In the digital age, where screens dominate our lives yet the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons, creative projects, or just adding the personal touch to your area, Professional Tax Rebate Section have become an invaluable resource. Through this post, we'll take a dive into the sphere of "Professional Tax Rebate Section," exploring the benefits of them, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest Professional Tax Rebate Section Below

Professional Tax Rebate Section

Professional Tax Rebate Section - Professional Tax Deduction Section, Professional Tax Deduction Section In Itr, Professional Tax Deduction Under Section 80c, Professional Tax Deduction Under Section 16, How Do I Claim Professional Tax In Itr, Can We Claim Professional Tax

Web 1 janv 2023 nbsp 0183 32 Contribution pour la formation professionnelle CFP due pour 2023 payable en novembre 2023 Profession lib 233 rale r 233 glement 233 e 0 25 de la base forfaitaire 43

Web 3 f 233 vr 2022 nbsp 0183 32 Les remboursements de d 233 penses engag 233 es par le salari 233 pour le compte de l entreprise sont toujours exon 233 r 233 s puisque le salari 233 n a fait qu avancer des fonds 224 la

Printables for free cover a broad assortment of printable material that is available online at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and more. One of the advantages of Professional Tax Rebate Section is their versatility and accessibility.

More of Professional Tax Rebate Section

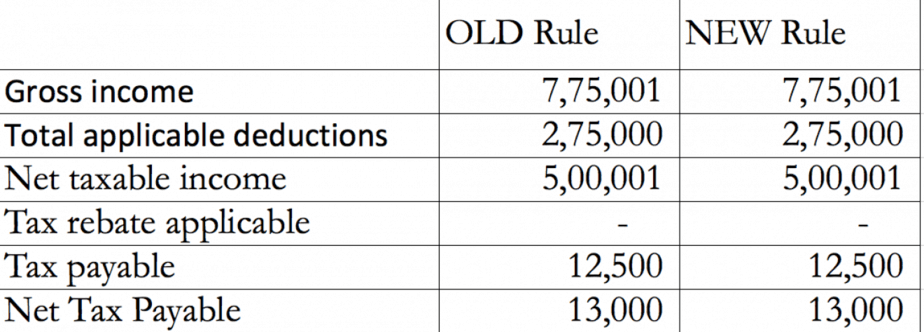

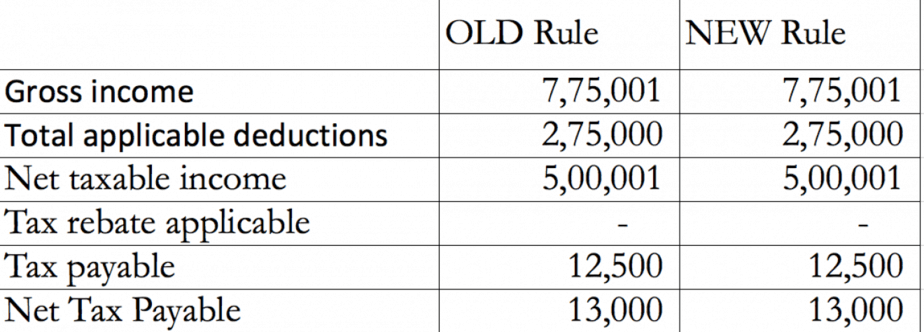

Revised Tax Rebate Section 87A Examples Budget 2019 For FY 2019 20

Revised Tax Rebate Section 87A Examples Budget 2019 For FY 2019 20

Web 20 Travaux publics Conducteurs d engins et de camions d entreprises 10 Article 5 de l annexe IV du code g 233 n 233 ral des imp 244 ts dans sa r 233 daction en vigueur au 31 d 233 cembre

Web 27 juil 2023 nbsp 0183 32 The deduction solely depends on the actual amount of professional tax However any state government cannot levy more than rs 2500 annually as a

The Professional Tax Rebate Section have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations and schedules, or even decorating your house.

-

Educational value: These Professional Tax Rebate Section offer a wide range of educational content for learners of all ages, making them an essential tool for parents and teachers.

-

Easy to use: Fast access an array of designs and templates can save you time and energy.

Where to Find more Professional Tax Rebate Section

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Web 2 f 233 vr 2023 nbsp 0183 32 The maximum deduction that can be claimed under this section is Rs 50 000 Section 80D This deduction is available for premium paid on medical insurance policy

If we've already piqued your curiosity about Professional Tax Rebate Section Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Professional Tax Rebate Section suitable for many reasons.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Professional Tax Rebate Section

Here are some innovative ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Professional Tax Rebate Section are a treasure trove of fun and practical tools that satisfy a wide range of requirements and preferences. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the many options of Professional Tax Rebate Section right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes they are! You can download and print these tools for free.

-

Do I have the right to use free printables for commercial purposes?

- It's based on specific terms of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables may be subject to restrictions on use. Always read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit an in-store print shop to get better quality prints.

-

What software do I require to open Professional Tax Rebate Section?

- A majority of printed materials are in the format PDF. This can be opened using free programs like Adobe Reader.

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Check more sample of Professional Tax Rebate Section below

Tds Slab Rate For Ay 2019 20

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Union Budget 2017 18 Proposed Tax Slabs For FY 2017 18 Taxing Tax

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://droit-finances.commentcamarche.com/impots/guide-impots/2725...

Web 3 f 233 vr 2022 nbsp 0183 32 Les remboursements de d 233 penses engag 233 es par le salari 233 pour le compte de l entreprise sont toujours exon 233 r 233 s puisque le salari 233 n a fait qu avancer des fonds 224 la

https://cleartax.in/s/professional-tax

Web 17 mai 2018 nbsp 0183 32 Professional tax is a tax on all kinds of professions trades and employment and is levied based on the income of such profession trade and employment It is levied

Web 3 f 233 vr 2022 nbsp 0183 32 Les remboursements de d 233 penses engag 233 es par le salari 233 pour le compte de l entreprise sont toujours exon 233 r 233 s puisque le salari 233 n a fait qu avancer des fonds 224 la

Web 17 mai 2018 nbsp 0183 32 Professional tax is a tax on all kinds of professions trades and employment and is levied based on the income of such profession trade and employment It is levied

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo