Today, when screens dominate our lives and the appeal of physical printed material hasn't diminished. For educational purposes in creative or artistic projects, or simply adding an individual touch to the space, Is Employer Nps Contribution Taxable are now an essential source. Here, we'll dive in the world of "Is Employer Nps Contribution Taxable," exploring what they are, where to find them, and ways they can help you improve many aspects of your daily life.

Get Latest Is Employer Nps Contribution Taxable Below

Is Employer Nps Contribution Taxable

Is Employer Nps Contribution Taxable -

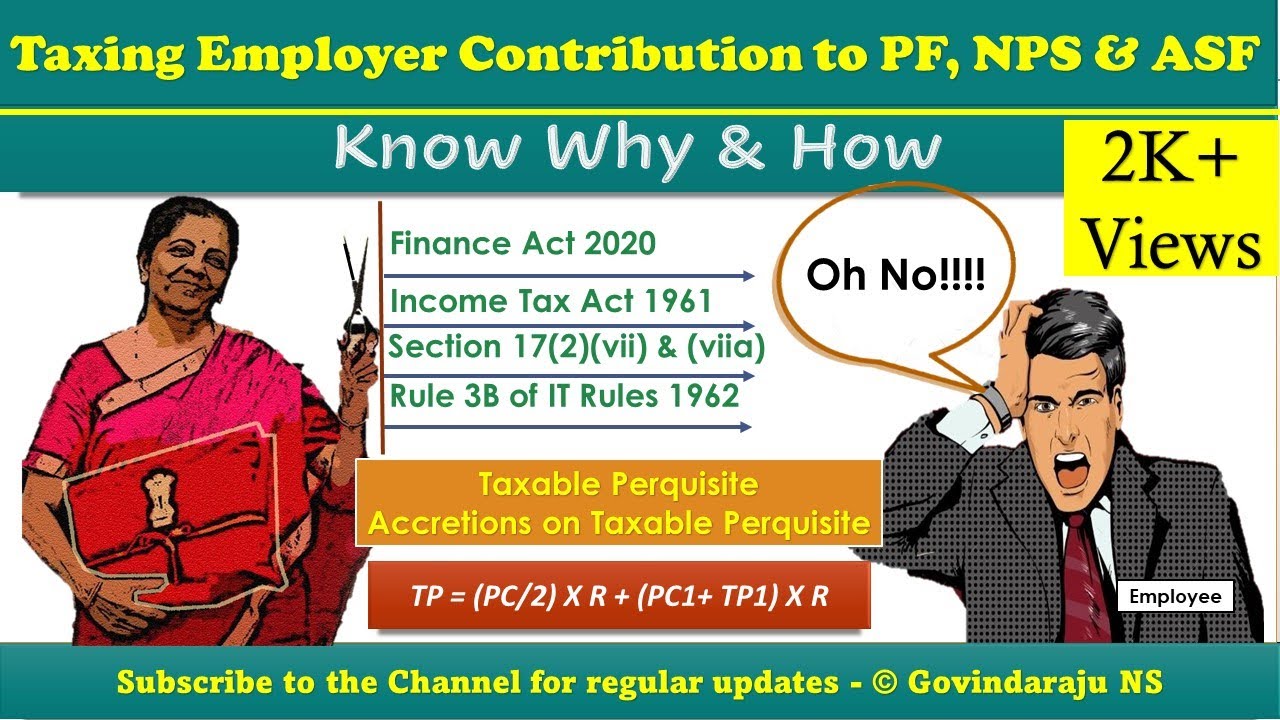

Verkko 8 lokak 2020 nbsp 0183 32 Contribution made by an employer is allowed under Section 80 CCD 2 subject to a ceiling of 10 of the salary 14 for central government employees My employer contributes 10 of my

Verkko 30 maalisk 2023 nbsp 0183 32 The third deduction is in the form of employer s contribution of up to 10 per cent of salary basic component dearness allowance to the NPS Tier I

The Is Employer Nps Contribution Taxable are a huge range of printable, free content that can be downloaded from the internet at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages and much more. The attraction of printables that are free is their versatility and accessibility.

More of Is Employer Nps Contribution Taxable

Employer s NPS Contribution Of 14 For State And Central Government

Employer s NPS Contribution Of 14 For State And Central Government

Verkko 16 elok 2022 nbsp 0183 32 An employer is also allowed to make contributions into an employee s NPS account and this is entirely voluntary However

Verkko 21 syysk 2022 nbsp 0183 32 The employer s contributions to the NPS also qualify for tax benefits under Section 80CCD 2 The amount of deduction is limited to 10 of the salary Basic and Dearness allowance for

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring the design to meet your needs whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational value: The free educational worksheets cater to learners from all ages, making them an essential resource for educators and parents.

-

The convenience of You have instant access a plethora of designs and templates reduces time and effort.

Where to Find more Is Employer Nps Contribution Taxable

Nps Contribution By Employee Werohmedia

Nps Contribution By Employee Werohmedia

Verkko 20 syysk 2022 nbsp 0183 32 National Pension System NPS is instrument that allows subscribers to accumulate monies towards one s retirement So are the NPS returns and maturity

Verkko 5 lokak 2022 nbsp 0183 32 In respect of employer s contribution toward NPS account of an employee deduction under Section 80CCD 2 is available to an employee

We hope we've stimulated your interest in printables for free Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Is Employer Nps Contribution Taxable suitable for many reasons.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free with flashcards and other teaching tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing Is Employer Nps Contribution Taxable

Here are some ideas create the maximum value use of Is Employer Nps Contribution Taxable:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Is Employer Nps Contribution Taxable are a treasure trove of practical and innovative resources catering to different needs and interest. Their accessibility and flexibility make them a fantastic addition to both professional and personal life. Explore the wide world of Is Employer Nps Contribution Taxable today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these documents for free.

-

Can I use the free printables for commercial uses?

- It's all dependent on the terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may contain restrictions on their use. Make sure to read the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to the local print shops for top quality prints.

-

What program is required to open printables for free?

- Many printables are offered as PDF files, which is open with no cost software like Adobe Reader.

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

NPS Contribution Online And Offline Contribution By Employer 2022

Check more sample of Is Employer Nps Contribution Taxable below

Employer s EPF NPS Contribution Can Be Taxable In Your Hands Here s

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh Taxed

Creating NPS Contribution Pay Head For Employers Payroll

EPF NPS

11th Bipartite Settlement Items Of Family Pension And Increase In

NPS Tax Exemption Important News Way To Get Tax Exemption On Employer

https://www.valueresearchonline.com/stories/52395/what-should-i-do...

Verkko 30 maalisk 2023 nbsp 0183 32 The third deduction is in the form of employer s contribution of up to 10 per cent of salary basic component dearness allowance to the NPS Tier I

https://www.forbes.com/advisor/in/retirement/…

Verkko 30 tammik 2023 nbsp 0183 32 Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic

Verkko 30 maalisk 2023 nbsp 0183 32 The third deduction is in the form of employer s contribution of up to 10 per cent of salary basic component dearness allowance to the NPS Tier I

Verkko 30 tammik 2023 nbsp 0183 32 Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic

EPF NPS

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh Taxed

11th Bipartite Settlement Items Of Family Pension And Increase In

NPS Tax Exemption Important News Way To Get Tax Exemption On Employer

Employer EPF NPS Contribution Can Be Taxable In Your Hands All You

NPS Investment Proof How To Claim Income Tax Deduction Mint

NPS Investment Proof How To Claim Income Tax Deduction Mint

How To Know Your POP In NPS Know Your NPS Account POP POPSP DDO Name