In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. For educational purposes as well as creative projects or simply adding an extra personal touch to your home, printables for free are now a vital source. Here, we'll take a dive into the world "Input Tax Credit On Air Conditioner," exploring their purpose, where they are, and how they can be used to enhance different aspects of your lives.

Get Latest Input Tax Credit On Air Conditioner Below

Input Tax Credit On Air Conditioner

Input Tax Credit On Air Conditioner -

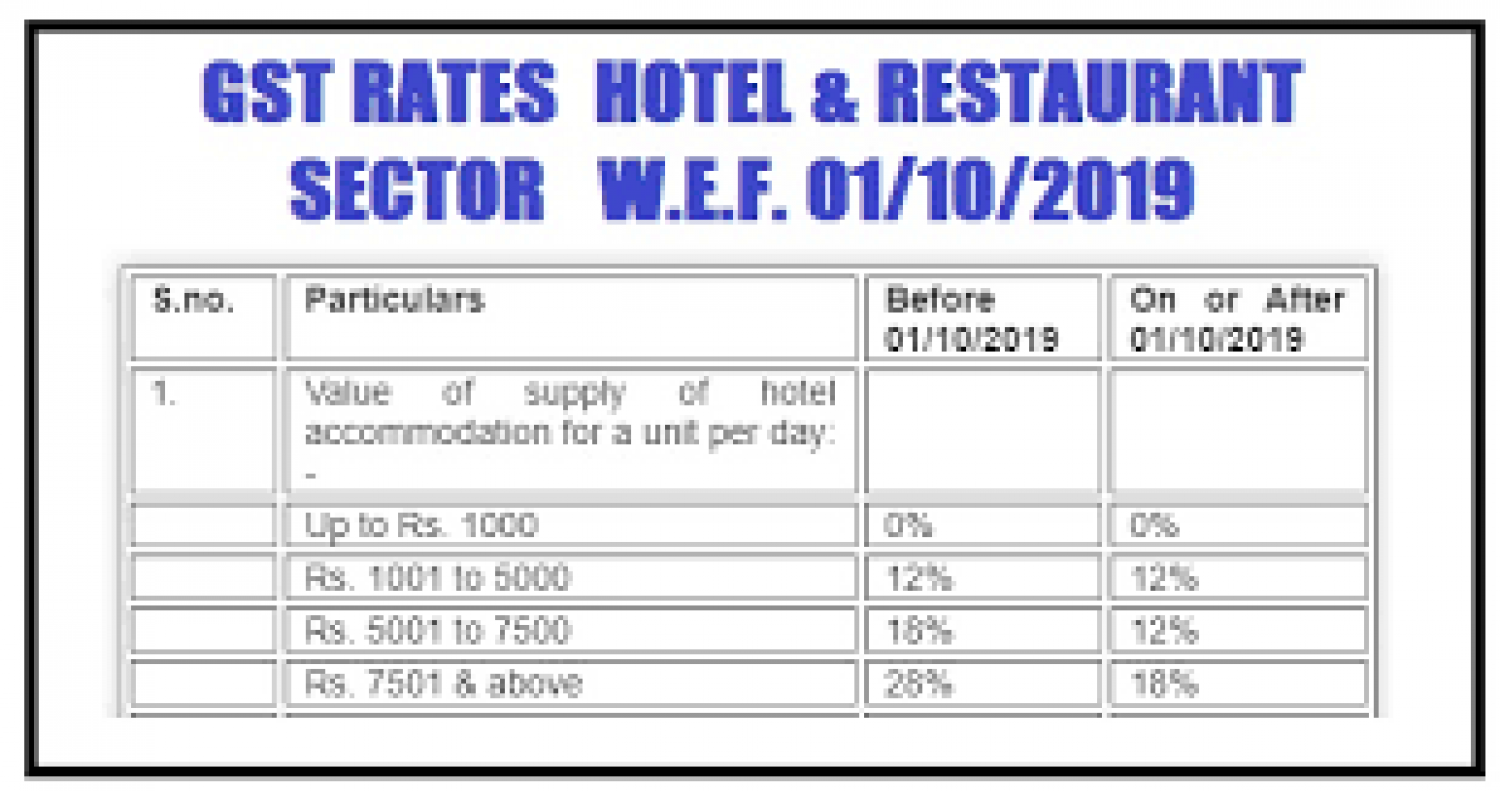

What is the GST effect on air conditioner Previously consumer durables were subject to two significant taxes VAT and excise duty The aggregat e rate was approximately 23

What is theGST effect on air conditioner Previously consumer durables were subject to two significant taxes VAT and excise duty The aggregat e rate was

Input Tax Credit On Air Conditioner include a broad assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and more. The appealingness of Input Tax Credit On Air Conditioner is their versatility and accessibility.

