Today, in which screens are the norm but the value of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons such as creative projects or just adding personal touches to your home, printables for free are a great source. This article will dive to the depths of "Property Tax Exemption In Panama," exploring the different types of printables, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Property Tax Exemption In Panama Below

Property Tax Exemption In Panama

Property Tax Exemption In Panama -

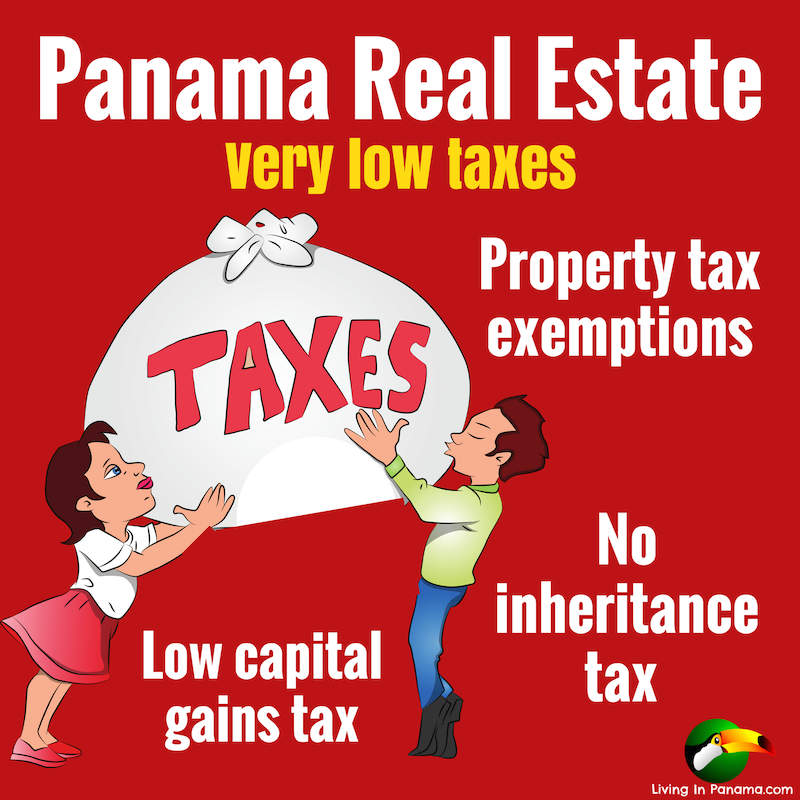

Verkko At the time of this writing according to Article 764 of the Panamanian Tax Code there are some exemptions for property tax under certain conditions All properties registered at a value of 30 000 or less including improvements of land for instance construction

Verkko 14 tammik 2019 nbsp 0183 32 Properties valued between 0 and 120 000 are exempt from taxes Properties valued between 120 001 and 700 000 will have a 0 5 tax rate Properties valued above 700 000 will have a 0 7 tax rate This means that if your home has a value of 400 000 you would pay 0 5 on 400 000 minus 120 000

Property Tax Exemption In Panama cover a large assortment of printable materials that are accessible online for free cost. These resources come in many forms, including worksheets, templates, coloring pages and more. The appeal of printables for free is in their versatility and accessibility.

More of Property Tax Exemption In Panama

A Complete Guide On Property Tax Exemption Cut My Taxes

A Complete Guide On Property Tax Exemption Cut My Taxes

Verkko There are numerous property tax exemptions but these apply to the value of the construction only the land may still be subject to tax Properties valued at 30 000 or less including land value have a zero percent tax rate The 2 10 percent band is

Verkko Panama has a Progressive Combined Tax see table below The new tax law 66 also enacted an exemption of property taxes on the initial US 120 000 00 of the registered value if the property is considered Tributary Family Patrimony TFP or Primary Residence PR

The Property Tax Exemption In Panama have gained huge popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: They can make designs to suit your personal needs, whether it's designing invitations making your schedule, or even decorating your home.

