In this digital age, in which screens are the norm but the value of tangible printed products hasn't decreased. In the case of educational materials, creative projects, or simply adding an element of personalization to your area, Qu Bec Solidarity Tax Credit Calculator are now a useful resource. This article will dive through the vast world of "Qu Bec Solidarity Tax Credit Calculator," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Qu Bec Solidarity Tax Credit Calculator Below

Qu Bec Solidarity Tax Credit Calculator

Qu Bec Solidarity Tax Credit Calculator -

As a rule you must be registered for direct deposit to receive the solidarity tax credit For an estimation of the tax credit you may receive use the Solidarity Tax Credit Payments Estimator

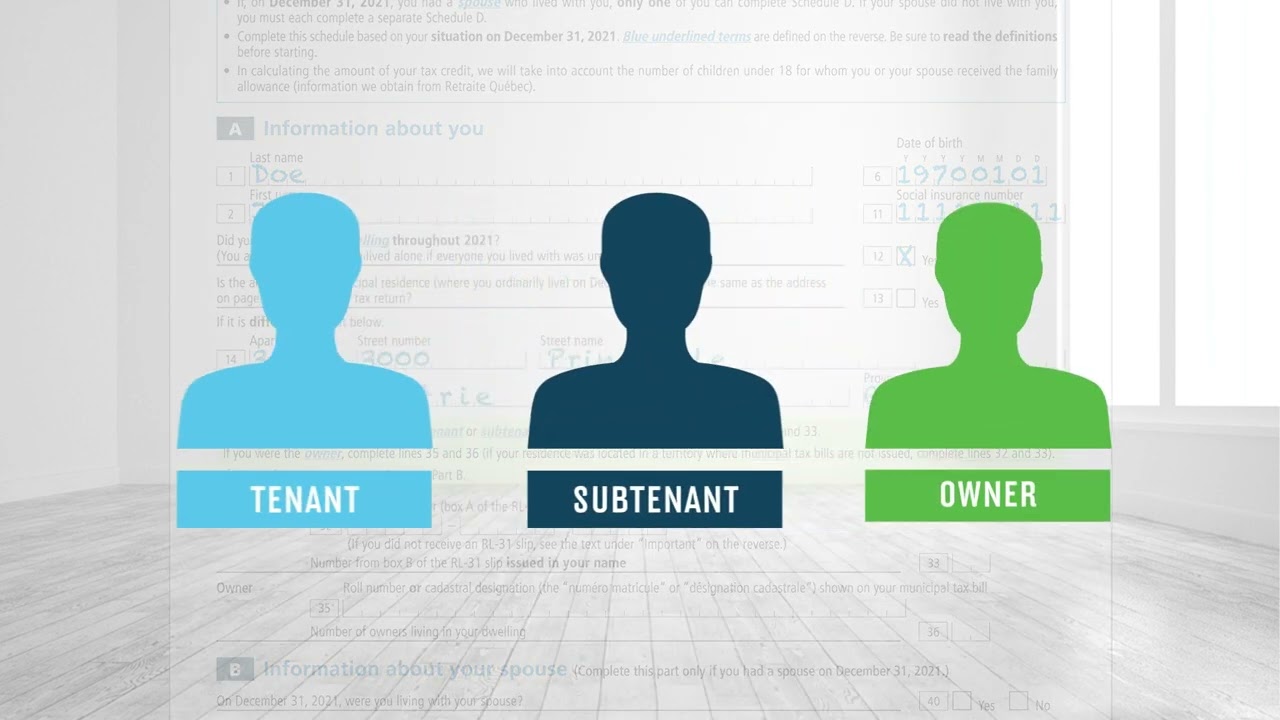

The solidarity tax credit for the period from July 2024 to June 2025 is based on your situation on December 31 2023 To calculate your credit we will add the amounts to which you are entitled under each of the three credit components the housing component the QST component

Qu Bec Solidarity Tax Credit Calculator include a broad assortment of printable materials that are accessible online for free cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages, and much more. The appeal of printables for free is in their variety and accessibility.

