In this age of electronic devices, where screens rule our lives The appeal of tangible printed objects hasn't waned. For educational purposes and creative work, or just adding some personal flair to your space, Irs Tax Rebates Energy are now a useful source. The following article is a dive into the sphere of "Irs Tax Rebates Energy," exploring their purpose, where to get them, as well as how they can enhance various aspects of your life.

Get Latest Irs Tax Rebates Energy Below

Irs Tax Rebates Energy

Irs Tax Rebates Energy - Irs Tax Credit Energy Efficient Windows, Federal Tax Rebates Energy Efficiency, Irs Tax Credit Energy Efficiency, Federal Tax Credit Energy Efficient Shades, Federal Tax Credit Energy, Federal Tax Credit Energy Efficient Blinds, Federal Tax Credit Energy Efficient Air Conditioner, Federal Tax Credit Energy Efficient Water Heater, Irs.gov Energy Credit, Irs Tax Credit For Energy Efficient Air Conditioner

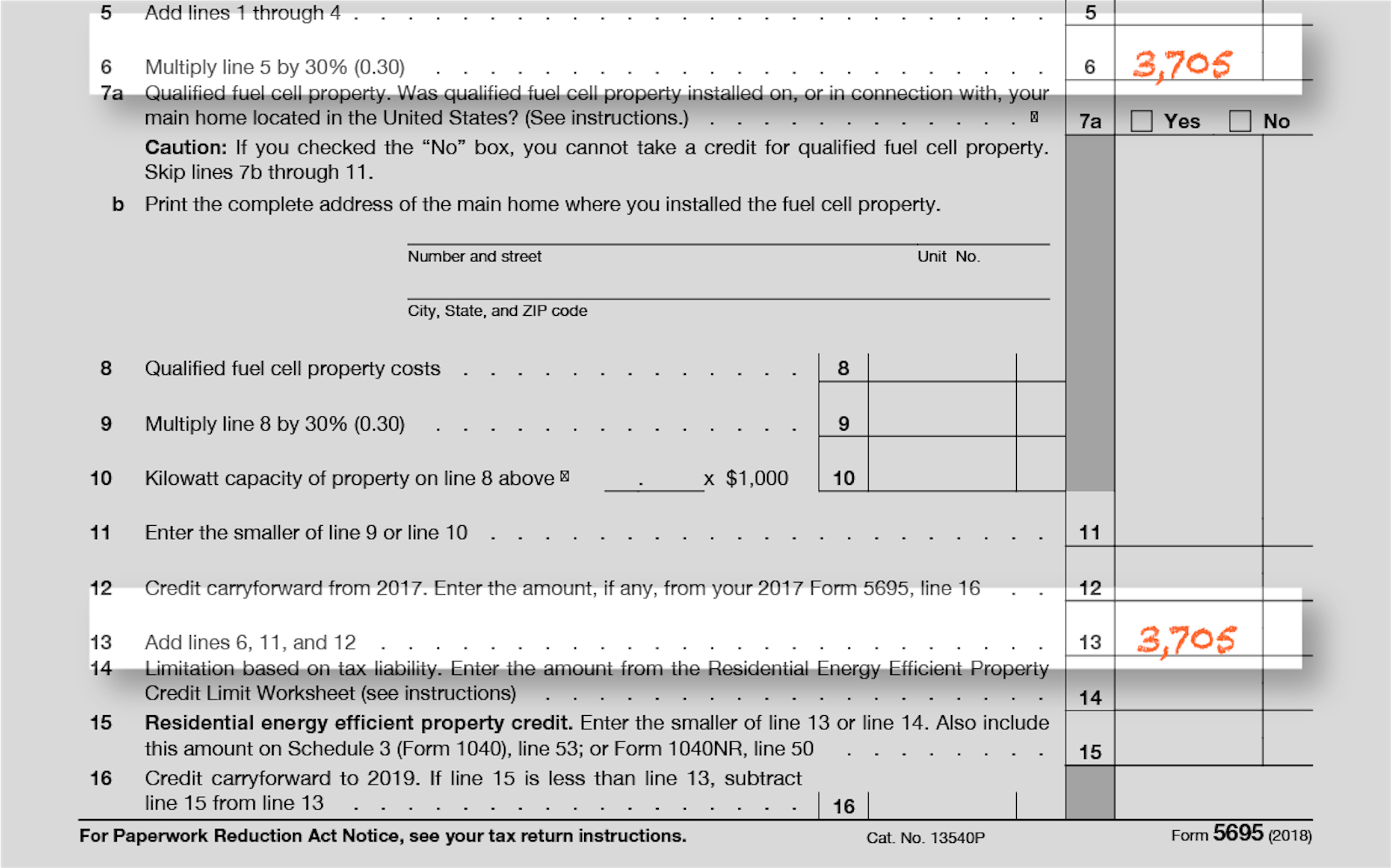

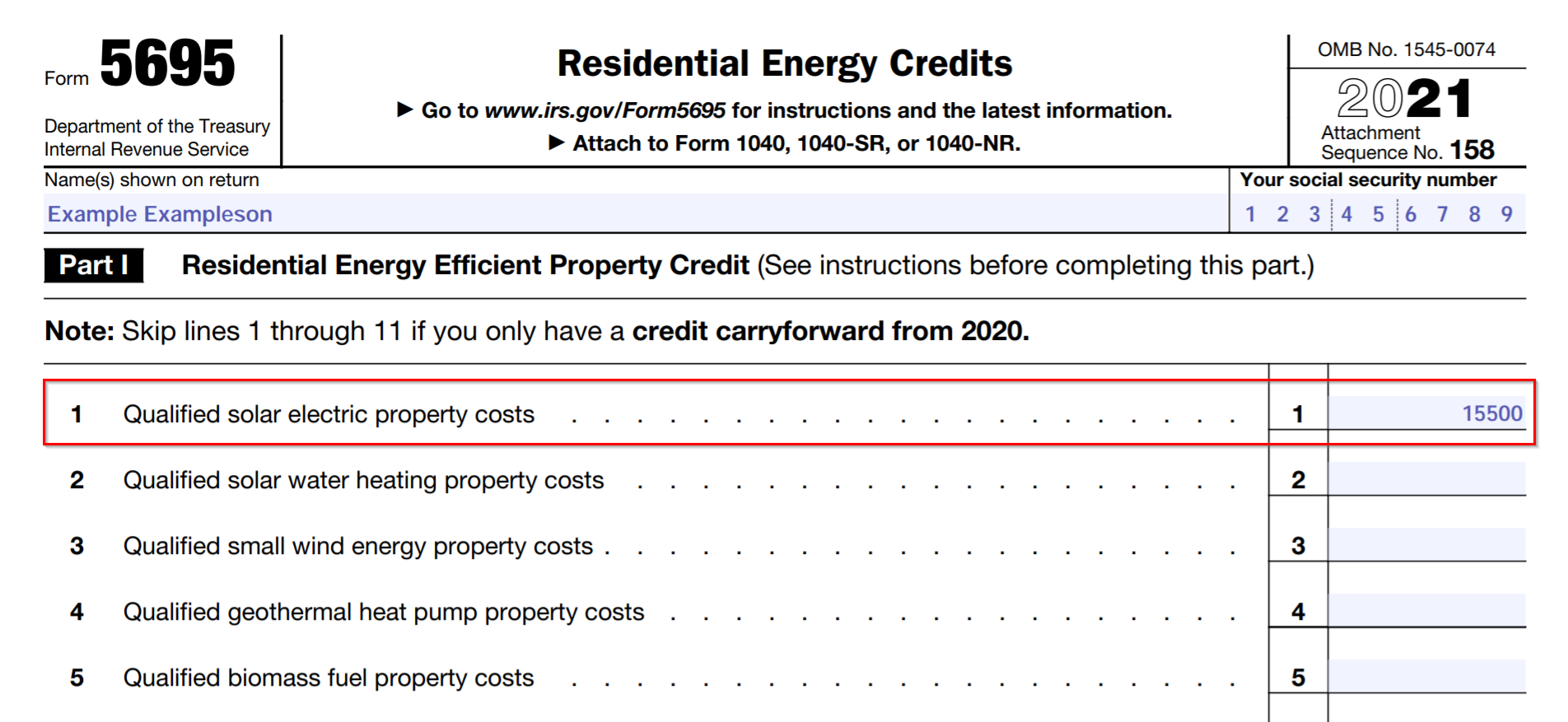

Web 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit How to Claim the Credit File Form 5695 Residential Energy Credits Part II with

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Irs Tax Rebates Energy provide a diverse selection of printable and downloadable material that is available online at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and more. The value of Irs Tax Rebates Energy lies in their versatility and accessibility.

More of Irs Tax Rebates Energy

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Irs Tax Rebates Energy have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: You can tailor printing templates to your own specific requirements whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational Benefits: Printables for education that are free provide for students of all ages. This makes them a valuable tool for teachers and parents.

-

Easy to use: Access to many designs and templates reduces time and effort.

Where to Find more Irs Tax Rebates Energy

