In this digital age, where screens rule our lives but the value of tangible, printed materials hasn't diminished. No matter whether it's for educational uses for creative projects, simply to add an individual touch to the home, printables for free have become an invaluable resource. Through this post, we'll take a dive into the world of "New Home Construction Tax Deductions," exploring the benefits of them, where you can find them, and how they can improve various aspects of your daily life.

Get Latest New Home Construction Tax Deductions Below

New Home Construction Tax Deductions

New Home Construction Tax Deductions -

Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be able to claim tax credits up to 5 000 per home The amount of the

Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home

The New Home Construction Tax Deductions are a huge assortment of printable, downloadable material that is available online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages and much more. The great thing about New Home Construction Tax Deductions lies in their versatility as well as accessibility.

More of New Home Construction Tax Deductions

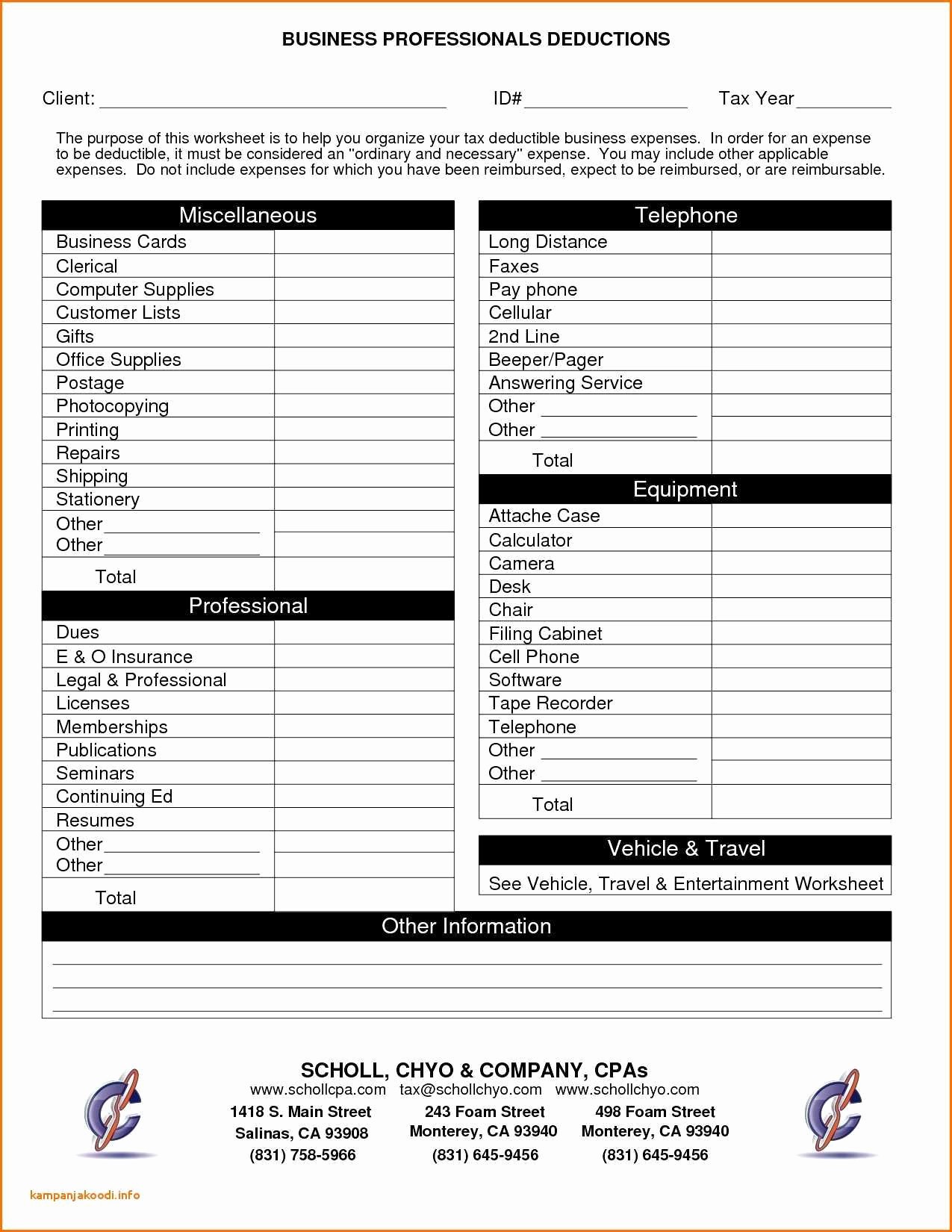

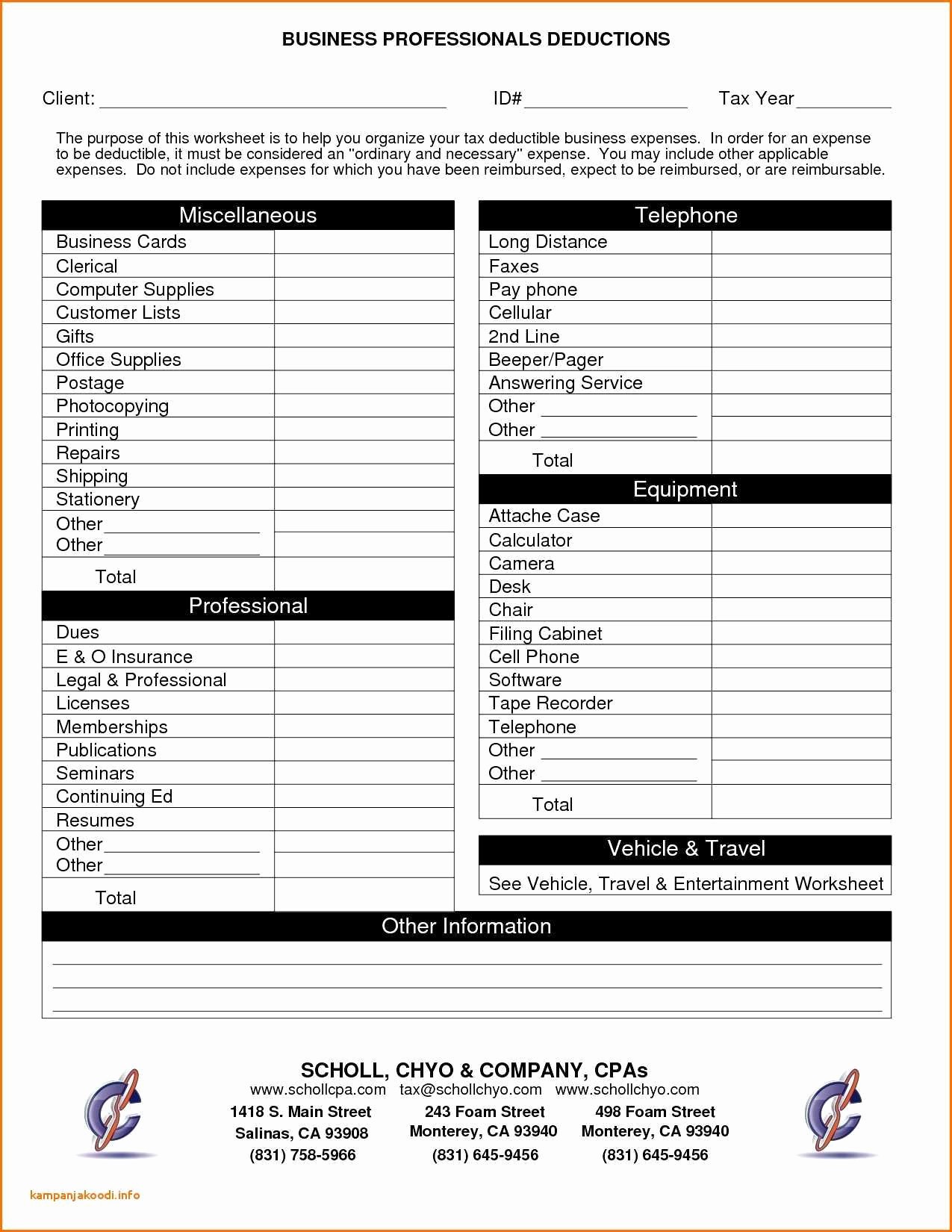

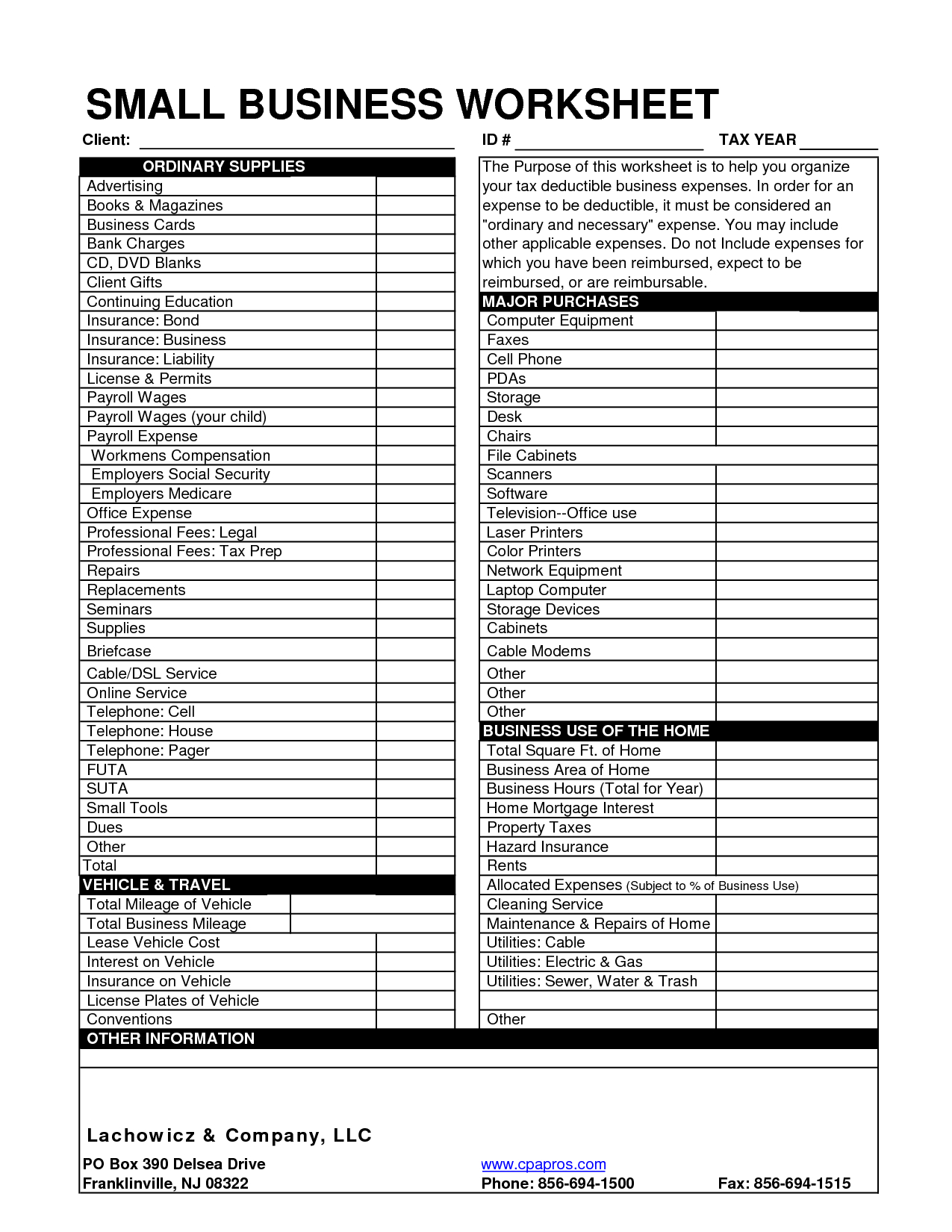

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040

What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some

New Home Construction Tax Deductions have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Individualization We can customize printables to your specific needs in designing invitations planning your schedule or even decorating your house.

