In this digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. Be it for educational use or creative projects, or simply to add a personal touch to your home, printables for free are now a vital resource. The following article is a dive through the vast world of "Medical Insurance Tax Exemption India," exploring what they are, how to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Medical Insurance Tax Exemption India Below

Medical Insurance Tax Exemption India

Medical Insurance Tax Exemption India -

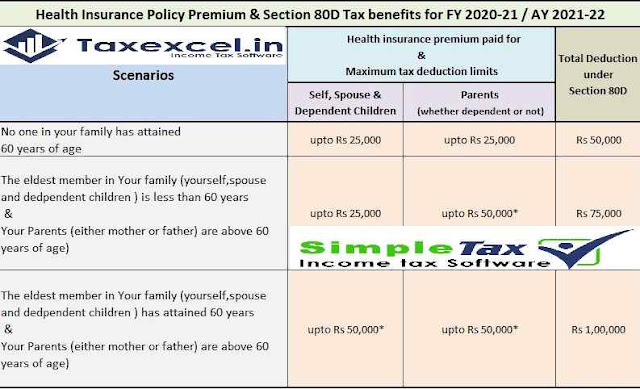

Yes under Section 80D of the Income Tax Act HUFs are entitled to claim tax exemption for all or any members The total tax exemption however is capped at Rs 25 000 per fiscal year Can I get tax exemption for my group health insurance No group health insurance policies are not eligible for tax benefits

Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses paid for preventative health check ups This deduction is limited to Rs 25 000 Rs 50 000 as applicable

Medical Insurance Tax Exemption India offer a wide collection of printable content that can be downloaded from the internet at no cost. They come in many types, such as worksheets templates, coloring pages, and many more. One of the advantages of Medical Insurance Tax Exemption India lies in their versatility and accessibility.

More of Medical Insurance Tax Exemption India

Tax On Rental Income India Deduction Exemption Calculation More

Tax On Rental Income India Deduction Exemption Calculation More

Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical Expenditure

In India medical insurance premiums are subject to income tax exemption under section 80D This is applicable on health insurance premium paid for personal spouse children and dependents parents The exemption is

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization We can customize the templates to meet your individual needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: These Medical Insurance Tax Exemption India are designed to appeal to students of all ages, making these printables a powerful resource for educators and parents.

-

Affordability: instant access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Medical Insurance Tax Exemption India

