In a world where screens rule our lives however, the attraction of tangible printed materials hasn't faded away. Whatever the reason, whether for education in creative or artistic projects, or simply to add some personal flair to your space, Military Tax Relief Act have proven to be a valuable resource. Through this post, we'll take a dive into the world of "Military Tax Relief Act," exploring what they are, how they can be found, and what they can do to improve different aspects of your lives.

Get Latest Military Tax Relief Act Below

Military Tax Relief Act

Military Tax Relief Act -

The MSRRA changes the basic rules of taxation with respect to military spouses who earn income from services performed in a State in which the spouse is present with the Service member SM in compliance with military orders when that State is not the spouse s domicile legal residence

7 minute read Jan 30 2024 The Servicemembers Civil Relief Act provides financial and legal protections for active duty service members including National Guard and reserve members and their families Because the details of the SCRA are complicated service members and their families are encouraged to contact the nearest legal

Military Tax Relief Act cover a large array of printable materials online, at no cost. These printables come in different types, such as worksheets coloring pages, templates and much more. One of the advantages of Military Tax Relief Act is their versatility and accessibility.

More of Military Tax Relief Act

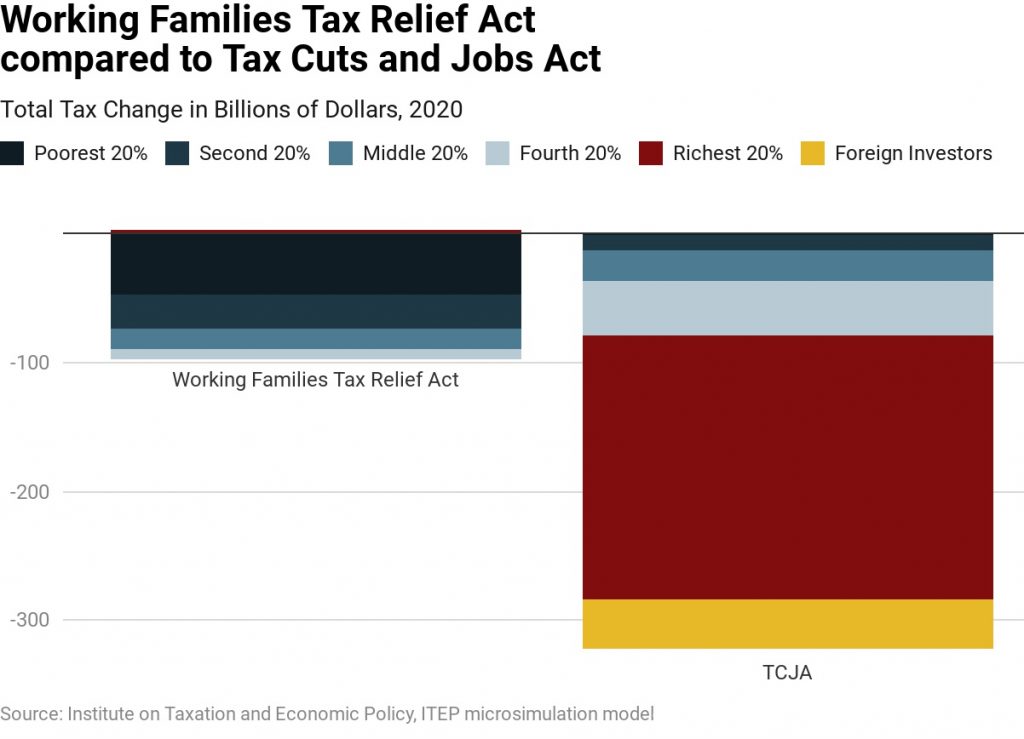

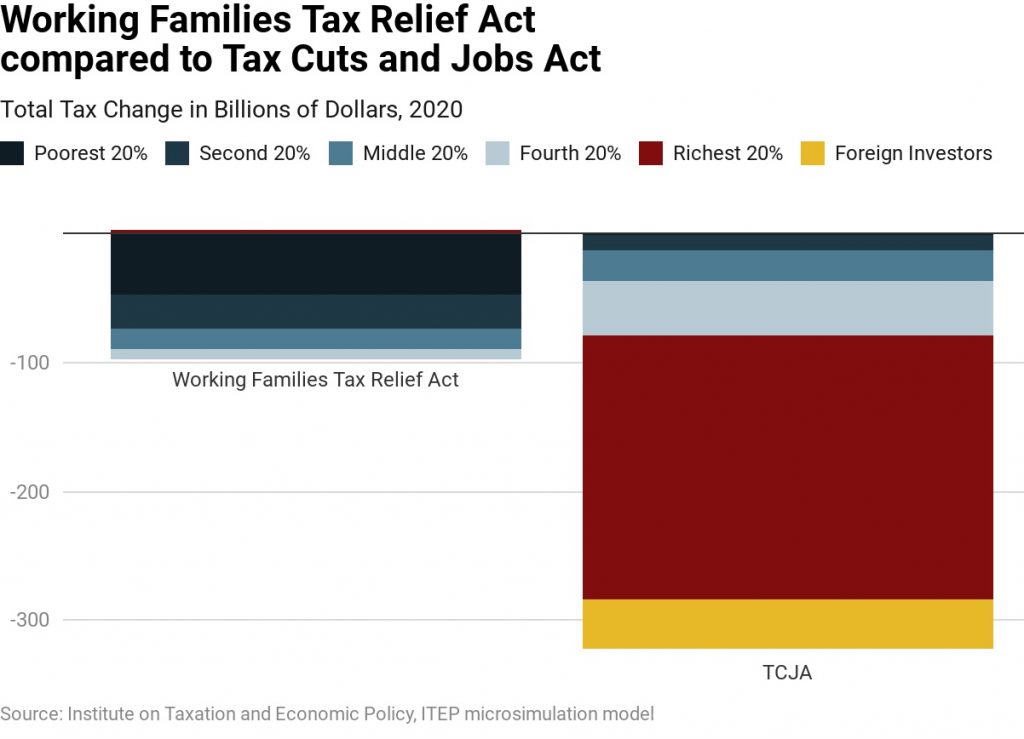

Working Families Tax Relief Act ITEP

Working Families Tax Relief Act ITEP

Published July 13 2021 You might have heard of a military spouses residency relief act a rule rumored to help military spouses But what is it and what does it mean and what does it

The MSRRA amends the Servicemembers Civil Relief Act SCRA to provide that the spouse of a military member does not lose nor acquire a residence domicile for purposes of income or property