-

Educational Worth: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making the perfect aid for parents as well as educators.

-

The convenience of immediate access a plethora of designs and templates reduces time and effort.

Where to Find more New Home Construction Tax Deductions

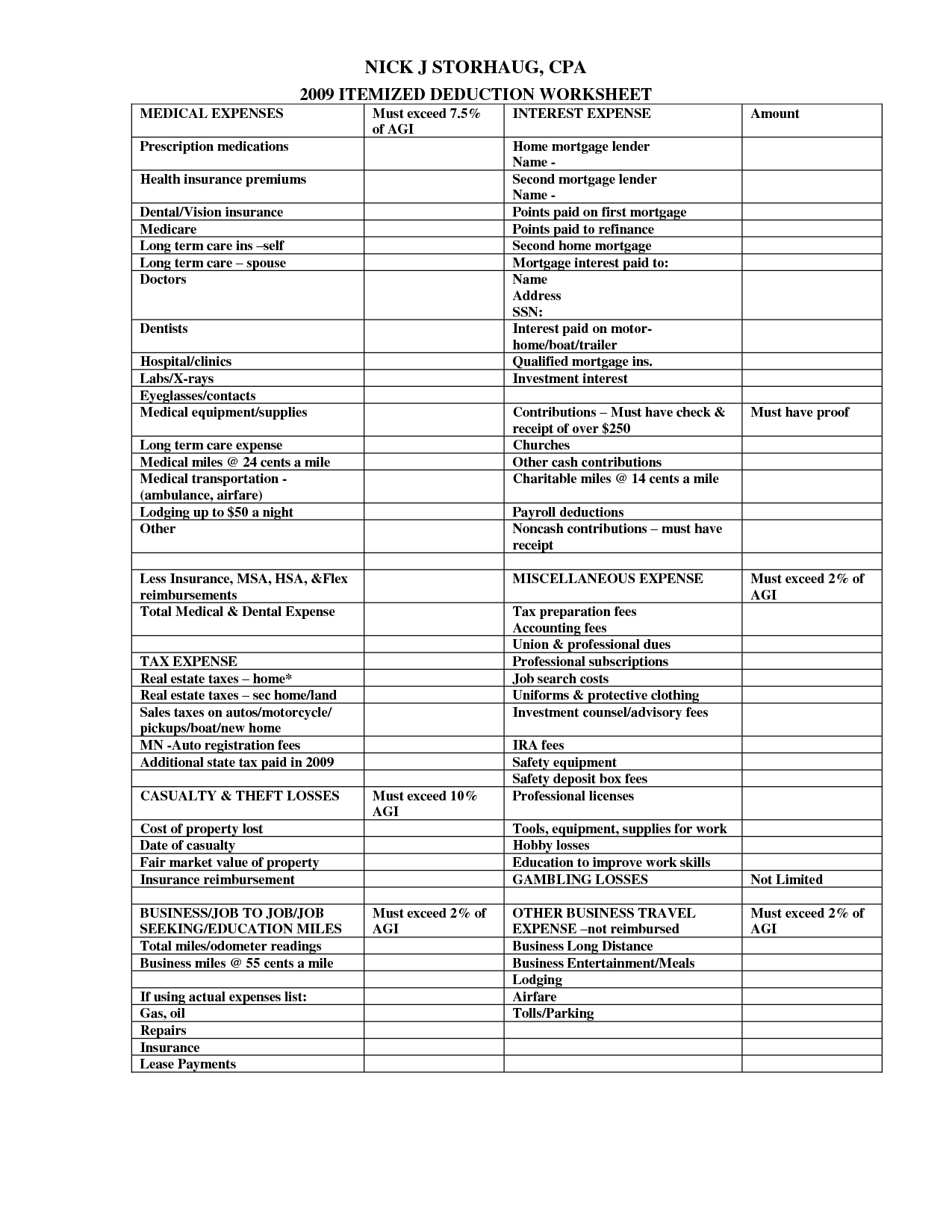

Worksheet For Tax Deductions

Worksheet For Tax Deductions

In some cases home improvements can result in tax deductions But before tearing down the walls in your house and expecting huge tax write off results there are several important factors

