In this age of technology, when screens dominate our lives however, the attraction of tangible printed objects isn't diminished. Be it for educational use project ideas, artistic or simply to add an individual touch to the home, printables for free are now a useful source. Through this post, we'll take a dive into the world of "Mobile Phone Tax Deduction Uk," exploring their purpose, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Mobile Phone Tax Deduction Uk Below

Mobile Phone Tax Deduction Uk

Mobile Phone Tax Deduction Uk -

If you are VAT registered you need to include the VAT only on the business portion of your calls For Limited companies everything depends on the type of mobile phone contract If the mobile phone or sim card is

You can therefore claim 140 of your mobile phone costs against tax If you are VAT registered you can also claim back the relevant proportion of the VAT you pay

Mobile Phone Tax Deduction Uk offer a wide assortment of printable materials online, at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility and accessibility.

More of Mobile Phone Tax Deduction Uk

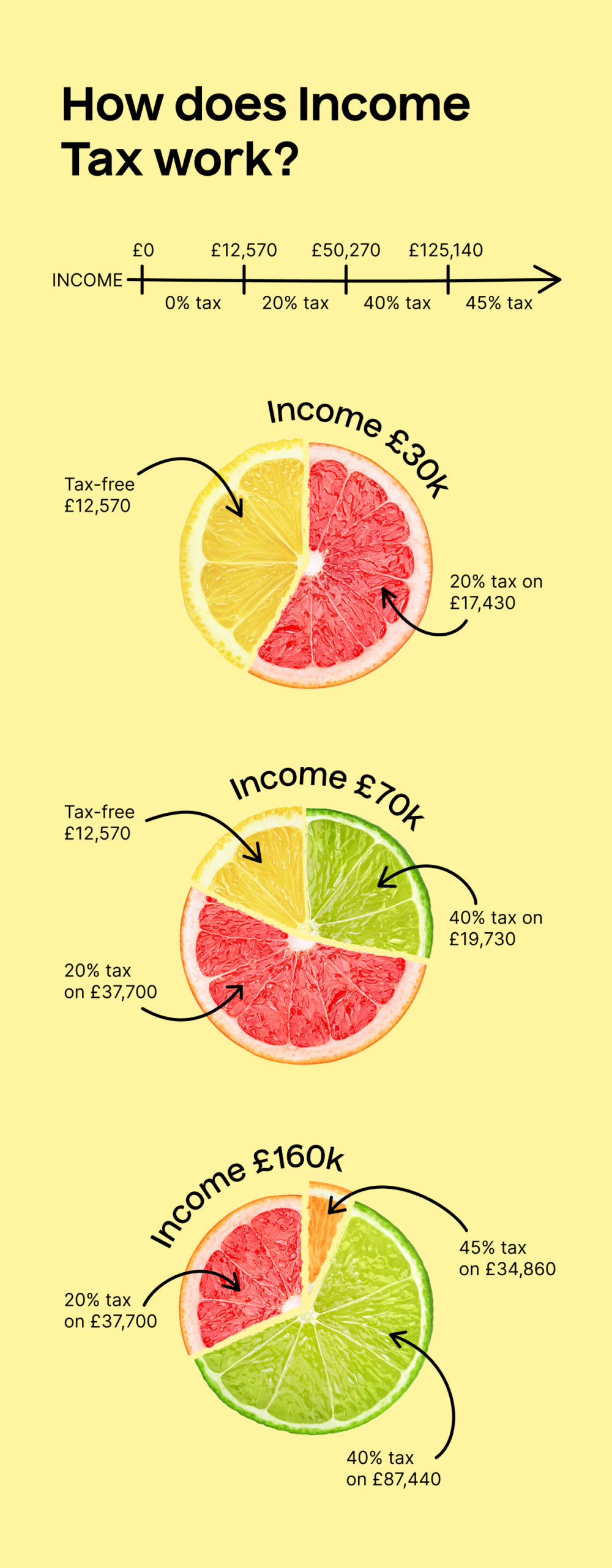

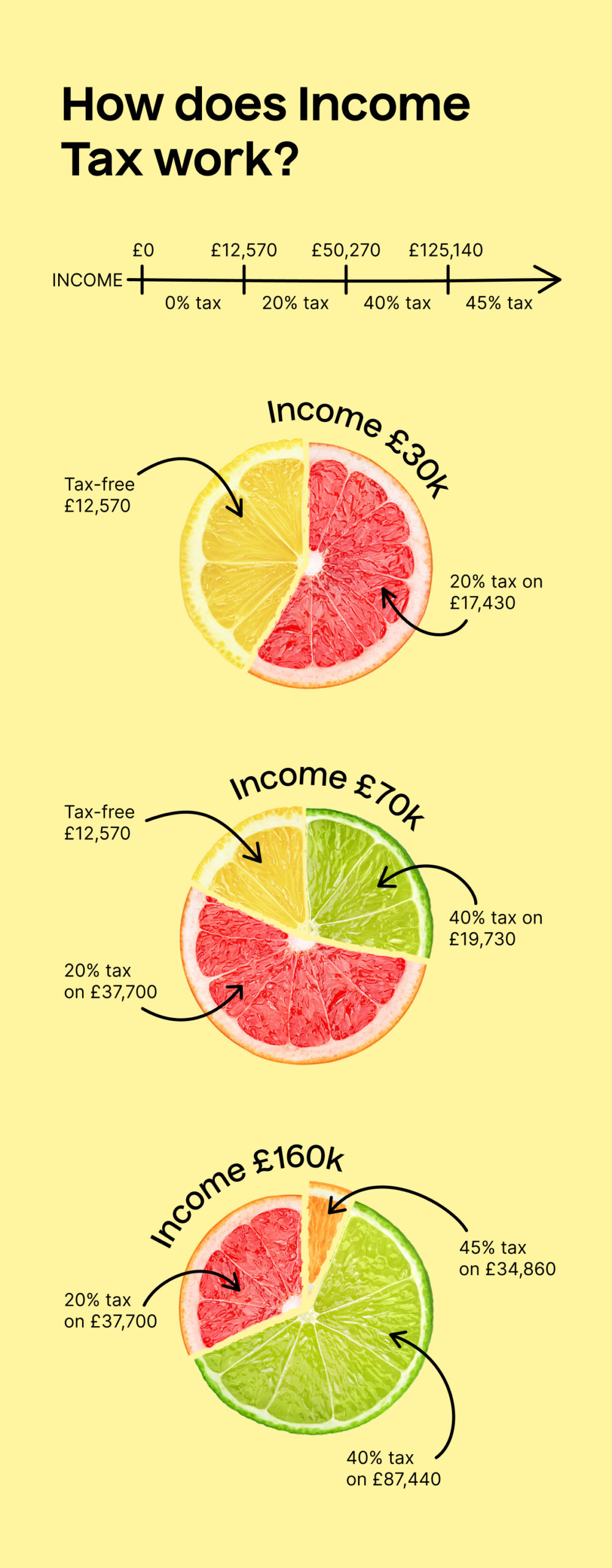

Income Tax Rates In The UK TaxScouts

Income Tax Rates In The UK TaxScouts

HMRC allow the full costs of your mobile phone bills as a tax allowable expense providing the mobile phone contract is held in the name of the limited

On 03 Jan 2020 HMRC have released new guidance for employers on how to tax company mobile phones that are given to employees and which devices qualify for tax treatment 3 January 2020 Did you receive a new

Mobile Phone Tax Deduction Uk have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization: We can customize print-ready templates to your specific requirements in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a great source for educators and parents.

-

Accessibility: The instant accessibility to the vast array of design and templates is time-saving and saves effort.

Where to Find more Mobile Phone Tax Deduction Uk

Have You Claimed All The Tax Deductions You Are Eligible For In UK

Have You Claimed All The Tax Deductions You Are Eligible For In UK

If you deduct 10 000 from that for allowable expenses you will pay tax on the 30 000 that remains If you use money in your business account to pay for personal

If you use your phone mobile and internet for personal and business use you ll need to demonstrate a realistic way of dividing the costs and can only claim tax back on the part for business use You

After we've peaked your curiosity about Mobile Phone Tax Deduction Uk Let's find out where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Mobile Phone Tax Deduction Uk for a variety objectives.

