In the digital age, where screens have become the dominant feature of our lives, the charm of tangible printed material hasn't diminished. Whether it's for educational purposes or creative projects, or just adding an individual touch to the home, printables for free have become a valuable resource. Here, we'll take a dive through the vast world of "Insurance Premium Income Tax Deduction," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your life.

Get Latest Insurance Premium Income Tax Deduction Below

Insurance Premium Income Tax Deduction

Insurance Premium Income Tax Deduction -

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross

If you receive a subsidy that pays for 70 of your health insurance premium you would only be allowed to deduct the 30 you pay on your taxes COBRA insurance plans

Insurance Premium Income Tax Deduction cover a large range of printable, free documents that can be downloaded online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and much more. The attraction of printables that are free is their flexibility and accessibility.

More of Insurance Premium Income Tax Deduction

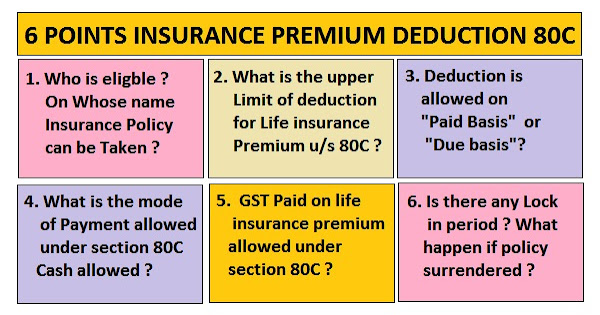

LIFE INSURANCE PREMIUM DEDUCTION U S 80C SIMPLE TAX INDIA

LIFE INSURANCE PREMIUM DEDUCTION U S 80C SIMPLE TAX INDIA

1 Disability Insurance Disability insurance is probably the most commonly overlooked insurance premium tax deduction This type of insurance can provide supplemental income if

In 2021 the average cost for health insurance premiums ranged from 2 664 to 7 152 per person You may be eligible to claim your health insurance premiums on your tax forms depending on your situation This tax break could help you combat the rising cost of healthcare and save more money

The Insurance Premium Income Tax Deduction have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: They can make the templates to meet your individual needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational Worth: Education-related printables at no charge provide for students of all ages, making them a useful tool for parents and educators.

-

An easy way to access HTML0: You have instant access many designs and templates reduces time and effort.

