In a world when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding some personal flair to your home, printables for free are now a vital source. For this piece, we'll take a dive deep into the realm of "Possible Tax Exemptions For Salaried Employees," exploring their purpose, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest Possible Tax Exemptions For Salaried Employees Below

Possible Tax Exemptions For Salaried Employees

Possible Tax Exemptions For Salaried Employees -

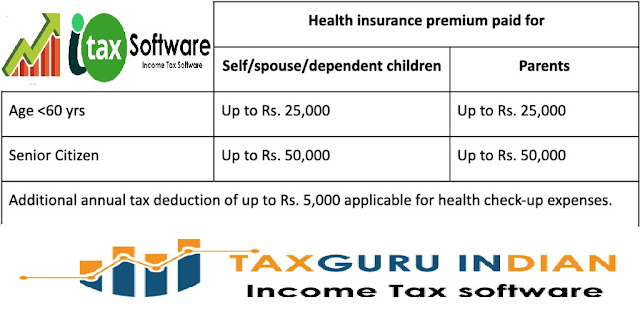

Allowances are generally fixed irrespective of actual expenditure and are taxable Under the Act it is taxable under Section 15 on a due or accrual basis irrespective of whether it is paid in addition to or in lieu of salary However some exemptions are allowed by the Income tax Act

For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income tax exemption

Possible Tax Exemptions For Salaried Employees include a broad variety of printable, downloadable items that are available online at no cost. They come in many kinds, including worksheets templates, coloring pages and much more. The appealingness of Possible Tax Exemptions For Salaried Employees is their flexibility and accessibility.

More of Possible Tax Exemptions For Salaried Employees

Income Tax Exemptions For Salaried Employees F Y 2022 23

Income Tax Exemptions For Salaried Employees F Y 2022 23

1 HRA Exemption for Salaried Employees Many employers give House Rent Allowance HRA to their employees for them to reside at a good place A portion of the House Rent Allowance given by an employer to an employee is exempted from the levy of the Income Tax and Income Tax is only levied on the remaining part

Standard deductions Since the Union Budget of 2019 salaried individuals can claim a flat standard deduction of Rs 50 000 This is a replacement for the medical reimbursements and transport allowance Child education allowance If your employer provides you with a children s allowance you can claim a maximum of Rs 100 tax

Possible Tax Exemptions For Salaried Employees have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: There is the possibility of tailoring printables to fit your particular needs such as designing invitations and schedules, or even decorating your home.

-

Educational Value: Downloads of educational content for free provide for students of all ages. This makes them an essential aid for parents as well as educators.

-

Convenience: You have instant access a variety of designs and templates cuts down on time and efforts.

Where to Find more Possible Tax Exemptions For Salaried Employees

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

Updated on Apr 15th 2024 19 min read Salaried taxpayers primarily earn their income from salary The salaried are normally offered a salary package or CTC cost to company The taxability of the salary income is determined by the employer The employer also deducts a tax TDS on the salary paid to them

Government employees can claim up to 14 of salary as a deduction under section 80 CCD 2 There is also another condition which is employer s contribution to NPS EPF and a superannuation fund is eligible for

Since we've got your interest in printables for free Let's see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Possible Tax Exemptions For Salaried Employees for all goals.

- Explore categories like home decor, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad range of interests, ranging from DIY projects to planning a party.

Maximizing Possible Tax Exemptions For Salaried Employees

Here are some creative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Possible Tax Exemptions For Salaried Employees are an abundance of innovative and useful resources that cater to various needs and preferences. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the vast collection that is Possible Tax Exemptions For Salaried Employees today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes you can! You can download and print these documents for free.

-

Can I download free printables to make commercial products?

- It's based on specific rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright problems with Possible Tax Exemptions For Salaried Employees?

- Some printables may have restrictions regarding usage. Make sure you read these terms and conditions as set out by the author.

-

How do I print printables for free?

- Print them at home using either a printer at home or in the local print shop for superior prints.

-

What program do I need to open printables at no cost?

- The majority of PDF documents are provided in PDF format, which is open with no cost software, such as Adobe Reader.