-

Educational Use: The free educational worksheets can be used by students of all ages, making them a valuable tool for parents and educators.

-

It's easy: You have instant access a variety of designs and templates will save you time and effort.

Where to Find more Property Tax Exemption In Panama

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Homestead Tax Exemption Cedar Park Texas Living

Verkko 9 maalisk 2018 nbsp 0183 32 Here s the lowdown on the Panama property tax rates primary and secondary residences exemptions and more The law increased the 100 exemption to properties valued at 120 000 up from 30 000 for primary residence meaning properties under that threshold will be fully exempt starting January 1 2019 The

Verkko This tax is levied on the difference between the purchase price and the sale price with the exception of the first 30 000 00 which is exempt from CGT Inheritance Tax Inheritance tax is not levied in Panama Gift Tax Gift tax is not levied in Panama Tax on Property Income Income from property rental is taxed in Panama with a rate of

After we've peaked your interest in printables for free we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Property Tax Exemption In Panama for all applications.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a wide range of interests, everything from DIY projects to party planning.

Maximizing Property Tax Exemption In Panama

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Property Tax Exemption In Panama are an abundance of creative and practical resources catering to different needs and desires. Their accessibility and flexibility make them a fantastic addition to your professional and personal life. Explore the wide world of Property Tax Exemption In Panama right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use free printables for commercial uses?

- It's dependent on the particular usage guidelines. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding their use. Be sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in the local print shops for high-quality prints.

-

What program will I need to access Property Tax Exemption In Panama?

- Most printables come in PDF format. These can be opened with free software such as Adobe Reader.

Ohio Real Property Tax Exemption Denials For SNFs ALs ROLF LAW

Panama Property Tax Exemption Exoneration It s NOT What You Think

Check more sample of Property Tax Exemption In Panama below

Senior Citizen Property Tax Exemption California Form Riverside County

Claim For Homeowners Property Tax Exemption Santa Clara County

Jefferson County Property Tax Exemption Form ExemptForm

Sales Tax Exemption Certificate Wisconsin

Florida Property Tax Lawyer FLORIDA PROPERTY TAX NEWS MARCH 1 IS

How To Get An Agricultural Property Tax Exemption In Texas Updated 2022

https://www.panamaequity.com/.../law/panama-property-tax

Verkko 14 tammik 2019 nbsp 0183 32 Properties valued between 0 and 120 000 are exempt from taxes Properties valued between 120 001 and 700 000 will have a 0 5 tax rate Properties valued above 700 000 will have a 0 7 tax rate This means that if your home has a value of 400 000 you would pay 0 5 on 400 000 minus 120 000

https://thepanamalink.com/property-taxes

Verkko Under the new Tax Law 66 there is a full exemption for the first 120 000 of the property s registered value and the tax rate varies from 0 5 to 0 7 for higher property values This benefit extends to married couples single parents retirees pensioners and properties held within trust accounts

Verkko 14 tammik 2019 nbsp 0183 32 Properties valued between 0 and 120 000 are exempt from taxes Properties valued between 120 001 and 700 000 will have a 0 5 tax rate Properties valued above 700 000 will have a 0 7 tax rate This means that if your home has a value of 400 000 you would pay 0 5 on 400 000 minus 120 000

Verkko Under the new Tax Law 66 there is a full exemption for the first 120 000 of the property s registered value and the tax rate varies from 0 5 to 0 7 for higher property values This benefit extends to married couples single parents retirees pensioners and properties held within trust accounts

Sales Tax Exemption Certificate Wisconsin

Claim For Homeowners Property Tax Exemption Santa Clara County

Florida Property Tax Lawyer FLORIDA PROPERTY TAX NEWS MARCH 1 IS

How To Get An Agricultural Property Tax Exemption In Texas Updated 2022

What Is The NYC Disabled Homeowners Property Tax Exemption

Real Estate In Panama Taxes Transaction Costs

Real Estate In Panama Taxes Transaction Costs

Berkeley County Property Tax Homestead Exemption ZDOLLZ ExemptForm