In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses project ideas, artistic or just adding personal touches to your home, printables for free are now a vital resource. We'll dive to the depths of "Income Tax Treatment Of Insurance Claim Received," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Treatment Of Insurance Claim Received Below

Income Tax Treatment Of Insurance Claim Received

Income Tax Treatment Of Insurance Claim Received -

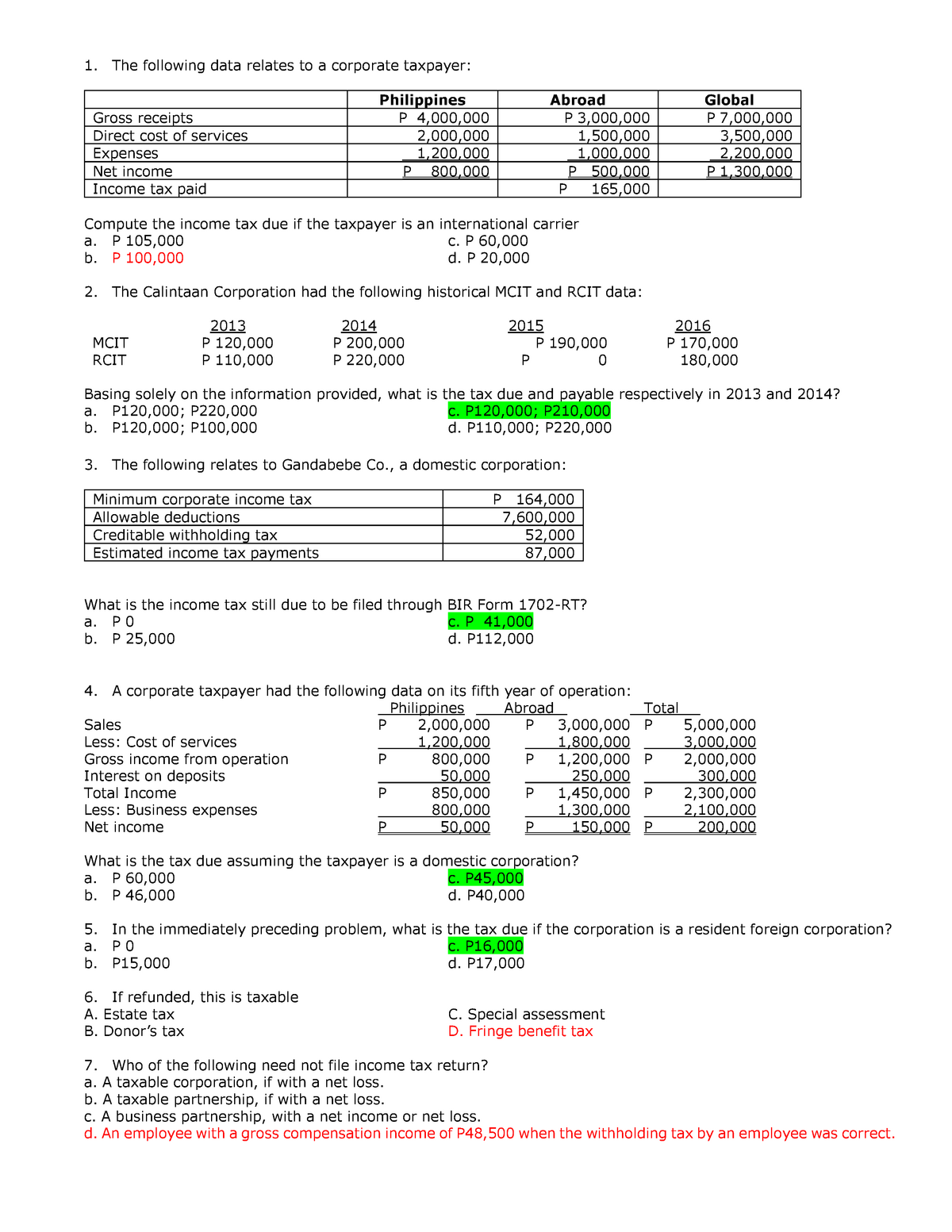

Recoveries to compensate the trader for a hole in the commercial profits either because an incoming fails to materialise or an additional outgoing is incurred and even if the compensation

Income tax tax levied on business income for individuals or companies or any other entities and it varies with their respective income or profits taxable income PAYE Employee tax a withholding tax charged on salaries income payable to employees

The Income Tax Treatment Of Insurance Claim Received are a huge range of downloadable, printable material that is available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and more. The value of Income Tax Treatment Of Insurance Claim Received lies in their versatility and accessibility.

More of Income Tax Treatment Of Insurance Claim Received

The Federal Income Tax Treatment Of Debt YouTube

The Federal Income Tax Treatment Of Debt YouTube

Money you receive as part of an insurance claim or settlement is typically not taxed The IRS only levies taxes on income which is money or payment received that results in you having more wealth than you did before

Income Tax Act Zimbabwe Zimbabwe Income Tax Act Chapter 23 06 Commenced on 1 April 1967 This is the version of this document as it was from 20 July 2018 to 19 February 2019 Note This version of the Act was revised and consolidated by the Law Development Commission of Zimbabwe

The Income Tax Treatment Of Insurance Claim Received have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: You can tailor printed materials to meet your requirements when it comes to designing invitations planning your schedule or decorating your home.

-

Education Value These Income Tax Treatment Of Insurance Claim Received can be used by students of all ages, which makes them an essential device for teachers and parents.

-

It's easy: Access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Income Tax Treatment Of Insurance Claim Received

Insurance Claim Received Taxability

Insurance Claim Received Taxability

In order to claim the input tax a registered operator must be in possession of a valid fiscal tax invoice Fiscal Tax invoice Finance Act Number 7 of 2021 amended the definition of Tax Invoice to a Fiscal Tax Invoice The effective date for the issuance of Fiscal tax invoices is 1 January 2022

An individual or HUF can claim a life insurance premium paid up to Rs 1 5 lakhs under section 80C of the Income Tax Act 1961 along with other eligible financial products

After we've peaked your curiosity about Income Tax Treatment Of Insurance Claim Received Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Treatment Of Insurance Claim Received suitable for many uses.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Income Tax Treatment Of Insurance Claim Received

Here are some new ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Treatment Of Insurance Claim Received are a treasure trove of creative and practical resources which cater to a wide range of needs and desires. Their availability and versatility make them an invaluable addition to the professional and personal lives of both. Explore the endless world of Income Tax Treatment Of Insurance Claim Received right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can print and download these tools for free.

-

Can I make use of free printables in commercial projects?

- It's dependent on the particular conditions of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations on use. Make sure you read the terms and conditions set forth by the creator.

-

How do I print Income Tax Treatment Of Insurance Claim Received?

- You can print them at home with either a printer or go to the local print shops for top quality prints.

-

What program is required to open printables at no cost?

- Many printables are offered in the format of PDF, which can be opened with free software, such as Adobe Reader.

Income Tax Treatment Of Leases July 2020 Tax Alert

.jpg)

Insurance Claim Received Journal Entry CArunway

Check more sample of Income Tax Treatment Of Insurance Claim Received below

Brazil Corporate Income Tax Treatment KPMG United States

Income Tax Treatment Of A Company s Dividend India Financial Consultancy

Tax Treatment Of Insurance Payments For Damaged Property Abacus

RR No 13 2022 Prescribes The Guidelines Procedures And Requirements

Finance Guidance On Income Tax Treatment 2020 Book Suruga ya

Beneficiary Taxed Offshore Trusts Everfair Tax

https://www.zimra.co.zw › frequently-asked-questions

Income tax tax levied on business income for individuals or companies or any other entities and it varies with their respective income or profits taxable income PAYE Employee tax a withholding tax charged on salaries income payable to employees

https://taxguru.in › income-tax › taxability...

As per section 45 1A any profit arising on receipt of claim from Insurance company on account of damage or destruction of capital asset would be treated as Capital Gain of the year in which such claim is received

Income tax tax levied on business income for individuals or companies or any other entities and it varies with their respective income or profits taxable income PAYE Employee tax a withholding tax charged on salaries income payable to employees

As per section 45 1A any profit arising on receipt of claim from Insurance company on account of damage or destruction of capital asset would be treated as Capital Gain of the year in which such claim is received

RR No 13 2022 Prescribes The Guidelines Procedures And Requirements

Income Tax Treatment Of A Company s Dividend India Financial Consultancy

Finance Guidance On Income Tax Treatment 2020 Book Suruga ya

Beneficiary Taxed Offshore Trusts Everfair Tax

Summary Of Income Tax Treatment Of COVID 19 Related Payouts Crowe

Tax Treatment Of Insurance Claims Arising From The July Riots 2022

Tax Treatment Of Insurance Claims Arising From The July Riots 2022

ToazToazASDFGDHFJGKHLKJHJGFDVSCAXSCVFGHJKILOI LUKVVSDNVKNSKK