In this age of technology, where screens have become the dominant feature of our lives The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses project ideas, artistic or simply adding personal touches to your home, printables for free have become a valuable resource. The following article is a dive deeper into "Is Fuel Reimbursement Taxable Income," exploring the benefits of them, where they are, and how they can add value to various aspects of your life.

Get Latest Is Fuel Reimbursement Taxable Income Below

Is Fuel Reimbursement Taxable Income

Is Fuel Reimbursement Taxable Income -

If your business uses an accountable plan reimbursements are not taxable You do not have to withhold or contribute income FICA or unemployment taxes To have an accountable plan your employees must meet all three of the following rules The employee must have incurred deductible expenses while performing services as your

It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website

Is Fuel Reimbursement Taxable Income cover a large variety of printable, downloadable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, templates, coloring pages and much more. One of the advantages of Is Fuel Reimbursement Taxable Income is their flexibility and accessibility.

More of Is Fuel Reimbursement Taxable Income

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Typically a mileage reimbursement stays non taxable as long as the cents per mile rate used does not exceed the IRS standard business rate 0 67 mile for 2024 But this assumes that other rules are being followed to make the reimbursement part of an accountable plan

The answer No it s not ok How to Tell If Your Car Allowance Is Taxable As an employer if you require your employees to use their personal vehicles for business purpose you have two options to address their driving expenses You can either 1 Compensate employees taxable allowance OR 2 Reimburse employees non taxable method

Is Fuel Reimbursement Taxable Income have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: This allows you to modify the design to meet your needs such as designing invitations making your schedule, or even decorating your home.

-

Educational Value Downloads of educational content for free cater to learners of all ages, making the perfect device for teachers and parents.

-

Convenience: immediate access an array of designs and templates, which saves time as well as effort.

Where to Find more Is Fuel Reimbursement Taxable Income

KIA Lump Sum Fuel Reimbursement Program Seeks To Resolve MPG Circus

KIA Lump Sum Fuel Reimbursement Program Seeks To Resolve MPG Circus

If the reimbursement amount is at the standard IRS there won t be any tax implications However if your employer reimburses you at a higher rate the excess will be considered taxable income for you In other words your company is paying you more than what the IRS determines is the cost per mile It is therefore considered compensation

What is a taxable benefit Automobile or motor vehicle benefits Allowances or reimbursements provided to an employee for the use of their own vehicle Other taxable benefits Determine the tax treatment of payments other than regular employment income How to calculate Make corrections before filing

In the event that we've stirred your curiosity about Is Fuel Reimbursement Taxable Income and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and Is Fuel Reimbursement Taxable Income for a variety goals.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs covered cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Is Fuel Reimbursement Taxable Income

Here are some fresh ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Fuel Reimbursement Taxable Income are a treasure trove of practical and innovative resources that meet a variety of needs and preferences. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the vast collection of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted regarding usage. Always read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit an in-store print shop to get better quality prints.

-

What software do I require to view printables at no cost?

- Most PDF-based printables are available in the PDF format, and is open with no cost software like Adobe Reader.

