In this age of electronic devices, where screens have become the dominant feature of our lives however, the attraction of tangible printed materials hasn't faded away. Be it for educational use and creative work, or just adding an element of personalization to your home, printables for free have proven to be a valuable resource. Through this post, we'll take a dive deeper into "Is Education Loan Tax Exemption," exploring their purpose, where to find them and how they can improve various aspects of your lives.

Get Latest Is Education Loan Tax Exemption Below

Is Education Loan Tax Exemption

Is Education Loan Tax Exemption -

Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings account ESA which features tax free earnings

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the interest part of the loan

Printables for free cover a broad selection of printable and downloadable documents that can be downloaded online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Is Education Loan Tax Exemption

Tax Benefits Of Education Loan 80E Education Loan Tax Exemption

Tax Benefits Of Education Loan 80E Education Loan Tax Exemption

You may exclude certain educational assistance benefits from your income That means that you won t have to pay any tax on them However it also means that you can t use any of the tax free education expenses as the basis for any other deduction or credit including the lifetime learning credit

Feb 8 2024 at 9 53 a m Getty Images You may be eligible for a tax reduction based on your student loan interest Key Takeaways If you took out an educational loan for yourself your

The Is Education Loan Tax Exemption have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: They can make designs to suit your personal needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: Downloads of educational content for free provide for students of all ages. This makes the perfect tool for parents and educators.

-

The convenience of instant access a plethora of designs and templates helps save time and effort.

Where to Find more Is Education Loan Tax Exemption

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Describing the provisions u s 80E and how one can take advantage of it Ankit Mehra CEO and Founder GyanDhan said Section 80E of the Income Tax Act Act allows education loan borrowers to

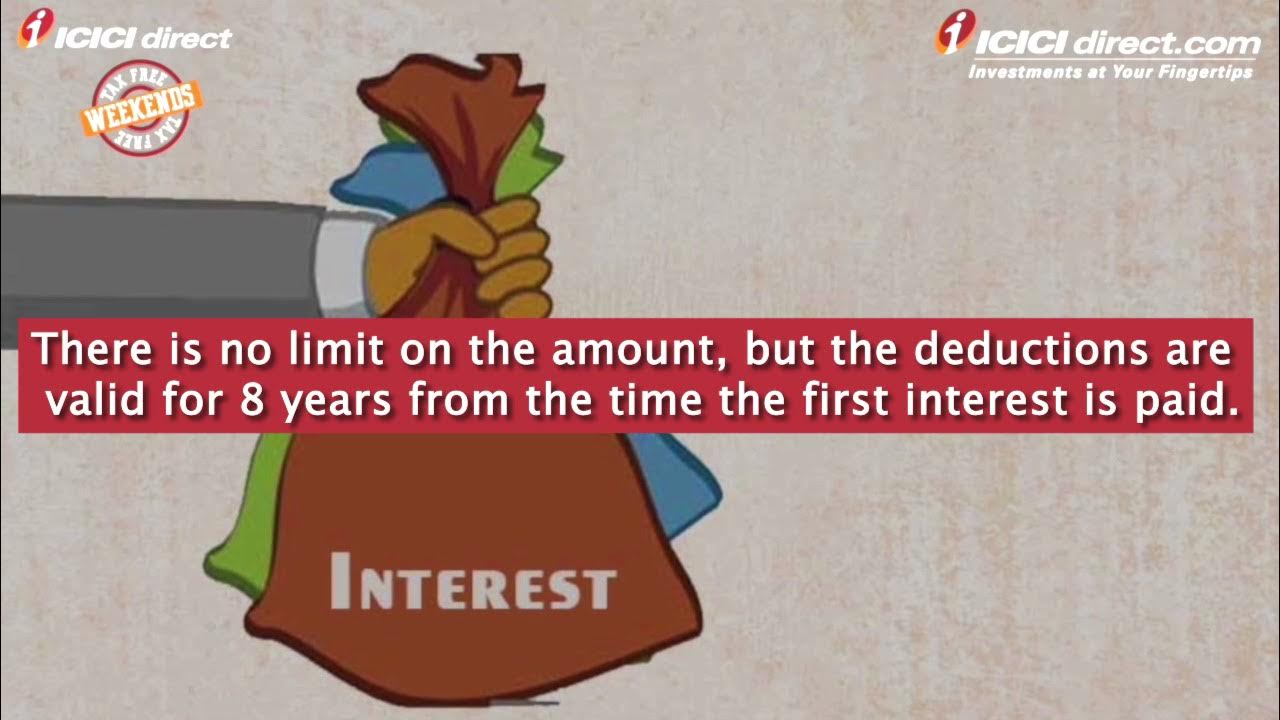

Education loan option tax exemption limit under Section 80E The interest portion of an education loan option qualifies for deduction from your income akin to deductions under Section 80C and Section 80D which are subtracted before arriving at your total taxable income for tax calculation

Now that we've piqued your interest in Is Education Loan Tax Exemption, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of motives.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a wide selection of subjects, starting from DIY projects to party planning.