Where to Find more Insurance Premium Income Tax Deduction

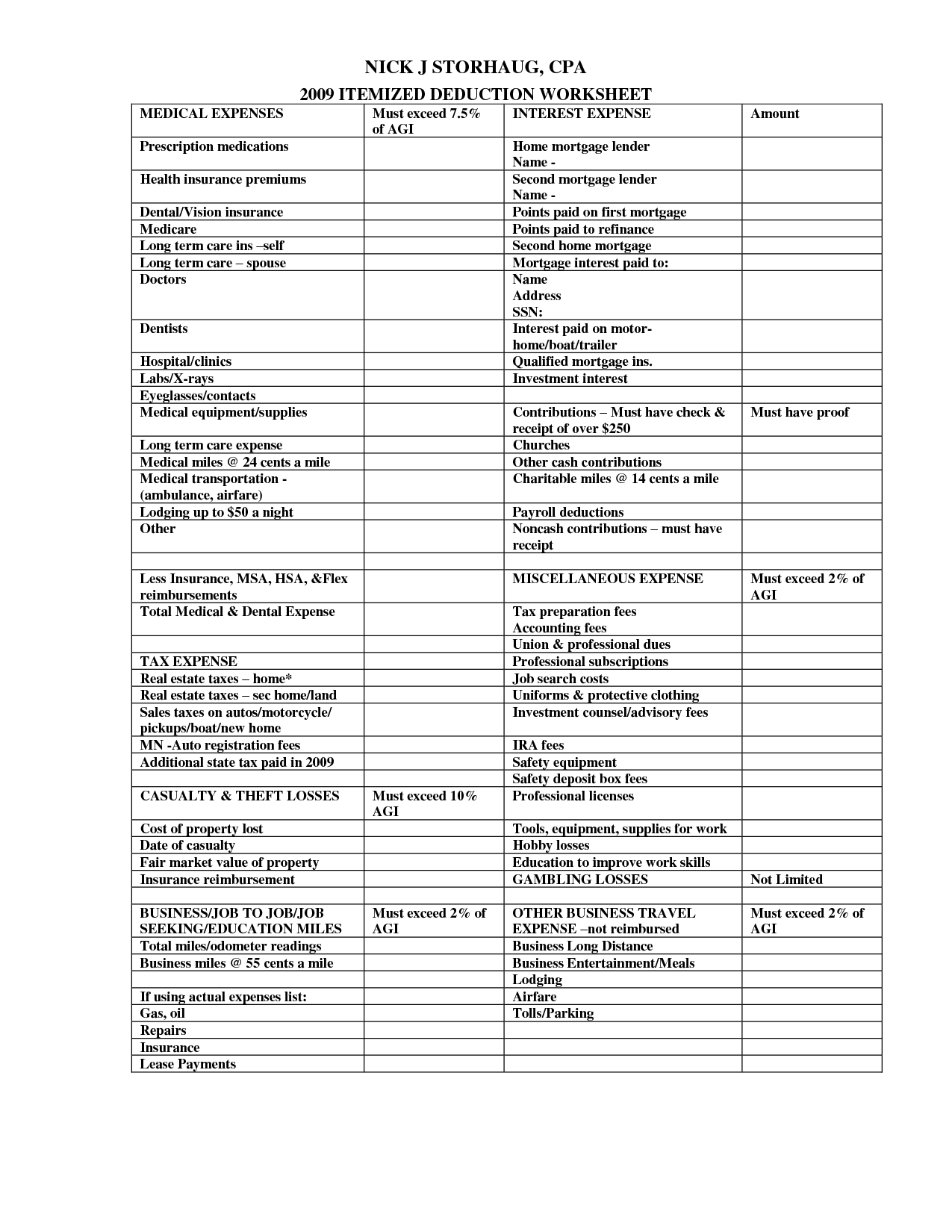

12 Self Employed Tax Worksheet Worksheeto

12 Self Employed Tax Worksheet Worksheeto

Medical costs that exceed 7 5 of your adjusted gross income AGI can be deducted for tax purposes You can deduct insurance premiums and most other upfront costs or standard fees that you pay out of pocket Track your spending on all travel and purchases related to treatment or called for by a health care

In some instances you might be able to deduct your insurance premiums medical expenses and other health related costs on your taxes Here s what to know about potential deductions when they apply and how much they can reduce your tax bill

Since we've got your interest in Insurance Premium Income Tax Deduction We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Insurance Premium Income Tax Deduction for various motives.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Insurance Premium Income Tax Deduction

Here are some innovative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Insurance Premium Income Tax Deduction are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and hobbies. Their availability and versatility make them a great addition to both professional and personal life. Explore the vast world of Insurance Premium Income Tax Deduction to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes they are! You can print and download these resources at no cost.

-

Can I utilize free printables for commercial use?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright problems with Insurance Premium Income Tax Deduction?

- Certain printables may be subject to restrictions concerning their use. Be sure to review these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home with your printer or visit an in-store print shop to get better quality prints.

-

What program do I require to open printables for free?

- The majority of printables are in PDF format. They is open with no cost software such as Adobe Reader.

Preventive Check Up 80d Wkcn

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Check more sample of Insurance Premium Income Tax Deduction below

When Can You Claim A Tax Deduction For Health Insurance

Anything To Everything Income Tax Guide For Individuals Including

About Form 1095 A Health Insurance Marketplace Statement Definition

Income Tax 80c Deduction Fy 2021 22 TAX

Income Tax Deduction Under 80C 80D And 80CCD Overview Types And

Income Tax Return Filing Five Common Mistakes You Should Avoid While

https://www.forbes.com/advisor/health-insurance/is...

If you receive a subsidy that pays for 70 of your health insurance premium you would only be allowed to deduct the 30 you pay on your taxes COBRA insurance plans

https://money.usnews.com/money/personal-finance/...

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

If you receive a subsidy that pays for 70 of your health insurance premium you would only be allowed to deduct the 30 you pay on your taxes COBRA insurance plans

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

Income Tax 80c Deduction Fy 2021 22 TAX

Anything To Everything Income Tax Guide For Individuals Including

Income Tax Deduction Under 80C 80D And 80CCD Overview Types And

Income Tax Return Filing Five Common Mistakes You Should Avoid While

Printable Itemized Deductions Worksheet

Section 80D Deduction For Medical Insurance Health Checkups 2019

Section 80D Deduction For Medical Insurance Health Checkups 2019

Tax Deduction For Mortgage Insurance Premiums Content Insurance Term