In a world when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. No matter whether it's for educational uses and creative work, or simply adding an individual touch to the home, printables for free can be an excellent source. Here, we'll dive into the world of "R D Tax Credit Calculator Hmrc," exploring their purpose, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest R D Tax Credit Calculator Hmrc Below

R D Tax Credit Calculator Hmrc

R D Tax Credit Calculator Hmrc -

R D tax credit calculator R D tax credits reward forward thinking companies who are investing in R D The credits are awarded in the form of a cash credit or tax reduction We ve designed this R D tax calculator

Your RDEC claim generates a taxable above the line credit of 20 of your identified R D costs As this is taxable it results in a net benefit of up to 16 2 after tax These costs can be offset against your tax bill

R D Tax Credit Calculator Hmrc offer a wide range of printable, free documents that can be downloaded online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages and many more. The beauty of R D Tax Credit Calculator Hmrc is their flexibility and accessibility.

More of R D Tax Credit Calculator Hmrc

What Does HMRC s Payout Slowdown Mean For R D Tax Credit Claims Zest Tax

What Does HMRC s Payout Slowdown Mean For R D Tax Credit Claims Zest Tax

R D Tax Credit Calculator Which scheme are you eligible for SME Scheme RDEC Scheme Is the company profit or loss making Profit making Loss making Spend Exclude Sub contractors Spend Only Sub contractors Calculate What expenses are included Staff PAYE costs Pension contributions Materials and consumables Subcontractors cost

R D tax credit calculator Easy R D claims SeedLegals Spent money developing a new product or service You could be eligible to claim back up to 33 of your research and development spend from HMRC Estimate

R D Tax Credit Calculator Hmrc have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: They can make designs to suit your personal needs whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: Printables for education that are free can be used by students of all ages. This makes the perfect source for educators and parents.

-

Affordability: Quick access to many designs and templates, which saves time as well as effort.

