In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding an individual touch to your home, printables for free have become a valuable resource. For this piece, we'll dive to the depths of "Rebate U S 87a As Per Income Tax Act," exploring what they are, how to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Rebate U S 87a As Per Income Tax Act Below

Rebate U S 87a As Per Income Tax Act

Rebate U S 87a As Per Income Tax Act -

Rebate under section 87A Section 87A of the Income Tax Act 1961 was introduced in Finance Act 2013 and was further amended As per Finance Act 2017 a

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

Rebate U S 87a As Per Income Tax Act encompass a wide assortment of printable content that can be downloaded from the internet at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages and many more. The benefit of Rebate U S 87a As Per Income Tax Act is their versatility and accessibility.

More of Rebate U S 87a As Per Income Tax Act

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax rebate u s 87A We can also easily claim an income

The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming the rebate here

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Use: These Rebate U S 87a As Per Income Tax Act are designed to appeal to students from all ages, making the perfect source for educators and parents.

-

Affordability: Access to the vast array of design and templates, which saves time as well as effort.

Where to Find more Rebate U S 87a As Per Income Tax Act

REBATE U S 87A INCOME TAX ACT REBATE 87A Rebate 87A

REBATE U S 87A INCOME TAX ACT REBATE 87A Rebate 87A

Rebate under section 87A is allowed from tax payable before levy of Education cess secondary and higher education cess Surcharge The amount of

What is Tax Rebate Under Section 87 A Steps to Claim Rebate Who is Eligible Things to Consider FAQs Understanding Rebate Under Section 87 A Income tax rules in India

Now that we've piqued your curiosity about Rebate U S 87a As Per Income Tax Act and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Rebate U S 87a As Per Income Tax Act designed for a variety reasons.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing Rebate U S 87a As Per Income Tax Act

Here are some fresh ways for you to get the best of Rebate U S 87a As Per Income Tax Act:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Rebate U S 87a As Per Income Tax Act are an abundance of useful and creative resources that cater to various needs and needs and. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the many options of Rebate U S 87a As Per Income Tax Act today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printouts for commercial usage?

- It's based on specific conditions of use. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with Rebate U S 87a As Per Income Tax Act?

- Certain printables might have limitations on use. Be sure to check the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using your printer or visit an in-store print shop to get the highest quality prints.

-

What program is required to open printables that are free?

- Most PDF-based printables are available in PDF format. These is open with no cost programs like Adobe Reader.

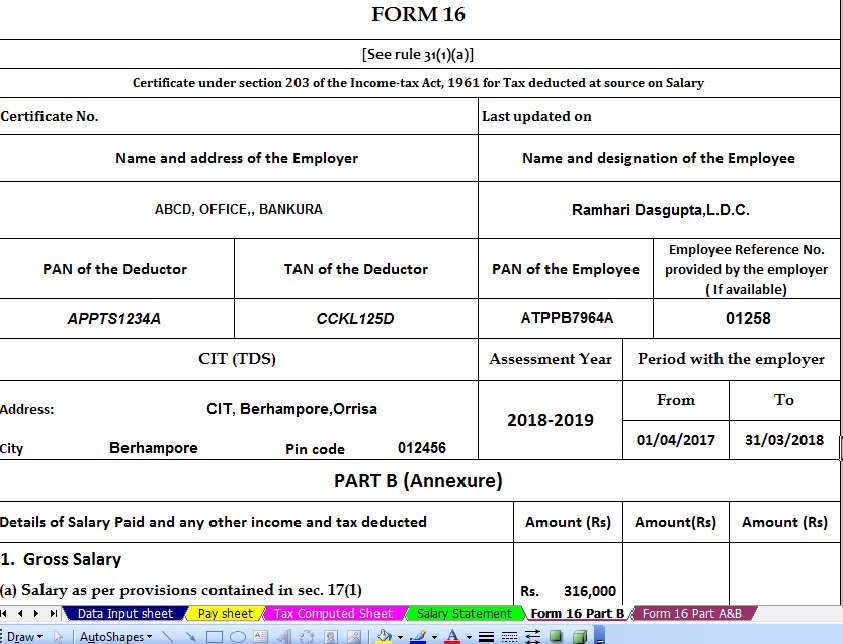

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

Income Tax Rebate U s 87A For The Financial Year 2022 23

Check more sample of Rebate U S 87a As Per Income Tax Act below

Income Tax Sec 87A Amendment Rebate YouTube

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Income Tax Rebate Under Section 87A

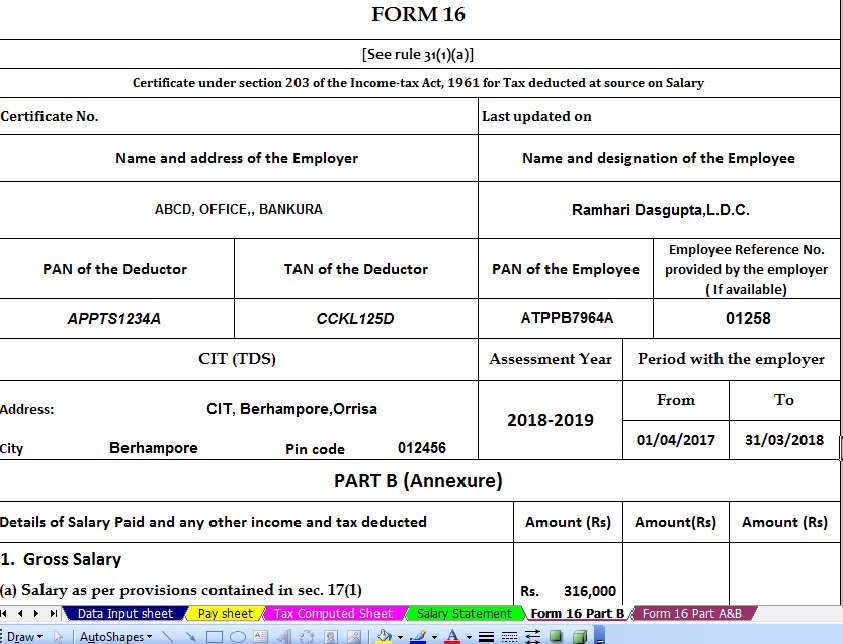

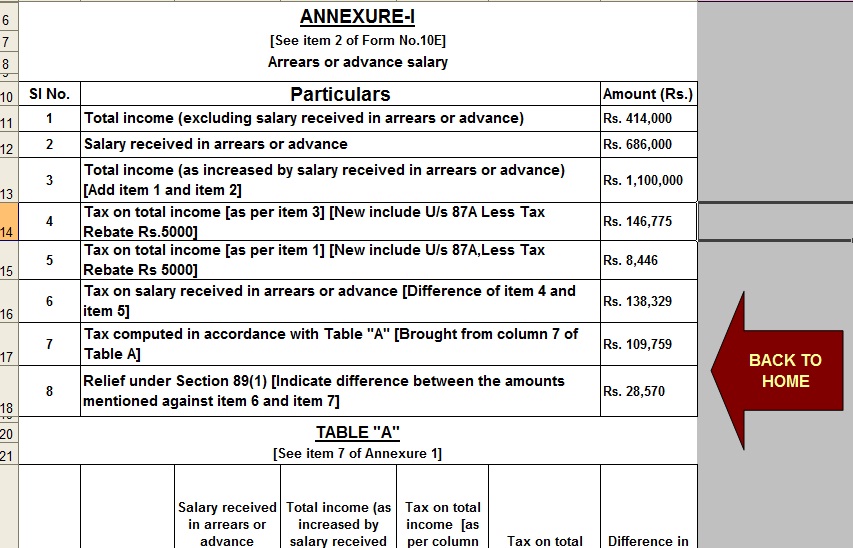

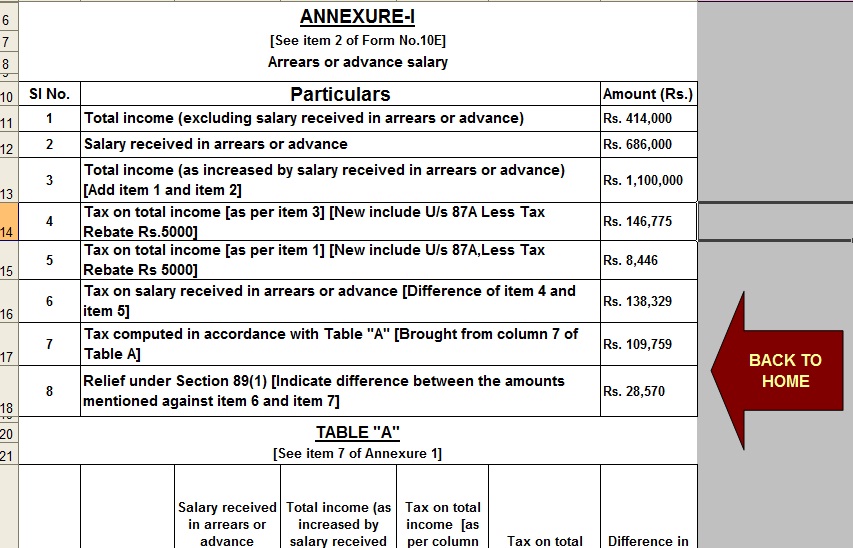

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://tax2win.in/guide/section-87a

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

https://taxguru.in/income-tax/marginal-relief-…

Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A Of I Tax Act Income Tax