- Explore categories like the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad range of topics, ranging from DIY projects to planning a party.

Maximizing Mobile Phone Tax Deduction Uk

Here are some ideas in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Mobile Phone Tax Deduction Uk are an abundance with useful and creative ideas that meet a variety of needs and pursuits. Their accessibility and versatility make them an invaluable addition to the professional and personal lives of both. Explore the many options of Mobile Phone Tax Deduction Uk today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can print and download these items for free.

-

Can I utilize free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions on usage. You should read the terms and conditions offered by the creator.

-

How do I print Mobile Phone Tax Deduction Uk?

- You can print them at home with the printer, or go to any local print store for higher quality prints.

-

What program must I use to open printables that are free?

- The majority of PDF documents are provided in the format PDF. This can be opened using free programs like Adobe Reader.

Cameroon Govt Introduces New Mobile Phone Tax Collection System

Pakistan Increases Tax On Mobile Phone Recharge

Check more sample of Mobile Phone Tax Deduction Uk below

Mobile Phone Tax Calculator For Import Of Mobile Phones In Pakistan

UK Super deduction Learn How You Can Save With Capital Allowance

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

What Is The Super deduction And Am I Eligible Conveney Nicholls

130 Super Deduction HMA Tax

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

https://www.thp.co.uk/mobile-phone-tax-deductible

You can therefore claim 140 of your mobile phone costs against tax If you are VAT registered you can also claim back the relevant proportion of the VAT you pay

https://partneraccountancy.co.uk/can-i-claim-my...

Published 13 September 2021 HMRC expenses rules state that you can make available for use to an employee one mobile phone for business purposes which is exempt from tax

You can therefore claim 140 of your mobile phone costs against tax If you are VAT registered you can also claim back the relevant proportion of the VAT you pay

Published 13 September 2021 HMRC expenses rules state that you can make available for use to an employee one mobile phone for business purposes which is exempt from tax

What Is The Super deduction And Am I Eligible Conveney Nicholls

UK Super deduction Learn How You Can Save With Capital Allowance

130 Super Deduction HMA Tax

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

UK Super deduction Learn How You Can Save With Capital Allowance

Bethlehem Turn On The Light Of Hope Pro Terra Sancta

Bethlehem Turn On The Light Of Hope Pro Terra Sancta

What Would Labour Do To Sort The Power Sharing Issues In Northern