Today, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. If it's to aid in education and creative work, or just adding the personal touch to your home, printables for free have become a valuable resource. Here, we'll take a dive deeper into "Irs Tax Credit On Hybrid Cars," exploring their purpose, where to locate them, and how they can enhance various aspects of your life.

Get Latest Irs Tax Credit On Hybrid Cars Below

Irs Tax Credit On Hybrid Cars

Irs Tax Credit On Hybrid Cars -

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

Irs Tax Credit On Hybrid Cars include a broad collection of printable resources available online for download at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages, and many more. The appeal of printables for free is their flexibility and accessibility.

More of Irs Tax Credit On Hybrid Cars

What Does The EV Tax Credit Overhaul Mean For Car Shoppers News

What Does The EV Tax Credit Overhaul Mean For Car Shoppers News

Looking to snap up a new hybrid vehicle in the new year and have tax credits on your mind Oh dear you ve got some homework to do Despite its popularity understanding both what and

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Irs Tax Credit On Hybrid Cars have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Individualization The Customization feature lets you tailor printed materials to meet your requirements, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: Education-related printables at no charge are designed to appeal to students from all ages, making them a useful tool for teachers and parents.

-

Accessibility: Fast access a variety of designs and templates reduces time and effort.

Where to Find more Irs Tax Credit On Hybrid Cars

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit The credit equals 30 of the sale price up to a

Now that we've piqued your interest in Irs Tax Credit On Hybrid Cars Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Irs Tax Credit On Hybrid Cars to suit a variety of goals.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets with flashcards and other teaching materials.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Irs Tax Credit On Hybrid Cars

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Irs Tax Credit On Hybrid Cars are a treasure trove filled with creative and practical information which cater to a wide range of needs and interest. Their availability and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the plethora that is Irs Tax Credit On Hybrid Cars today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Tax Credit On Hybrid Cars really completely free?

- Yes they are! You can download and print these free resources for no cost.

-

Does it allow me to use free printing templates for commercial purposes?

- It's contingent upon the specific conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may have restrictions in use. Make sure to read the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home with any printer or head to a local print shop for high-quality prints.

-

What software will I need to access Irs Tax Credit On Hybrid Cars?

- The majority of printables are in PDF format. They is open with no cost software like Adobe Reader.

The Florida Hybrid Car Rebate Save Money And Help The Environment

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Check more sample of Irs Tax Credit On Hybrid Cars below

EV Federal IRS Tax Credit Survival Is Good News For Consumers In

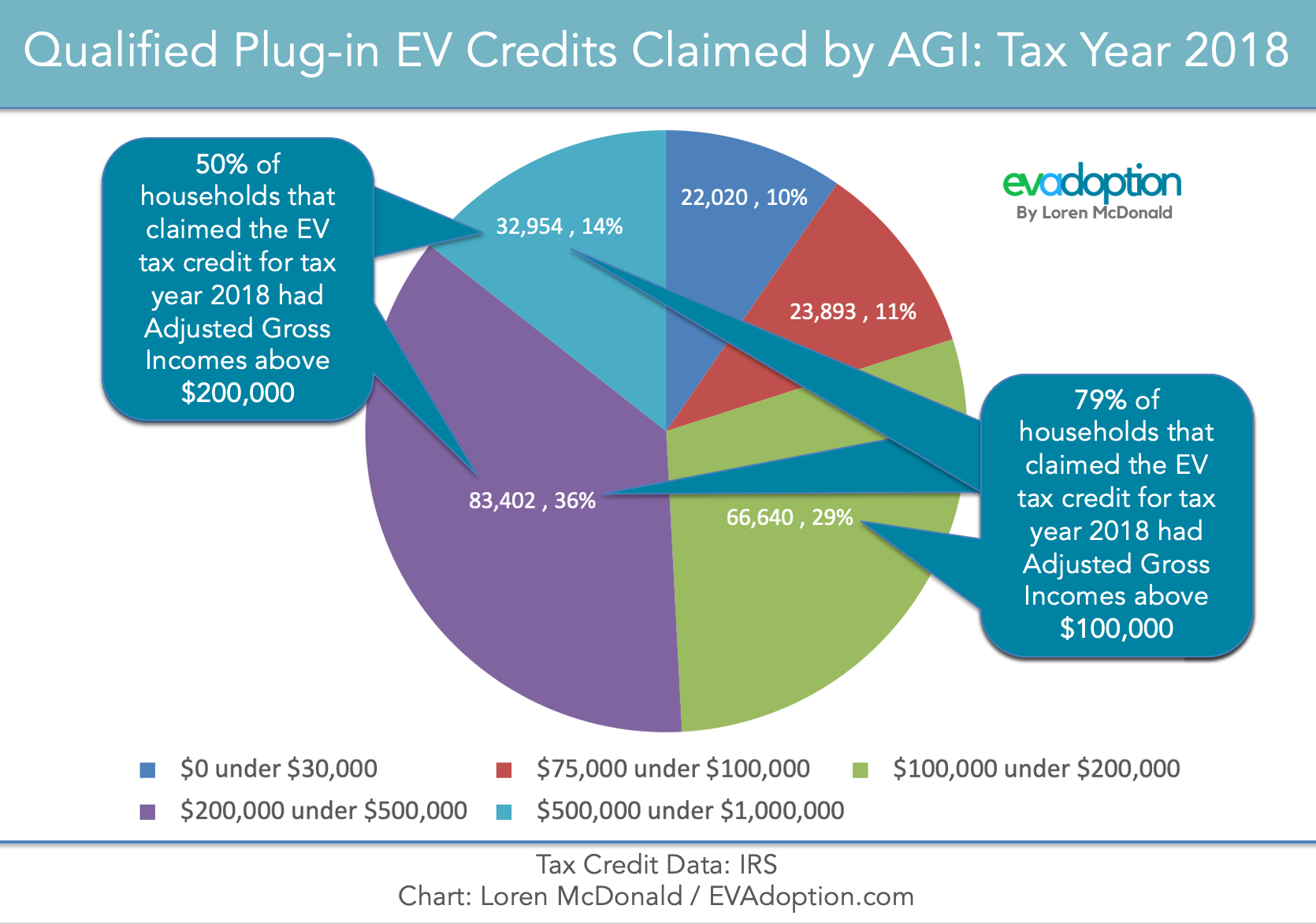

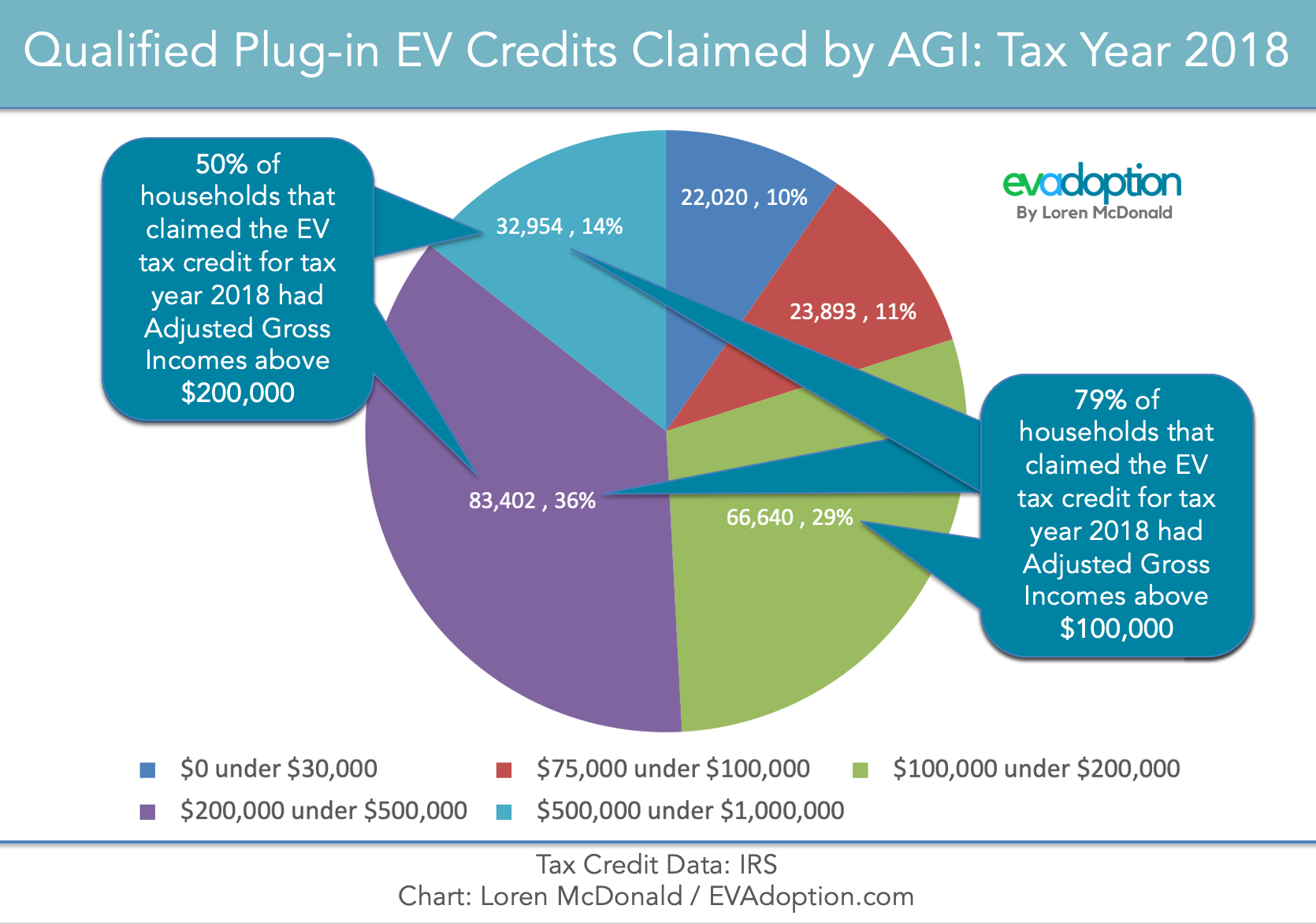

IRS Tax credit by Household AGI 2018 updated EVAdoption

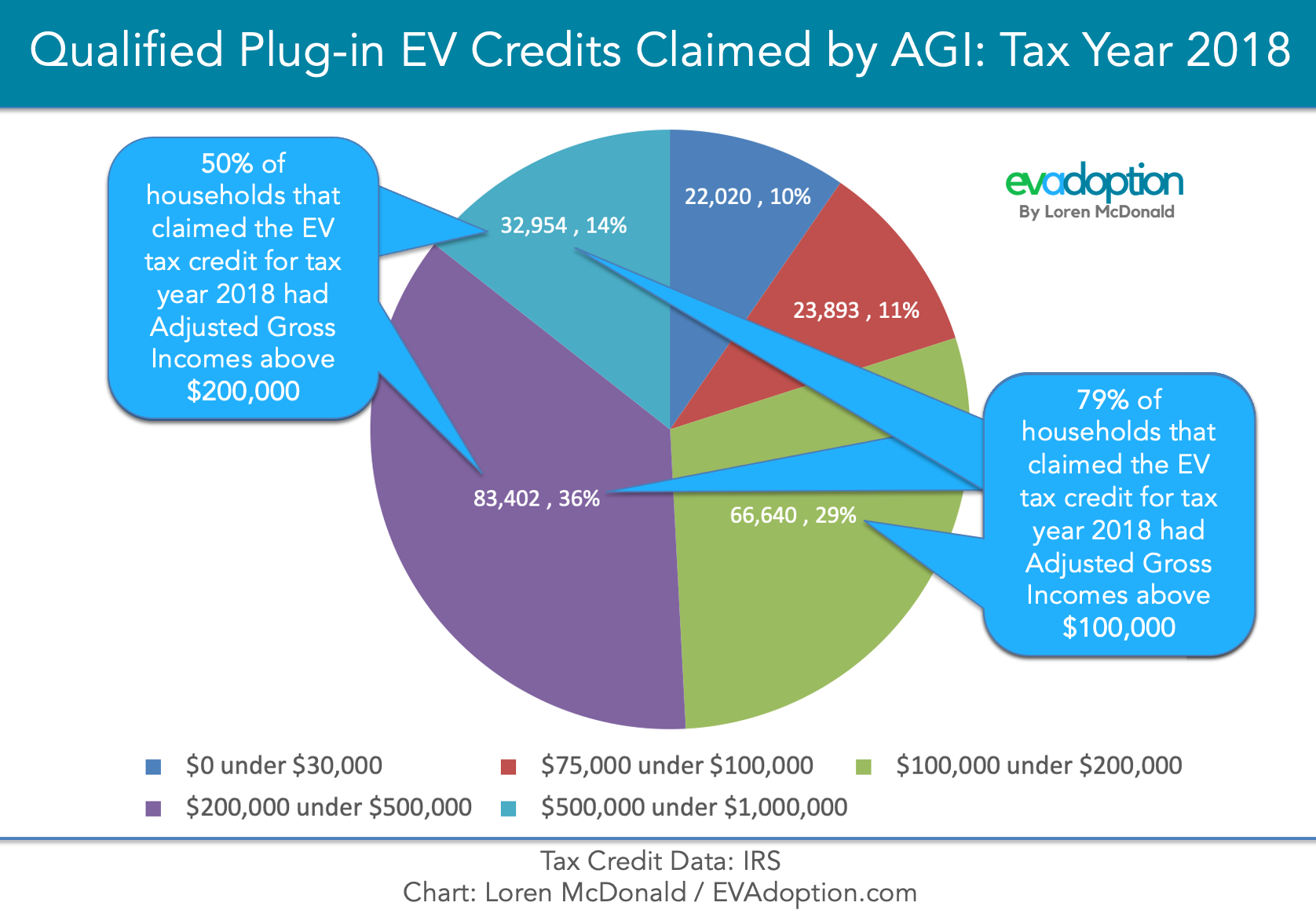

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

Employee Retention Credit IRS Tax Credit

35 Important Pros Cons Of Hybrid Cars E C

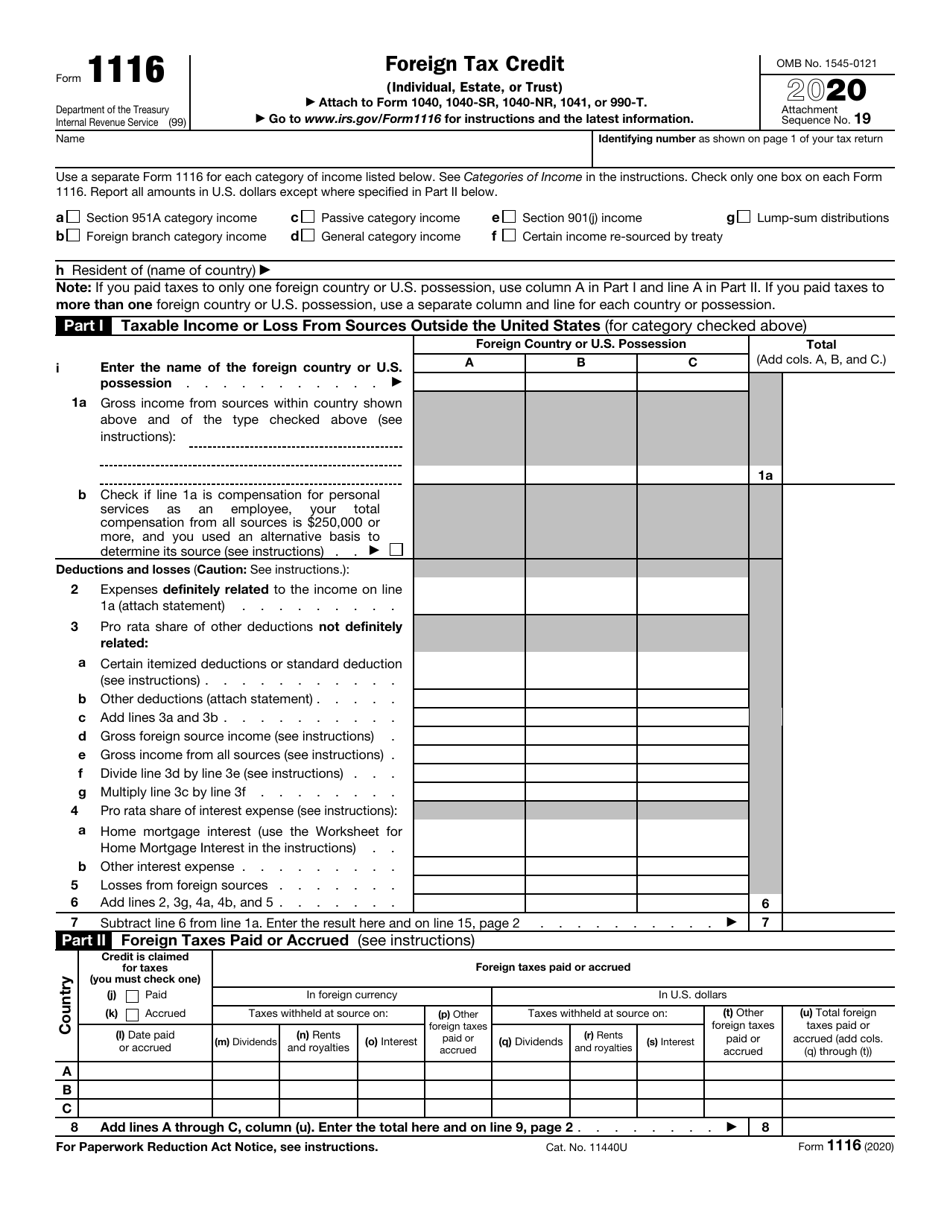

Irs Tax Credit TAX

https://www.irs.gov/clean-vehicle-tax-credits

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

https://www.irs.gov/credits-deductions/...

Clean Vehicle Credits Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought Planning to buy or already bought a used clean vehicle

Clean Vehicle Credits Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

Employee Retention Credit IRS Tax Credit

IRS Tax credit by Household AGI 2018 updated EVAdoption

35 Important Pros Cons Of Hybrid Cars E C

Irs Tax Credit TAX

American Acupuncture Alternative Medicine Association

Beware IRS Dirty Dozen List Includes R D Tax Credit Security Sales

Beware IRS Dirty Dozen List Includes R D Tax Credit Security Sales

Dominican Republic Adoption Agency Adoption From The Dominican