In this digital age, where screens have become the dominant feature of our lives yet the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or simply to add some personal flair to your home, printables for free can be an excellent resource. The following article is a take a dive in the world of "New House Construction Tax Deductions," exploring the benefits of them, where to locate them, and how they can enhance various aspects of your lives.

Get Latest New House Construction Tax Deductions Below

New House Construction Tax Deductions

New House Construction Tax Deductions -

Ministers and members of the uniformed services who receive a nontaxable housing allowance can still deduct their real estate taxes and home mortgage interest They

Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home The actual amount of the credit

New House Construction Tax Deductions cover a large selection of printable and downloadable materials available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and more. The value of New House Construction Tax Deductions lies in their versatility as well as accessibility.

More of New House Construction Tax Deductions

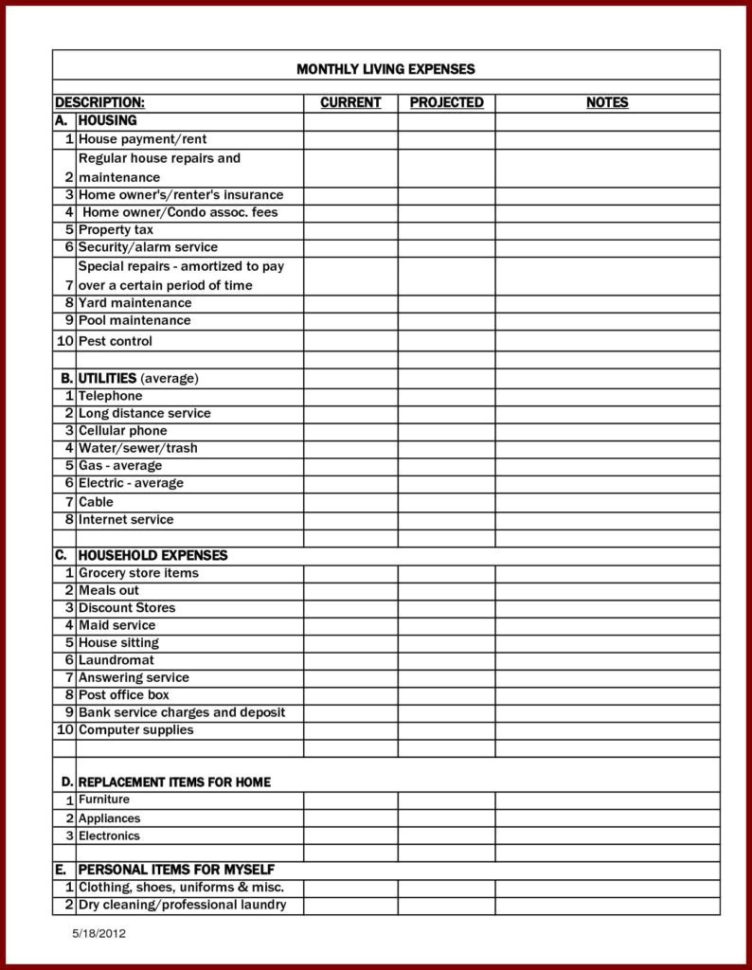

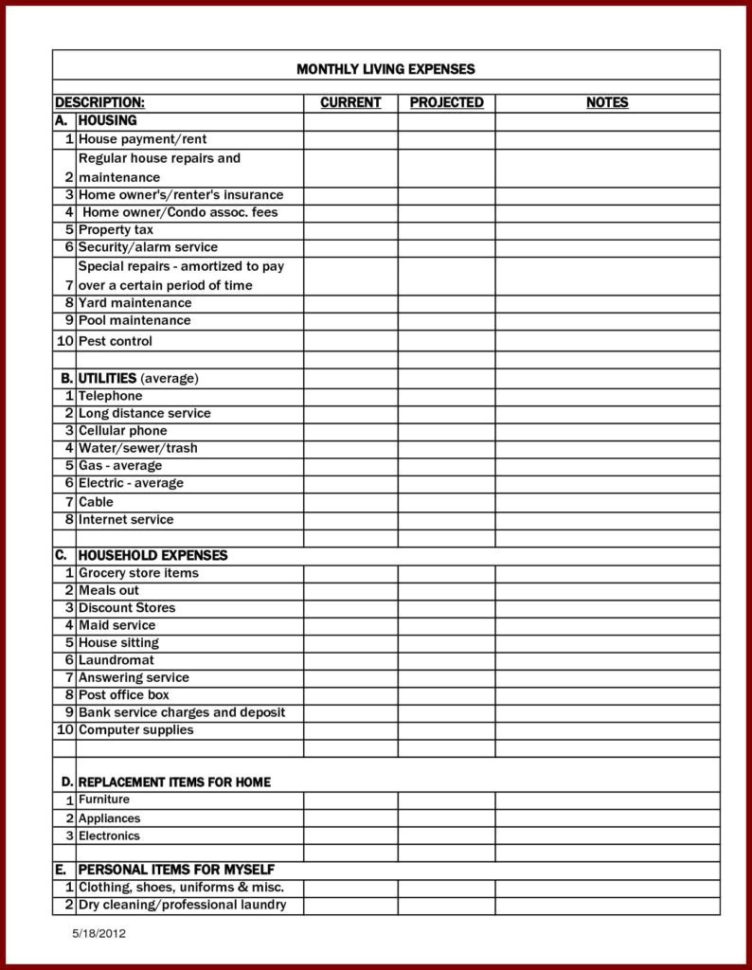

List Of Common Expenses And Tax Deductions For Construction Workers And

List Of Common Expenses And Tax Deductions For Construction Workers And

It permits you to deduct the interest on up to 750 000 you borrow to buy or build a new main home and or second non rental home so long as the loan is secured by the home the limit is

The government is supporting first time and main home buyers by increasing the Higher Rates for Additional Dwellings in Stamp Duty Land Tax on the purchases of second

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize printed materials to meet your requirements in designing invitations and schedules, or decorating your home.

-

Educational Value Downloads of educational content for free cater to learners of all ages, making them a vital device for teachers and parents.

-

Simple: immediate access a plethora of designs and templates helps save time and effort.

Where to Find more New House Construction Tax Deductions

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

Taxable income includes rental income deemed let out properties self occupied property annual value Deductions include municipal tax standard deduction interest on home loan

New home construction tax deductions are everywhere if you know where to look In this post we ll show you several construction tax deductions talk about

