Today, when screens dominate our lives The appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add a personal touch to your area, Rebate 87a For Ay 2023 23 are a great resource. For this piece, we'll dive in the world of "Rebate 87a For Ay 2023 23," exploring the benefits of them, where they are, and how they can add value to various aspects of your daily life.

Get Latest Rebate 87a For Ay 2023 23 Below

Rebate 87a For Ay 2023 23

Rebate 87a For Ay 2023 23 -

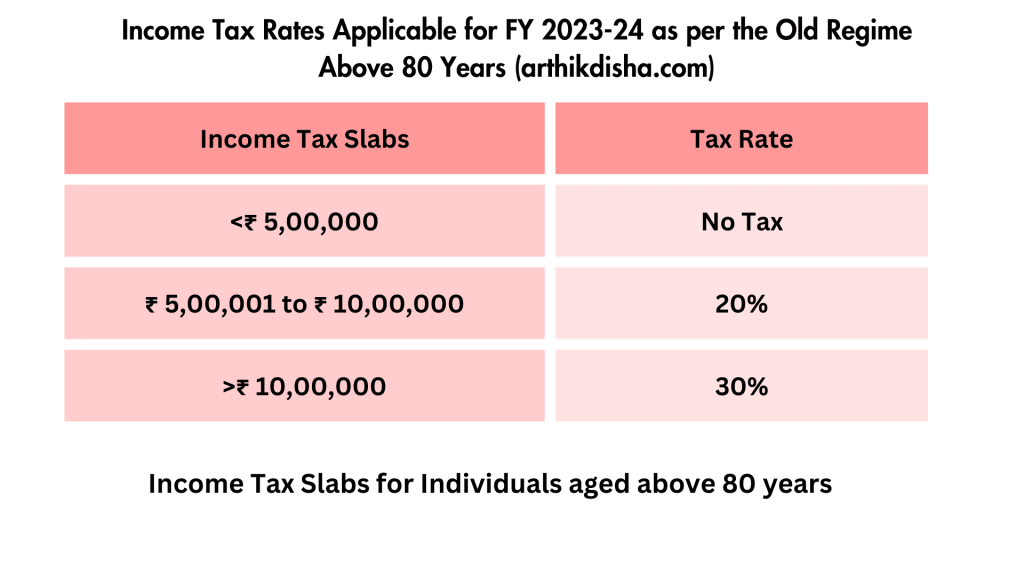

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower This applies to both the old and new tax regimes

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the amount of tax payable whichever is lower

The Rebate 87a For Ay 2023 23 are a huge selection of printable and downloadable documents that can be downloaded online at no cost. These resources come in various kinds, including worksheets templates, coloring pages and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Rebate 87a For Ay 2023 23

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been amended from time to time In the beginning the maximum limit of tax rebate under Section 87A of the Income Tax Act was 2 000

Rebate 87a For Ay 2023 23 have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: They can make designs to suit your personal needs be it designing invitations planning your schedule or even decorating your home.

-

Educational value: These Rebate 87a For Ay 2023 23 provide for students of all ages, which makes them a vital resource for educators and parents.

-

An easy way to access HTML0: immediate access various designs and templates saves time and effort.

Where to Find more Rebate 87a For Ay 2023 23

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

Individual assessee having total income up to 5 Lakhs can claim rebate of 12500 for AY 2023 24 under section 87A of Income Tax Act 1961 Amended and updated notes on section 87A of Income Tax Act 1961 as amended by the Finance Act 2022 and Income tax Rules 1962