Military Tax Relief Act have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization This allows you to modify the templates to meet your individual needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Value: These Military Tax Relief Act cater to learners of all ages, which makes these printables a powerful resource for educators and parents.

-

Simple: immediate access various designs and templates cuts down on time and efforts.

Where to Find more Military Tax Relief Act

The COVID related Tax Relief Act Of 2020 Itax Services

The COVID related Tax Relief Act Of 2020 Itax Services

The spouse of a servicemember is exempt from income taxation by a state when he or she 1 Currently resides in a state different than the state of domicile 2 Resides in the state solely in

SCRA extends relief to all Army Air Force Coast Guard Marine Corps and Navy service members on active duty members of the Reserve component when serving on active duty members of the National Guard component mobilized under federal orders for more than 30 consecutive days and active duty commissioned officers of the Public Health Service

Now that we've piqued your curiosity about Military Tax Relief Act Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of motives.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast spectrum of interests, starting from DIY projects to planning a party.

Maximizing Military Tax Relief Act

Here are some unique ways create the maximum value use of Military Tax Relief Act:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Military Tax Relief Act are an abundance of practical and imaginative resources that satisfy a wide range of requirements and interest. Their availability and versatility make them an invaluable addition to both professional and personal life. Explore the vast array of Military Tax Relief Act today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes you can! You can download and print these materials for free.

-

Can I utilize free printables for commercial uses?

- It's based on the terms of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may contain restrictions in use. Be sure to check the terms and conditions set forth by the designer.

