In the age of digital, where screens rule our lives, the charm of tangible printed products hasn't decreased. Be it for educational use and creative work, or simply to add an extra personal touch to your space, Is Health Insurance Tax Exempt are now a vital resource. With this guide, you'll dive deep into the realm of "Is Health Insurance Tax Exempt," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Is Health Insurance Tax Exempt Below

Is Health Insurance Tax Exempt

Is Health Insurance Tax Exempt -

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

Health Plans If an employer pays the cost of an accident or health insurance plan for his her employees including an employee s spouse and dependents then the employer s payments are not wages and are not subject to social security Medicare and FUTA taxes or federal income tax withholding

Is Health Insurance Tax Exempt include a broad range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and much more. One of the advantages of Is Health Insurance Tax Exempt is their versatility and accessibility.

More of Is Health Insurance Tax Exempt

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

Employer paid premiums for health insurance are exempt from federal income and payroll taxes Additionally the portion of premiums employees pay is typically excluded from taxable income The exclusion of premiums lowers most workers tax bills and thus reduces their after tax cost of coverage

Payroll deductions are wages withheld from an employee s total earnings for the purpose of paying taxes garnishments and benefits like health insurance These withholdings constitute the difference between gross pay and net pay and may include Income tax Social security tax 401 k contributions Wage garnishments 1 Child support payments

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: This allows you to modify the templates to meet your individual needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value: Printing educational materials for no cost can be used by students of all ages, which makes the perfect resource for educators and parents.

-

An easy way to access HTML0: Fast access a myriad of designs as well as templates helps save time and effort.

Where to Find more Is Health Insurance Tax Exempt

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

What s exempt What to report and pay Work out the value Technical guidance Overview As an employer providing medical or dental treatment or insurance to your employees you have certain

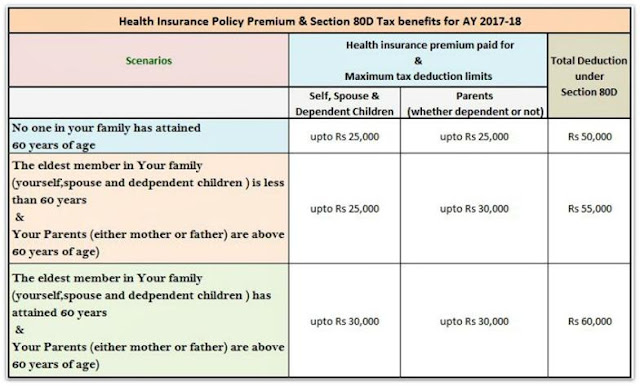

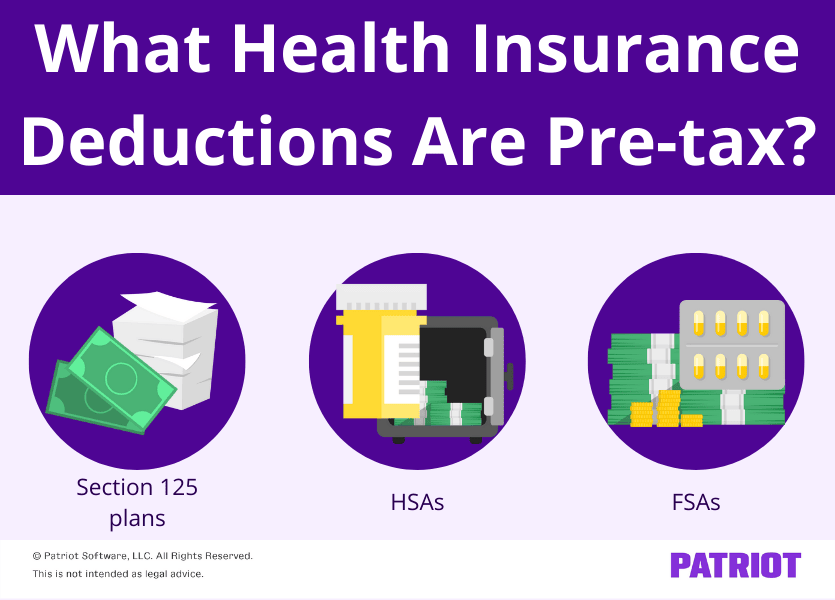

Currently employers spending on health insurance premiums is exempt from taxation for both employers and employees Premiums paid by employees are exempt as well if the firm has established a Section 125 cafeteria plan roughly 80 percent of employees with insurance have such a plan

We hope we've stimulated your curiosity about Is Health Insurance Tax Exempt and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Is Health Insurance Tax Exempt designed for a variety needs.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning tools.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a wide selection of subjects, that range from DIY projects to party planning.

Maximizing Is Health Insurance Tax Exempt

Here are some ideas that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Is Health Insurance Tax Exempt are an abundance of useful and creative resources catering to different needs and interest. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the vast array of Is Health Insurance Tax Exempt and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can download and print the resources for free.

-

Can I use free printing templates for commercial purposes?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Is Health Insurance Tax Exempt?

- Some printables may come with restrictions regarding their use. You should read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a print shop in your area for better quality prints.

-

What program is required to open printables at no cost?

- Most printables come as PDF files, which can be opened with free software like Adobe Reader.

How Health Insurance Tax Benefits 2016 Can Ease Your Pain

Is Health Insurance Tax Deductible

Check more sample of Is Health Insurance Tax Exempt below

Health Insurance Is A Necessity These Days And It s Eligible For A Tax

Are Dental Implants Taxable Dental News Network

5 Year End Medical Plan Tax Deduction Strategies

Is Health Insurance Tax Deductible Advocate Health Plans

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Is Health Insurance Tax Deductible In India Plum Blog

https://www.irs.gov/businesses/small-businesses...

Health Plans If an employer pays the cost of an accident or health insurance plan for his her employees including an employee s spouse and dependents then the employer s payments are not wages and are not subject to social security Medicare and FUTA taxes or federal income tax withholding

https://turbotax.intuit.com/tax-tips/health-care/...

Beginning after 2018 there s no longer a federal tax penalty for not having health insurance If you obtain your health insurance from the Health Insurance Marketplace you may be eligible to receive a tax credit to offset some of

Health Plans If an employer pays the cost of an accident or health insurance plan for his her employees including an employee s spouse and dependents then the employer s payments are not wages and are not subject to social security Medicare and FUTA taxes or federal income tax withholding

Beginning after 2018 there s no longer a federal tax penalty for not having health insurance If you obtain your health insurance from the Health Insurance Marketplace you may be eligible to receive a tax credit to offset some of

Is Health Insurance Tax Deductible Advocate Health Plans

Are Dental Implants Taxable Dental News Network

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Is Health Insurance Tax Deductible In India Plum Blog

APP 2023 10 APP 10

Sample Letter Exemption Doc Template PdfFiller

Sample Letter Exemption Doc Template PdfFiller

Is Health Insurance Premium Tax Deductible Cares Healthy