Today, when screens dominate our lives and the appeal of physical printed material hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding personal touches to your area, Irs Energy Tax Credit have become an invaluable resource. Here, we'll take a dive into the world "Irs Energy Tax Credit," exploring the benefits of them, where to locate them, and how they can improve various aspects of your life.

Get Latest Irs Energy Tax Credit Below

Irs Energy Tax Credit

Irs Energy Tax Credit - Irs Energy Tax Credit 2023, Irs Energy Tax Credit 2023 Form, Irs Energy Tax Credit 2022 Form, Irs Energy Tax Credit 2023 Eligibility, Irs Energy Tax Credit 2022 For Windows, Can I Claim Energy Tax Credit, What Is The Federal Energy Tax Credit, What Qualifies For Energy Tax Credit, What Qualifies For Federal Energy Tax Credit

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Irs Energy Tax Credit provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. They come in many kinds, including worksheets templates, coloring pages, and much more. One of the advantages of Irs Energy Tax Credit is their flexibility and accessibility.

More of Irs Energy Tax Credit

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

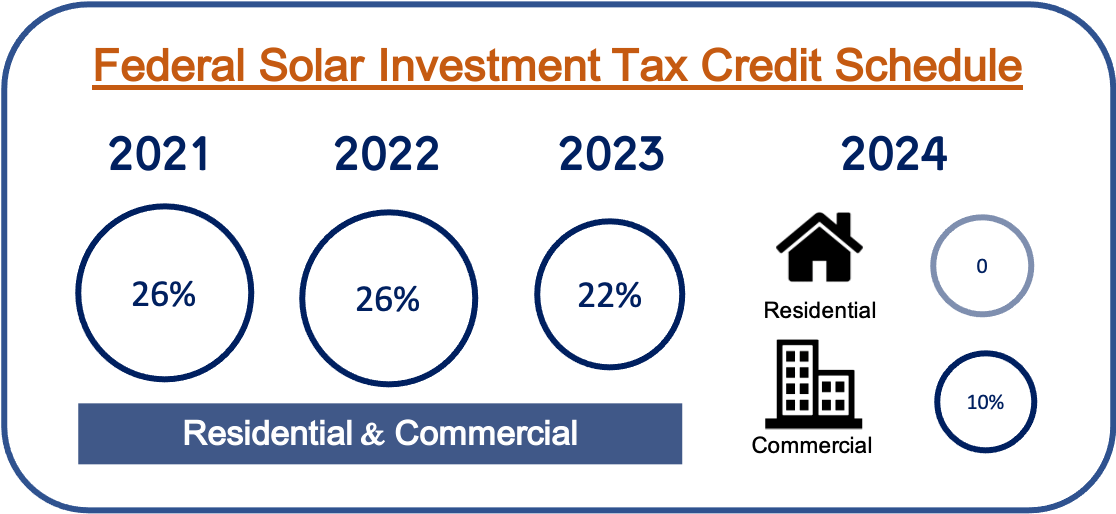

How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Irs Energy Tax Credit have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: The Customization feature lets you tailor printed materials to meet your requirements such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: Education-related printables at no charge cater to learners of all ages, making these printables a powerful tool for teachers and parents.

-

Easy to use: instant access the vast array of design and templates saves time and effort.

Where to Find more Irs Energy Tax Credit

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources

Since we've got your curiosity about Irs Energy Tax Credit Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Irs Energy Tax Credit designed for a variety purposes.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Irs Energy Tax Credit

Here are some inventive ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Irs Energy Tax Credit are a treasure trove filled with creative and practical information for a variety of needs and hobbies. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the vast array of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use the free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright concerns with Irs Energy Tax Credit?

- Some printables may contain restrictions on usage. Be sure to review these terms and conditions as set out by the author.

-

How do I print Irs Energy Tax Credit?

- Print them at home using either a printer or go to an in-store print shop to get top quality prints.

-

What software do I need in order to open printables at no cost?

- A majority of printed materials are as PDF files, which can be opened using free software such as Adobe Reader.

Heated Up How To Claim The 300 Stove Tax Credit

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Check more sample of Irs Energy Tax Credit below

