In this day and age where screens have become the dominant feature of our lives however, the attraction of tangible printed objects hasn't waned. In the case of educational materials for creative projects, simply adding a personal touch to your area, Input Tax Credit Meaning are now an essential source. Here, we'll dive into the sphere of "Input Tax Credit Meaning," exploring the benefits of them, where you can find them, and how they can enrich various aspects of your lives.

Get Latest Input Tax Credit Meaning Below

Input Tax Credit Meaning

Input Tax Credit Meaning -

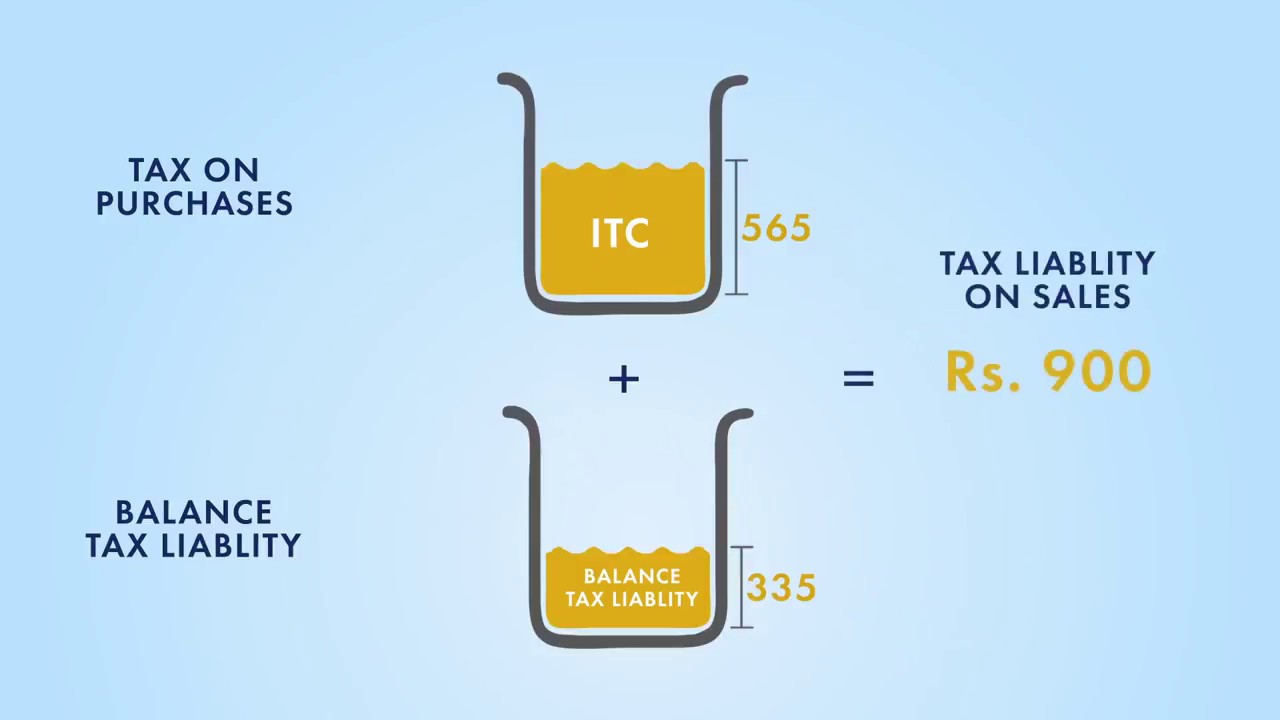

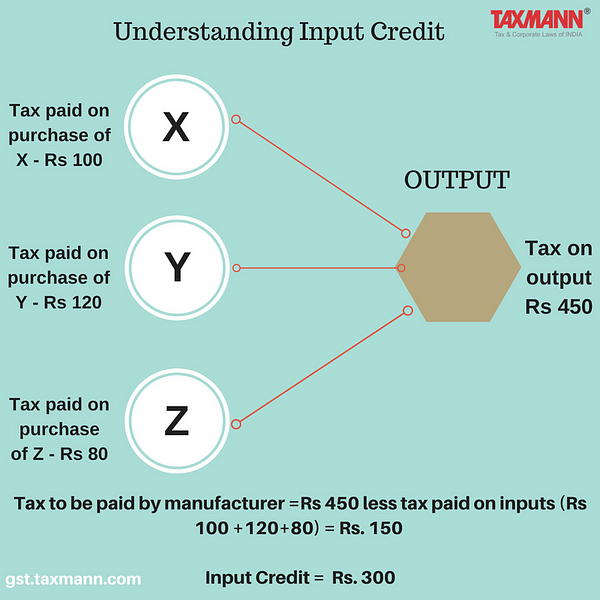

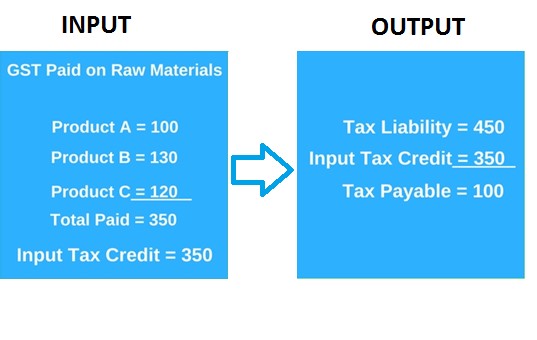

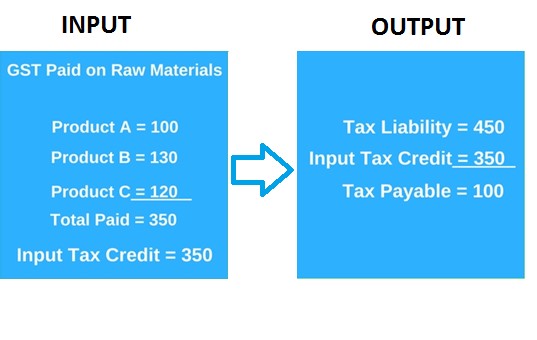

Meaning of Input Tax Credit It refers to claiming the credit on the taxes that have been paid on inputs Commonly we also refer to it as ITC Claiming this credit helps in the reduction of output liability the liability that arises on the supply of goods and services sale of the registered person

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

Input Tax Credit Meaning cover a large selection of printable and downloadable resources available online for download at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and more. One of the advantages of Input Tax Credit Meaning lies in their versatility as well as accessibility.

More of Input Tax Credit Meaning

How GST Input Tax Credit Works YouTube

How GST Input Tax Credit Works YouTube

A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

As a GST HST registrant you recover the GST HST paid or payable on your purchases and expenses related to your commercial activities by claiming input tax credits ITCs in your line 108 calculation if you are filing electronically or on line 106 if you are filing a paper GST HST return

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: We can customize designs to suit your personal needs for invitations, whether that's creating them, organizing your schedule, or even decorating your house.

-

Educational Benefits: Downloads of educational content for free cater to learners from all ages, making the perfect tool for parents and educators.

-

The convenience of Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Input Tax Credit Meaning

Input Tax Credit Meaning Conditions To Avail Documents Required

Input Tax Credit Meaning Conditions To Avail Documents Required

What is Input Tax Credit ITC It is the tax that a business pays on a purchase and that it can use to reduce its tax liability when it makes a sale In simple terms input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance amount

Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability payable on outward supplies is known as input tax credit In other words input tax credit is tax reduced from output tax payable on account of sales Lets Understand With the help of

We've now piqued your interest in Input Tax Credit Meaning Let's see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Input Tax Credit Meaning for all purposes.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning tools.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Input Tax Credit Meaning

Here are some ways for you to get the best of Input Tax Credit Meaning:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to enhance learning at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Input Tax Credit Meaning are an abundance of innovative and useful resources that can meet the needs of a variety of people and pursuits. Their accessibility and flexibility make them a fantastic addition to your professional and personal life. Explore the endless world of Input Tax Credit Meaning today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these documents for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Are there any copyright problems with Input Tax Credit Meaning?

- Some printables may contain restrictions in use. Check the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with the printer, or go to a print shop in your area for higher quality prints.

-

What program must I use to open printables that are free?

- The majority of printables are in the format of PDF, which can be opened using free software, such as Adobe Reader.

What Is Input Credit Under GST And How To Claim It

What Is Input Tax Credit Under GST How Does Input Tax Credit Mechanism

Check more sample of Input Tax Credit Meaning below

ITC Reversal Not Required When Electricity Is Generated For Captive

What GST Input Tax Credit How To Claim It

Important Points Of Input Tax Credit In GST Input Tax Credit In GST

GST And How To Avail Input Tax Credit In India

What Is Input Tax Credit ITC HostBooks

Gst Input Tax Credit Example Input Tax Credit Under Gst All You Want

https://www.embibe.com/exams/input-tax-credit

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

https://cleartax.in/glossary/input-tax-credit

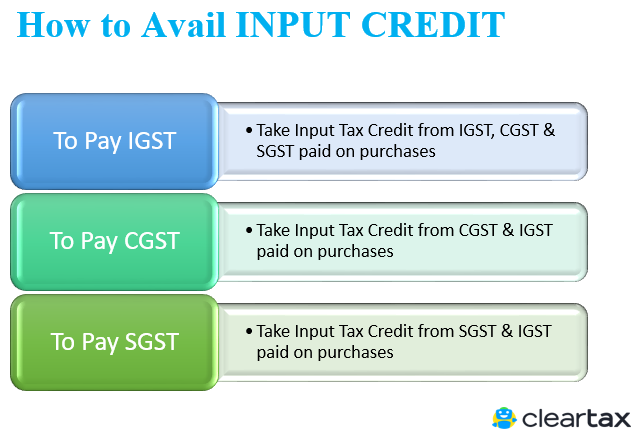

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business enterprise can claim an input tax credit while calculating output tax on their goods sold or services provided

Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business enterprise can claim an input tax credit while calculating output tax on their goods sold or services provided

GST And How To Avail Input Tax Credit In India

What GST Input Tax Credit How To Claim It

What Is Input Tax Credit ITC HostBooks

Gst Input Tax Credit Example Input Tax Credit Under Gst All You Want

INPUT TAX CREDIT MEANING EXPLAIN INPUT TAX CREDIT UNDER GST shorts

Input Tax Credit Under GST Meaning Capital Goods Gold And Job Work

Input Tax Credit Under GST Meaning Capital Goods Gold And Job Work

Input Tax Credit Under GST Meaning Types Working How To Claim