In the digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. If it's to aid in education, creative projects, or simply adding personal touches to your area, New York State Real Estate Tax Deduction have proven to be a valuable source. For this piece, we'll take a dive into the sphere of "New York State Real Estate Tax Deduction," exploring what they are, where to get them, as well as the ways that they can benefit different aspects of your life.

Get Latest New York State Real Estate Tax Deduction Below

New York State Real Estate Tax Deduction

New York State Real Estate Tax Deduction -

The estate of a New York State nonresident must file a New York State estate tax return if the estate includes any real or tangible property located in New York State and the

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are

New York State Real Estate Tax Deduction encompass a wide assortment of printable materials available online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and much more. The value of New York State Real Estate Tax Deduction is in their versatility and accessibility.

More of New York State Real Estate Tax Deduction

How To Deduct Real Estate Taxes On Your Federal Tax Return Homeowners

How To Deduct Real Estate Taxes On Your Federal Tax Return Homeowners

New York State itemized deductions are reported on Form IT 196 New York Resident Nonresident and Part Year Resident Itemized Deductions For certain

Real estate taxes deduction You may be able to deduct real estate taxes imposed on your property You must have paid them either at the settlement or closing or to a taxing authority either directly or

New York State Real Estate Tax Deduction have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization They can make printed materials to meet your requirements be it designing invitations, organizing your schedule, or decorating your home.

-

Educational Value: These New York State Real Estate Tax Deduction are designed to appeal to students from all ages, making them an essential aid for parents as well as educators.

-

The convenience of Access to an array of designs and templates helps save time and effort.

Where to Find more New York State Real Estate Tax Deduction

Free Of Charge Creative Commons Property Tax Deduction Image Real

Free Of Charge Creative Commons Property Tax Deduction Image Real

Housing is again the talk of the budget with a potential deal to enact a new tax break for developers in return to building affordable apartments in New York City Both