More of Qu Bec Solidarity Tax Credit Calculator

Czech Solidarity Tax Who Pays It And How To Get This Money Back

Czech Solidarity Tax Who Pays It And How To Get This Money Back

If you are eligible for the solidarity tax credit we will send you a notice of determination showing the amount of your credit for the period from July 2024 to June 2025 and the information we took into consideration to calculate it The tax credit will be paid in the first five days of each month for which the credit is payable

To calculate the solidarity tax credit we add up the amounts you re entitled to under each of the three components the QST component the housing component the component for individuals living in a northern village The result may be reduced on the basis of your family income For an estimate of your payments use the calculator on our

Qu Bec Solidarity Tax Credit Calculator have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization The Customization feature lets you tailor print-ready templates to your specific requirements whether you're designing invitations to organize your schedule or even decorating your house.

-

Educational value: The free educational worksheets cater to learners from all ages, making them a great source for educators and parents.

-

Convenience: Instant access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Qu Bec Solidarity Tax Credit Calculator

How To Claim The Solidarity Tax Credit Revenu Qu bec YouTube

How To Claim The Solidarity Tax Credit Revenu Qu bec YouTube

The solidarity tax credit is a refundable tax credit that provides assistance to low and middle income households Tax credit for childcare expenses This tax credit is one of the tax measures intended for families It is calculated according to your family income that is your income plus that of your spouse if applicable

How to Calculate Solidarity Tax Credit With the information you have provided Revenu Quebec they will then determine your eligibility based on the components mentioned above Take note that only one person in a family may claim this credit

Now that we've ignited your interest in Qu Bec Solidarity Tax Credit Calculator We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Qu Bec Solidarity Tax Credit Calculator suitable for many reasons.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a wide range of interests, from DIY projects to planning a party.

Maximizing Qu Bec Solidarity Tax Credit Calculator

Here are some fresh ways how you could make the most use of Qu Bec Solidarity Tax Credit Calculator:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Qu Bec Solidarity Tax Credit Calculator are a treasure trove of useful and creative resources catering to different needs and pursuits. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the wide world of Qu Bec Solidarity Tax Credit Calculator right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Qu Bec Solidarity Tax Credit Calculator truly absolutely free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use the free printouts for commercial usage?

- It's all dependent on the conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions on usage. Be sure to review the terms and regulations provided by the creator.

-

How can I print printables for free?

- You can print them at home with either a printer or go to the local print shop for premium prints.

-

What software do I need to open printables for free?

- The majority of printables are in the format of PDF, which is open with no cost software, such as Adobe Reader.

Qu bec Property Owners RL 31 Slips And The Solidarity Tax Credit

SOLIDARITY TAX CREDIT Everything You Need To Know Filing Taxes

Check more sample of Qu Bec Solidarity Tax Credit Calculator below

Explained Do I Have To Pay Germany s solidarity Tax The Local

Taxes As A Student What You Need To Know National Bank

Insurance Premiums Medical Expenses Solidarity Tax Credit And Direct

It s Time For A Solidarity Tax Madhyam

What Is A Solidarity Tax Credit DRC

Tax Solidarity EU Tomasz Wr blewski YouTube

https://www. revenuquebec.ca /en/citizens/tax...

The solidarity tax credit for the period from July 2024 to June 2025 is based on your situation on December 31 2023 To calculate your credit we will add the amounts to which you are entitled under each of the three credit components the housing component the QST component

https://www. revenuquebec.ca /en/citizens/tax-credits/solidarity-tax-credit

The solidarity tax credit is a refundable tax credit for low and middle income families Since it is based on your situation on December 31 of the previous year the amount of your credit for the period from July 2024 to June 2025 will be based on your situation on December 31 2023

The solidarity tax credit for the period from July 2024 to June 2025 is based on your situation on December 31 2023 To calculate your credit we will add the amounts to which you are entitled under each of the three credit components the housing component the QST component

The solidarity tax credit is a refundable tax credit for low and middle income families Since it is based on your situation on December 31 of the previous year the amount of your credit for the period from July 2024 to June 2025 will be based on your situation on December 31 2023

It s Time For A Solidarity Tax Madhyam

Taxes As A Student What You Need To Know National Bank

What Is A Solidarity Tax Credit DRC

Tax Solidarity EU Tomasz Wr blewski YouTube

Letters Words Soli And Nein Abolition Of The Solidarity Tax Icon

Quebec Overspent 360 Million On Solidarity Tax Credit Auditor General

Quebec Overspent 360 Million On Solidarity Tax Credit Auditor General

Quebec s Solidarity Tax Credit Gives Money Back To Low Income Quebecers