In this age of technology, where screens dominate our lives The appeal of tangible printed objects hasn't waned. In the case of educational materials in creative or artistic projects, or simply adding an element of personalization to your area, Limited Company Tax Refund have become a valuable source. For this piece, we'll take a dive deep into the realm of "Limited Company Tax Refund," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your daily life.

Get Latest Limited Company Tax Refund Below

Limited Company Tax Refund

Limited Company Tax Refund -

Imagine your limited company made a loss of 7 000 in the accounting period 1st January 2022 to 31st December 2022 and a profit of 19 000 in the previous 12 months Under the carry back rules the company s 7 000 loss can be offset against the profits for the previous accounting year

Running a limited company Get a refund or interest if your company pays too much Corporation Tax or pays it early

Limited Company Tax Refund offer a wide variety of printable, downloadable items that are available online at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and much more. The beauty of Limited Company Tax Refund lies in their versatility as well as accessibility.

More of Limited Company Tax Refund

Uk Limited Company Tax Calculator CALCULATORUK DFE

Uk Limited Company Tax Calculator CALCULATORUK DFE

If you believe you should get a corporation tax refund then you should use your company corporation tax return to inform HMRC that a refund is due and how you want the repayment paid There are broadly four main ways to get it paid notably Having it paid directly to your company bank account

If your limited company pays too much Corporation Tax you can ask HMRC for a Corporation Tax refund i e a repayment of the amount that you overpay You may also be entitled to interest on the overpayment HMRC s current interest rate is 0 5

Limited Company Tax Refund have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization We can customize designs to suit your personal needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Downloads of educational content for free cater to learners of all ages. This makes them a vital device for teachers and parents.

-

It's easy: Quick access to the vast array of design and templates reduces time and effort.

Where to Find more Limited Company Tax Refund

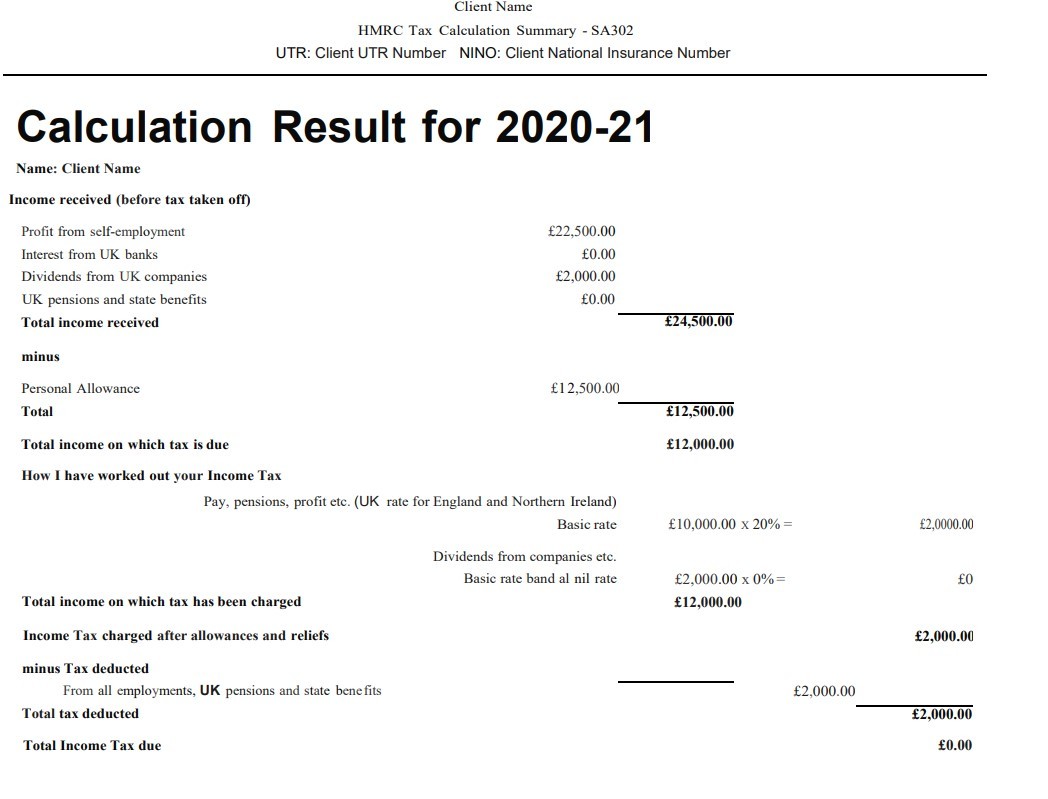

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

Under previous loss carry back rules A tax refund of 47 500 would have been available to ABC Ltd Under the extended loss carry back rules A tax refund of 76 000 will be available to ABC Ltd If the current year loss had been between 500 001 750 000 ABC Ltd would have been able to carry back losses into the 2017 accounting

A limited company in the UK can claim back CIS Construction Industry Scheme tax that has been deducted from payments made to subcontractors by following these steps Register for CIS with HM Revenue and

We hope we've stimulated your interest in printables for free we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Limited Company Tax Refund to suit a variety of needs.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing Limited Company Tax Refund

Here are some inventive ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Limited Company Tax Refund are a treasure trove of fun and practical tools which cater to a wide range of needs and pursuits. Their accessibility and flexibility make them a fantastic addition to your professional and personal life. Explore the endless world of Limited Company Tax Refund and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Limited Company Tax Refund really absolutely free?

