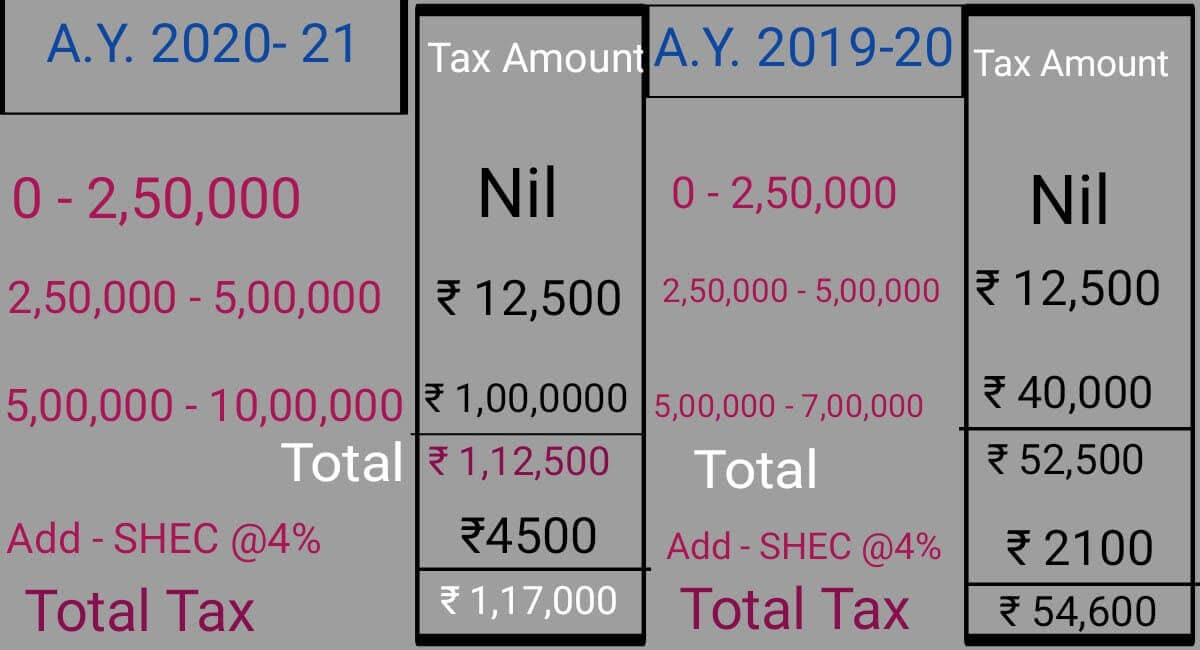

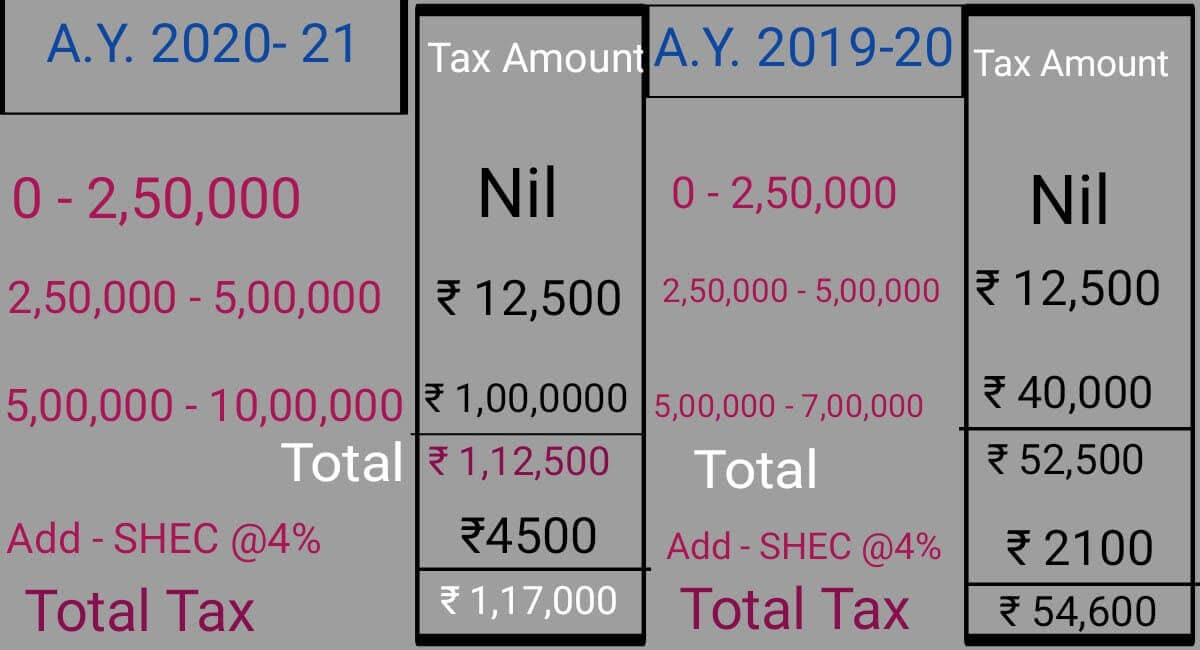

Web 3 nov 2022 nbsp 0183 32 Income Tax Rebate Eligibility And Types Of Tax Rebates In India Calculation of Relief under Section 89 Step 1 Compute the present year s tax due by adding the arrears in total income Step 2 Next