-

How do I print printables for free?

- Print them at home using any printer or head to a print shop in your area for higher quality prints.

-

What software do I need in order to open printables for free?

- The majority of printed documents are in the format PDF. This can be opened using free software like Adobe Reader.

Military Tax Relief Is Achievable Here s How

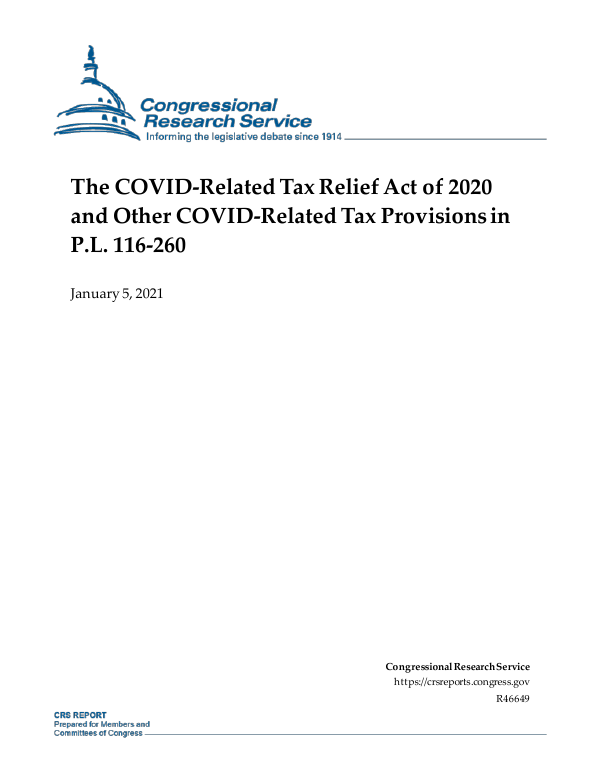

The COVID Related Tax Relief Act Of 2020 And Other COVID Related Tax

Check more sample of Military Tax Relief Act below

The COVID Related Tax Relief Act Of 2020 AbitOs CPAs And Advisors

Hurricane Tax Relief Act Wikipedia

.svg/1200px-Great_Seal_of_the_United_States_(obverse).svg.png)

Temporary Tax Relief Act Of 2007 Buy Temporary Tax Relief Act Of 2007

CONTENTdm

Time Is Running Out Congress Extend The Mortgage Forgiveness Tax

Military Family Tax Relief Act Ideal Tax

https://www.militaryonesource.mil/financial-legal/...

7 minute read Jan 30 2024 The Servicemembers Civil Relief Act provides financial and legal protections for active duty service members including National Guard and reserve members and their families Because the details of the SCRA are complicated service members and their families are encouraged to contact the nearest legal

https://www.hrblock.com/tax-center/lifestyle/...

The MSRRA only applies when The spouse currently lives in a state different than their residency state The spouse lives in the new state solely to be with the service member The service member is in the state under military orders Also the spouse can t lose or get a new residence for tax purposes if they re moving with the service member

7 minute read Jan 30 2024 The Servicemembers Civil Relief Act provides financial and legal protections for active duty service members including National Guard and reserve members and their families Because the details of the SCRA are complicated service members and their families are encouraged to contact the nearest legal

The MSRRA only applies when The spouse currently lives in a state different than their residency state The spouse lives in the new state solely to be with the service member The service member is in the state under military orders Also the spouse can t lose or get a new residence for tax purposes if they re moving with the service member

CONTENTdm

.svg/1200px-Great_Seal_of_the_United_States_(obverse).svg.png)

Hurricane Tax Relief Act Wikipedia

Time Is Running Out Congress Extend The Mortgage Forgiveness Tax

Military Family Tax Relief Act Ideal Tax

Disaster Tax Relief Act Rosenfield Co

COVID related Tax Relief Act Of 2020 Lucke And Associates CPAs L C

COVID related Tax Relief Act Of 2020 Lucke And Associates CPAs L C

Iowa Working Families Tax Relief Act Iowa Senate Republicans