We've now piqued your curiosity about New House Construction Tax Deductions we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of New House Construction Tax Deductions suitable for many purposes.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing New House Construction Tax Deductions

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

New House Construction Tax Deductions are an abundance of useful and creative resources that cater to various needs and hobbies. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the vast array of New House Construction Tax Deductions to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes you can! You can print and download these documents for free.

-

Does it allow me to use free printables for commercial purposes?

- It's contingent upon the specific usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using New House Construction Tax Deductions?

- Some printables may have restrictions in use. Be sure to read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using the printer, or go to an area print shop for higher quality prints.

-

What software do I require to open printables at no cost?

- Many printables are offered in the format of PDF, which can be opened with free programs like Adobe Reader.

8 Tax Itemized Deduction Worksheet Worksheeto

Tax Deductions For Construction Workers Contractors

Check more sample of New House Construction Tax Deductions below

Worksheet For Tax Deductions

Self Employed Tax Deductions Worksheet Db excel

4 Tax Deductions Construction Business Owners Overlook Knowify

Construction Tax Deductions 10 Strategies To Reduce Tax

10 2014 Itemized Deductions Worksheet Worksheeto

Essential Tax Deductions For Construction Businesses FreshBooks

https://www.irs.gov/newsroom/builders-of-new...

Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home The actual amount of the credit

https://nationaltaxreports.com/tax-credit …

Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions and tax credits A tax

Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home The actual amount of the credit

Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions and tax credits A tax

Construction Tax Deductions 10 Strategies To Reduce Tax

Self Employed Tax Deductions Worksheet Db excel

10 2014 Itemized Deductions Worksheet Worksheeto

Essential Tax Deductions For Construction Businesses FreshBooks

Small Business Tax Deductions Worksheet

Common Tax Deductions For New House Construction New House

Common Tax Deductions For New House Construction New House

Common Tax Deductions For Contractors Construction Accountants