Where to Find more R D Tax Credit Calculator Hmrc

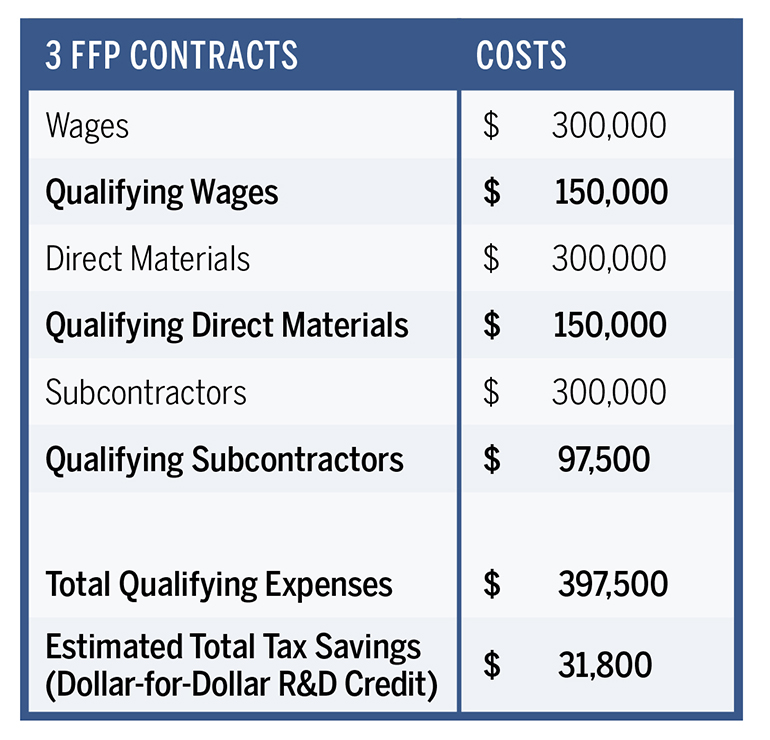

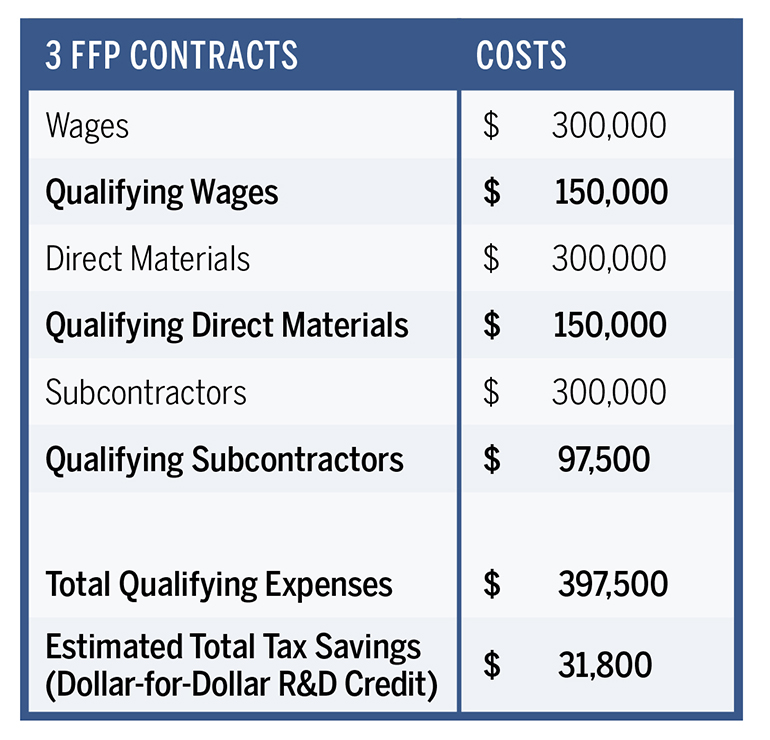

How To Calculate R D Tax Credit Guide Calculator TaxRobot

How To Calculate R D Tax Credit Guide Calculator TaxRobot

How to Calculate R D Tax Credit Eligibility and Qualifying Expenditure Before getting into the nitty gritty of calculating R D tax credit let s first look at eligibility and qualifying expenditure Who Is Eligible The R D tax credit scheme is available to SMEs and large companies attempting to resolve technological or scientific uncertainties

HMRC allows businesses to deduct an extra 130 on qualifying R D expenditure costs from the annual profits on their corporation tax bill This means profitable companies can claim up to

Now that we've piqued your interest in printables for free we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of needs.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs are a vast array of topics, ranging including DIY projects to party planning.

Maximizing R D Tax Credit Calculator Hmrc

Here are some unique ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

R D Tax Credit Calculator Hmrc are a treasure trove of innovative and useful resources that cater to various needs and interests. Their accessibility and flexibility make them a fantastic addition to any professional or personal life. Explore the many options of R D Tax Credit Calculator Hmrc today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are R D Tax Credit Calculator Hmrc really available for download?

- Yes, they are! You can print and download these items for free.

-

Do I have the right to use free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright problems with R D Tax Credit Calculator Hmrc?

- Some printables may have restrictions regarding usage. Always read the terms and conditions set forth by the designer.

-

How do I print R D Tax Credit Calculator Hmrc?

- You can print them at home with either a printer at home or in a print shop in your area for the highest quality prints.

-

What software is required to open printables at no cost?

- The majority are printed with PDF formats, which can be opened using free software such as Adobe Reader.

HMRC Pauses R D Tax Credit Payments Due To Large Fraud Investigation

Investing In An R D Tax Credit Calculator For Startups

Check more sample of R D Tax Credit Calculator Hmrc below

UK R D Tax Credit For Startups Get 33 Of Your R D Paid Back

Multiple Entities With Common Ownership Can Benefit From The R D Tax

Innovating The Future With R D Product Development In Manufacturing

R d Tax Credit Calculation Example Simple Choice Blogged Photo Exhibition

UPDATE Are HMRC Still Processing R D Tax Credit Claims Ian Farley

IRS Announces New R D Tax Credit Guidelines

https://forrestbrown.co.uk/rd-tax-credits...

Your RDEC claim generates a taxable above the line credit of 20 of your identified R D costs As this is taxable it results in a net benefit of up to 16 2 after tax These costs can be offset against your tax bill

https://www.hmrc.gov.uk/gds/cird/attachments/rd...

Research and Development Expenditure Credit RDEC scheme From 1 April 2015 a taxable credit is available at 11 of qualifying R D expenditure For loss making companies the tax credit is fully payable subject to certain restrictions

Your RDEC claim generates a taxable above the line credit of 20 of your identified R D costs As this is taxable it results in a net benefit of up to 16 2 after tax These costs can be offset against your tax bill

Research and Development Expenditure Credit RDEC scheme From 1 April 2015 a taxable credit is available at 11 of qualifying R D expenditure For loss making companies the tax credit is fully payable subject to certain restrictions

R d Tax Credit Calculation Example Simple Choice Blogged Photo Exhibition

Multiple Entities With Common Ownership Can Benefit From The R D Tax

UPDATE Are HMRC Still Processing R D Tax Credit Claims Ian Farley

IRS Announces New R D Tax Credit Guidelines

R D Tax Credit Calculator Get Your Estimate Acena Consulting

R D Tax Credit Calculator Get Your Credit Estimate Today Leyton USA

R D Tax Credit Calculator Get Your Credit Estimate Today Leyton USA

Why You Should Apply For A Federal R D Tax Credit