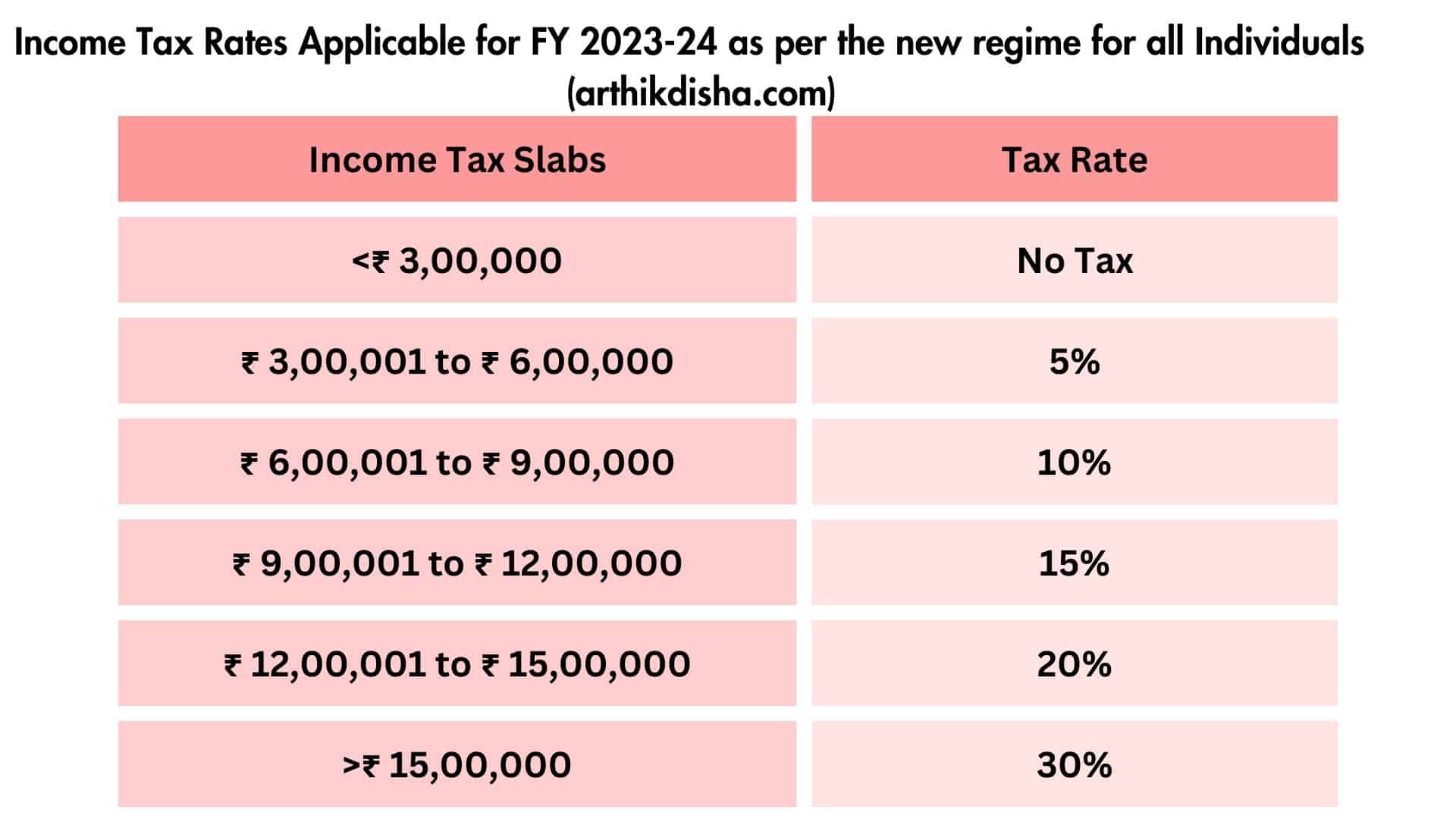

Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to

After we've peaked your interest in printables for free Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Rebate 87a For Ay 2023 23 for various applications.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a wide range of topics, from DIY projects to party planning.

Maximizing Rebate 87a For Ay 2023 23

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Rebate 87a For Ay 2023 23 are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and preferences. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the plethora of Rebate 87a For Ay 2023 23 right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate 87a For Ay 2023 23 really for free?

- Yes they are! You can print and download these free resources for no cost.

-

Are there any free printouts for commercial usage?

- It depends on the specific rules of usage. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions on usage. Make sure you read the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with the printer, or go to a local print shop for premium prints.

-

What software is required to open printables free of charge?

- The majority are printed as PDF files, which can be opened with free software, such as Adobe Reader.

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Check more sample of Rebate 87a For Ay 2023 23 below

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

BUDGET 2023 REBATE 87A NO TAX UPTO 700000 INCOME TAX CHANGE 2023 NEW

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

Know New Rebate Under Section 87A Budget 2023

https://tax2win.in/guide/section-87a

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the amount of tax payable whichever is lower

https://m.economictimes.com/wealth/tax/who-is...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the amount of tax payable whichever is lower

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

Know New Rebate Under Section 87A Budget 2023

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a