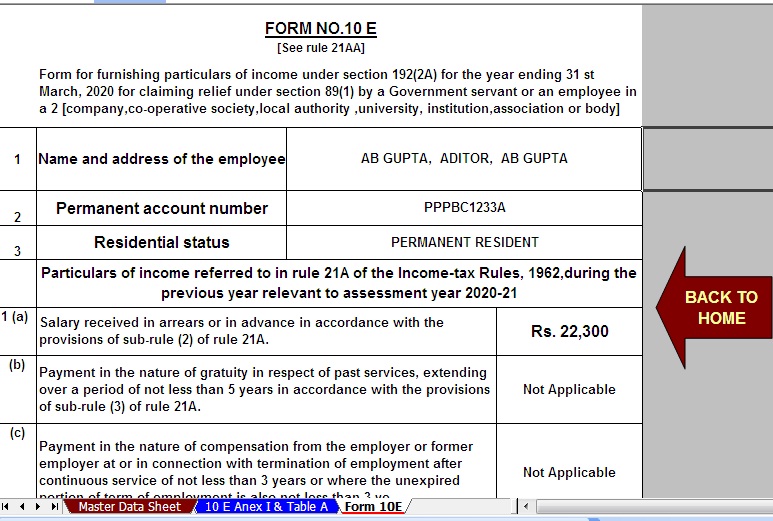

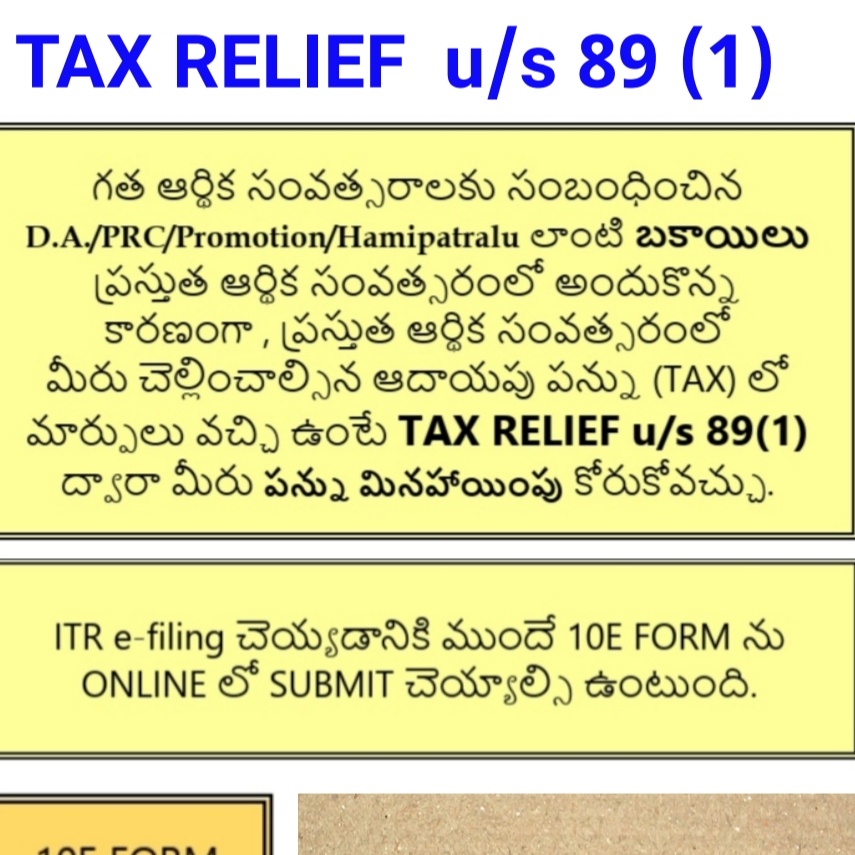

Web 4 janv 2022 nbsp 0183 32 Tax Relief Tax Rebate Meaning If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief

The Rebate U S 89 Of Income Tax Act are a huge collection of printable material that is available online at no cost. These materials come in a variety of forms, like worksheets coloring pages, templates and much more. The benefit of Rebate U S 89 Of Income Tax Act lies in their versatility as well as accessibility.

More of Rebate U S 89 Of Income Tax Act

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

Web 3 ao 251 t 2023 nbsp 0183 32 Section 89 1 of the Income Tax Act 1961 states that if an assessee s income has dues of salary from the previous year then the assessee can claim relief

Web 11 mai 2023 nbsp 0183 32 If the total income of a taxpayer includes any past salary paid in the current financial year and the tax slab rates are different in both years this may lead to higher tax dues Thus the Income Tax Act

Rebate U S 89 Of Income Tax Act have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: We can customize designs to suit your personal needs, whether it's designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Education-related printables at no charge provide for students of all ages, which makes them a valuable aid for parents as well as educators.

-

Affordability: Access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Rebate U S 89 Of Income Tax Act

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Web The Inflation Reduction Act also extended the tax break for residential charging systems through 2032 and made it retroactive to Jan 1 2022 It s worth 1 000 or 30 of the

Web opting for the New Tax Regime u s 115BAC except for deduction u s 80CCD 2 Rebate u s 87A The rebate is available to a resident individual if his total income does not

After we've peaked your curiosity about Rebate U S 89 Of Income Tax Act and other printables, let's discover where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Rebate U S 89 Of Income Tax Act for various needs.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide range of interests, that includes DIY projects to party planning.

Maximizing Rebate U S 89 Of Income Tax Act

Here are some new ways how you could make the most of Rebate U S 89 Of Income Tax Act:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Rebate U S 89 Of Income Tax Act are an abundance of practical and innovative resources for a variety of needs and interest. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the many options of Rebate U S 89 Of Income Tax Act and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can print and download these documents for free.

-

Can I use the free printables to make commercial products?

- It's all dependent on the usage guidelines. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright concerns when using Rebate U S 89 Of Income Tax Act?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms and condition of use as provided by the designer.

-

How do I print Rebate U S 89 Of Income Tax Act?

- Print them at home using the printer, or go to an area print shop for better quality prints.

-

What software do I require to view Rebate U S 89 Of Income Tax Act?

- Most printables come as PDF files, which can be opened with free software like Adobe Reader.

