In the age of digital, where screens dominate our lives, the charm of tangible printed objects isn't diminished. For educational purposes, creative projects, or simply to add an element of personalization to your space, Ny State Solar Tax Credit Form are a great resource. In this article, we'll take a dive to the depths of "Ny State Solar Tax Credit Form," exploring what they are, where to locate them, and how they can enrich various aspects of your lives.

Get Latest Ny State Solar Tax Credit Form Below

Ny State Solar Tax Credit Form

Ny State Solar Tax Credit Form -

Verkko 8 30 am to 5 00 pm NY Sun provides incentives and financing to make solar generated electricity accessible and affordable for all New York homeowners renters and businesses Using solar can help lower energy costs compared to using conventionally generated electricity

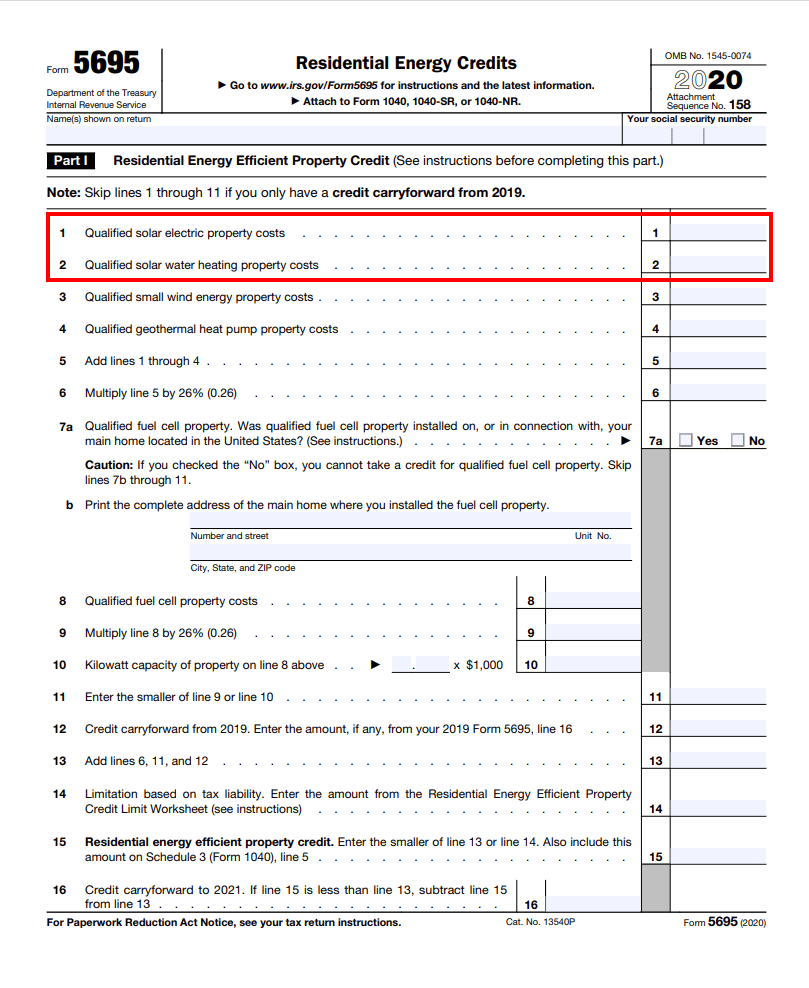

Verkko Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

Ny State Solar Tax Credit Form encompass a wide assortment of printable material that is available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and much more. The value of Ny State Solar Tax Credit Form is in their variety and accessibility.

More of Ny State Solar Tax Credit Form

Why NY State Solar NY State Solar

Why NY State Solar NY State Solar

Verkko Instructions for Form IT 267 Geothermal Energy System Credit General information You may claim a credit for qualified geothermal energy system equipment and expenditures installed at residential property located in New York State and placed into service after January 1 2022 To qualify for the credit the property where the geothermal system is

Verkko 02 16 22 Solar Credits Federal The residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property

Ny State Solar Tax Credit Form have garnered immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: This allows you to modify printables to fit your particular needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Impact: Free educational printables are designed to appeal to students of all ages, making them a valuable resource for educators and parents.

-

Easy to use: Fast access a variety of designs and templates cuts down on time and efforts.