Maximizing Is Education Loan Tax Exemption

Here are some ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Is Education Loan Tax Exemption are a treasure trove of fun and practical tools that meet a variety of needs and desires. Their accessibility and versatility make them an essential part of your professional and personal life. Explore the plethora of Is Education Loan Tax Exemption and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these tools for free.

-

Can I use free printables for commercial use?

- It's based on specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using Is Education Loan Tax Exemption?

- Some printables may have restrictions in their usage. Be sure to check the terms and conditions offered by the author.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit any local print store for high-quality prints.

-

What program do I require to view printables at no cost?

- Most printables come in the format of PDF, which can be opened using free software such as Adobe Reader.

5 Things You Must Know About Education Loan Tax Benefits In 2022 Tata

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Check more sample of Is Education Loan Tax Exemption below

Education Loan Tax Benefit Education Loan Tax Exemption ICICI

Income Tax Exemption On Interest Of Education Loan YouTube

Tax Exemption On Education Loan Who Is Eligible To Claim Tax Benefits

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Education Loan A Student s Guide To Taking And Repaying An Education

https://www.etmoney.com/learn/income-tax/education...

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the interest part of the loan

https://tax2win.in/guide/sec-80e-deducti…

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Maximize your tax savings by understanding Section 80E deduction and how it

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the interest part of the loan

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Maximize your tax savings by understanding Section 80E deduction and how it

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

Income Tax Exemption On Interest Of Education Loan YouTube

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Education Loan A Student s Guide To Taking And Repaying An Education