More of Input Tax Credit On Air Conditioner

Input Tax Credit Meaning Conditions To Avail Documents Required

Input Tax Credit Meaning Conditions To Avail Documents Required

The input tax credit is not available for claims in the following cases Motor vehicles with a seating capacity of less than or equal to 13 persons including the driver goods

Itc by air conditioner When you purchase anything you are required to pay GST on it Later you can claim Input Tax credit on the GST paid on your purchases

Input Tax Credit On Air Conditioner have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: This allows you to modify printables to fit your particular needs for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Value: Printables for education that are free can be used by students of all ages. This makes these printables a powerful device for teachers and parents.

-

Easy to use: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Input Tax Credit On Air Conditioner

Can You Claim Input Tax Credit On Travel

Can You Claim Input Tax Credit On Travel

Input Tax Credit ITC of the taxes paid on the inward supplies of inputs capital goods and services which are used in the course or furtherance of the business

ITC estimators Input Tax Credit estimators Understand the risks and governance required when using an Input Tax Credit ITC estimator for calculating

We've now piqued your curiosity about Input Tax Credit On Air Conditioner Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Input Tax Credit On Air Conditioner designed for a variety motives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free, flashcards, and learning materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs are a vast range of topics, everything from DIY projects to party planning.

Maximizing Input Tax Credit On Air Conditioner

Here are some innovative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Input Tax Credit On Air Conditioner are a treasure trove with useful and creative ideas catering to different needs and desires. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the vast array of Input Tax Credit On Air Conditioner right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Input Tax Credit On Air Conditioner truly gratis?

- Yes you can! You can download and print these items for free.

-

Can I make use of free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright problems with Input Tax Credit On Air Conditioner?

- Certain printables might have limitations on usage. You should read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with the printer, or go to the local print shops for the highest quality prints.

-

What program do I require to open Input Tax Credit On Air Conditioner?

- The majority of PDF documents are provided as PDF files, which can be opened using free software like Adobe Reader.

ITC Not Admissible On Air conditioning Cooling System Ventilation

New GST Input Tax Credit Rules Tally FAQ News Announcements Blog

Check more sample of Input Tax Credit On Air Conditioner below

Gst On Hotels Restaurant Industry Gst On Hotel

GST Input Tax Credit On Loyalty Vouchers By Myntra Logitax

Know Whether You Can Claim Input Tax Credit On Food

Input Tax Credit On Iphones Capital Goods

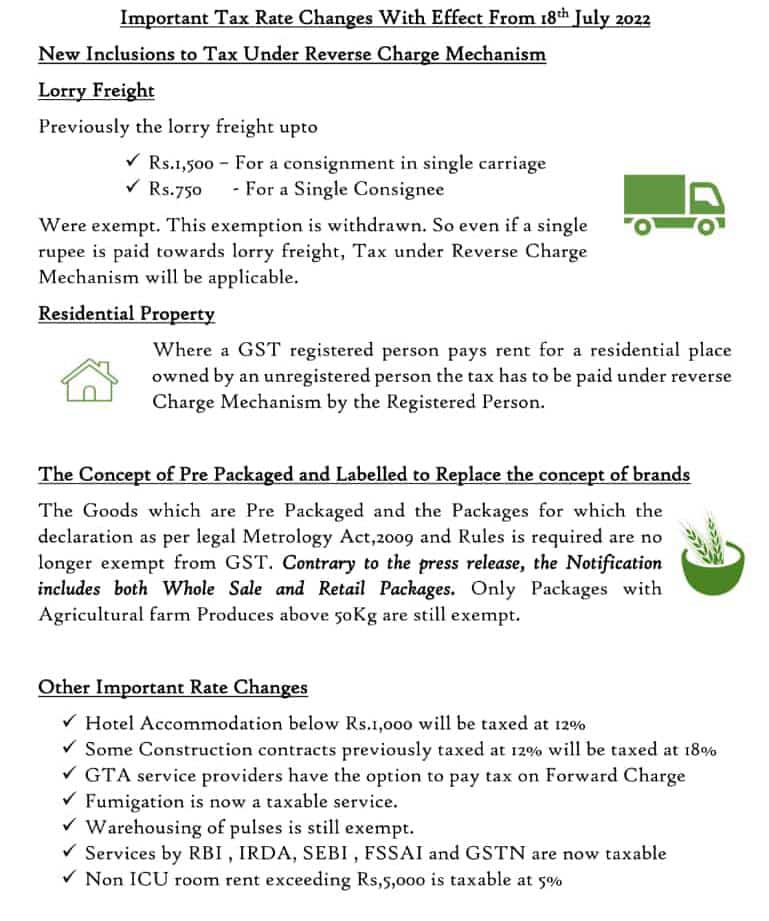

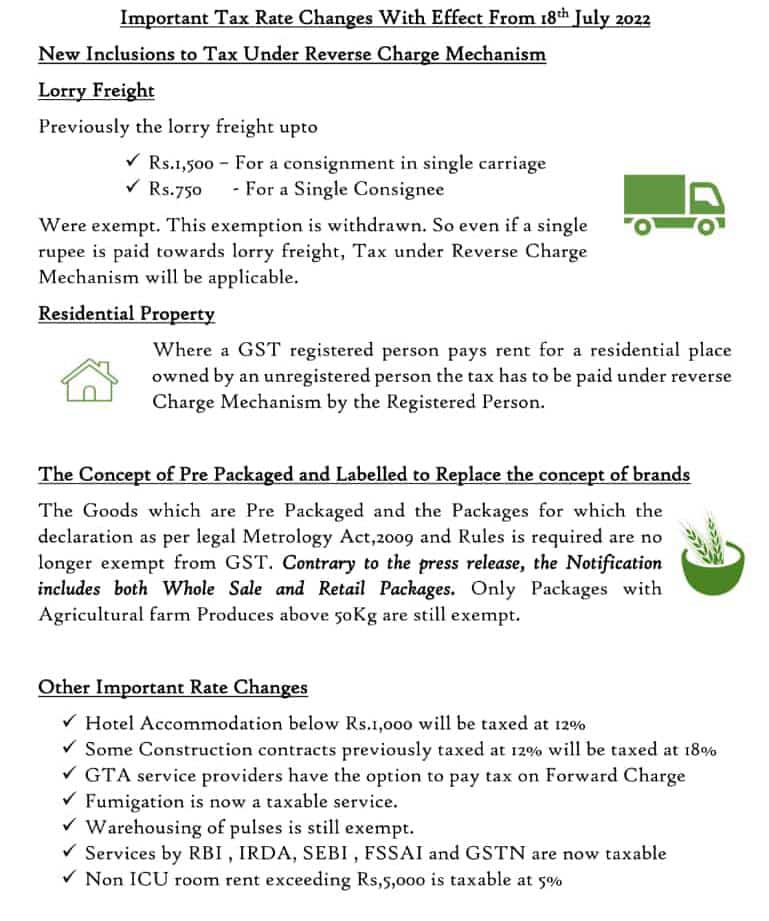

New GST Rate Changes From July 2022 Onwards India Financial Consultancy

Timely Need To Study Circumstances Of Input Tax Credit

https://khatabook.com/blog/gst-on-air-conditioners

What is theGST effect on air conditioner Previously consumer durables were subject to two significant taxes VAT and excise duty The aggregat e rate was

https://www.ascgroup.in/admissibility-of-itc-on...

The input tax credit is not admissible on Air conditioning and Cooling systems and Ventilation systems as this is blocked credit falling under Section 17 5 c

What is theGST effect on air conditioner Previously consumer durables were subject to two significant taxes VAT and excise duty The aggregat e rate was

The input tax credit is not admissible on Air conditioning and Cooling systems and Ventilation systems as this is blocked credit falling under Section 17 5 c

Input Tax Credit On Iphones Capital Goods

GST Input Tax Credit On Loyalty Vouchers By Myntra Logitax

New GST Rate Changes From July 2022 Onwards India Financial Consultancy

Timely Need To Study Circumstances Of Input Tax Credit

Input Tax Credit Under GST 10 Cases Where You Cannot Claim It

Input Tax Credit GST Input Tax Credit Services In New Delhi

Input Tax Credit GST Input Tax Credit Services In New Delhi

Input Tax Credit On CSR Spending By Companies In Detailed