In this age of electronic devices, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education or creative projects, or simply adding a personal touch to your area, Is Child Care Tax Deductible For Self Employed are now a vital source. This article will dive deeper into "Is Child Care Tax Deductible For Self Employed," exploring their purpose, where you can find them, and how they can add value to various aspects of your life.

Get Latest Is Child Care Tax Deductible For Self Employed Below

Is Child Care Tax Deductible For Self Employed

Is Child Care Tax Deductible For Self Employed -

FAQs about the Child and Dependent Care Credit expansion due to the ARPA Claiming the Credit Q1 Q17 Work related expenses Q18 Q23 The child and

For purposes of the child and dependent care credit net earnings from self employment generally means the amount from Schedule SE Form 1040 line 3 minus any deduction for self employment tax on

Printables for free cover a broad assortment of printable documents that can be downloaded online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and much more. The beauty of Is Child Care Tax Deductible For Self Employed is their flexibility and accessibility.

More of Is Child Care Tax Deductible For Self Employed

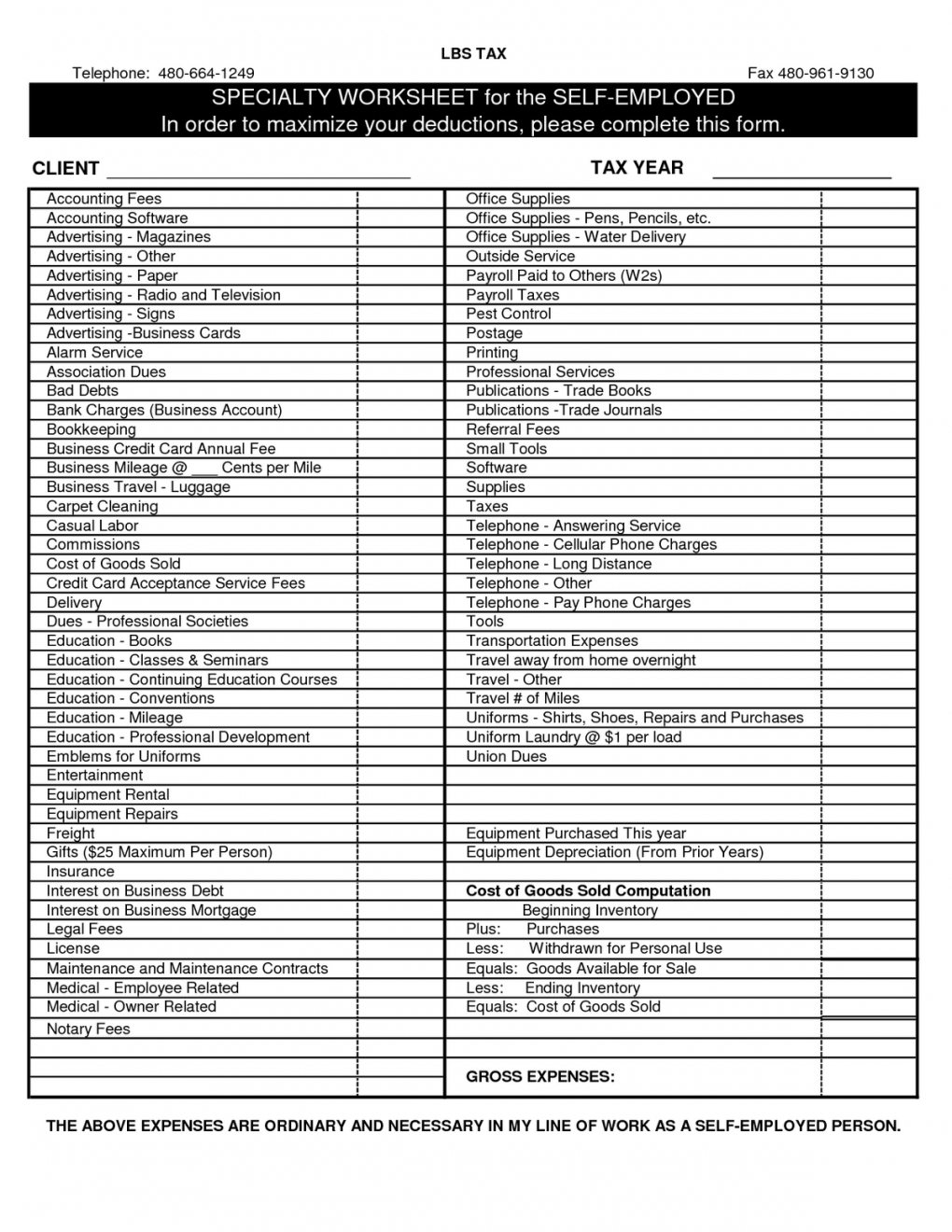

Are Work Clothes Tax Deductible For Self Employed

Are Work Clothes Tax Deductible For Self Employed

In general you can deduct 15 CHF per meal taken outside of your home If you have access to a discounted canteen or if your employer contributes to your meals you will only be able to

In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t disappear

Is Child Care Tax Deductible For Self Employed have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: This allows you to modify print-ready templates to your specific requirements when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value These Is Child Care Tax Deductible For Self Employed can be used by students of all ages. This makes them a great resource for educators and parents.

-

An easy way to access HTML0: Access to many designs and templates, which saves time as well as effort.

Where to Find more Is Child Care Tax Deductible For Self Employed

Is Memory Care Tax Deductible What You Can Claim 2019

Is Memory Care Tax Deductible What You Can Claim 2019

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This

Tax Limited Company December 4th 2023 No childcare costs are not tax deductible for the self employed or small business owners HMRC figures that if you re

If we've already piqued your interest in printables for free Let's find out where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Is Child Care Tax Deductible For Self Employed designed for a variety needs.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning materials.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs covered cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Is Child Care Tax Deductible For Self Employed

Here are some innovative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Is Child Care Tax Deductible For Self Employed are an abundance of fun and practical tools that can meet the needs of a variety of people and interests. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast array of Is Child Care Tax Deductible For Self Employed and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can print and download these resources at no cost.

-

Are there any free templates for commercial use?

- It is contingent on the specific rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may come with restrictions in their usage. Make sure to read the terms of service and conditions provided by the author.

-

How can I print Is Child Care Tax Deductible For Self Employed?

- You can print them at home using your printer or visit a local print shop for higher quality prints.

-

What software do I need to open printables at no cost?

- Many printables are offered in PDF format, which is open with no cost software, such as Adobe Reader.

Qualified Business Income Deduction And The Self Employed The CPA Journal

Is Lawn Care Tax Deductible

Check more sample of Is Child Care Tax Deductible For Self Employed below

Farm Income And Expense Spreadsheet Download Pertaining To Farm Expense

Are Child Care Expenses Tax Deductible ATC Income Tax

Are Work Clothes Tax deductible For Self employed EMS

What Travel Expenses Are Tax Deductible For Self Employed The

Is Memory Care Tax Deductible What You Can Claim 2019

Is Private Health Care Tax Deductible For Self Employed TAXW

www.irs.gov/publications/p503

For purposes of the child and dependent care credit net earnings from self employment generally means the amount from Schedule SE Form 1040 line 3 minus any deduction for self employment tax on

www.investopedia.com/which-t…

The child and dependent care tax credit allows you to deduct up to 1 050 in childcare expenses 2 100 for two or more children every year the child qualifies Families can deduct most

For purposes of the child and dependent care credit net earnings from self employment generally means the amount from Schedule SE Form 1040 line 3 minus any deduction for self employment tax on

The child and dependent care tax credit allows you to deduct up to 1 050 in childcare expenses 2 100 for two or more children every year the child qualifies Families can deduct most

What Travel Expenses Are Tax Deductible For Self Employed The

Are Child Care Expenses Tax Deductible ATC Income Tax

Is Memory Care Tax Deductible What You Can Claim 2019

Is Private Health Care Tax Deductible For Self Employed TAXW

Is Health Insurance Deductible For Self employed

Is Dementia Care Tax Deductible Credits Deductions For Caregivers

Is Dementia Care Tax Deductible Credits Deductions For Caregivers

Is Lawn Care Tax Deductible Landscaping Lawn Garden Landscape