In this age of electronic devices, where screens rule our lives and the appeal of physical printed objects isn't diminished. Whether it's for educational purposes such as creative projects or just adding an individual touch to the space, Interest Rebate On Second Housing Loan are now a useful resource. Through this post, we'll dive deep into the realm of "Interest Rebate On Second Housing Loan," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your life.

Get Latest Interest Rebate On Second Housing Loan Below

Interest Rebate On Second Housing Loan

Interest Rebate On Second Housing Loan -

For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the second home loan In that case a deduction of up to Rs 2 lakh will be available for taxpayers

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5 equal installments from fy 23 24 upto a max of rs 2 lacs per fy aggregate

Printables for free include a vast range of printable, free documents that can be downloaded online at no cost. They come in many kinds, including worksheets templates, coloring pages and many more. The attraction of printables that are free is in their versatility and accessibility.

More of Interest Rebate On Second Housing Loan

TDPCS About

TDPCS About

Tax benefit on interest payment in 2024 You can claim deduction for interest payable on a loan taken for purchase construction repair or renovation of any property whether commercial or residential under Section 24 b This deduction on interest payment is available for any residential or commercial property owned by you

Similarly if you own a second home that is vacant or inhabited by family members such as parents you can also claim a deduction on the interest paid for that property under the same section However it s important to keep in mind that the total deduction for interest paid on both home loans combined should not exceed INR 2 lakhs

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Customization: There is the possibility of tailoring printables to your specific needs such as designing invitations making your schedule, or even decorating your house.

-

Education Value The free educational worksheets provide for students of all ages. This makes them a valuable instrument for parents and teachers.

-

It's easy: Instant access to numerous designs and templates is time-saving and saves effort.

Where to Find more Interest Rebate On Second Housing Loan

Loan Rates Advantage Credit Union

Loan Rates Advantage Credit Union

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually provided the construction acquisition of the house is completed within 5 years

The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business investment or other deductible purposes Otherwise it is considered personal interest and isn t deductible

Now that we've ignited your curiosity about Interest Rebate On Second Housing Loan Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Interest Rebate On Second Housing Loan for a variety uses.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast range of interests, that includes DIY projects to party planning.

Maximizing Interest Rebate On Second Housing Loan

Here are some fresh ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Interest Rebate On Second Housing Loan are a treasure trove of creative and practical resources designed to meet a range of needs and desires. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the endless world of Interest Rebate On Second Housing Loan right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Interest Rebate On Second Housing Loan really free?

- Yes you can! You can print and download these resources at no cost.

-

Do I have the right to use free printables for commercial uses?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Interest Rebate On Second Housing Loan?

- Some printables may contain restrictions in use. Check the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home with either a printer or go to a local print shop for premium prints.

-

What program do I require to view printables for free?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software like Adobe Reader.

