In this age of technology, when screens dominate our lives The appeal of tangible, printed materials hasn't diminished. In the case of educational materials in creative or artistic projects, or just adding an individual touch to your space, Rebate For Short Term Capital Gain are a great source. For this piece, we'll take a dive in the world of "Rebate For Short Term Capital Gain," exploring what they are, how to find them and how they can improve various aspects of your daily life.

Get Latest Rebate For Short Term Capital Gain Below

Rebate For Short Term Capital Gain

Rebate For Short Term Capital Gain -

Therefore you can claim a section 87A rebate on your short term capital gains on equity shares and mutual funds The main aim of introducing Rebate under section 87A was to

As per Bombay Chartered Accountants Society the new ITR filing utilities are not allowing the rebate under section 87A for various special rate incomes including short term capital gains on equity shares or equity oriented

Printables for free cover a broad range of downloadable, printable documents that can be downloaded online at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Rebate For Short Term Capital Gain

Trust Capital Gains Tax Rate 2019 Tierra Durant

Trust Capital Gains Tax Rate 2019 Tierra Durant

After an updation of tax filing utility on the income tax portal this month taxpayers are being forced to give up a valid rebate of up to Rs 25 000 under the new tax regime if they have

Explore the ongoing issues of tax rebate under Section 87A for short term capital gains on shares following the new utility release on July 5 2024

Rebate For Short Term Capital Gain have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: We can customize the design to meet your needs such as designing invitations making your schedule, or decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them a valuable tool for teachers and parents.

-

Affordability: You have instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Rebate For Short Term Capital Gain

Gifts Of Long Term Vs Short Term Capital Gain Property Gordon

Gifts Of Long Term Vs Short Term Capital Gain Property Gordon

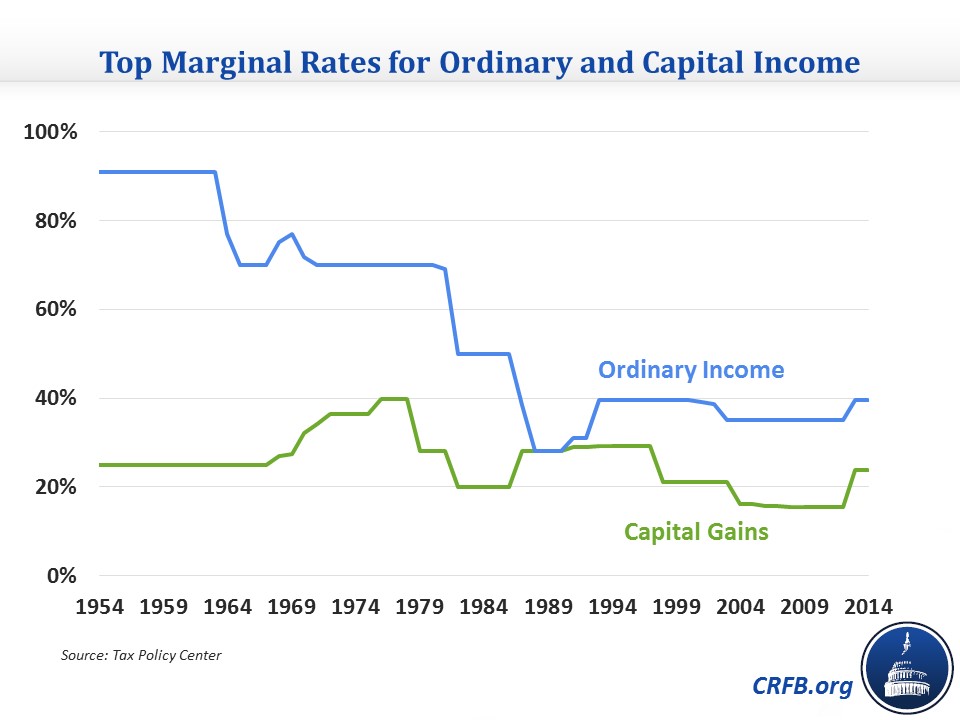

Short term capital gain under Section 111A is taxed at a concessional rate of 15 with applicable cess However with effect from 23rd July 2024 the tax on Short term capital

According to an earlier Economic Times report dated July 21 2024 the ITR filing utilities stopped allowing tax rebate under section 87A for various special rate incomes

Since we've got your curiosity about Rebate For Short Term Capital Gain We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Rebate For Short Term Capital Gain designed for a variety goals.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs covered cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Rebate For Short Term Capital Gain

Here are some ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Rebate For Short Term Capital Gain are an abundance of fun and practical tools which cater to a wide range of needs and passions. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the world of Rebate For Short Term Capital Gain to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these resources at no cost.

-

Does it allow me to use free printables for commercial uses?

- It's contingent upon the specific terms of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Rebate For Short Term Capital Gain?

- Some printables may come with restrictions concerning their use. You should read the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home using your printer or visit any local print store for more high-quality prints.

-

What program do I need to open printables that are free?

- The majority of printables are in PDF format. They is open with no cost software such as Adobe Reader.

Long Term Vs Short Term Capital Gains Tax

Know Everything About Short Term Capital Gain Tax MoneyInsight

Check more sample of Rebate For Short Term Capital Gain below

How Capital Gains Tax Is Calculated

Long term Capital Gains From Shares And Rebate Under Section 87A For

Short Term Vs Long Term Capital Gains Definition And Tax Rates

A Guide To Short term Vs Long term Capital Gains Tax Rates TheStreet

Understanding The Capital Gains Tax A Case Study

Short Term And Long Term Capital Gains Tax Rates By Income

https://economictimes.indiatimes.com…

As per Bombay Chartered Accountants Society the new ITR filing utilities are not allowing the rebate under section 87A for various special rate incomes including short term capital gains on equity shares or equity oriented

https://www.caclubindia.com/articles/rec…

Short term capital gains STCG on shares under Section 111A Long term capital gains LTCG Lottery winnings Income from gaming Before 5th July 2024 The ITR utility and tax calculator allowed the Section 87A

As per Bombay Chartered Accountants Society the new ITR filing utilities are not allowing the rebate under section 87A for various special rate incomes including short term capital gains on equity shares or equity oriented

Short term capital gains STCG on shares under Section 111A Long term capital gains LTCG Lottery winnings Income from gaming Before 5th July 2024 The ITR utility and tax calculator allowed the Section 87A

A Guide To Short term Vs Long term Capital Gains Tax Rates TheStreet

Long term Capital Gains From Shares And Rebate Under Section 87A For

Understanding The Capital Gains Tax A Case Study

Short Term And Long Term Capital Gains Tax Rates By Income

Short term Vs Long term Capital Gains Taxes explained Public

Juno Juno Explains Crypto Taxes

Juno Juno Explains Crypto Taxes

Calculator Carrot Corporation A Corporation As Amet Short Term