In a world where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes or creative projects, or simply adding a personal touch to your area, Is Arrears Of Salary Taxable are now a vital resource. In this article, we'll dive into the world of "Is Arrears Of Salary Taxable," exploring what they are, where they can be found, and how they can enrich various aspects of your life.

Get Latest Is Arrears Of Salary Taxable Below

Is Arrears Of Salary Taxable

Is Arrears Of Salary Taxable -

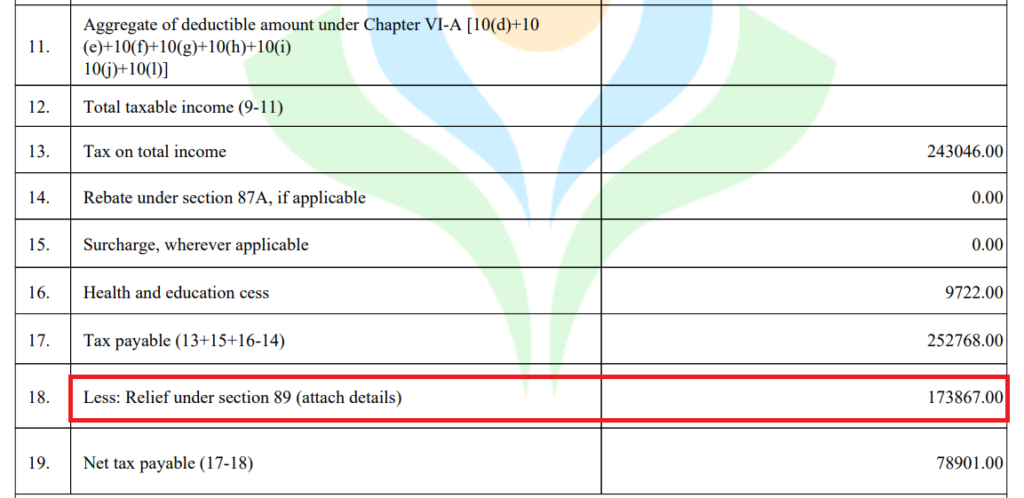

Relief under section 89 1 Taxability in case of Arrear of Salary Updated on 07 May 2024 02 20 PM An employee may receive a component of his salary in the form of arrear or advance salary during employment These advances or arrears can affect your taxes and are reflected in the year of the receipt

Taxable salary Add Arrears of salary 8 25 000 1 50 000 8 75 000 1 25 000 9 00 000 1 75 000 Taxable salary 9 75 000 10 00 000 10 75 000 Tax on the above Add Cess at applicable rate 1 20 000 3 600 1 12 500 3 375 1 35 000 5 400 Tax payable 1 23 600 1 15 875 1 40 400

Is Arrears Of Salary Taxable encompass a wide range of printable, free documents that can be downloaded online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and many more. The value of Is Arrears Of Salary Taxable is in their variety and accessibility.

More of Is Arrears Of Salary Taxable

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

Relief under section 89 1 for arrears of salary Assisted Team 1 year ago Updated Did you receive any advance salary or arrears of salary If yes you might be worried about the tax implications of the same Do I have to pay taxes on the total amount What about the tax calculations of the previous year and so on

Can you claim income tax relief for arrears Yes If the assessee has received a portion of his salary in arrears or in advance or received a family pension in arrears the Income Tax Act allows you to claim tax relief under section 89 1

Is Arrears Of Salary Taxable have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization You can tailor the templates to meet your individual needs be it designing invitations planning your schedule or even decorating your home.

-

Educational value: Printables for education that are free cater to learners of all ages, which makes them an essential tool for teachers and parents.

-

Affordability: Quick access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Is Arrears Of Salary Taxable

If There Is A Salary Revision Do We Need To Deduct PF From The Arrears

If There Is A Salary Revision Do We Need To Deduct PF From The Arrears

Salary is usually taxable when it is due or when it is received but in case of arrears they are usually announced from a back date which is why they cannot be taxed when due 3 Submit Form 10E before filing your ITR When it comes to choosing the assessment year for arrears you must choose the assessment year in which arrears have been

Arrears of salary is treated as salary income in the ITR They are taxable in the year of receipt However the taxpayer may be worried about paying taxes at a higher rate because of a higher tax bracket in the year of receipt or due to a change in the applicable slab rate

If we've already piqued your interest in printables for free Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Is Arrears Of Salary Taxable for various goals.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide variety of topics, that includes DIY projects to planning a party.

