In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed items hasn't gone away. In the case of educational materials project ideas, artistic or just adding an individual touch to the area, Is Diesel Fuel Rebate Taxable Income are now a useful resource. The following article is a take a dive deeper into "Is Diesel Fuel Rebate Taxable Income," exploring the benefits of them, where to find them, and how they can add value to various aspects of your daily life.

Get Latest Is Diesel Fuel Rebate Taxable Income Below

Is Diesel Fuel Rebate Taxable Income

Is Diesel Fuel Rebate Taxable Income -

Forms and Instructions About Form 4136 Credit For Federal Tax Paid On Fuels Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The alternative fuel credit Aa credit for blending a diesel water fuel emulsion Current Revision Form 4136 PDF Instructions for Form 4136 Print Version

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

Is Diesel Fuel Rebate Taxable Income encompass a wide selection of printable and downloadable content that can be downloaded from the internet at no cost. These resources come in various styles, from worksheets to coloring pages, templates and many more. The appealingness of Is Diesel Fuel Rebate Taxable Income lies in their versatility and accessibility.

More of Is Diesel Fuel Rebate Taxable Income

Texas Taxable Fuel Bond Surety Bond Authority

Texas Taxable Fuel Bond Surety Bond Authority

Part 3 of Schedule 6 to the Customs and Excise Act deals with rebates and refunds of the fuel levy and road accident fund levy generally referred to as the diesel rebate Paragraph 6 f of the Schedule contains the detailed rules governing the diesel rebate for users conducting mining activities on land Paragraph 6 f ii of the Schedule

The heavy vehicle road user charge will increase by 6 each year over 3 years from 28 8 cents per litre for petrol and diesel in 2023 24 to 30 5 cents per litre in 2024 25 and to 32 4 cents per litre in 2025 26

The Is Diesel Fuel Rebate Taxable Income have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: It is possible to tailor designs to suit your personal needs for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Benefits: Printables for education that are free can be used by students of all ages. This makes these printables a powerful tool for teachers and parents.

-

Affordability: Instant access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Is Diesel Fuel Rebate Taxable Income

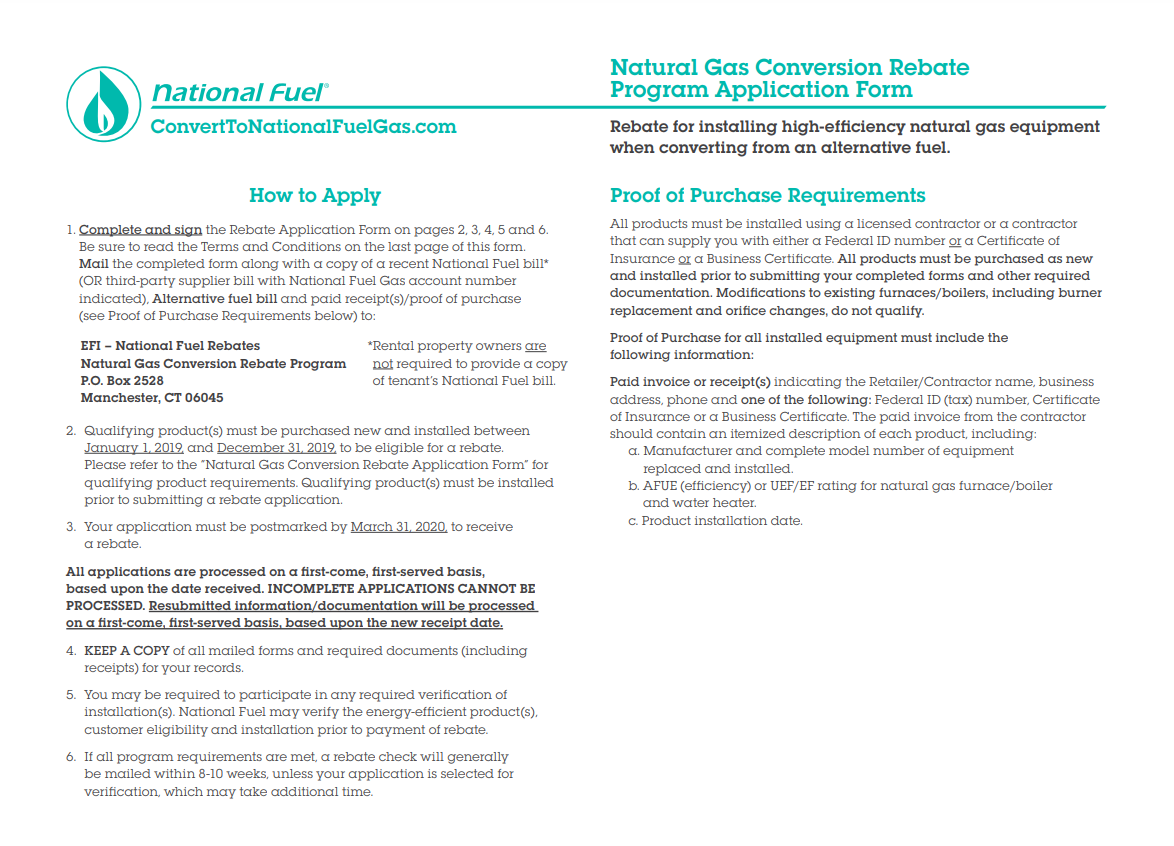

National Fuel Rebate Form 2022 Printable Rebate Form

National Fuel Rebate Form 2022 Printable Rebate Form

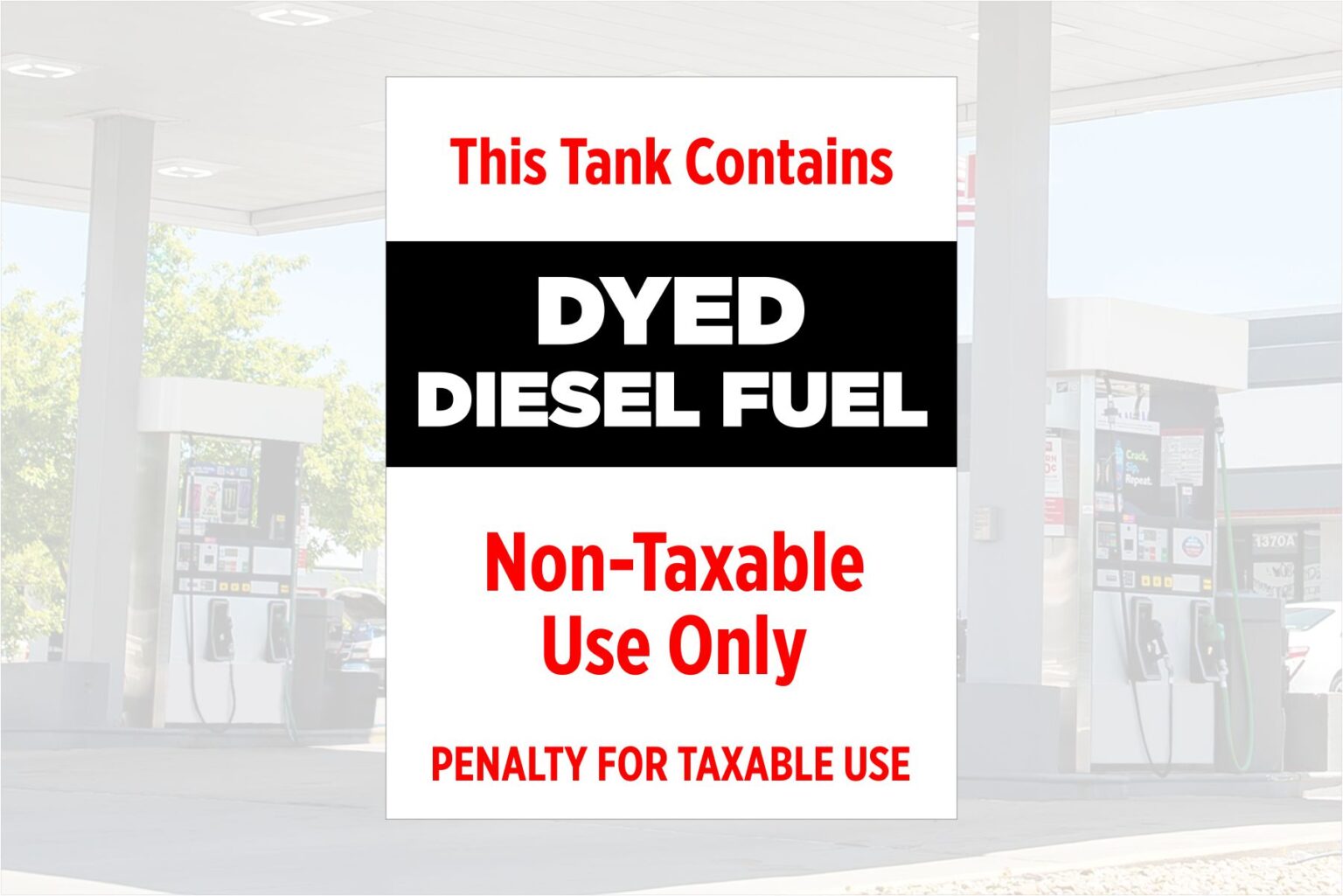

In the case of the operator of the vehicle in which the dyed diesel fuel is used the relief is available only if the operator or the person selling such fuel pays the tax of 24 4 cents per gallon that is normally applied to diesel fuel for highway use The IRS will not impose penalties for failure to make semimonthly deposits of this tax

27 October 2022 The Manage Diesel Refund Calculations Policy has been revised to include All criteria that a prospective claimant must meet to qualify for a diesel refund The refund calculation prescribed in Rebate Item 670 04 of Schedule 6 Information needed to complete Part C of the VAT201

We hope we've stimulated your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Is Diesel Fuel Rebate Taxable Income for various goals.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast range of topics, everything from DIY projects to planning a party.

Maximizing Is Diesel Fuel Rebate Taxable Income

Here are some ways to make the most of Is Diesel Fuel Rebate Taxable Income:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Is Diesel Fuel Rebate Taxable Income are a treasure trove of innovative and useful resources catering to different needs and passions. Their access and versatility makes these printables a useful addition to both personal and professional life. Explore the endless world of Is Diesel Fuel Rebate Taxable Income to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can print and download these resources at no cost.

-

Can I use the free printouts for commercial usage?

- It's based on the conditions of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions regarding their use. Be sure to check the terms and regulations provided by the author.

-

How do I print Is Diesel Fuel Rebate Taxable Income?

- Print them at home with the printer, or go to any local print store for higher quality prints.

-

What program will I need to access printables for free?

- The majority of printed documents are in the format PDF. This is open with no cost software like Adobe Reader.

Australian Taxpayers Could Save 7 8bn A Year If Diesel Fuel Rebates

National Fuel Rebate Form 2022 Application Printable Rebate Form

Check more sample of Is Diesel Fuel Rebate Taxable Income below

Business Gas Cards Small Business Commercial Fuelman

Diesel Not Under GST But Taxable At 18 As Part Of Composite Service

Want An EV Rebate SCE Clean Fuel Rebate Program YouTube

National Budget Speech 2022 SimplePay Blog

Is Costco Rebate Taxable Income CostcoRebate

Income Property Tax Rebate Payments Going Out Chronicle Media

https://www. investopedia.com /terms/f/fuel-credit.asp

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

https:// bowmanslaw.com /insights/south-africa...

Glencore Operations SA Pty Ltd Glencore claimed refunds for diesel fuel levies used for primary production in mining in terms of the provisions of Note 6 f iii Item 670 04 in Part 3 of Schedule 6 to the Customs and Excise Act 91 of 1964 CE Act

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

Glencore Operations SA Pty Ltd Glencore claimed refunds for diesel fuel levies used for primary production in mining in terms of the provisions of Note 6 f iii Item 670 04 in Part 3 of Schedule 6 to the Customs and Excise Act 91 of 1964 CE Act

National Budget Speech 2022 SimplePay Blog

Diesel Not Under GST But Taxable At 18 As Part Of Composite Service

Is Costco Rebate Taxable Income CostcoRebate

Income Property Tax Rebate Payments Going Out Chronicle Media

Diesel Fuel Credit Subsidy Or Rebate Farm Online Farmonline

Valero Fuel Rebates Planned Fuel Rebates Gallon

Valero Fuel Rebates Planned Fuel Rebates Gallon

This Tank Contains Dyed Diesel Fuel Non Taxable Use Only Penalty For