Today, where screens rule our lives The appeal of tangible printed materials hasn't faded away. For educational purposes in creative or artistic projects, or simply to add a personal touch to your home, printables for free have proven to be a valuable source. The following article is a dive through the vast world of "Property Tax Exemption For Seniors Illinois," exploring the different types of printables, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Property Tax Exemption For Seniors Illinois Below

Property Tax Exemption For Seniors Illinois

Property Tax Exemption For Seniors Illinois -

To apply for the senior freeze exemption the applicant must Be a senior citizen with an annual household income of 65 000 or less Have owned and occupied the home on January 1 2021 and January 1 2022 and have been responsible for the 2021 and 2022 taxes to be eligible for Tax Year 2020 payable in 2021 To apply

The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

Property Tax Exemption For Seniors Illinois include a broad range of printable, free materials that are accessible online for free cost. These printables come in different forms, like worksheets coloring pages, templates and much more. The beauty of Property Tax Exemption For Seniors Illinois lies in their versatility and accessibility.

More of Property Tax Exemption For Seniors Illinois

County Auditors Push To Expand Property Tax Exemption For Seniors

County Auditors Push To Expand Property Tax Exemption For Seniors

A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property Automatic Renewal Yes this exemption automatically renews each year Due Date The deadline to file for tax year 2023 is Monday April 29 2024

Seniors in the counties bordering Cook County will see the maximum homestead exemption raised from 5 000 to 8 000 putting them on the same level as Cook County The maximum senior

Property Tax Exemption For Seniors Illinois have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization It is possible to tailor printables to fit your particular needs in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Printables for education that are free cater to learners from all ages, making them a great resource for educators and parents.

-

Convenience: Instant access to an array of designs and templates can save you time and energy.

Where to Find more Property Tax Exemption For Seniors Illinois

Nassau Property Tax Exemption For Seniors Expires Newsday

Nassau Property Tax Exemption For Seniors Expires Newsday

118 North Clark Street Room 320 Chicago IL 60602 312 443 7550 You may find applications and additional information at www cookcountyassessor Senior Citizen Homestead Exemption Seniors can save on average up to 300 a year in property taxes and up to 750 when combined with the Homeowner Exemption

Benefit Following the Illinois Property Tax Code this exemption lowers the equalized assessed value of the property by 8 000 and may be claimed in addition to the General Homestead Exemption These changes will be reflective

We've now piqued your interest in printables for free and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Property Tax Exemption For Seniors Illinois to suit a variety of purposes.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Property Tax Exemption For Seniors Illinois

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Property Tax Exemption For Seniors Illinois are an abundance of innovative and useful resources that meet a variety of needs and preferences. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the wide world that is Property Tax Exemption For Seniors Illinois today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's based on specific terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with Property Tax Exemption For Seniors Illinois?

- Some printables may come with restrictions on their use. Be sure to review the terms and conditions offered by the creator.

-

How can I print Property Tax Exemption For Seniors Illinois?

- You can print them at home using the printer, or go to the local print shop for more high-quality prints.

-

What program do I need to run printables free of charge?

- The majority are printed in the format of PDF, which is open with no cost software like Adobe Reader.

County Auditors Push To Expand Property Tax Exemption For Seniors

Shoreline Area News Property Tax Exemption For Seniors

Check more sample of Property Tax Exemption For Seniors Illinois below

Property Tax Exemption For Richardson Seniors To Remain Unchanged In

Guide To Property Tax In Arlington TX 2022 Four 19 Properties

Hecht Group Property Tax Exemption For Seniors In Alabama

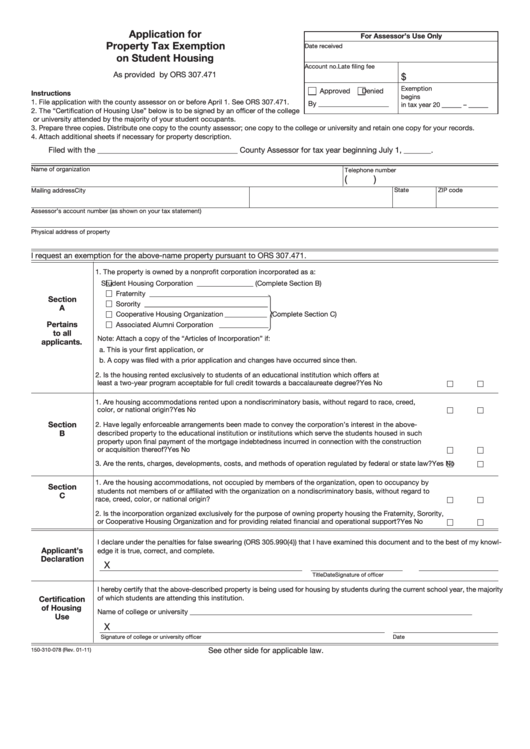

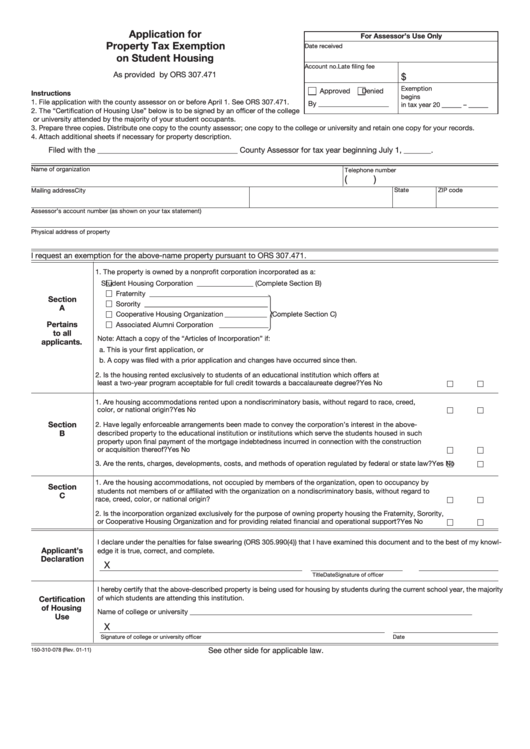

Jefferson County Property Tax Exemption Form ExemptForm

Cu les Son Los Elementos Principales De Un Pr stamo Pr stamos es

Hecht Group Property Tax Exemption For Seniors In Alabama

https://www.illinoislegalaid.org/legal-information/...

The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

https://www.cookcountyassessor.com/senior-citizen-exemption

A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property Automatic Renewal Yes this exemption automatically renews each year Due Date The deadline to file for tax year 2023 is Monday April 29 2024 Did you file online for your senior exemption Log in to view your application status

The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property Automatic Renewal Yes this exemption automatically renews each year Due Date The deadline to file for tax year 2023 is Monday April 29 2024 Did you file online for your senior exemption Log in to view your application status

Jefferson County Property Tax Exemption Form ExemptForm

Guide To Property Tax In Arlington TX 2022 Four 19 Properties

Cu les Son Los Elementos Principales De Un Pr stamo Pr stamos es

Hecht Group Property Tax Exemption For Seniors In Alabama

Fillable Online Long Form Property Tax Exemption For Seniors Fax

Jefferson County Property Tax Exemption Form ExemptForm

Jefferson County Property Tax Exemption Form ExemptForm

Property Tax Exemption For Seniors In California PRFRTY CountyForms