In this digital age, with screens dominating our lives, the charm of tangible printed items hasn't gone away. Whether it's for educational purposes in creative or artistic projects, or simply to add personal touches to your area, New Home Build Tax Deductions have become a valuable source. This article will take a dive deeper into "New Home Build Tax Deductions," exploring what they are, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest New Home Build Tax Deductions Below

New Home Build Tax Deductions

New Home Build Tax Deductions -

Tax Credits for New Home Construction August 5 2023 Tax Credits Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions and tax credits

Most people don t know that you can deduct aspects of your new home build from your taxes or receive tax credits Once the construction is complete you can deduct the mortgage interest on the loan used to finance the construction as well as property taxes paid on the home

New Home Build Tax Deductions cover a large range of printable, free items that are available online at no cost. They come in many types, such as worksheets templates, coloring pages, and many more. The value of New Home Build Tax Deductions lies in their versatility and accessibility.

More of New Home Build Tax Deductions

KBKG Welcomes Jesse Stanley As New Practice Leader To Support CPAs

KBKG Welcomes Jesse Stanley As New Practice Leader To Support CPAs

If you ve recently built your new home and were able to itemize your deductions you can deduct the interest you paid during the first 34 months of the construction loan

Tax Deductions for New Homes The most beneficial tax savings related to a new home is the mortgage interest deduction This is the interest the new homeowner pays on the mortgage loan taken out to purchase the house Interest paid on this loan can be deducted from taxes reducing the amount the homeowner will owe to the government

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization You can tailor the templates to meet your individual needs in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free provide for students of all ages. This makes the perfect tool for parents and educators.

-

Affordability: Fast access a plethora of designs and templates helps save time and effort.

Where to Find more New Home Build Tax Deductions

Build Tax Free Savings Using Roth Conversions Retirement Plan Services

Build Tax Free Savings Using Roth Conversions Retirement Plan Services

Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be able to claim tax credits up to 5 000 per home The amount of the credit depends on factors including the type of home its energy efficiency and the date when the home is acquired On this page Who is eligible Homes that qualify

Because the costs that are associated with the of building a new home are considered personal expenses as versus business expenses that pertain to owners of rental real estate you can claim any federal income tax credits and

If we've already piqued your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of New Home Build Tax Deductions for various motives.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing New Home Build Tax Deductions

Here are some ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

New Home Build Tax Deductions are a treasure trove of practical and innovative resources designed to meet a range of needs and interest. Their accessibility and versatility make them an essential part of both personal and professional life. Explore the vast collection of New Home Build Tax Deductions now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can print and download these tools for free.

-

Do I have the right to use free printables for commercial uses?

- It's all dependent on the conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables could be restricted on usage. Make sure you read the terms and conditions provided by the designer.

-

How do I print New Home Build Tax Deductions?

- Print them at home with an printer, or go to any local print store for better quality prints.

-

What program will I need to access printables for free?

- The majority of printed documents are in PDF format. These is open with no cost software, such as Adobe Reader.

