In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible printed material hasn't diminished. If it's to aid in education, creative projects, or simply adding an extra personal touch to your home, printables for free are a great resource. Through this post, we'll take a dive to the depths of "Inflation Reduction Energy Tax Credits," exploring what they are, where to find them, and how they can enhance various aspects of your lives.

Get Latest Inflation Reduction Energy Tax Credits Below

Inflation Reduction Energy Tax Credits

Inflation Reduction Energy Tax Credits -

Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act 5 ways to save in 2023 with home energy tax credits Publication 5886 A Clean Energy Tax Incentives for Individuals PDF

For an interactive guide to energy credits available under the Inflation Reduction Act visit cleanenergy gov Bonus incentive credits Qualifying energy projects that also meet other specific criteria may be eligible for additional tax credit amounts also known as bonuses Check back for details on these bonuses Low income

Inflation Reduction Energy Tax Credits include a broad range of downloadable, printable materials that are accessible online for free cost. They come in many types, such as worksheets templates, coloring pages and more. One of the advantages of Inflation Reduction Energy Tax Credits is their versatility and accessibility.

More of Inflation Reduction Energy Tax Credits

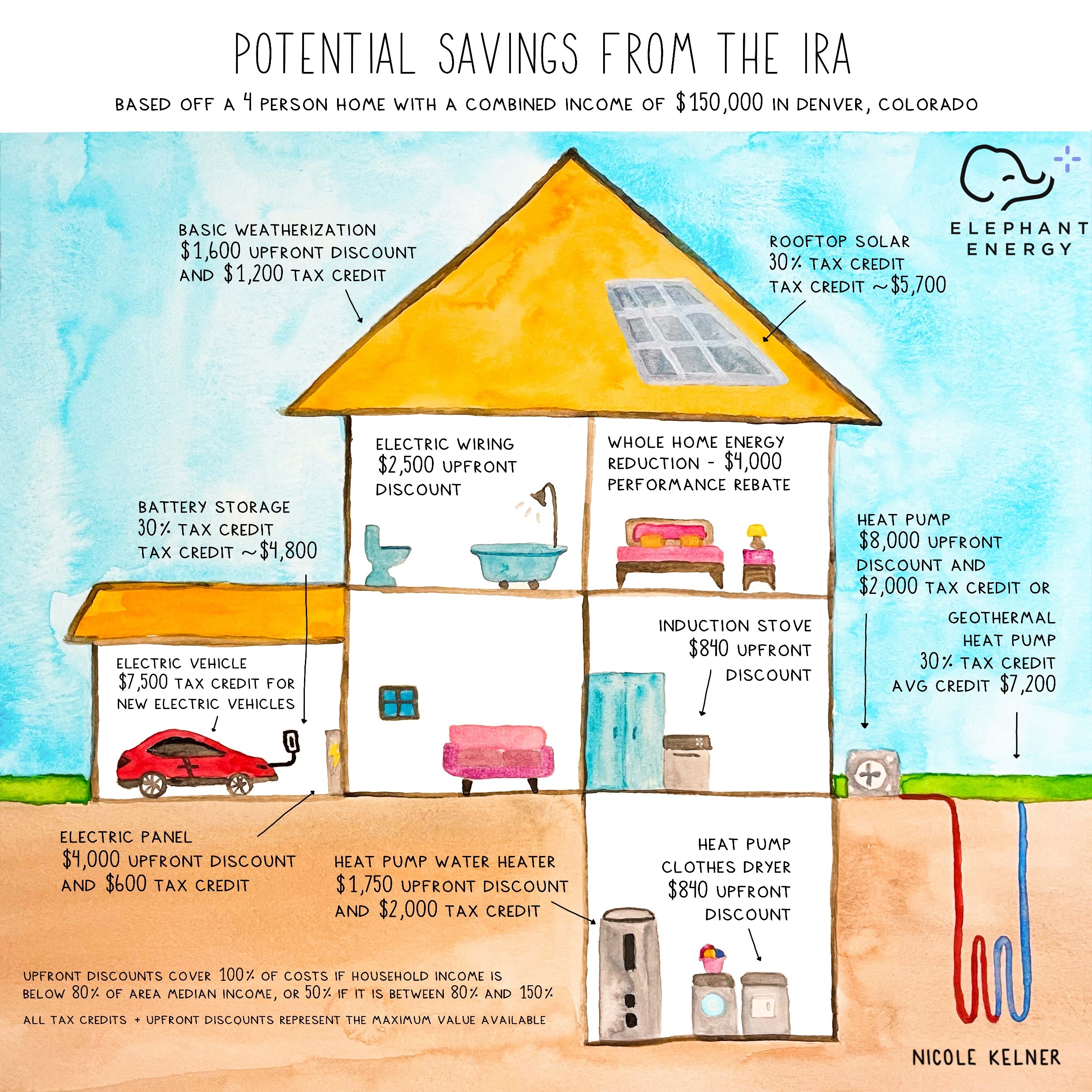

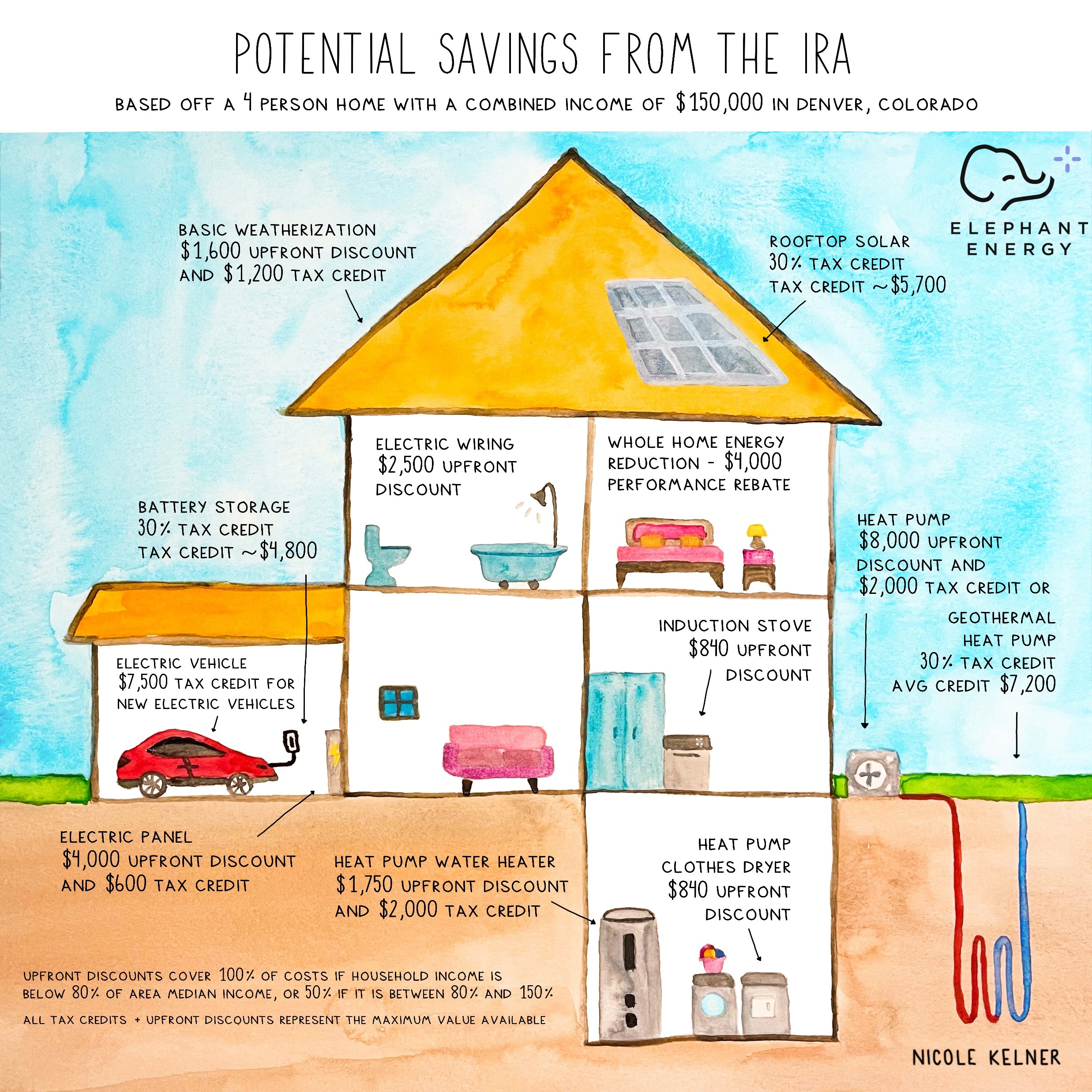

Inflation Reduction Act IRA The Ultimate Guide To Saving

Inflation Reduction Act IRA The Ultimate Guide To Saving

T he Inflation Reduction Act IRA signed into law in August of 2022 includes 370 billion in investments targeted at lowering energy costs and tackling climate change

A Consumer Guide to the Inflation Reduction Act Here s how to save on electric vehicles solar panels heat pumps and more via tax credits and rebates July 20 2023 iStock Courtney

The Inflation Reduction Energy Tax Credits have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize the design to meet your needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Use: The free educational worksheets offer a wide range of educational content for learners of all ages. This makes these printables a powerful resource for educators and parents.

-

Accessibility: Fast access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Inflation Reduction Energy Tax Credits

Renewable Energy Tax Credits And The Inflation Reduction Act SmartBrief

Renewable Energy Tax Credits And The Inflation Reduction Act SmartBrief

January 1 2023 C Corporation Income Taxation Credits Tax Planning Tax Minimization Editor Susan Minasian Grais CPA J D LL M The Inflation Reduction Act of 2022 P L 117 169 represents a monumental and unprecedented investment in the adoption and expansion of renewable and alternative energy

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and

After we've peaked your interest in printables for free, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Inflation Reduction Energy Tax Credits suitable for many reasons.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing Inflation Reduction Energy Tax Credits

Here are some innovative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Inflation Reduction Energy Tax Credits are a treasure trove of innovative and useful resources that meet a variety of needs and desires. Their access and versatility makes they a beneficial addition to the professional and personal lives of both. Explore the plethora of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Inflation Reduction Energy Tax Credits really cost-free?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free printables for commercial uses?

- It's based on the usage guidelines. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables may be subject to restrictions on usage. Make sure you read the terms of service and conditions provided by the designer.

-

How do I print Inflation Reduction Energy Tax Credits?

- You can print them at home using printing equipment or visit a local print shop for superior prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided in the format of PDF, which can be opened with free software like Adobe Reader.

The Inflation Reduction Act And Residential Energy Certasun

Inflation Reduction Act What Manufacturers Need To Know About New

Check more sample of Inflation Reduction Energy Tax Credits below

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Refundability And Transferability Of The Clean Energy Tax Credits In

Inflation Reduction Act Business Tax Incentives Virginia CPA

What s In The Inflation Reduction Act And What s Next For Its

The Inflation Reduction Act Solar And Clean Energy Tax Credits Enphase

How Alabama Homeowners Can Unlock Clean Energy Tax Credits Under The

https://www.irs.gov/credits-and-deductions-under...

For an interactive guide to energy credits available under the Inflation Reduction Act visit cleanenergy gov Bonus incentive credits Qualifying energy projects that also meet other specific criteria may be eligible for additional tax credit amounts also known as bonuses Check back for details on these bonuses Low income

https://www.whitehouse.gov/cleanenergy/directpay

Applicable entities can use direct pay for 12 of the Inflation Reduction Act s tax credits including for generating clean electricity through solar wind and battery storage projects

For an interactive guide to energy credits available under the Inflation Reduction Act visit cleanenergy gov Bonus incentive credits Qualifying energy projects that also meet other specific criteria may be eligible for additional tax credit amounts also known as bonuses Check back for details on these bonuses Low income

Applicable entities can use direct pay for 12 of the Inflation Reduction Act s tax credits including for generating clean electricity through solar wind and battery storage projects

What s In The Inflation Reduction Act And What s Next For Its

Refundability And Transferability Of The Clean Energy Tax Credits In

The Inflation Reduction Act Solar And Clean Energy Tax Credits Enphase

How Alabama Homeowners Can Unlock Clean Energy Tax Credits Under The

Inflation Reduction Act L Electric Vehicle Tax Credits GM Advisory Group

What Are The New Tax Credits In The Inflation Reduction Act Landmark

What Are The New Tax Credits In The Inflation Reduction Act Landmark

Machinists Union Pledges Support For Inflation Reduction Act IAMAW