In this digital age, where screens have become the dominant feature of our lives but the value of tangible printed items hasn't gone away. Whether it's for educational purposes project ideas, artistic or simply to add a personal touch to your area, Kentucky Energy Efficiency Tax Credit are now an essential resource. In this article, we'll take a dive into the sphere of "Kentucky Energy Efficiency Tax Credit," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your life.

Get Latest Kentucky Energy Efficiency Tax Credit Below

Kentucky Energy Efficiency Tax Credit

Kentucky Energy Efficiency Tax Credit -

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Tax credits covering 30 of the costs of community solar projects owned by local businesses that sign up families to save on their electric bills with additional bonus

Kentucky Energy Efficiency Tax Credit encompass a wide variety of printable, downloadable documents that can be downloaded online at no cost. These resources come in many designs, including worksheets templates, coloring pages, and more. The great thing about Kentucky Energy Efficiency Tax Credit is in their versatility and accessibility.

More of Kentucky Energy Efficiency Tax Credit

Home Energy Improvements Lead To Real Savings Infographic Solar

Home Energy Improvements Lead To Real Savings Infographic Solar

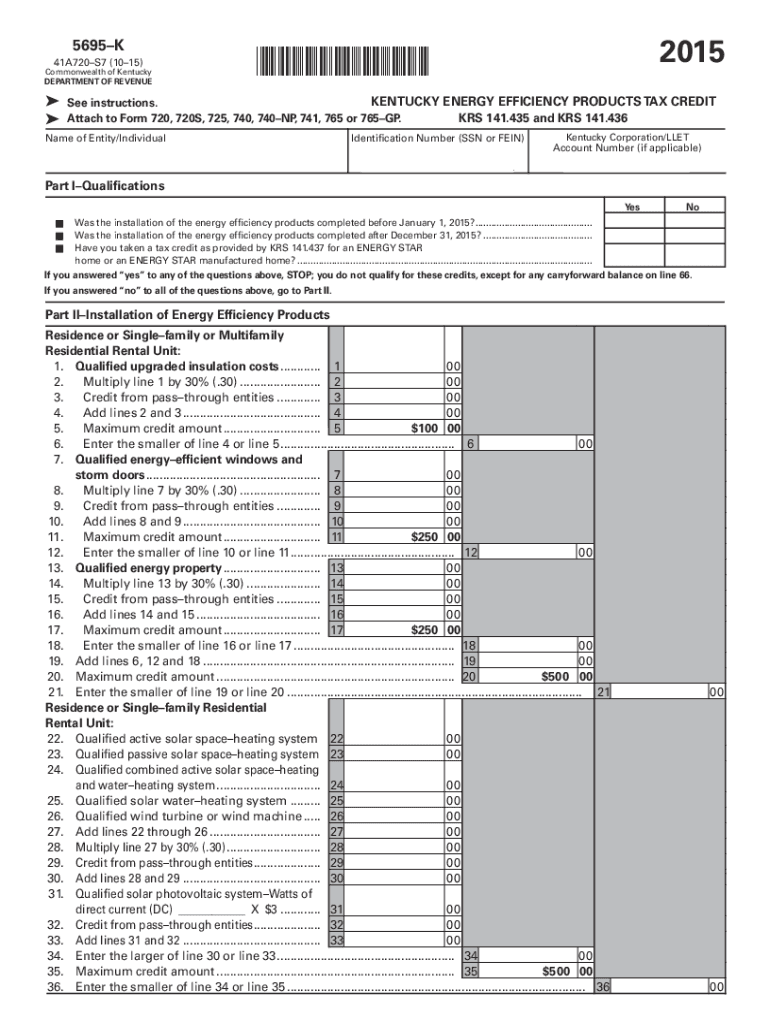

Purpose of Form This form is used by a taxpayer to claim a tax credit for installation of energy efficiency products for residential and commercial property as provided by KRS

Does Kentucky have net metering for solar Learn about Kentucky solar incentives tax credits local rebates and the cost of solar panels in Kentucky in our

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: This allows you to modify printed materials to meet your requirements whether it's making invitations making your schedule, or even decorating your house.

-

Educational Value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a valuable resource for educators and parents.

-

The convenience of Access to many designs and templates reduces time and effort.

Where to Find more Kentucky Energy Efficiency Tax Credit

Form 5695 Fill Out And Sign Printable PDF Template SignNow

Form 5695 Fill Out And Sign Printable PDF Template SignNow

Energy Efficiency Conservation Block Grants Energy Efficiency Appliance Rebate Program Award in millions 52 5 70 9 25 1 The Executive Office of The

KENTUCKY Energy Effi ciency Products Tax Credit Name of Business Individual Identifi cation Number SSN or FEIN Kentucky

Now that we've piqued your interest in printables for free Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Kentucky Energy Efficiency Tax Credit for a variety reasons.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning tools.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing Kentucky Energy Efficiency Tax Credit

Here are some inventive ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Kentucky Energy Efficiency Tax Credit are an abundance with useful and creative ideas that satisfy a wide range of requirements and interests. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the plethora of Kentucky Energy Efficiency Tax Credit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes they are! You can print and download these materials for free.

-

Can I make use of free printables for commercial purposes?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright issues in Kentucky Energy Efficiency Tax Credit?

- Some printables may have restrictions regarding usage. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer or go to a local print shop to purchase premium prints.

-

What software must I use to open printables that are free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software like Adobe Reader.

