In this day and age in which screens are the norm however, the attraction of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons, creative projects, or simply adding a personal touch to your area, Is The Energy Tax Credit Refundable are now a useful source. Here, we'll take a dive deeper into "Is The Energy Tax Credit Refundable," exploring the benefits of them, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Is The Energy Tax Credit Refundable Below

Is The Energy Tax Credit Refundable

Is The Energy Tax Credit Refundable -

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

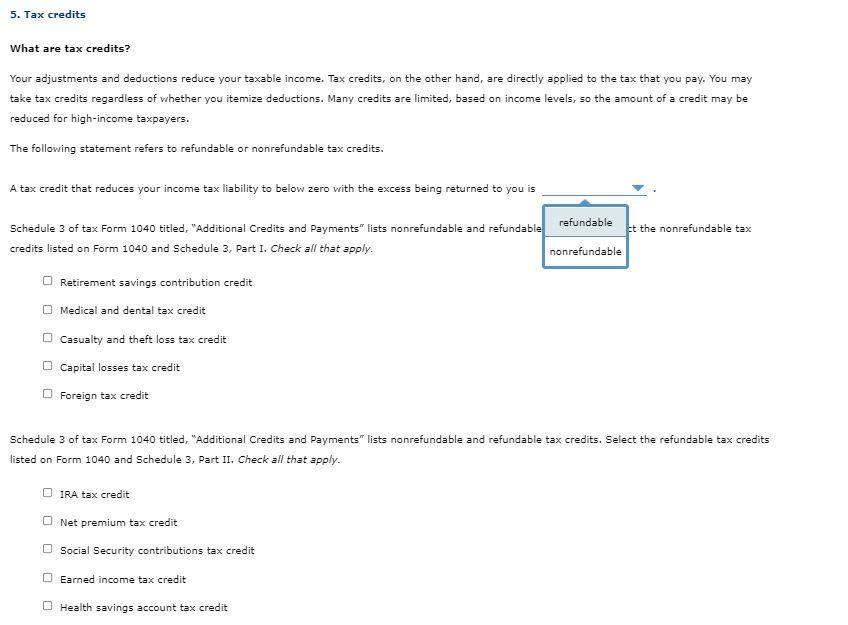

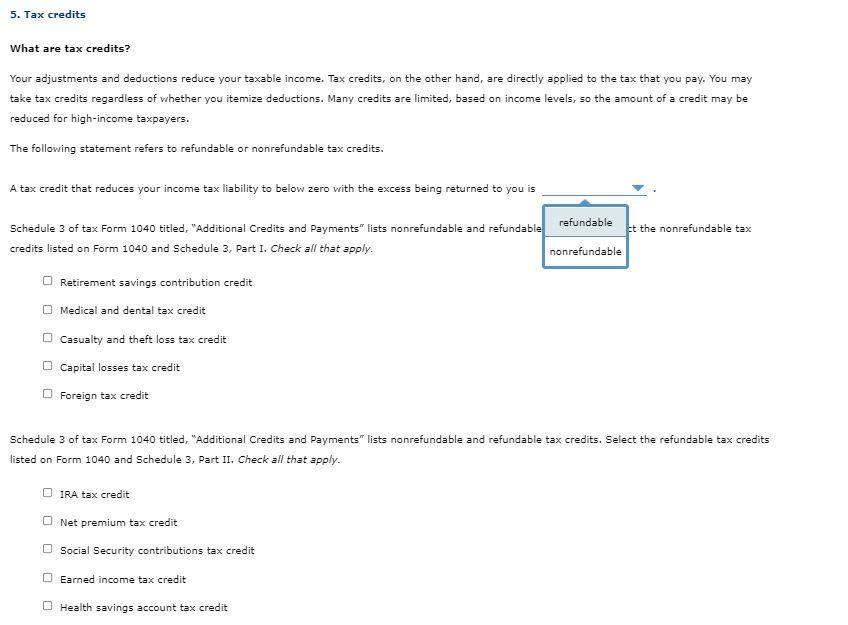

Both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit are nonrefundable personal tax credits A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability

Is The Energy Tax Credit Refundable encompass a wide assortment of printable materials available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and many more. The value of Is The Energy Tax Credit Refundable is their versatility and accessibility.