Maximizing Is Arrears Of Salary Taxable

Here are some fresh ways in order to maximize the use of Is Arrears Of Salary Taxable:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Is Arrears Of Salary Taxable are an abundance of fun and practical tools that meet a variety of needs and pursuits. Their accessibility and versatility make them an essential part of your professional and personal life. Explore the vast world of Is Arrears Of Salary Taxable to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes, they are! You can download and print these materials for free.

-

Can I download free printables for commercial uses?

- It depends on the specific rules of usage. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may come with restrictions in use. Make sure you read the terms and conditions set forth by the author.

-

How can I print Is Arrears Of Salary Taxable?

- Print them at home using either a printer at home or in an in-store print shop to get high-quality prints.

-

What program do I require to view printables that are free?

- The majority are printed as PDF files, which can be opened with free software such as Adobe Reader.

Income Tax Salary Allowances PF Arrears Leave Encashment And

Income Tax FAQ On Salary Income Are Arrears Of Salary Taxable SA POST

Check more sample of Is Arrears Of Salary Taxable below

Relief Under Section 89 1 On Arrears Of Salary FY 2020 21 Excel

Income Tax Returns Filing Taxable Or Not PF And Gratuity To Salary

What Is The Meaning Of The Word ARREARS YouTube

Income Tax Return Filing Are Arrears Of Salary Taxable How To Claim

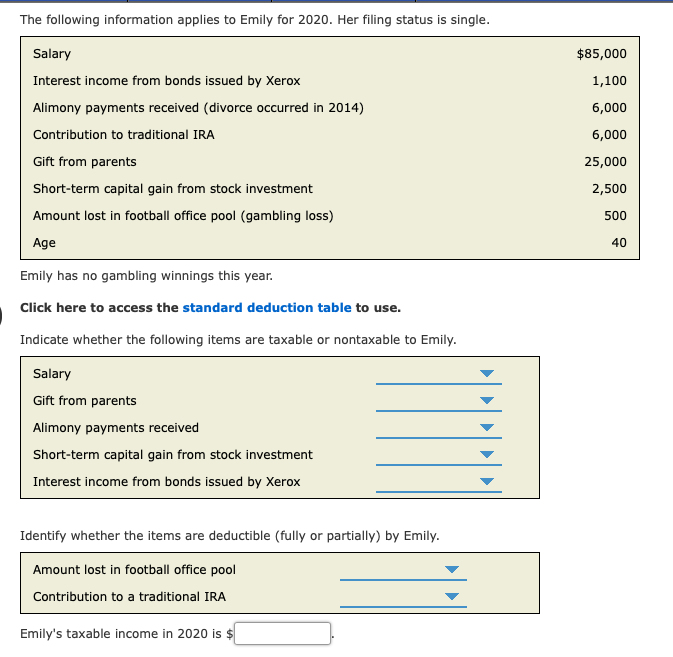

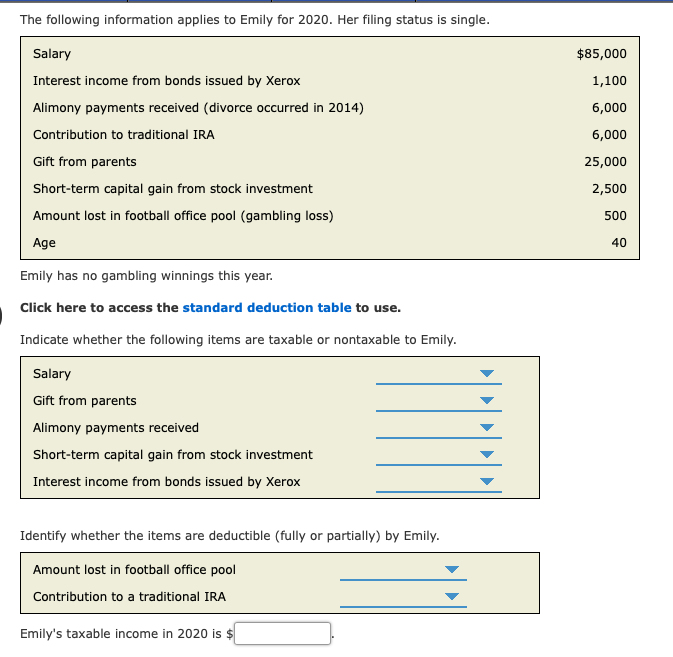

Solved The Following Information Applies To Emily For 2020 Chegg

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

https://taxguru.in/income-tax/arrears-salary-taxability-relief-section-891.html

Taxable salary Add Arrears of salary 8 25 000 1 50 000 8 75 000 1 25 000 9 00 000 1 75 000 Taxable salary 9 75 000 10 00 000 10 75 000 Tax on the above Add Cess at applicable rate 1 20 000 3 600 1 12 500 3 375 1 35 000 5 400 Tax payable 1 23 600 1 15 875 1 40 400

https://cleartax.in/s/get-help-with-salary-arrears

2 Salary is normally taxable when it is due or when it is received but arrears are usually announced from a back date so they cannot be taxed when they are due 3 Before filing your ITR submit Form 10E When determining the assessment year for arrears you must select the year in which the arrears were received

Taxable salary Add Arrears of salary 8 25 000 1 50 000 8 75 000 1 25 000 9 00 000 1 75 000 Taxable salary 9 75 000 10 00 000 10 75 000 Tax on the above Add Cess at applicable rate 1 20 000 3 600 1 12 500 3 375 1 35 000 5 400 Tax payable 1 23 600 1 15 875 1 40 400

2 Salary is normally taxable when it is due or when it is received but arrears are usually announced from a back date so they cannot be taxed when they are due 3 Before filing your ITR submit Form 10E When determining the assessment year for arrears you must select the year in which the arrears were received