Where to Find more Ny State Solar Tax Credit Form

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

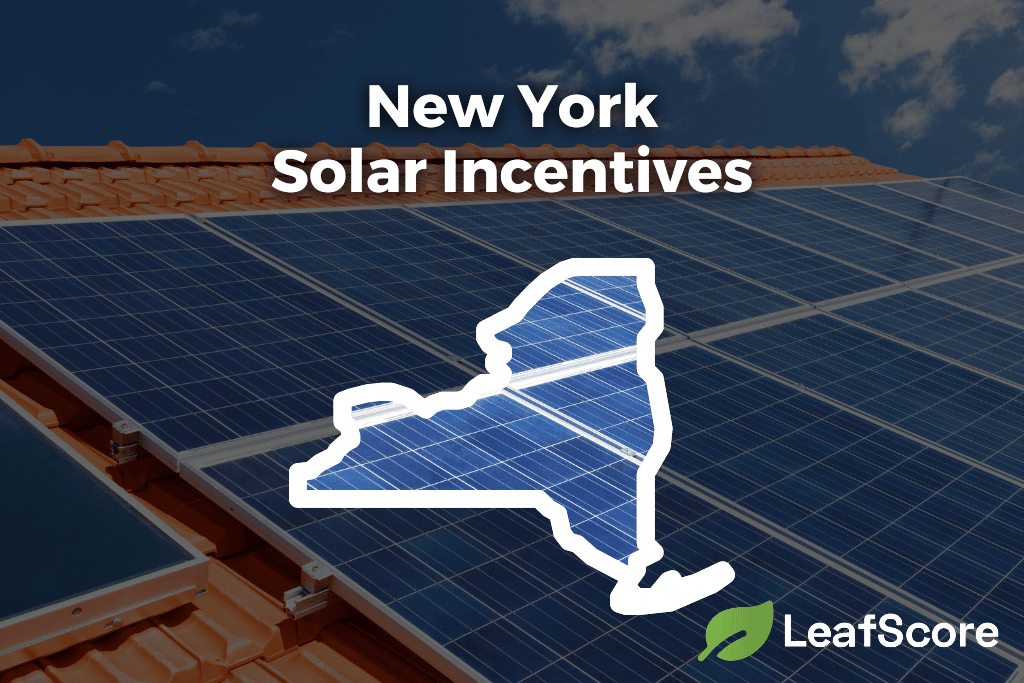

Verkko 7 elok 2023 nbsp 0183 32 Also known as the solar tax credit homeowners can get a tax credit for 30 of the cost of installed solar panels New York State Solar Equipment Tax Credit

Verkko How much you can save depends on the electric rates in your area There may also be significant federal State and local tax credits for installing solar at your home What are the environmental and health benefits of solar energy Solar is one of the cleanest forms of renewable energy

Since we've got your interest in Ny State Solar Tax Credit Form Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Ny State Solar Tax Credit Form to suit a variety of applications.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Ny State Solar Tax Credit Form

Here are some new ways ensure you get the very most of Ny State Solar Tax Credit Form:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Ny State Solar Tax Credit Form are a treasure trove of practical and innovative resources designed to meet a range of needs and interest. Their accessibility and flexibility make they a beneficial addition to your professional and personal life. Explore the vast array of Ny State Solar Tax Credit Form to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printables for commercial purposes?

- It is contingent on the specific terms of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues with Ny State Solar Tax Credit Form?

- Certain printables could be restricted concerning their use. Be sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a print shop in your area for premium prints.

-

What software do I need in order to open printables for free?

- The majority are printed in the format PDF. This can be opened with free programs like Adobe Reader.

New York Solar Incentives Kasselman Solar

New York Solar Incentives Tax Credits For 2023 LeafScore

Check more sample of Ny State Solar Tax Credit Form below

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

NY State Solar Hicksville

Utah State Solar Tax Credit Lanette Huber

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Latest News Solar Buzz FireFly Solar

https://www.tax.ny.gov/pdf/current_forms/it/it255i.pdf

Verkko Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

https://www.tax.ny.gov/pit/credits/solar_energy_system_equipment...

Verkko 16 jouluk 2019 nbsp 0183 32 Who is eligible You are entitled to claim this credit if you purchased solar energy system equipment entered into a written agreement for the lease of solar energy system equipment or entered into a written agreement that spans at least ten years for the purchase of power generated by solar energy system equipment not

Verkko Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

Verkko 16 jouluk 2019 nbsp 0183 32 Who is eligible You are entitled to claim this credit if you purchased solar energy system equipment entered into a written agreement for the lease of solar energy system equipment or entered into a written agreement that spans at least ten years for the purchase of power generated by solar energy system equipment not

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

NY State Solar Hicksville

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Latest News Solar Buzz FireFly Solar

Irs Solar Tax Credit 2022 Form

How Does The Federal Solar Tax Credit Work Freedom Solar

How Does The Federal Solar Tax Credit Work Freedom Solar

Tax Credit ITC Sungenia Solar