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Web General Overview of the Energy Efficient Home Improvement Credit Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As

Web On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law The law includes 391 billion to support clean energy and address

We've now piqued your interest in Irs Tax Rebates Energy, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Irs Tax Rebates Energy for various motives.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Irs Tax Rebates Energy

Here are some creative ways ensure you get the very most use of Irs Tax Rebates Energy:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Irs Tax Rebates Energy are a treasure trove filled with creative and practical information for a variety of needs and pursuits. Their accessibility and versatility make them an essential part of the professional and personal lives of both. Explore the many options of Irs Tax Rebates Energy to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free printouts for commercial usage?

- It's based on specific terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables could have limitations on usage. Always read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit a local print shop for higher quality prints.

-

What program do I need to open printables that are free?

- The majority of printed documents are in the format PDF. This is open with no cost software such as Adobe Reader.

Federal Solar Tax Credit Steps Down After 2019 Solar

.png)

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Check more sample of Irs Tax Rebates Energy below

Filing For The Solar Tax Credit Wells Solar

IRS CP 11R Recovery Rebate Credit Balance Due

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

IRS CP 11R Recovery Rebate Credit Balance Due

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Completed Form 5695 Residential Energy Credit Capital City Solar

Utility Company Rebates And Government Tax Incentives AEE

Utility Company Rebates And Government Tax Incentives AEE

Here s How To Claim The Federal 30 Tax Credit For Installing Solar