Income Tax Return Filing Are Arrears Of Salary Taxable How To Claim

Income Tax Returns Filing Taxable Or Not PF And Gratuity To Salary

Solved The Following Information Applies To Emily For 2020 Chegg

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

Calls In Arrears Example Of Calls In Arrear Meaning Of Calls In

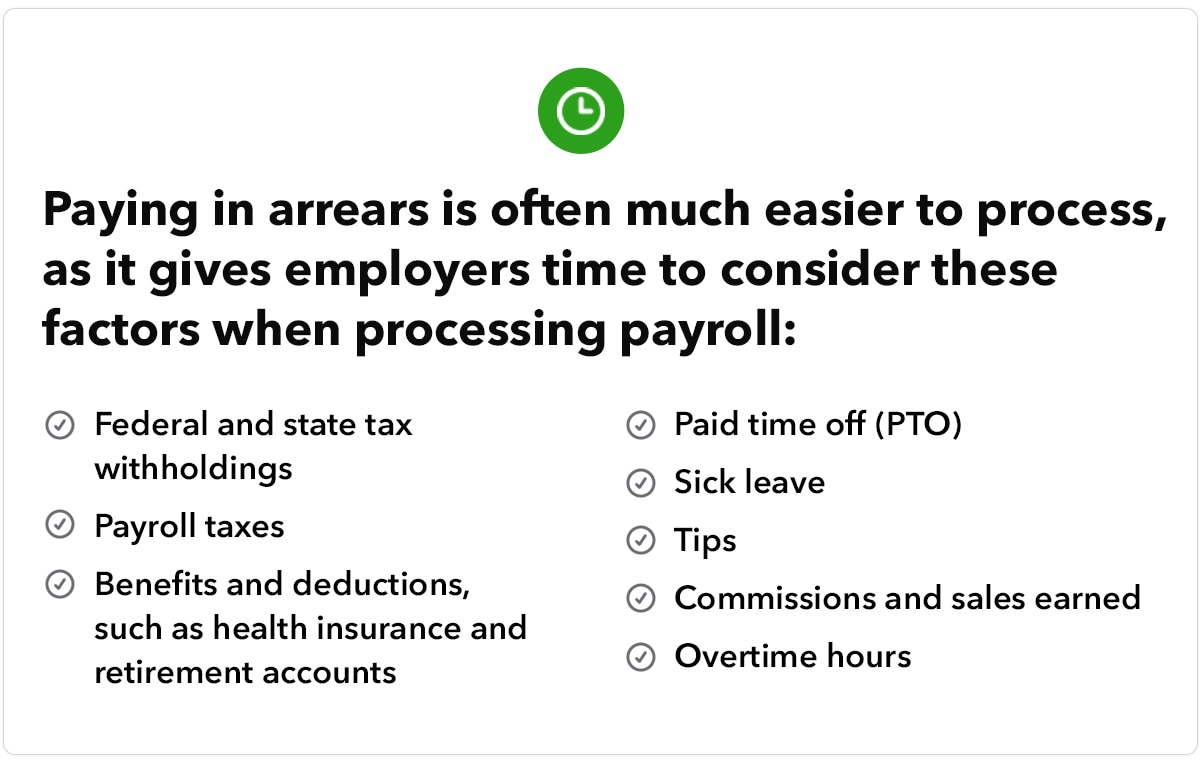

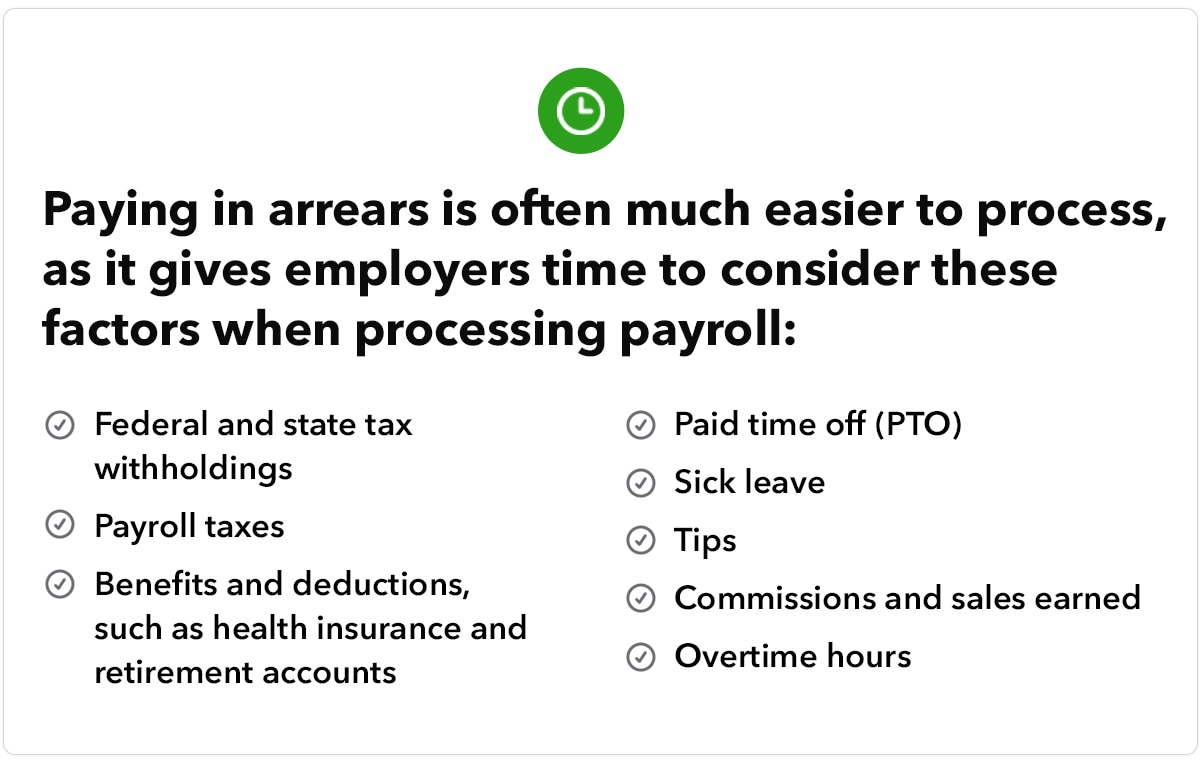

Arrears Billing And Payments What Does It Mean QuickBooks

Arrears Billing And Payments What Does It Mean QuickBooks

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput