In this age of electronic devices, where screens dominate our lives, the charm of tangible printed materials isn't diminishing. For educational purposes, creative projects, or simply to add a personal touch to your area, Michigan Property Tax Credit For Deceased Taxpayer can be an excellent resource. The following article is a take a dive deeper into "Michigan Property Tax Credit For Deceased Taxpayer," exploring what they are, how they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Michigan Property Tax Credit For Deceased Taxpayer Below

Michigan Property Tax Credit For Deceased Taxpayer

Michigan Property Tax Credit For Deceased Taxpayer -

Michigan Tax Tribunal by the end of July July and December board of review appeals must be made to the Michigan Tax Tribunal within 35 days of notice DISABLED

The 6 month residency rule does not apply to deceased taxpayers The taxes on which a credit may be based are those taxes billed to and paid by the claimant for

Printables for free cover a broad assortment of printable, downloadable resources available online for download at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages, and many more. The attraction of printables that are free is in their variety and accessibility.

More of Michigan Property Tax Credit For Deceased Taxpayer

Michigan Property Tax Exemptions I Am Landlord

Michigan Property Tax Exemptions I Am Landlord

To annualize total household resources project what it would have been for a full year Step 1 Divide 365 by the number of days the taxpayer was a Michigan resident in

This booklet contains information for your 2024 Michigan property taxes and 2023 individual income taxes homestead property tax credits farmland and open space tax

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: It is possible to tailor the design to meet your needs whether it's making invitations and schedules, or even decorating your home.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making them a great tool for teachers and parents.

-

Simple: Instant access to a variety of designs and templates helps save time and effort.

Where to Find more Michigan Property Tax Credit For Deceased Taxpayer

Will I Get A Check Or Property Tax Credit For The Senior Freeze Nj

Will I Get A Check Or Property Tax Credit For The Senior Freeze Nj

SOLVED by Intuit 5 Updated September 25 2023 Below you ll find answers to frequently asked questions about the Michigan homestead property tax

2018 MICHIGAN Homestead Property Tax Credit Claim Ml 1040CR Issued under authority of PublicAct 281 of 1967 as amended Type or print in blue or black ink Print

After we've peaked your interest in Michigan Property Tax Credit For Deceased Taxpayer Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Michigan Property Tax Credit For Deceased Taxpayer suitable for many uses.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast selection of subjects, ranging from DIY projects to planning a party.

Maximizing Michigan Property Tax Credit For Deceased Taxpayer

Here are some ideas ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Michigan Property Tax Credit For Deceased Taxpayer are an abundance of useful and creative resources designed to meet a range of needs and passions. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the wide world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes, they are! You can download and print these documents for free.

-

Do I have the right to use free printables in commercial projects?

- It's dependent on the particular terms of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations on their use. Be sure to review the conditions and terms of use provided by the author.

-

How can I print Michigan Property Tax Credit For Deceased Taxpayer?

- Print them at home with the printer, or go to an in-store print shop to get the highest quality prints.

-

What software do I require to open Michigan Property Tax Credit For Deceased Taxpayer?

- The majority of printed documents are in PDF format. They can be opened using free software such as Adobe Reader.

20 Property Tax Credit For Montgomery County Homeowners Ages 65 Who

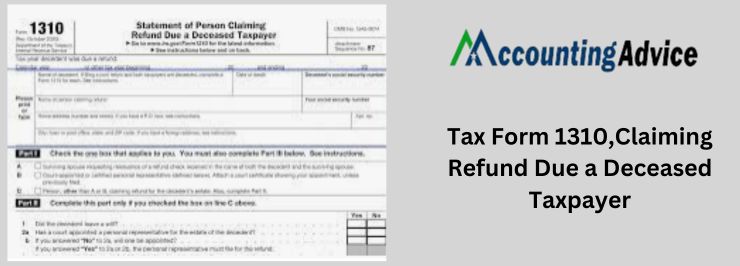

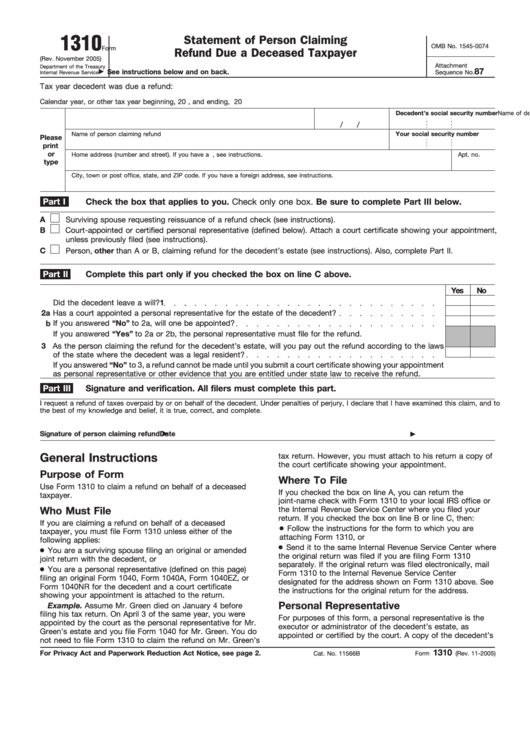

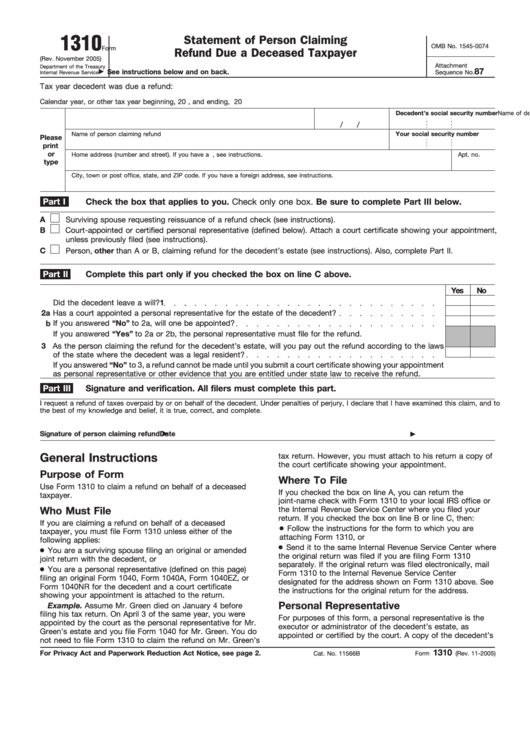

Tax Form 1310 Claiming Refund Due A Deceased Taxpayer

Check more sample of Michigan Property Tax Credit For Deceased Taxpayer below

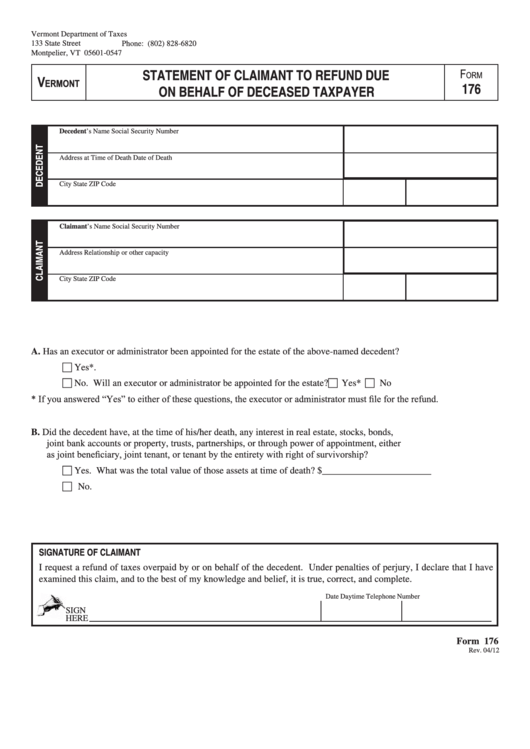

Form 176 Statement Of Claimant To Refund Due On Behalf Of Deceased

Michigan Non Homestead Property Tax PROPERTY HJE

Maryland Homestead Property Tax Credit Program

Filing A Deceased Person s Final Tax Return Form 1040 Or 1040 SR

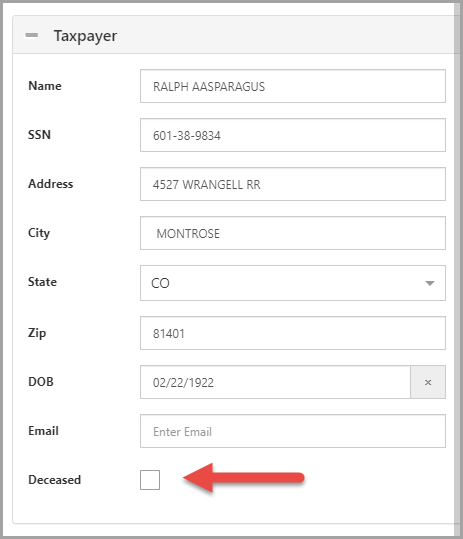

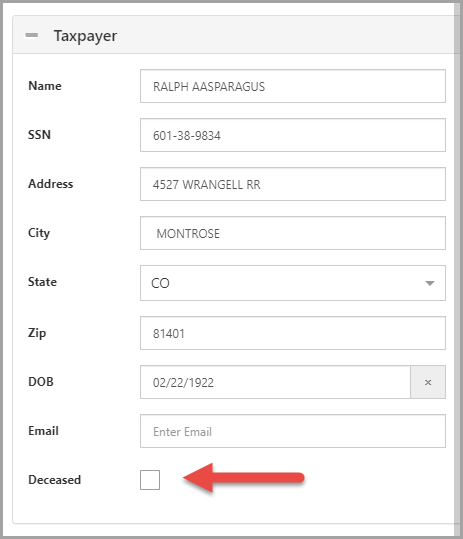

Deceased Taxpayer Option For 1040 Returns SafeSend Returns

Iowa Homestead Tax Credit Johnson County

https://casetext.com/regulation/michigan...

The 6 month residency rule does not apply to deceased taxpayers The taxes on which a credit may be based are those taxes billed to and paid by the claimant for

https://www.law.cornell.edu/regulations/michigan/...

Rule 31 The 6 month residency rule does not apply to deceased taxpayers The taxes on which a credit may be based are those taxes billed to and paid by the claimant for the

The 6 month residency rule does not apply to deceased taxpayers The taxes on which a credit may be based are those taxes billed to and paid by the claimant for

Rule 31 The 6 month residency rule does not apply to deceased taxpayers The taxes on which a credit may be based are those taxes billed to and paid by the claimant for the

Filing A Deceased Person s Final Tax Return Form 1040 Or 1040 SR

Michigan Non Homestead Property Tax PROPERTY HJE

Deceased Taxpayer Option For 1040 Returns SafeSend Returns

Iowa Homestead Tax Credit Johnson County

Affidavit For 1099 Tax Form For Deceased Taxpayer AffidavitForm

Irs Form 1310 Printable Portal Tutorials

Irs Form 1310 Printable Portal Tutorials

Groups Want Property Tax Credit For Iowa Veterans Doubled Radio Iowa