Is Mileage Reimbursement Taxable

Is Employee Mileage Reimbursement Taxable

Check more sample of Is Fuel Reimbursement Taxable Income below

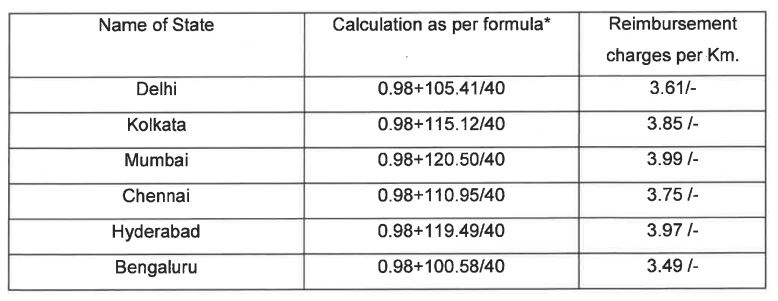

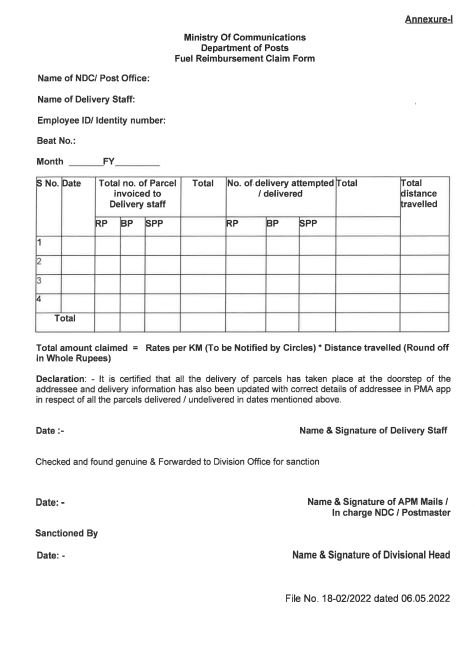

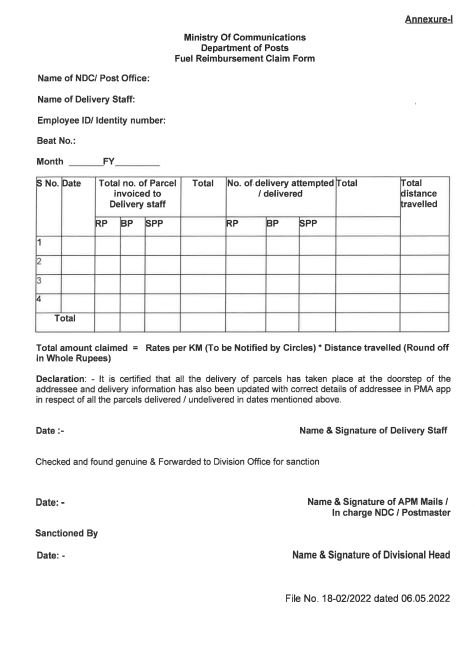

Fixing Payment Of Fuel Reimbursement Charges To Delivery Staff

DOP Guidelines For Fixing Payment Of Fuel Reimbursement Charges

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Health Insurance Reimbursement Taxable

Fuel Reimbursement Charges Guidelines For Fixing Payment To

Is Health Insurance Reimbursement Taxable Income Bedgut

https://www.kra.go.ke/images/publications/PAYE_Guide-2.pdf

It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website

https://www.justworks.com/blog/expenses-101-expense-reimbursements...

While they re not required by the IRS accountable plans help you set criteria that comply with IRS regulations on what reimbursements are deductible and what reimbursements count as taxable income An accountable plan for employee expenses acts as a guardrail for employees to avoid being taxed on employer reimbursements

It does NOT therefore in an wa modif or replace the General Legislation Income Tax Act Cap 470 and the Tax Procedures Act 2015 The Guide is available on the KRA website

While they re not required by the IRS accountable plans help you set criteria that comply with IRS regulations on what reimbursements are deductible and what reimbursements count as taxable income An accountable plan for employee expenses acts as a guardrail for employees to avoid being taxed on employer reimbursements

Is Health Insurance Reimbursement Taxable

DOP Guidelines For Fixing Payment Of Fuel Reimbursement Charges

Fuel Reimbursement Charges Guidelines For Fixing Payment To

Is Health Insurance Reimbursement Taxable Income Bedgut

Fuel Reimbursement Expenses For UAE Companies Increase By 38

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

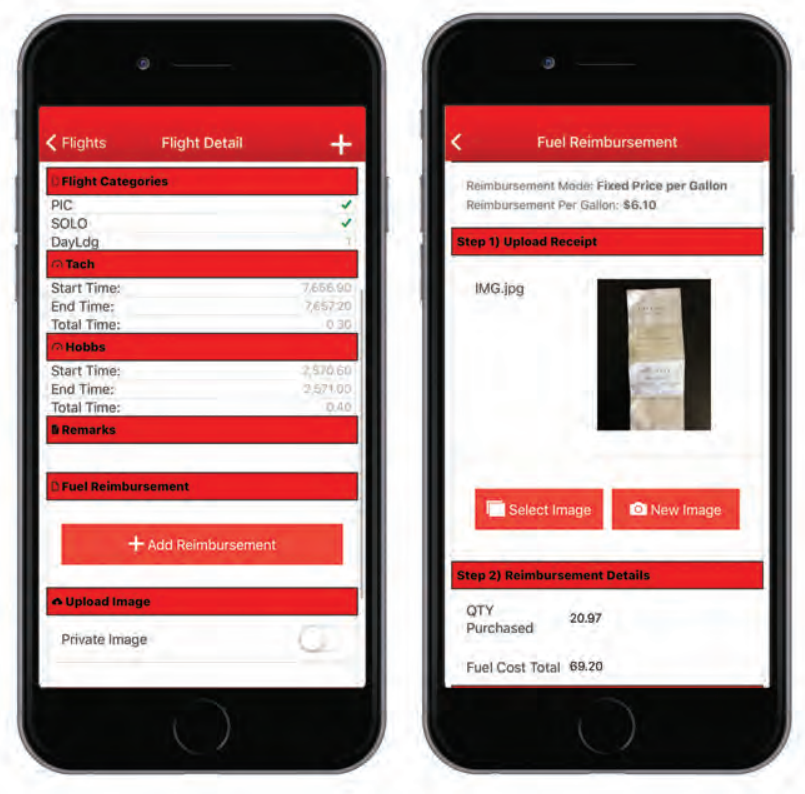

Fleet Member How To Submit Fuel Reimbursement Pilot Partner