In this age of electronic devices, where screens rule our lives yet the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education project ideas, artistic or simply adding an element of personalization to your space, Interest Income Tax Claim are a great resource. In this article, we'll dive through the vast world of "Interest Income Tax Claim," exploring the different types of printables, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Interest Income Tax Claim Below

Interest Income Tax Claim

Interest Income Tax Claim -

OVERVIEW If you receive a 1099 INT the tax form that reports most payments of interest income you may or may not have to pay income tax on the interest it reports However you may still need to include the information from it on your return TABLE OF CONTENTS

Tax Deductible Interest A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income Types of interest that are tax deductible include mortgage

Interest Income Tax Claim offer a wide variety of printable, downloadable material that is available online at no cost. These resources come in many forms, including worksheets, templates, coloring pages and much more. The value of Interest Income Tax Claim is in their versatility and accessibility.

More of Interest Income Tax Claim

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Interest income becomes taxable when it s actually paid to you assuming you use the cash method of accounting and the vast majority of taxpayers do It might accrue in 2022 but if it s not credited to you until 2023 for some reason you would report it on your 2023 return when you file in 2024

The earned interest on savings accounts is taxed but you do not have to pay taxes on the full balance in your account That money is your savings you presumably already paid income taxes before

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Modifications: You can tailor printed materials to meet your requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational Use: Printables for education that are free provide for students of all ages. This makes them a great aid for parents as well as educators.

-

Accessibility: Fast access the vast array of design and templates, which saves time as well as effort.

Where to Find more Interest Income Tax Claim

HDFC Credila Education Loan For Foreign Education RONE GLOBAL

HDFC Credila Education Loan For Foreign Education RONE GLOBAL

Using that information the tax on your savings account interest would generally be 2 200 On the other hand if you have 20 000 in your high yield savings account and earn 3 75 interest you

Payors must file Form 1099 INT and send a copy to the recipient by January 31 each year Interest income must be documented on Schedule B of IRS Form 1040 Types of Interest Income Interest

If we've already piqued your curiosity about Interest Income Tax Claim, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Interest Income Tax Claim for all needs.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning tools.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a wide selection of subjects, including DIY projects to party planning.

Maximizing Interest Income Tax Claim

Here are some fresh ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Interest Income Tax Claim are a treasure trove of practical and imaginative resources catering to different needs and interests. Their accessibility and flexibility make them a valuable addition to both personal and professional life. Explore the vast array of Interest Income Tax Claim right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes they are! You can download and print these items for free.

-

Are there any free printables for commercial uses?

- It's dependent on the particular rules of usage. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables might have limitations regarding their use. Make sure you read the terms and condition of use as provided by the creator.

-

How can I print Interest Income Tax Claim?

- You can print them at home using either a printer or go to the local print shops for more high-quality prints.

-

What software do I need to open printables that are free?

- Most PDF-based printables are available in the format PDF. This can be opened using free programs like Adobe Reader.

TIPS GAYA PELEPASAN HIDUP Miamorzafirah

Tax Benefits On Home Loan Know More At Taxhelpdesk

Check more sample of Interest Income Tax Claim below

Income Tax Claim These 5 Deductions Without Any Investment Zee Business

Claiming A Tax Deduction For Motor Vehicle Expenses Pro TAX SOLUTIONS

Tax Filing Deadline 2022 Malaysia Lhdn Latest News Update

Claim Forgotten Tax Credits

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://www.investopedia.com/terms/t/tax-deductible-interest.asp

Tax Deductible Interest A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income Types of interest that are tax deductible include mortgage

https://smartasset.com/taxes/how-much-interest-from-interest-is-taxable

Earned interest income is almost always taxable if it is earned in an account that isn t a tax deferred account such as a 401 k Some examples of savings and investment accounts that will require you to pay taxes on the interest you earn from those accounts are U S Savings Bonds Treasury Bonds

Tax Deductible Interest A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income Types of interest that are tax deductible include mortgage

Earned interest income is almost always taxable if it is earned in an account that isn t a tax deferred account such as a 401 k Some examples of savings and investment accounts that will require you to pay taxes on the interest you earn from those accounts are U S Savings Bonds Treasury Bonds

Claim Forgotten Tax Credits

Claiming A Tax Deduction For Motor Vehicle Expenses Pro TAX SOLUTIONS

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

Allowing Income Tax Claim Without Verifying Amount Of wrong Assessment

Interest Income Income Tax IndiaFilings

Interest Income Income Tax IndiaFilings

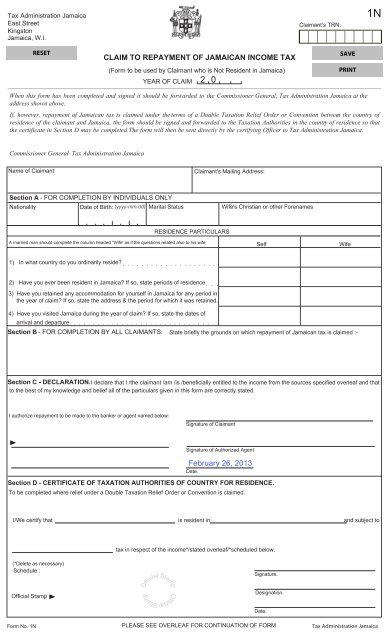

1N Claim Form For Repayment Of Jamaican Income Tax