Income Tax Exemptions For Salaried Employees

Income Tax Exemptions For Salaried Employees Business Times Of

Check more sample of Possible Tax Exemptions For Salaried Employees below

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

Income Tax Exemptions For Salaried Employees F Y 2022 23 With

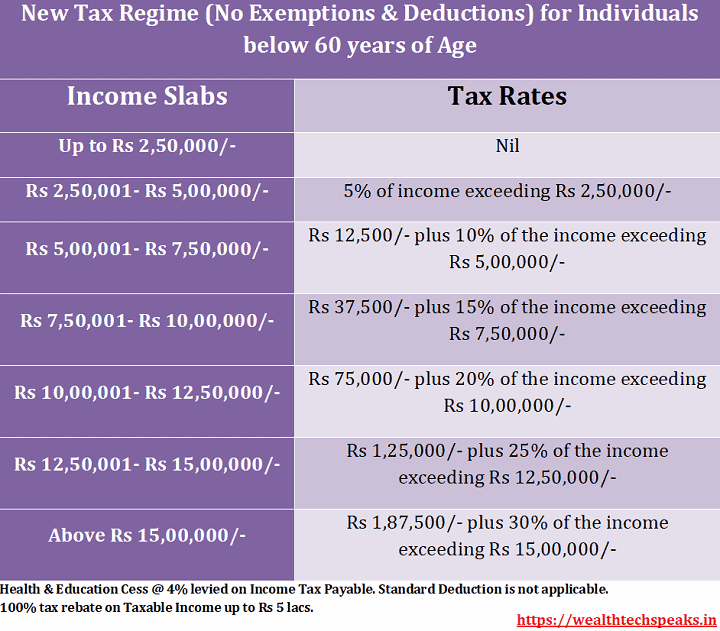

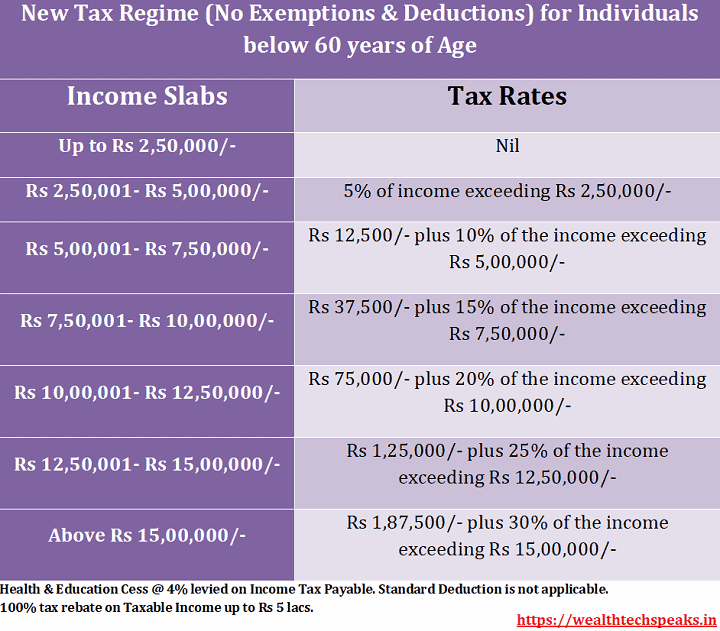

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Tax Planning Of Salaried Employees Goyal Mangal Company

Income Tax Slab For The A Y 2024 25

https://www.etmoney.com/learn/income-tax/tax...

For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income tax exemption

https://taxguru.in/income-tax/list-allowances...

If you are a salaried person you have a right to claim the benefits of an exemptions available on your few parts of the salary components given either in the form of Allowances or Perquisites Here is the list given of most of the common exemptions which can be availed by a salaried person on his her Allowances or Perquisites

For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income tax exemption

If you are a salaried person you have a right to claim the benefits of an exemptions available on your few parts of the salary components given either in the form of Allowances or Perquisites Here is the list given of most of the common exemptions which can be availed by a salaried person on his her Allowances or Perquisites

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

Tax Planning Of Salaried Employees Goyal Mangal Company

Income Tax Slab For The A Y 2024 25

How To File Income Tax Return Online For Salaried Employee

INCOME TAX RETURN OF SALARIED PERSON PART 1 SALARY BIFURCATION

INCOME TAX RETURN OF SALARIED PERSON PART 1 SALARY BIFURCATION

Tax Exemption Salaried Employees Can Save Tax Via Section 10