In a world with screens dominating our lives, the charm of tangible printed products hasn't decreased. No matter whether it's for educational uses for creative projects, just adding an extra personal touch to your space, Pros And Cons Of Amending Tax Return are now a useful source. With this guide, you'll dive into the sphere of "Pros And Cons Of Amending Tax Return," exploring the different types of printables, where to get them, as well as how they can improve various aspects of your lives.

Get Latest Pros And Cons Of Amending Tax Return Below

Pros And Cons Of Amending Tax Return

Pros And Cons Of Amending Tax Return -

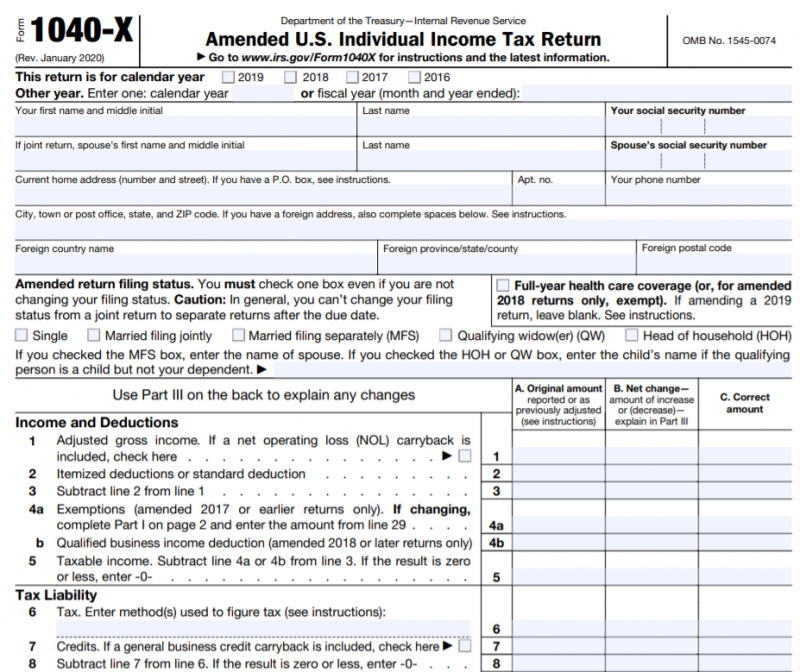

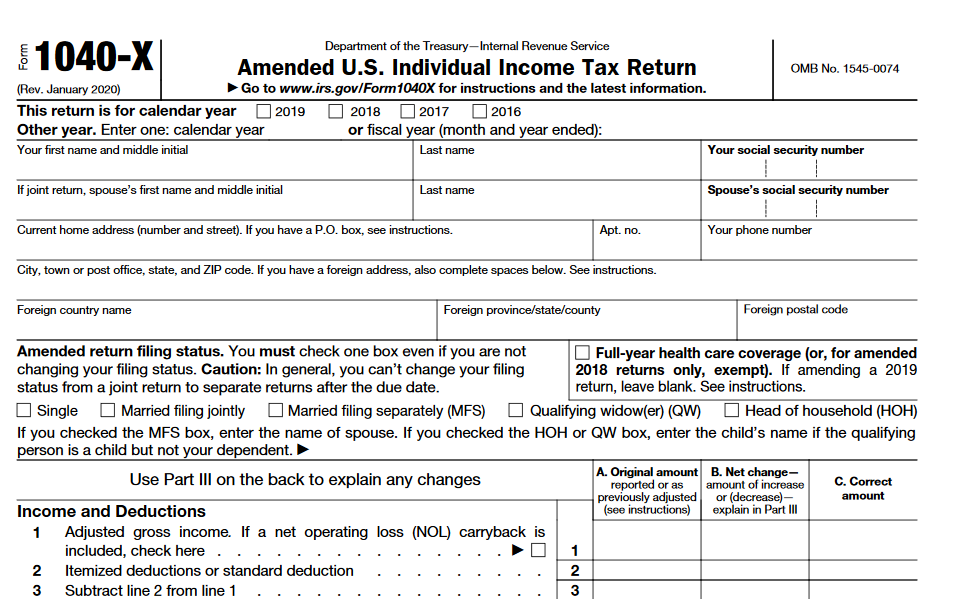

Here are some things they should know Taxpayers may now use tax software to file an electronic Form 1040 X At this time only tax year 2019 Forms 1040 and 1040 SR returns can be amended electronically if the original 2019 tax return was also filed electronically

Top Four Reasons to File an Amended Return Here are the Top 4 reasons to file an amended return Form 1040X 1 Correct an error or omission to your income If you find out after you file that you left income off your return from Form W 2 or 1099 for example or you got a corrected information statement with different income or

Printables for free include a vast range of downloadable, printable material that is available online at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages and more. The value of Pros And Cons Of Amending Tax Return lies in their versatility and accessibility.

More of Pros And Cons Of Amending Tax Return

IRS Touts major Milestone As Income Tax Amending Form 1040 X Becomes

IRS Touts major Milestone As Income Tax Amending Form 1040 X Becomes

When a taxpayer realizes that the tax return they filed has a math error missing income or other mistake they may wonder if they need to correct it by filing an amended return The Interactive Tax Assistant can help taxpayers decide if they need to file an amended return

Common reasons that people need to file amended tax returns include wanting to claim a tax credit or deduction that you didn t include on your original return needing to update your

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor printables to fit your particular needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Downloads of educational content for free can be used by students from all ages, making them a great source for educators and parents.

-

Convenience: Quick access to various designs and templates can save you time and energy.

Where to Find more Pros And Cons Of Amending Tax Return

IRS Adds E Filing For Form 1040 X Amended Tax Returns

IRS Adds E Filing For Form 1040 X Amended Tax Returns

Each year between three and four million taxpayers file amended returns on Form 1040 X Advising a client as to whether he should avail himself of the option of amending requires careful

We can help by amending IRS returns accurately which at times can wipe out the debt entirely and in some cases will even result in a net return to the taxpayer Form 1040 X is used to correct errors or remove information from your original federal tax return This is called an Amended Tax Return a correction to an

We hope we've stimulated your curiosity about Pros And Cons Of Amending Tax Return, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Pros And Cons Of Amending Tax Return to suit a variety of uses.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad range of topics, ranging from DIY projects to party planning.

Maximizing Pros And Cons Of Amending Tax Return

Here are some unique ways how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Pros And Cons Of Amending Tax Return are an abundance of practical and imaginative resources that can meet the needs of a variety of people and interest. Their accessibility and versatility make them a great addition to each day life. Explore the vast array of Pros And Cons Of Amending Tax Return today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these materials for free.

-

Are there any free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may contain restrictions on usage. Make sure to read the conditions and terms of use provided by the creator.

-

How can I print Pros And Cons Of Amending Tax Return?

- Print them at home with either a printer or go to any local print store for superior prints.

-

What software is required to open Pros And Cons Of Amending Tax Return?

- The majority of printed documents are in the format of PDF, which can be opened using free software, such as Adobe Reader.

What You Should Know When Amending A Federal Income Tax Return

Amending An Individual Tax Return YouTube

Check more sample of Pros And Cons Of Amending Tax Return below

Amending The Tax Return Musings And Mutterings

Chief Tax Information Officer Reveals The Top Six Things You Need To

Pros And Cons Of Clay Soil Is Clay Soil Good For Your Plants

Amending Your Income Tax Return TurboTax Tax Tips Videos

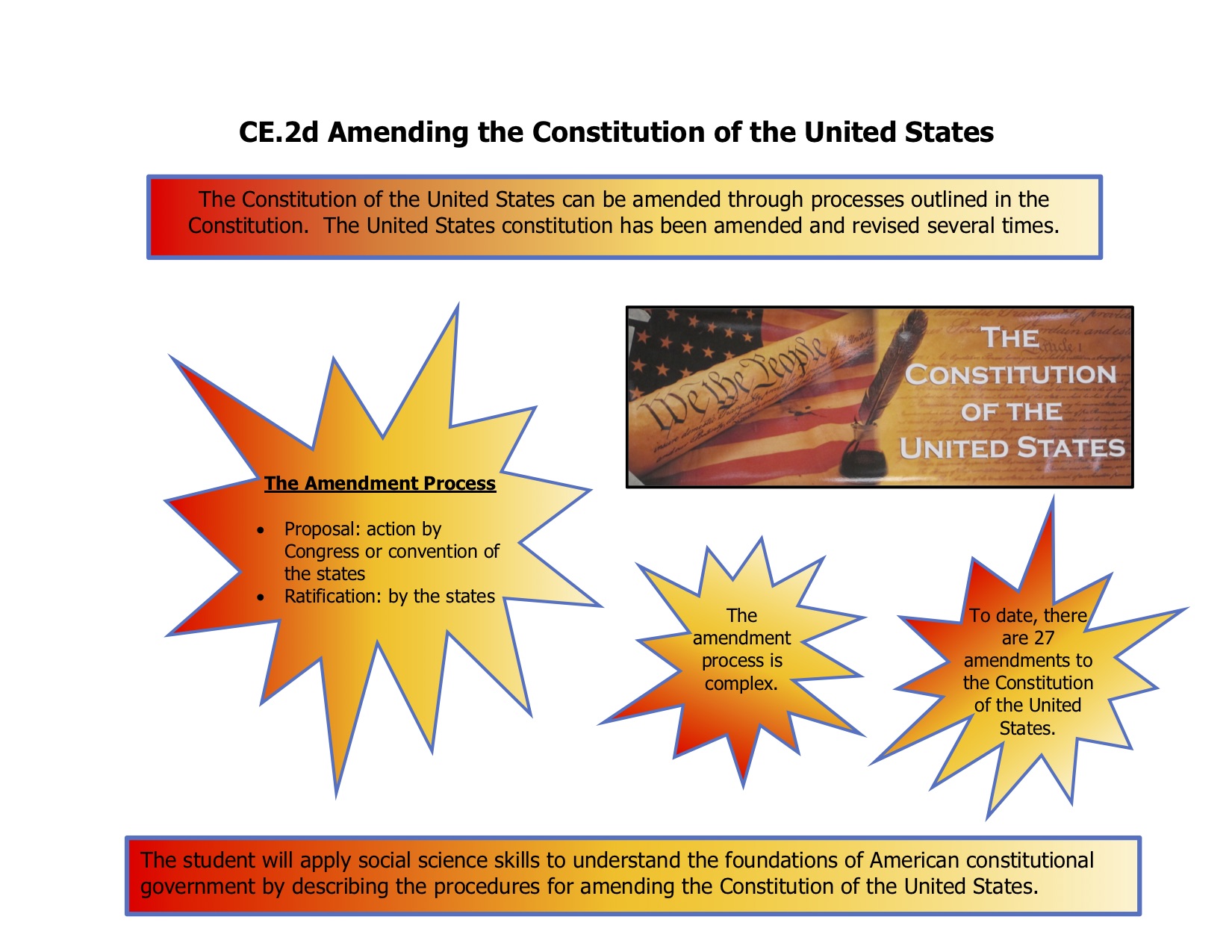

Amending The Constitution Of The United States And The Constitution Of

Optima Tax Relief Reviews Tips For Amending Tax Return Tax Return

https://www.hrblock.com/tax-center/irs/audits-and...

Top Four Reasons to File an Amended Return Here are the Top 4 reasons to file an amended return Form 1040X 1 Correct an error or omission to your income If you find out after you file that you left income off your return from Form W 2 or 1099 for example or you got a corrected information statement with different income or

https://www.investopedia.com/terms/a/amendedreturn.asp

An amended return is a form filed in order to make corrections to a tax return from a previous year An amended return can correct errors and claim a more advantageous tax status such as

Top Four Reasons to File an Amended Return Here are the Top 4 reasons to file an amended return Form 1040X 1 Correct an error or omission to your income If you find out after you file that you left income off your return from Form W 2 or 1099 for example or you got a corrected information statement with different income or

An amended return is a form filed in order to make corrections to a tax return from a previous year An amended return can correct errors and claim a more advantageous tax status such as

Amending Your Income Tax Return TurboTax Tax Tips Videos

Chief Tax Information Officer Reveals The Top Six Things You Need To

Amending The Constitution Of The United States And The Constitution Of

Optima Tax Relief Reviews Tips For Amending Tax Return Tax Return

What Do You Need To Know About Amending Your Tax Return Potomac

Soverign Citizens Not Paying Tax Is Illegal The ATO Process Of

Soverign Citizens Not Paying Tax Is Illegal The ATO Process Of

11 Tips On Amending Your Tax Return Campaign For Working Families Inc