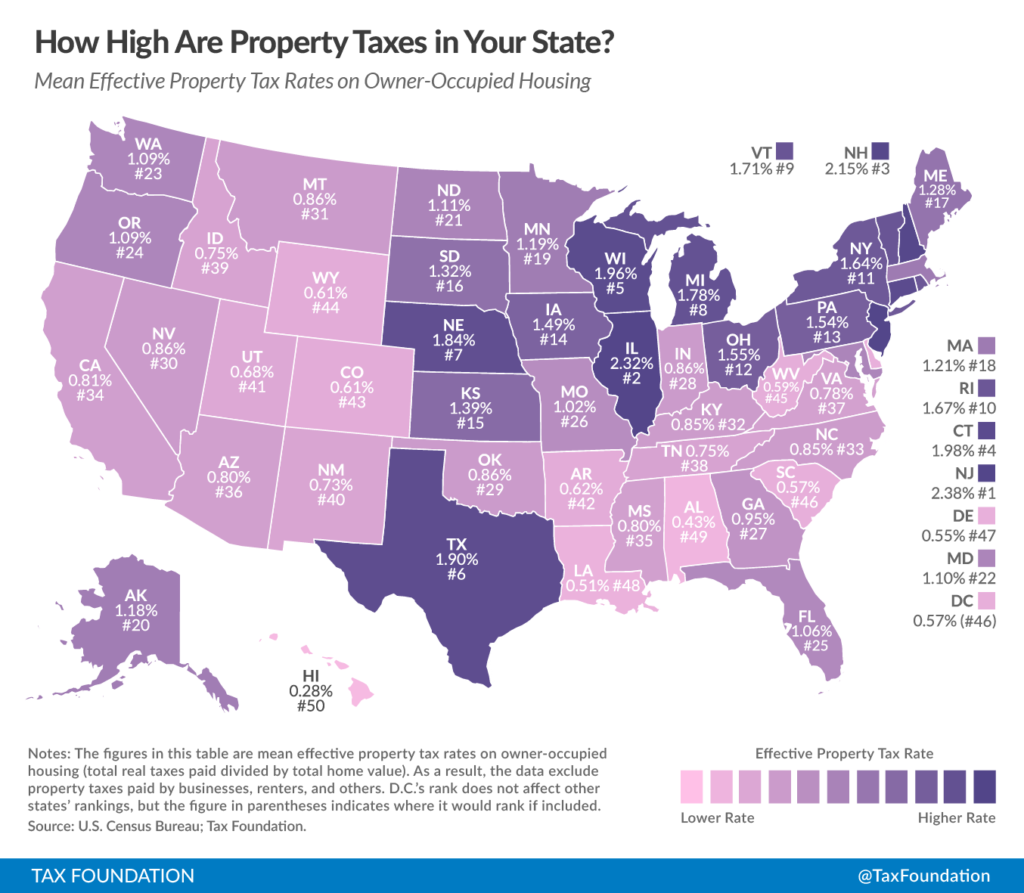

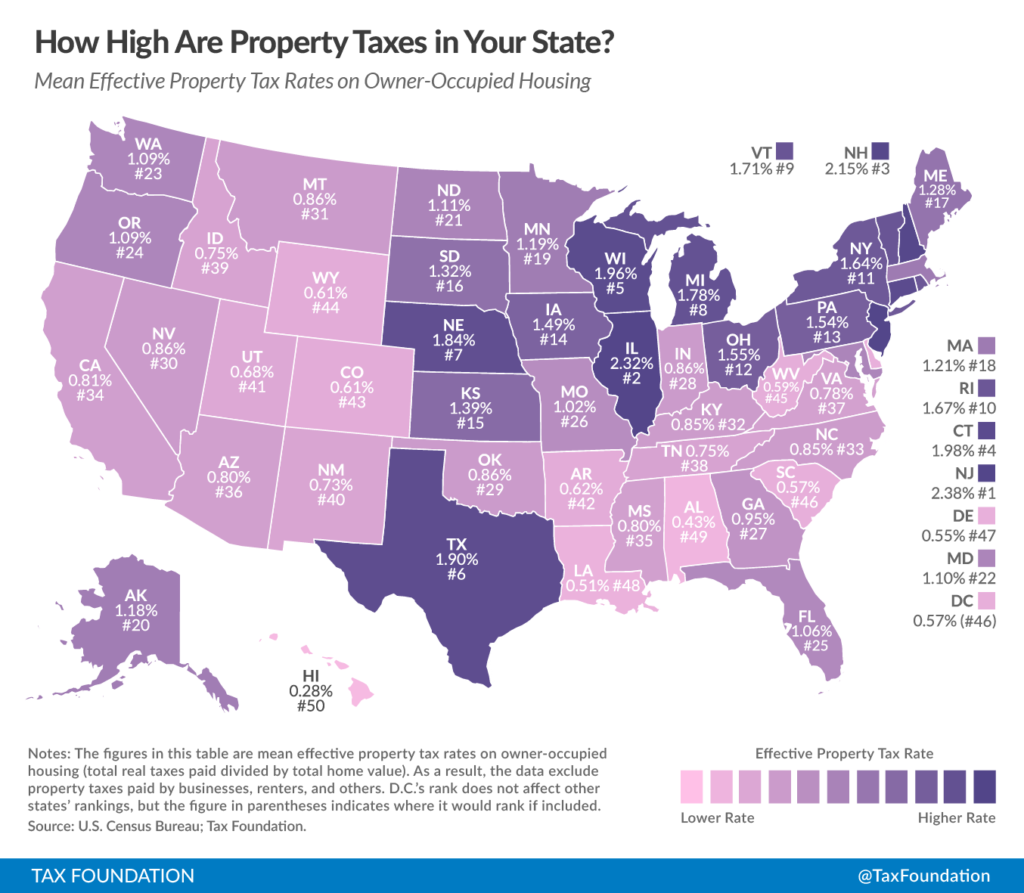

In New York State the property tax is a local tax raised and spent locally to finance local governments and public schools Real property commonly known as real estate is land and any permanent

We've now piqued your interest in New York State Real Estate Tax Deduction Let's see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of New York State Real Estate Tax Deduction designed for a variety purposes.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing New York State Real Estate Tax Deduction

Here are some innovative ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

New York State Real Estate Tax Deduction are a treasure trove of innovative and useful resources that cater to various needs and desires. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the endless world that is New York State Real Estate Tax Deduction today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use free printables in commercial projects?

- It's based on specific terms of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions concerning their use. Make sure to read the terms and condition of use as provided by the designer.

-

How do I print New York State Real Estate Tax Deduction?

- You can print them at home with an printer, or go to any local print store for more high-quality prints.

-

What software must I use to open printables free of charge?

- Most PDF-based printables are available in the PDF format, and can be opened using free software, such as Adobe Reader.

The Most Overlooked Tax Deduction By Real Estate Owners CPA Practice

How Does A Real Estate Tax Deduction Work Tax Relief Center Tax

Check more sample of New York State Real Estate Tax Deduction below

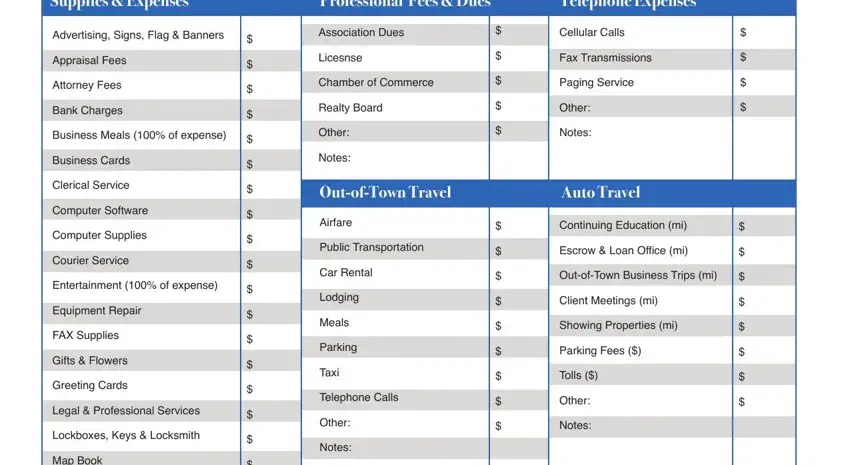

Realtor Tax Deductions Worksheets

The Art Of The Real Estate Tax Deduction Part 1 Tax Practice News

Budget 2022 Real Estate Expectations Improved Home Loan Amount Income

Realtor Tax Deduction Worksheet Small Business Tax Real Estate

New York State Real Estate

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are

https://www.tax.ny.gov/forms/current-forms/it/it196i.htm

For federal income tax purposes the deduction for state and local taxes is generally limited to 10 000 5 000 if married filing separately In addition you can no longer claim a

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are

For federal income tax purposes the deduction for state and local taxes is generally limited to 10 000 5 000 if married filing separately In addition you can no longer claim a

Realtor Tax Deduction Worksheet Small Business Tax Real Estate

The Art Of The Real Estate Tax Deduction Part 1 Tax Practice News

New York State Real Estate

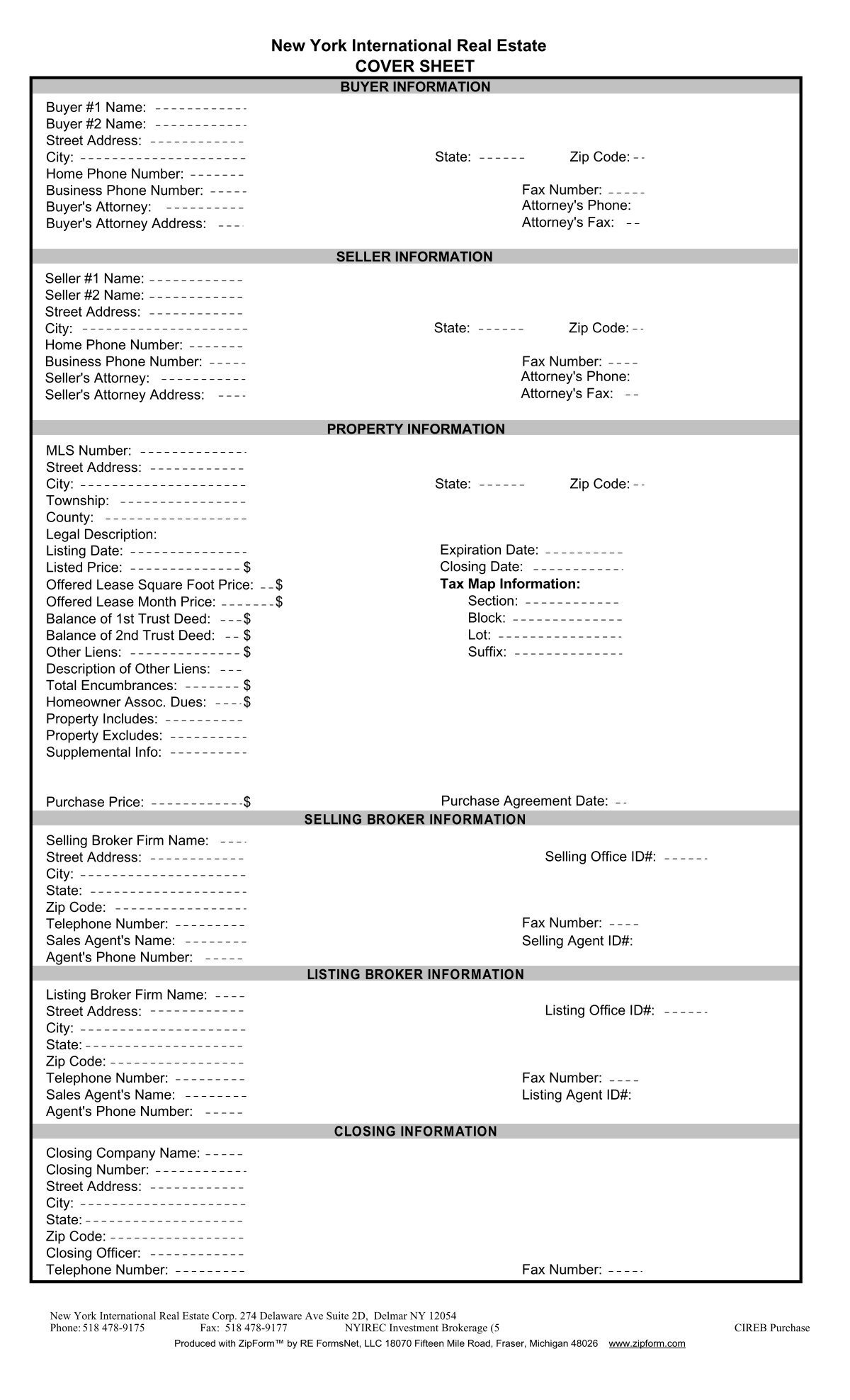

Purchase Contract Packet New York State Real Estate Auctions

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

Real Estate Tax Deduction Worksheet Fill Out Printable PDF Forms Online