You can get a federal tax credit of 30 of the cost of qualifying geothermal heat pumps solar water heaters solar panels small wind turbines or fuel cells placed in service for an existing or new construction home

After we've peaked your curiosity about New Home Construction Tax Deductions Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of New Home Construction Tax Deductions for various needs.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs are a vast variety of topics, that range from DIY projects to party planning.

Maximizing New Home Construction Tax Deductions

Here are some fresh ways of making the most use of New Home Construction Tax Deductions:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

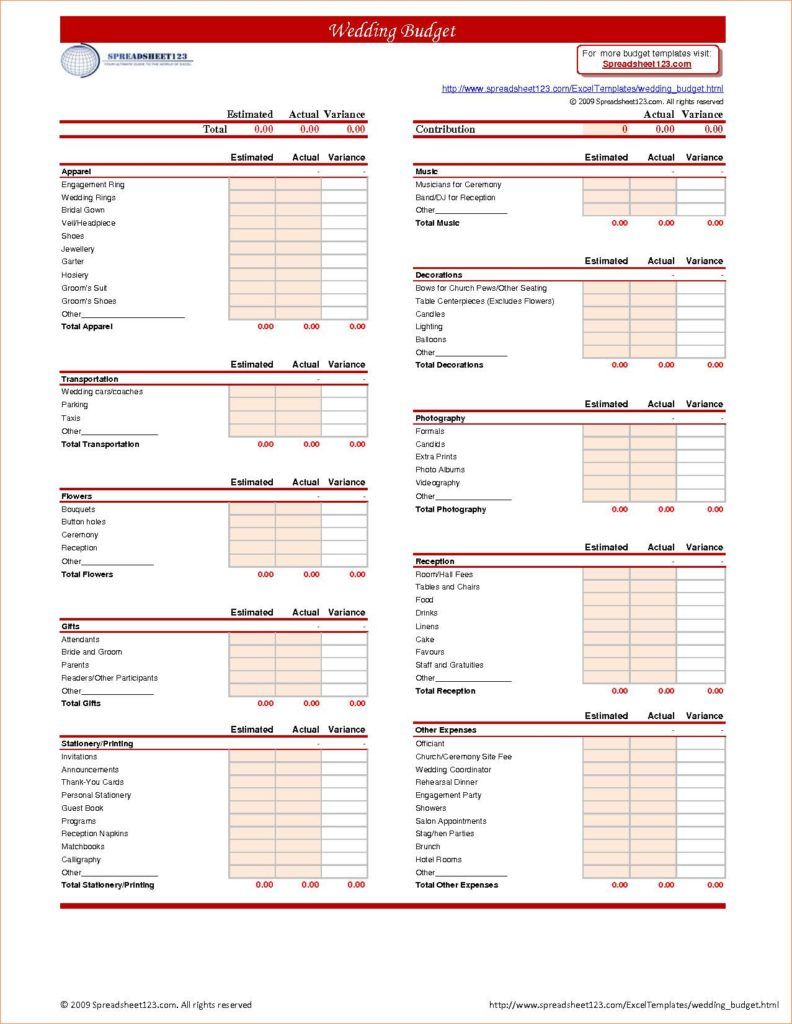

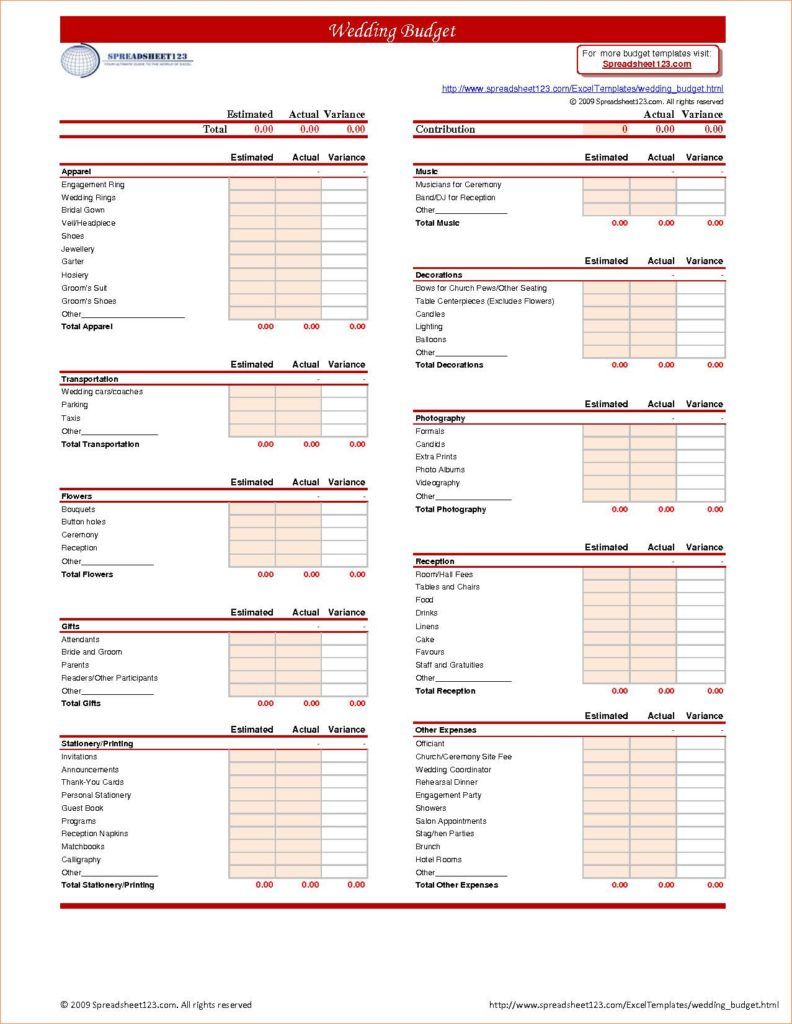

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

New Home Construction Tax Deductions are an abundance of practical and innovative resources for a variety of needs and pursuits. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the endless world of New Home Construction Tax Deductions and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can download and print these documents for free.

-

Do I have the right to use free printables to make commercial products?

- It is contingent on the specific rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with New Home Construction Tax Deductions?

- Some printables could have limitations regarding usage. Check these terms and conditions as set out by the designer.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit the local print shop for superior prints.

-

What software do I require to view printables for free?

- The majority are printed in the format PDF. This can be opened using free software such as Adobe Reader.