For 346PRODUCTION Www directingactors

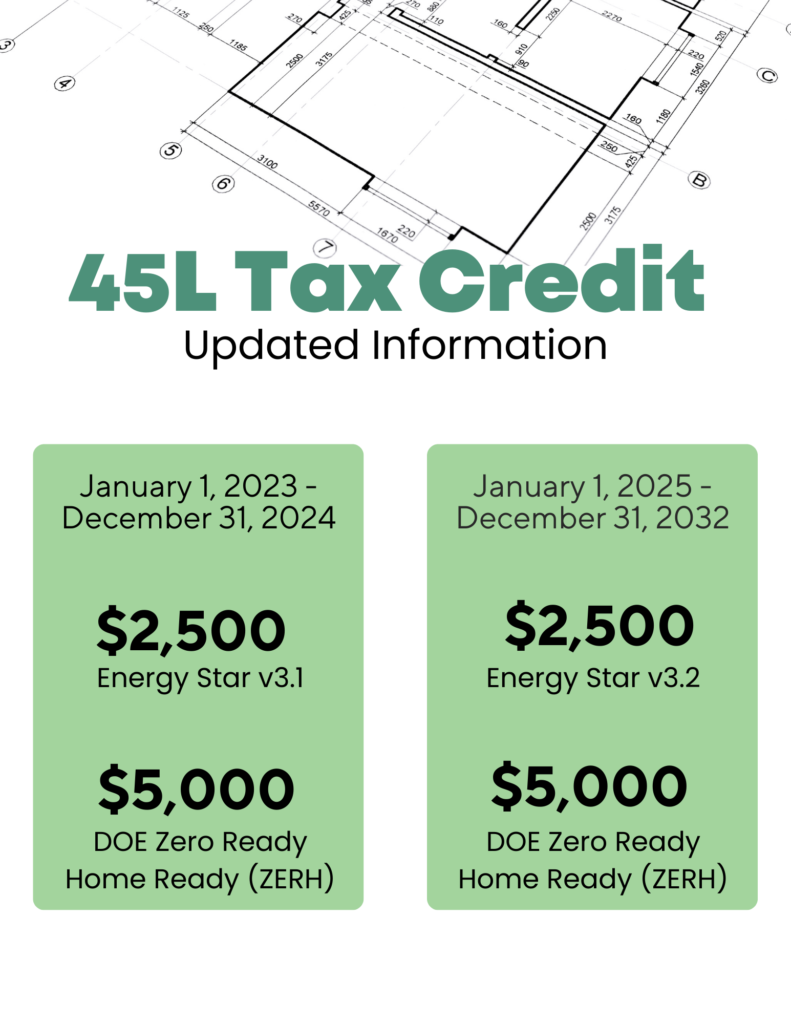

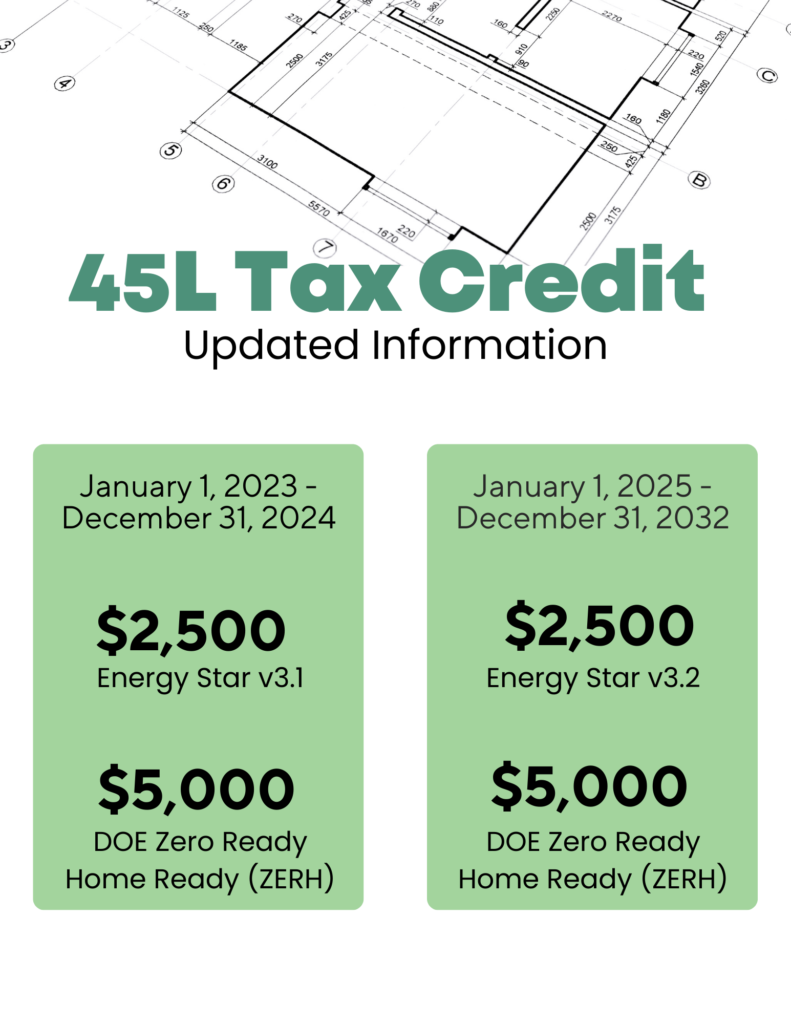

Section 45L Credit Extended Energy Saving Requirement Hamilton CPA

2023 Residential Clean Energy Credit Guide ReVision Energy

45L Tax Credit Energy Diagnostics

Form 5695 Instructions 2023 Printable Forms Free Online

What You Need To Know About Residential Energy Credits For Energy

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/newsroom/irs-updates...

IR 2024 113 April 17 2024 WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

IR 2024 113 April 17 2024 WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase

45L Tax Credit Energy Diagnostics

Section 45L Credit Extended Energy Saving Requirement Hamilton CPA

Form 5695 Instructions 2023 Printable Forms Free Online

What You Need To Know About Residential Energy Credits For Energy

Congress Gets Renewable Tax Credit Extension Right Renewable Energy World

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Residential Clean Energy Credit Limit Worksheet 2022 Printable Word