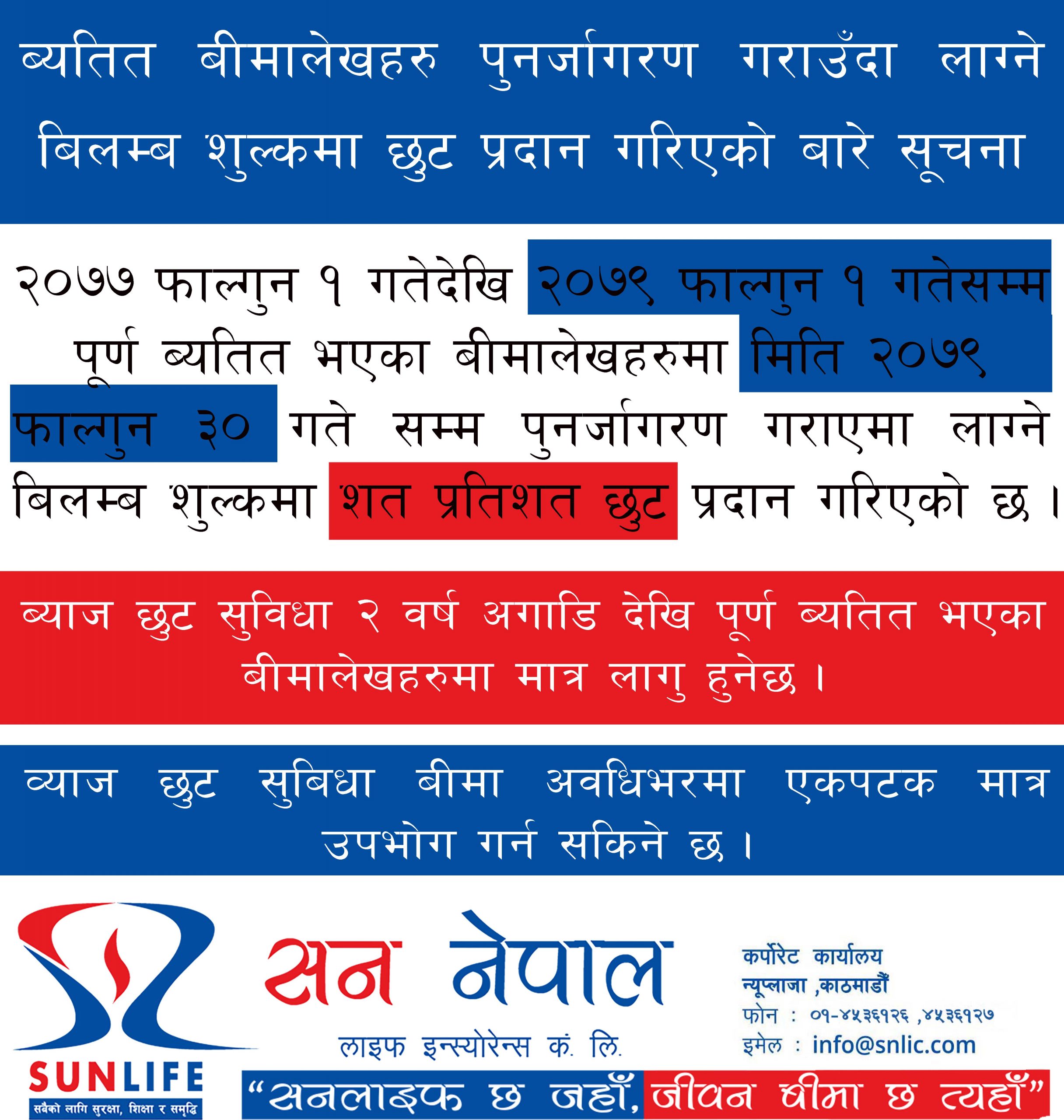

Rebate On Policy Interest Sun Life Insurance Nepal

X Wallet Interest Rebate For Selected Existing Customers Father s Day

Check more sample of Interest Rebate On Second Housing Loan below

X Wallet Interest Rebate For Existing Customers

Annual Dividends Loan Interest Rebates Wexford Credit Union Ltd

Farmers Will Now Get Interest Rebate On Repaying Loans Till 31 August

How To Write A Letter For Repayment Of Loan Alice Writing

TDPCS About

Haryana Deposit Outstanding Property Tax By December 31 You Will Get

https://taxguru.in/income-tax/income-tax-benefits...

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5 equal installments from fy 23 24 upto a max of rs 2 lacs per fy aggregate

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5 equal installments from fy 23 24 upto a max of rs 2 lacs per fy aggregate

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

How To Write A Letter For Repayment Of Loan Alice Writing

Annual Dividends Loan Interest Rebates Wexford Credit Union Ltd

TDPCS About

Haryana Deposit Outstanding Property Tax By December 31 You Will Get

Skylawn Memorial Park Cecilia Soo Cemetery And Funeral Advisor

Interest Rebate Program Feeder Associations Of Alberta Limited

Interest Rebate Program Feeder Associations Of Alberta Limited

BMW EASTER PROMOTION BMW HK