- Yes they are! You can print and download these materials for free.

-

Can I make use of free printables for commercial use?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions regarding usage. Be sure to check the terms and conditions provided by the creator.

-

How can I print Limited Company Tax Refund?

- You can print them at home using printing equipment or visit any local print store for top quality prints.

-

What software will I need to access printables that are free?

- A majority of printed materials are in PDF format. These can be opened with free software, such as Adobe Reader.

Proof Of Income Documents For Self Employed IncomeProTalk

How To Close A Limited Company Without Paying Any Tax

Check more sample of Limited Company Tax Refund below

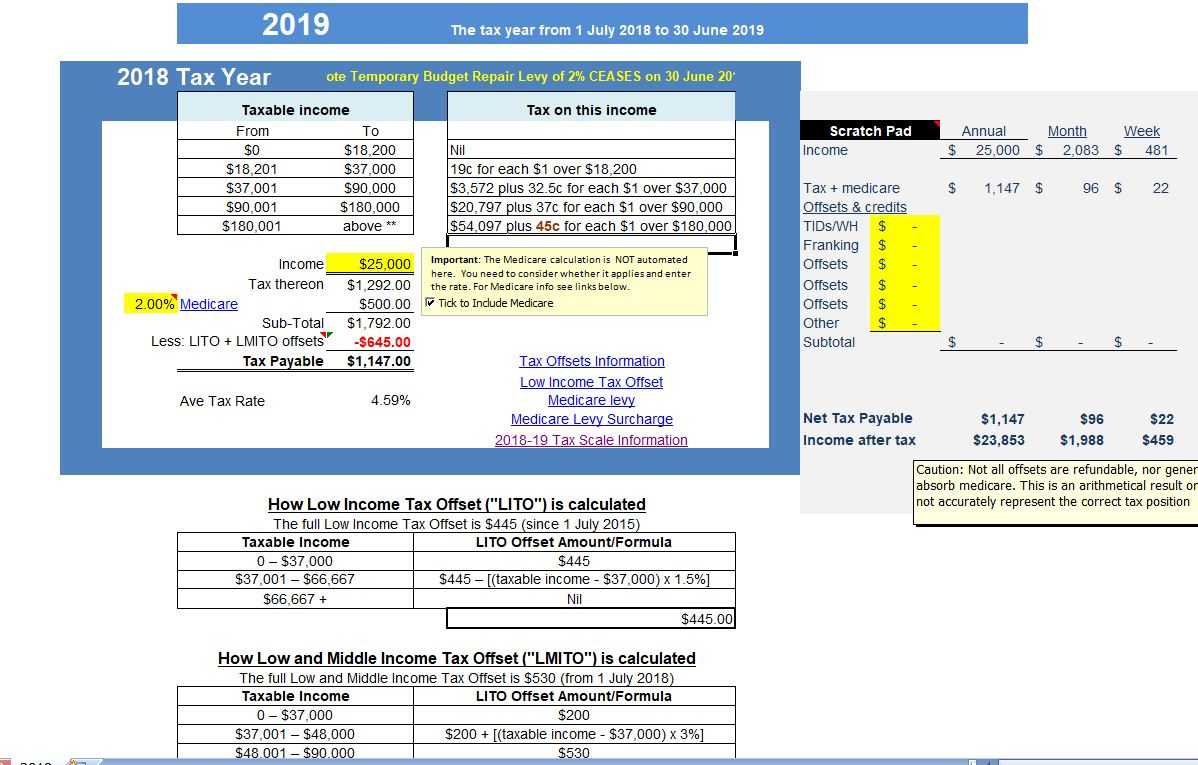

Limited Company Tax Calculator Spreadsheet Google Spreadshee Limited

Limited Company Tax The Practical Guide To UK Ltd Company Tax

Tax Cheat Sheet S24 Election Buyer Seller Can Jointly Make A S24

Limited Company Tax How What Where Why When

2022 Tax Planning Equity Transfer Tax Rate IMedia

How To Print Your SA302 Or Tax Year Overview From HMRC Love

https://www. gov.uk /get-refund-interest-corporation-tax

Running a limited company Get a refund or interest if your company pays too much Corporation Tax or pays it early

https://www. gov.uk /guidance/corporation-tax...

You can make a claim to carry back a trading loss when you submit your Company Tax Return for the period when you made the loss

Running a limited company Get a refund or interest if your company pays too much Corporation Tax or pays it early

You can make a claim to carry back a trading loss when you submit your Company Tax Return for the period when you made the loss

Limited Company Tax How What Where Why When

Limited Company Tax The Practical Guide To UK Ltd Company Tax

2022 Tax Planning Equity Transfer Tax Rate IMedia

How To Print Your SA302 Or Tax Year Overview From HMRC Love

2022 Tax Planning Equity Transfer Tax Rate IMedia

Limited Company Tax Return Swan Saunders

Limited Company Tax Return Swan Saunders

Limited Company Tax Calculator Spreadsheet Intended For Ato Tax