Essential Tax Deductions For Construction Businesses FreshBooks

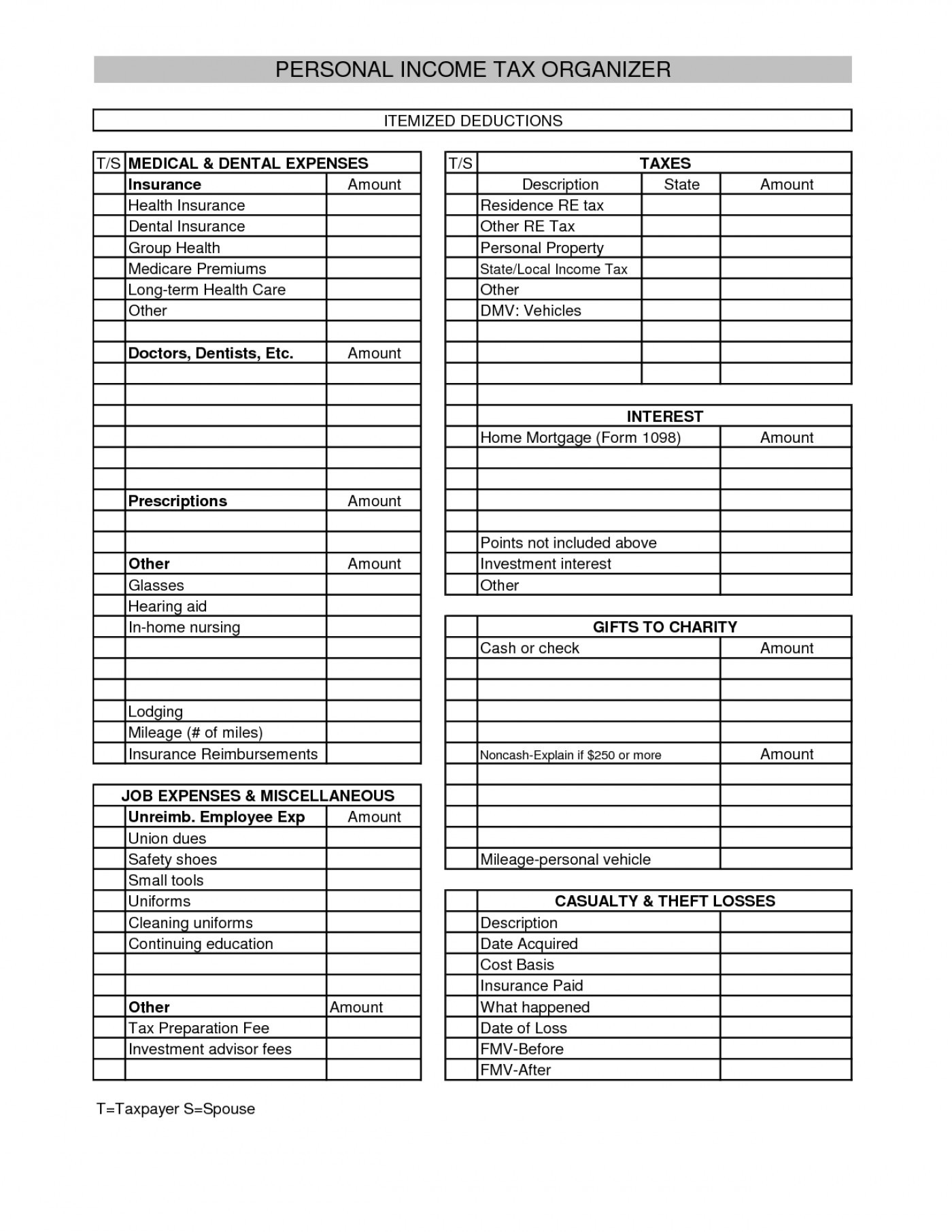

Printable Itemized Deductions Worksheet

Check more sample of New Home Construction Tax Deductions below

Small Business Tax Deductions Worksheet

Independent Contractor Excel Template Invoice Template

Printable Itemized Deductions Worksheet

Small Business Deductions Worksheet Petermcfarland us

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Common Tax Deductions For Construction Contractors STACK

https://www.irs.gov/newsroom/builders-of-new...

Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home

https://americantaxservice.org/tax-credits-new-home-construction

Learn how to save money on new home construction by claiming tax credits for energy efficient features and first time homebuyer programs Find out the eligibilit

Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home

Learn how to save money on new home construction by claiming tax credits for energy efficient features and first time homebuyer programs Find out the eligibilit

Small Business Deductions Worksheet Petermcfarland us

Independent Contractor Excel Template Invoice Template

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Common Tax Deductions For Construction Contractors STACK

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

Commonly Missed Tax Deductions In The Construction Industry Smith

Commonly Missed Tax Deductions In The Construction Industry Smith

Tax Donation Spreadsheet With Regard To Clothing Donation Tax Deduction