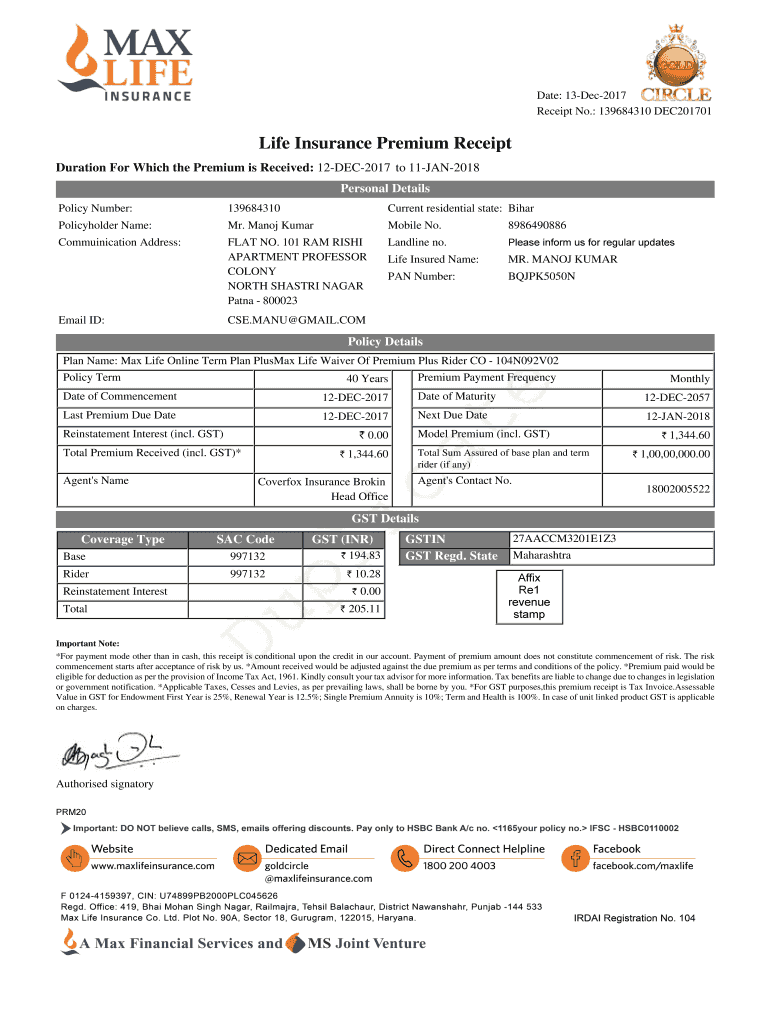

Premium Receipt Fill Out And Sign Printable PDF Template SignNow

Premium Receipt Fill Out And Sign Printable PDF Template SignNow

Tax Calculator to find maximum health insurance tax deduction eligible up to Rs 1 00 000 under Section 80D for AY 2019 20 onwards covering the expenses related to Health insurance premium paid Preventive health check up fees paid Medical Expenditure paid for self spouse or children either of parents

Section 80D allows individuals and Hindu Undivided Families HUF to claim deductions on certain expenses done towards medical health insurance premiums from their taxable income A person can claim deductions on the cost of health insurance and the cost of a preventative health examination for themselves their spouse their dependent children

Now that we've ignited your interest in printables for free We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Medical Insurance Tax Exemption India for all motives.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Medical Insurance Tax Exemption India

Here are some ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Medical Insurance Tax Exemption India are a treasure trove filled with creative and practical information for a variety of needs and needs and. Their access and versatility makes these printables a useful addition to both professional and personal life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Medical Insurance Tax Exemption India truly cost-free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I download free templates for commercial use?

- It's dependent on the particular usage guidelines. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Medical Insurance Tax Exemption India?

- Certain printables may be subject to restrictions on use. Be sure to read the terms and conditions set forth by the designer.

-

How do I print Medical Insurance Tax Exemption India?

- You can print them at home using an printer, or go to any local print store for more high-quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in the PDF format, and can be opened with free programs like Adobe Reader.

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Tax Exemption Of Health Insurance U s 80 D F Y 2020 21 With Automated

Check more sample of Medical Insurance Tax Exemption India below

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

Life Insurance Tax Exemption Limit CBDT Issues Guidelines For Tax

Health Insurance

Haryana Private Educational Institutions To Get One Year Property Tax

Health Insurance Tax Exemption Form ExemptForm

Toll Tax Exemption For Army Person viral yt army toll Tax india

https://www.policybazaar.com/health-insurance/section80d-deductions

Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses paid for preventative health check ups This deduction is limited to Rs 25 000 Rs 50 000 as applicable

https://tax2win.in/guide/section-80d-deduction...

Explore Section 80D 80D Deduction Understand income tax deductions for medical insurance find out who s eligible and unlock the tax benefits Income Tax deduction under sec 80D for Medical Insurance Read FAQ on Medical expenditure preventive health checkup for AY 2018 19 AY 2019 20 AY 2020 21

Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses paid for preventative health check ups This deduction is limited to Rs 25 000 Rs 50 000 as applicable

Explore Section 80D 80D Deduction Understand income tax deductions for medical insurance find out who s eligible and unlock the tax benefits Income Tax deduction under sec 80D for Medical Insurance Read FAQ on Medical expenditure preventive health checkup for AY 2018 19 AY 2019 20 AY 2020 21

Haryana Private Educational Institutions To Get One Year Property Tax

Life Insurance Tax Exemption Limit CBDT Issues Guidelines For Tax

Health Insurance Tax Exemption Form ExemptForm

Toll Tax Exemption For Army Person viral yt army toll Tax india

Corporate Tax Exemption For Companies And Startup India In Budget 2020

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Tax Exemption Life Insurance Financial Investing Protection India