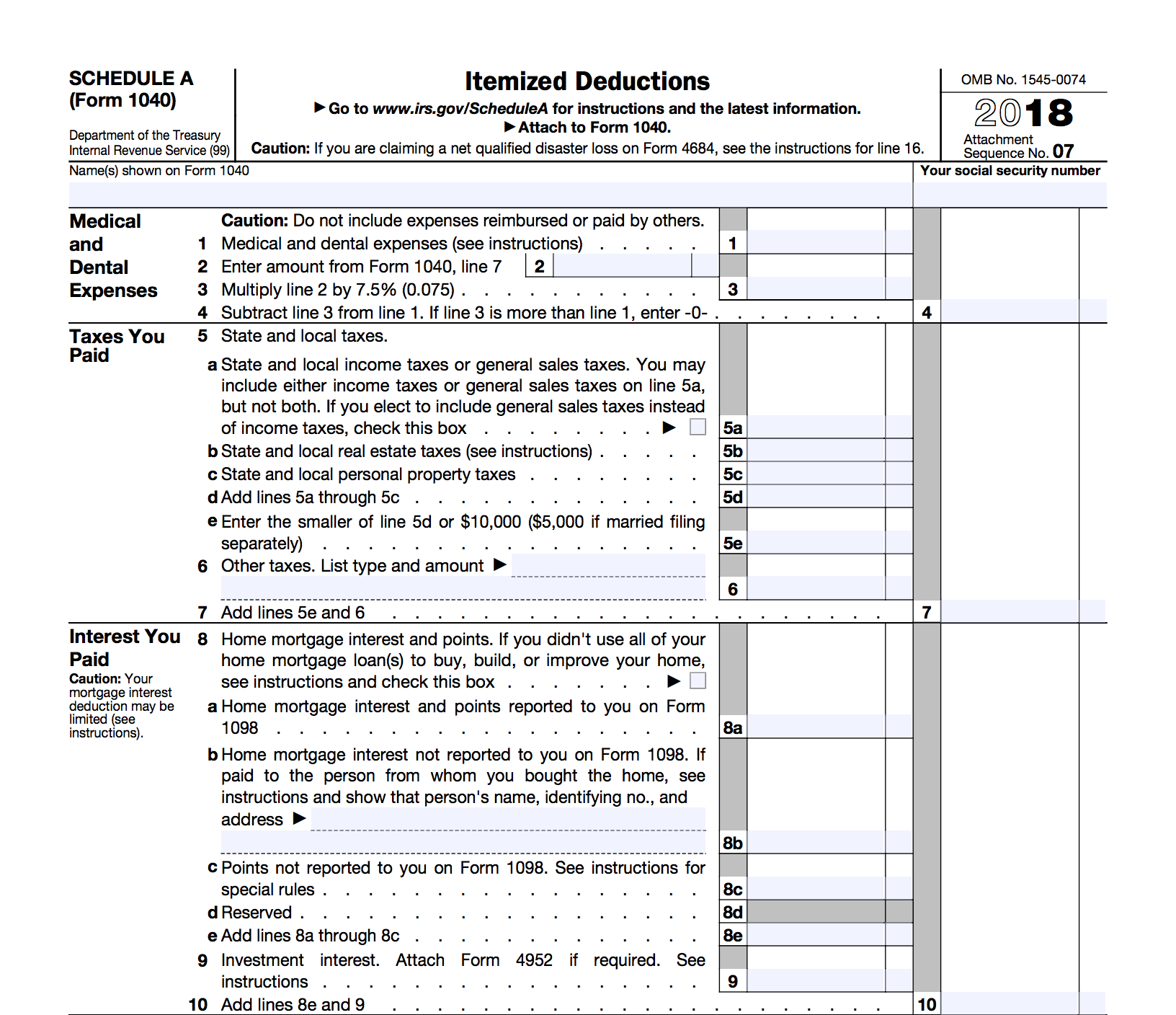

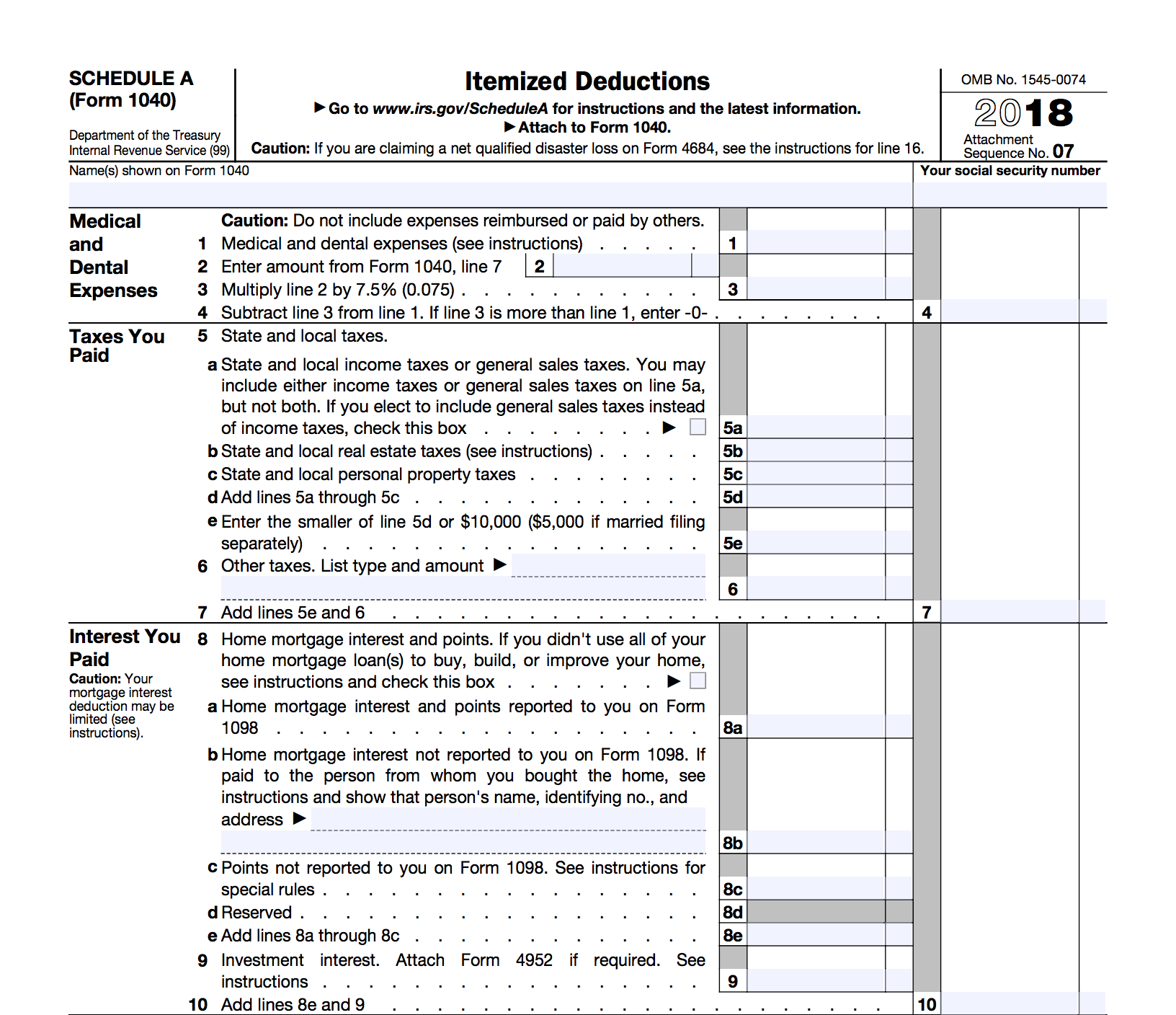

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

School Toilet Bag Moos Negro Padded Black 23 X 12 8 Cm

Check more sample of New Home Build Tax Deductions below

My Money Mechanics

Bernie Unloads After Manchin Sinks Dems Latest Spending Bill

How Can We Build Tax Capacity In Developing Countries

1040 Standard Deduction 2020 Standard Deduction 2021

Deductions Under The New Tax Regime Budget 2020 Quicko Blog

IRS Announces 2022 Tax Rates Standard Deduction

https://www.simplybuildable.com/knowledge-center/new-home-build-taxes

Most people don t know that you can deduct aspects of your new home build from your taxes or receive tax credits Once the construction is complete you can deduct the mortgage interest on the loan used to finance the construction as well as property taxes paid on the home

https://www.irs.gov/newsroom/know-whats-deductible...

Homeowners can t deduct any of the following items Insurance other than mortgage insurance including fire and comprehensive coverage and title insurance The amount applied to reduce the principal of the mortgage Wages you pay for domestic help Depreciation The cost of utilities such as gas electricity or water

Most people don t know that you can deduct aspects of your new home build from your taxes or receive tax credits Once the construction is complete you can deduct the mortgage interest on the loan used to finance the construction as well as property taxes paid on the home

Homeowners can t deduct any of the following items Insurance other than mortgage insurance including fire and comprehensive coverage and title insurance The amount applied to reduce the principal of the mortgage Wages you pay for domestic help Depreciation The cost of utilities such as gas electricity or water

1040 Standard Deduction 2020 Standard Deduction 2021

Bernie Unloads After Manchin Sinks Dems Latest Spending Bill

Deductions Under The New Tax Regime Budget 2020 Quicko Blog

IRS Announces 2022 Tax Rates Standard Deduction

Security Deposit Deductions List What Rental Damage Could Cost In

Business Tax List Of Business Tax Deductions

Business Tax List Of Business Tax Deductions

6 Ways To Build Tax Efficient Wealth My Road To Wealth And Freedom