TAX RELIEF U S 89 1 APEdu

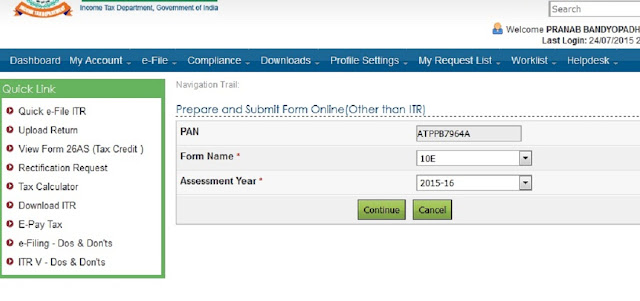

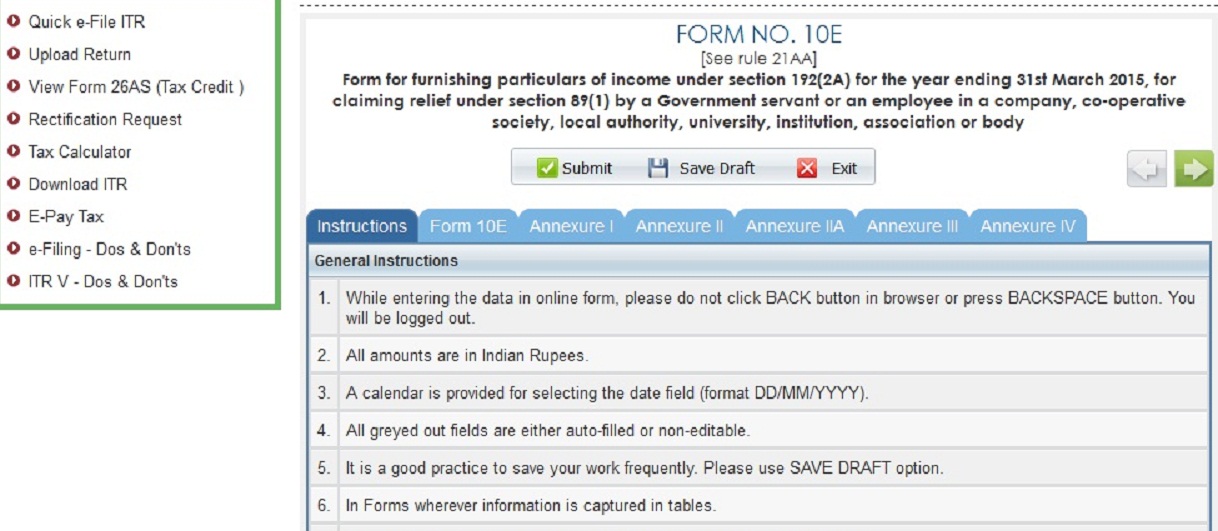

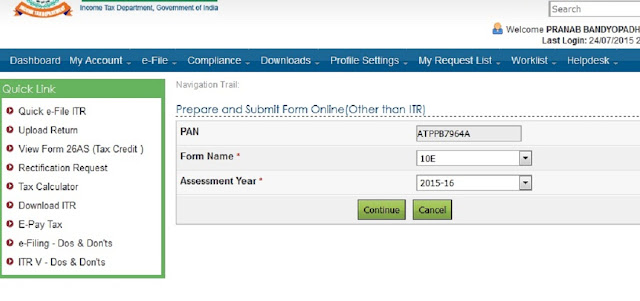

Now It Is Compulsory To Upload 10E Form For Claim Relief U s 89 1 To

Check more sample of Rebate U S 89 Of Income Tax Act below

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

Relief Under Section 89 Of Income Tax Act In Hindi 89

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

https://taxguru.in/income-tax/tax-relief-section-89-income-tax-act...

Web 4 janv 2022 nbsp 0183 32 Tax Relief Tax Rebate Meaning If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief

https://www.canarahsbclife.com/tax-university…

Web The advance or arrears received from an employer affect your taxes and are reflected in the year of receipt Relief under section 89 1 according to saves you from additional tax burden if there is a delay in receiving

Web 4 janv 2022 nbsp 0183 32 Tax Relief Tax Rebate Meaning If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief

Web The advance or arrears received from an employer affect your taxes and are reflected in the year of receipt Relief under section 89 1 according to saves you from additional tax burden if there is a delay in receiving

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

Relief Under Section 89 Of Income Tax Act In Hindi 89

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Section 89 Of Income Tax Act How To Claim Relief

Section 89 Of Income Tax Act How To Claim Relief

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U