More of Is The Energy Tax Credit Refundable

What Is The Non Refundable Portion Of Employee Retention Credit By

What Is The Non Refundable Portion Of Employee Retention Credit By

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property when they

The Inflation Reduction Act IRA created a new monetization regime under Section 6417 that allows tax exempt entities to elect to claim 12 of the IRA s energy credits as refundable payments Three of the credits are also effectively refundable for all taxpayers for up to a five year period

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: You can tailor printables to fit your particular needs whether it's making invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: These Is The Energy Tax Credit Refundable provide for students of all ages. This makes them an invaluable tool for parents and educators.

-

Affordability: instant access numerous designs and templates will save you time and effort.

Where to Find more Is The Energy Tax Credit Refundable

Is There An Energy Tax Credit For 2023 Facts You Didn T Know

Is There An Energy Tax Credit For 2023 Facts You Didn T Know

Individuals can claim a nonrefundable credit for a tax year in an amount equal to 30 of the sum of 1 the amount paid or incurred by the taxpayer for qualified energy efficiency improvements installed during the year known as energy efficient building envelope components plus 2 the amount of residential energy property expenditures

The Inflation Reduction Act also allows tax exempt and governmental entities to receive elective payments for 12 clean energy tax credits including the major Investment and Production Tax Credits as well as tax credits for electric vehicles and charging stations

In the event that we've stirred your interest in printables for free Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of goals.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging that range from DIY projects to party planning.

Maximizing Is The Energy Tax Credit Refundable

Here are some new ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free to build your knowledge at home as well as in the class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Is The Energy Tax Credit Refundable are a treasure trove of useful and creative resources for a variety of needs and hobbies. Their availability and versatility make them a fantastic addition to each day life. Explore the wide world of Is The Energy Tax Credit Refundable today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is The Energy Tax Credit Refundable truly for free?

- Yes, they are! You can download and print these items for free.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using Is The Energy Tax Credit Refundable?

- Certain printables could be restricted on usage. Be sure to check the terms and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home with an printer, or go to an area print shop for premium prints.

-

What software is required to open printables that are free?

- Most printables come in PDF format. They can be opened using free software, such as Adobe Reader.

Is The 2020 Child Tax Credit A Refundable Credit Leia Aqui Is The IRS

New Refundable Child Care Tax Credit REFUNDABLE TAX CREDIT

Check more sample of Is The Energy Tax Credit Refundable below

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

Candidate Q A State Senate District 22 Maile Shimabukuro Honolulu

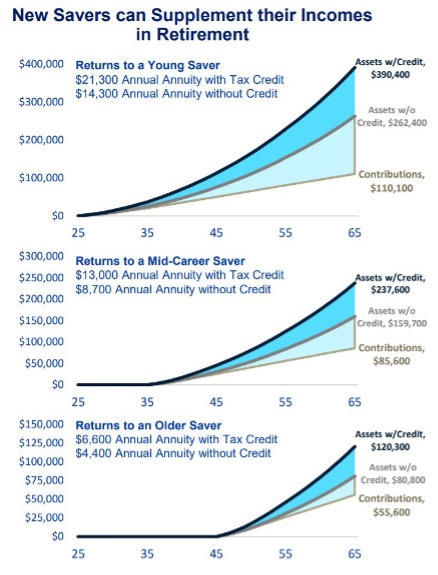

What s The Saver s Tax Credit And Is It Refundable

Understanding The Impact Of Non Refundable Tax Credits

The Potential Impact Of The Trump Administration Cancelling The

Are Education Credits Refundable AZexplained

https://www.irs.gov/credits-deductions/frequently...

Both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit are nonrefundable personal tax credits A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability

https://www.irs.gov/newsroom/irs-updates...

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property when they sell it

Both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit are nonrefundable personal tax credits A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property when they sell it

Understanding The Impact Of Non Refundable Tax Credits

Candidate Q A State Senate District 22 Maile Shimabukuro Honolulu

The Potential Impact Of The Trump Administration Cancelling The

Are Education Credits Refundable AZexplained

Police Cruiser Damaged In The Chase

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

How Universal Access And A Refundable Saver s Tax Credit Can Transform