In this day and age with screens dominating our lives however, the attraction of tangible printed objects hasn't waned. Whatever the reason, whether for education in creative or artistic projects, or simply to add some personal flair to your home, printables for free have become an invaluable resource. In this article, we'll dive to the depths of "Medical Insurance Income Tax Section Exemption," exploring what they are, how you can find them, and how they can enhance various aspects of your daily life.

Get Latest Medical Insurance Income Tax Section Exemption Below

Medical Insurance Income Tax Section Exemption

Medical Insurance Income Tax Section Exemption -

What is medical allowance exemption section 10 Medical allowance exemption Section 10 of the Income Tax Act provides exemptions of up to Rs 15 000

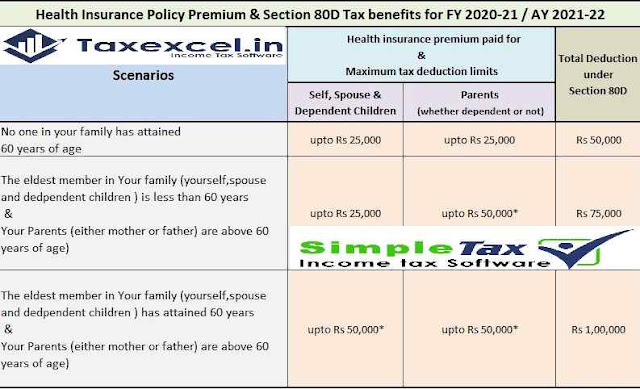

What is Section 80D of the Income Tax Act Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial

Medical Insurance Income Tax Section Exemption encompass a wide selection of printable and downloadable resources available online for download at no cost. They are available in numerous types, like worksheets, coloring pages, templates and much more. The appealingness of Medical Insurance Income Tax Section Exemption is in their variety and accessibility.

More of Medical Insurance Income Tax Section Exemption

Medical Insurance Income Tax Benefits By Sue Kneeland Medium

Medical Insurance Income Tax Benefits By Sue Kneeland Medium

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be

Section 80D exemption is a tax benefit provided by the Indian government for expenses related to health insurance It allows you to reduce your taxable income by the amount

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization This allows you to modify print-ready templates to your specific requirements whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free provide for students from all ages, making these printables a powerful aid for parents as well as educators.

-

It's easy: instant access many designs and templates will save you time and effort.

Where to Find more Medical Insurance Income Tax Section Exemption

Preventive Check Up 80d Wkcn

Preventive Check Up 80d Wkcn

Section 80D of the Income Tax Act 1961 allows the individuals and Hindu Undivided Families HUFs to claim tax deductions of up to INR 25 000 for health

Section 80D also allows you to claim a deduction for medical expenses or health insurance premiums paid for senior citizens As per Section 80D if your age is 60

If we've already piqued your curiosity about Medical Insurance Income Tax Section Exemption, let's explore where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Medical Insurance Income Tax Section Exemption suitable for many needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Medical Insurance Income Tax Section Exemption

Here are some inventive ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Medical Insurance Income Tax Section Exemption are an abundance filled with creative and practical information that can meet the needs of a variety of people and interests. Their accessibility and versatility make they a beneficial addition to both personal and professional life. Explore the vast array of Medical Insurance Income Tax Section Exemption and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print the resources for free.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific terms of use. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions in their usage. Make sure you read the conditions and terms of use provided by the creator.

-

How can I print Medical Insurance Income Tax Section Exemption?

- You can print them at home using either a printer at home or in the local print shop for better quality prints.

-

What program must I use to open printables at no cost?

- A majority of printed materials are as PDF files, which is open with no cost software like Adobe Reader.

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Information On Section 80G Of Income Tax Act Ebizfiling

Check more sample of Medical Insurance Income Tax Section Exemption below

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Anything To Everything Income Tax Guide For Individuals Including

OLD INDIAN CURRENCY SYSTEM SAVE TAX SAVE MONEY Insurance

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

https://www.policybazaar.com/health-insurance/...

What is Section 80D of the Income Tax Act Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial

https://cleartax.in/s/80c-80-deductions

You as an individual or HUF can claim a deduction of Rs 25 000 under section 80D on insurance for self spouse and dependent children An additional

What is Section 80D of the Income Tax Act Section 80D of the Income Tax Act 1961 offers tax deductions of up to 25 000 on health insurance premiums paid in a financial

You as an individual or HUF can claim a deduction of Rs 25 000 under section 80D on insurance for self spouse and dependent children An additional

OLD INDIAN CURRENCY SYSTEM SAVE TAX SAVE MONEY Insurance

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

What Is Income Tax Limit For Property Tax And Insurance

Section 10 10D Exemption Towards Amount Received Under A Life

Section 10 10D Exemption Towards Amount Received Under A Life

Tax Exemption On Life Insurance Policy Under Section 10 10D Plan