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

How To Cover Different Sized Windows In The Same Room In Las Vegas

Check more sample of Kentucky Energy Efficiency Tax Credit below

What Qualifies For Energy Efficient Tax Credit

How To Get The Energy Efficiency Tax Credit For Commercial Buildings

Companies Organizations Call For Modernizing Homeowner Energy

Claim Energy Efficiency Tax Credit For Homeowners Before It s Gone Inman

Roofing Options To Consider When It s Time To Replace

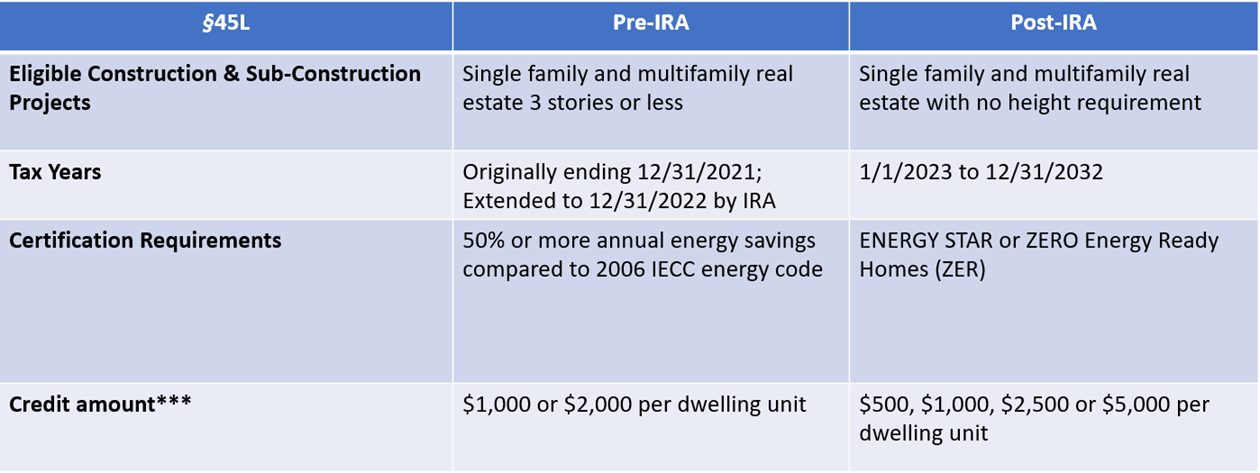

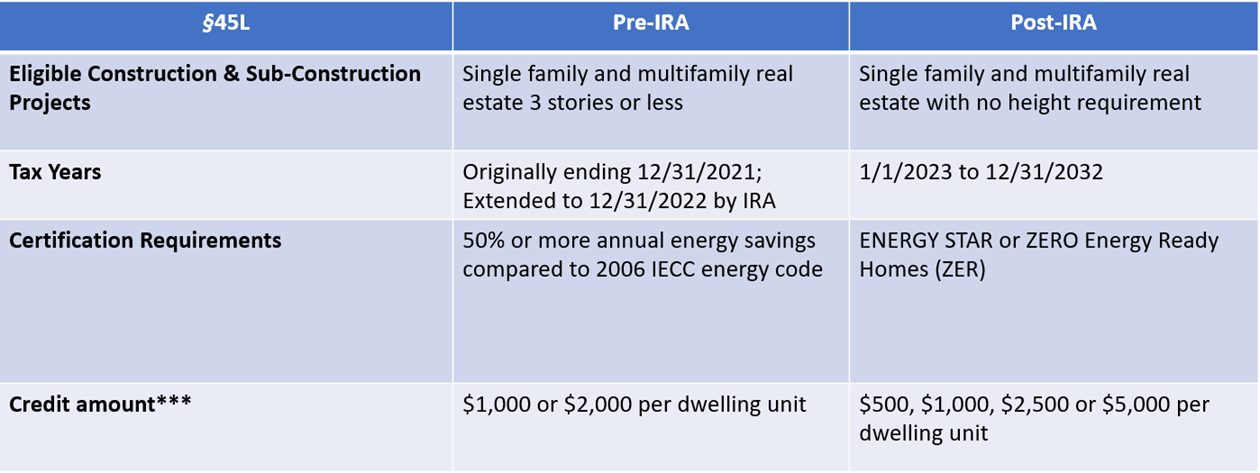

An Energy Efficiency Tax Credit And Motivated Buyers Await Builders Who

https://www.whitehouse.gov/.../2022/08/Kentucky.pdf

Tax credits covering 30 of the costs of community solar projects owned by local businesses that sign up families to save on their electric bills with additional bonus

https://revenue.ky.gov/Business/Pages/Tax-Credits.aspx

Business Tax Credits Individual Angel Investor Credit Child and Dependent Care Credit Credit for Tax Paid to Another State Education Tuition Tax Credit Flow

Tax credits covering 30 of the costs of community solar projects owned by local businesses that sign up families to save on their electric bills with additional bonus

Business Tax Credits Individual Angel Investor Credit Child and Dependent Care Credit Credit for Tax Paid to Another State Education Tuition Tax Credit Flow

Claim Energy Efficiency Tax Credit For Homeowners Before It s Gone Inman

How To Get The Energy Efficiency Tax Credit For Commercial Buildings

Roofing Options To Consider When It s Time To Replace

An Energy Efficiency Tax Credit And Motivated Buyers Await Builders Who

2022 Tax Credits For Residential Energy Efficiency Improvements Ciel

Energy Efficiency Tax Incentives For Real Estate Businesses Under The

Energy Efficiency Tax Incentives For Real Estate Businesses Under The

WB2B863 Viessmann WB2B863 WB2B 105 304 000 BTU Output Vitodens 200