Tax Exemption On Education Loan Who Is Eligible To Claim Tax Benefits

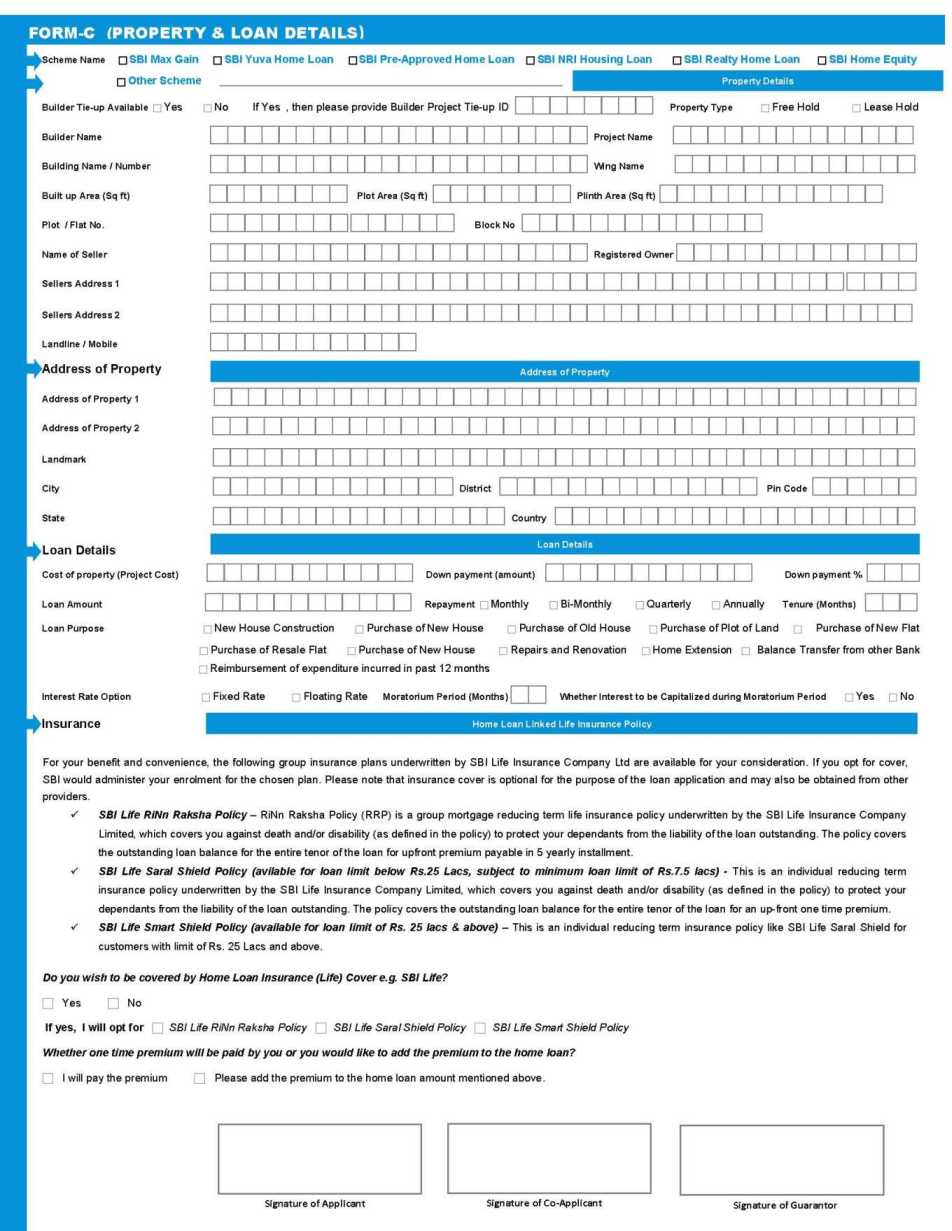

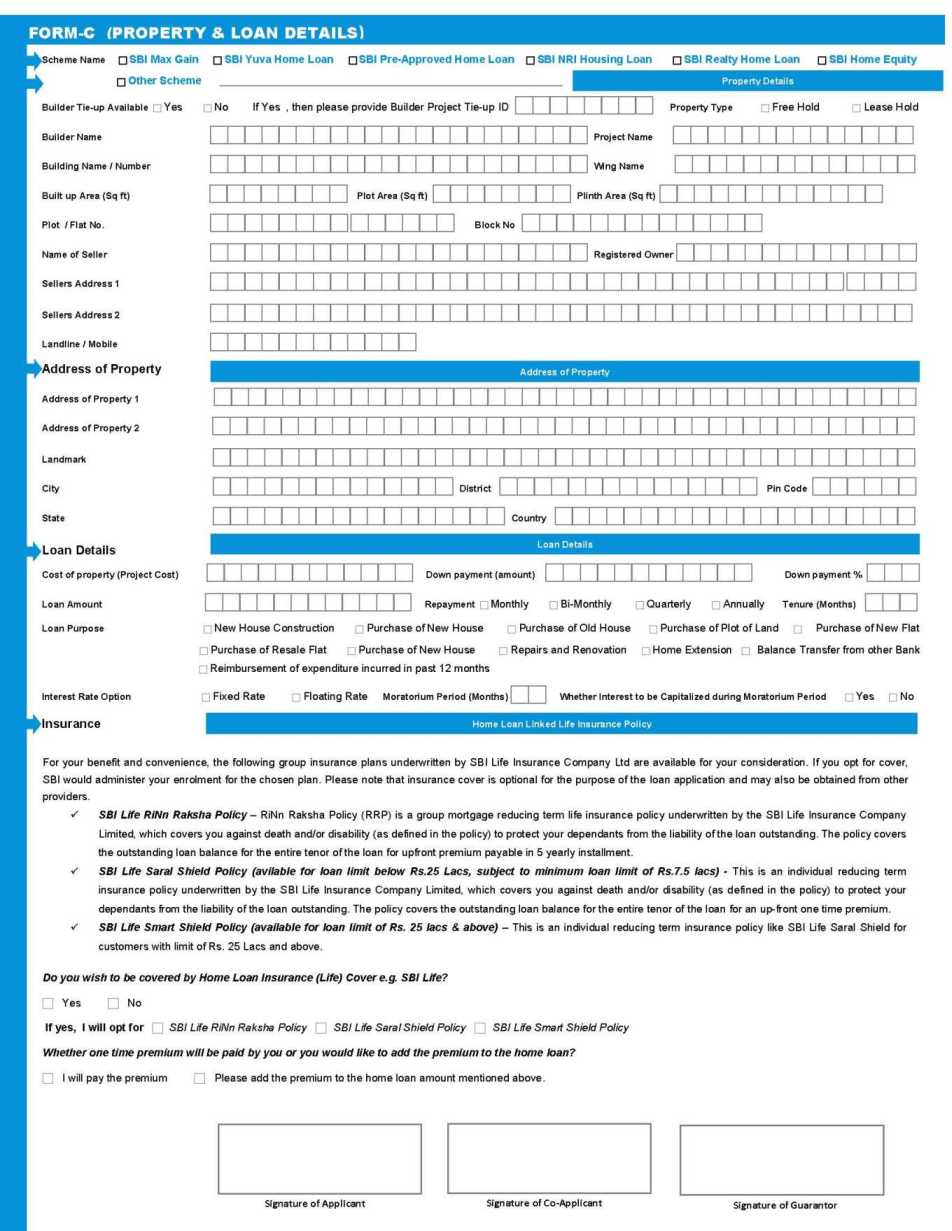

ECS Form SBI Home Loan 2023 2024 EduVark

ECS Form SBI Home Loan 2023 2024 EduVark

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB