In this digital age, with screens dominating our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons as well as creative projects or just adding personal touches to your area, Income Tax Return Home Loan Principal And Interest can be an excellent resource. Through this post, we'll take a dive in the world of "Income Tax Return Home Loan Principal And Interest," exploring their purpose, where they can be found, and how they can add value to various aspects of your lives.

Get Latest Income Tax Return Home Loan Principal And Interest Below

Income Tax Return Home Loan Principal And Interest

Income Tax Return Home Loan Principal And Interest -

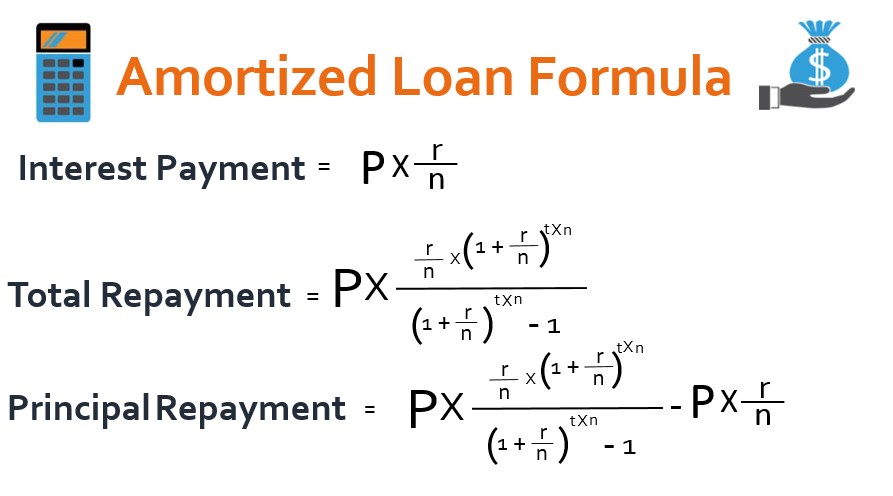

To understand the key tax benefits on a home loan we are bifurcating the repayment techniques into four major elements tax benefits on principal repaid tax benefits on interest paid deduction on pre

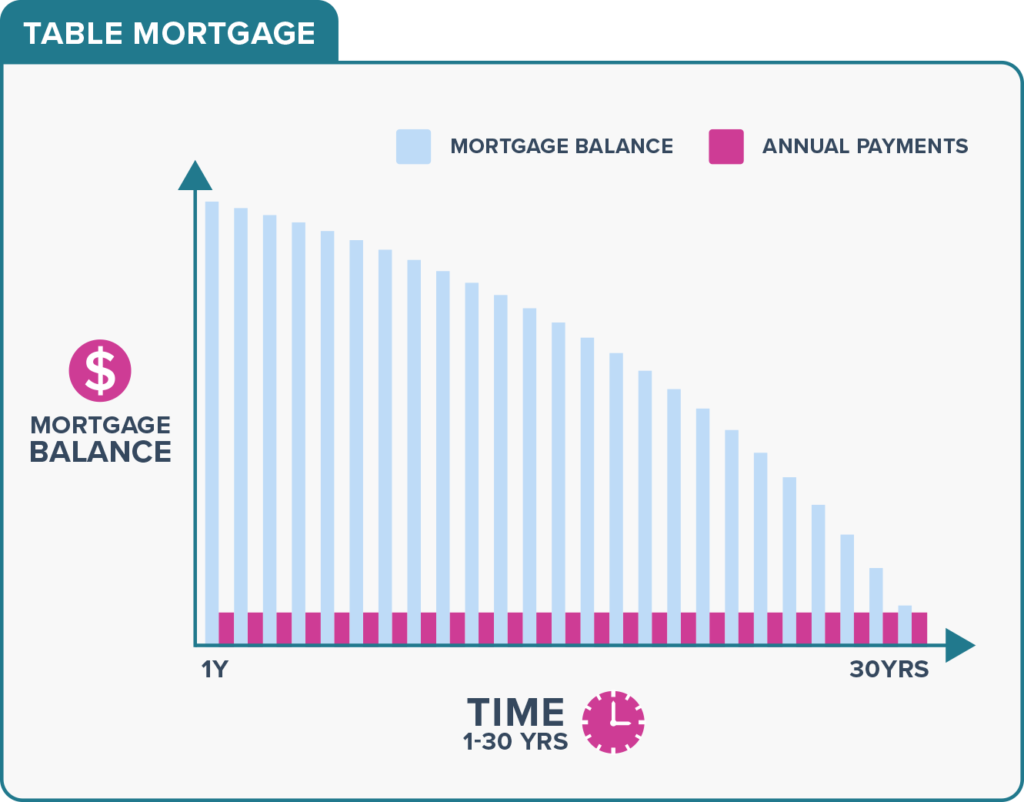

Thus the total deduction available to an individual taxpayer on the interest payment on a housing loan taken to buy an affordable house is Rs 3 5 lakh in a financial year This article is for information

Income Tax Return Home Loan Principal And Interest include a broad variety of printable, downloadable materials available online at no cost. These printables come in different types, like worksheets, templates, coloring pages, and many more. The beauty of Income Tax Return Home Loan Principal And Interest is their versatility and accessibility.

More of Income Tax Return Home Loan Principal And Interest

Ministry Of Commerce The Loan Principal And Interest Of Small Medium

Ministry Of Commerce The Loan Principal And Interest Of Small Medium

Under Section 80C Principal Repayment You can claim a deduction of up to 1 50 000 on the principal repayment In our example the principal component is

Section 80EE of the Income Tax Act deals with deductions on interest that an individual pays on home loans while purchasing a property What are the Eligibility

Income Tax Return Home Loan Principal And Interest have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages, making them an essential tool for teachers and parents.

-

It's easy: The instant accessibility to a variety of designs and templates can save you time and energy.

Where to Find more Income Tax Return Home Loan Principal And Interest

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

After we've peaked your interest in printables for free Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Income Tax Return Home Loan Principal And Interest designed for a variety needs.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching tools.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast range of topics, that includes DIY projects to party planning.

Maximizing Income Tax Return Home Loan Principal And Interest

Here are some ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Return Home Loan Principal And Interest are an abundance with useful and creative ideas for a variety of needs and desires. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the world that is Income Tax Return Home Loan Principal And Interest today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes, they are! You can download and print these free resources for no cost.

-

Are there any free printables to make commercial products?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may contain restrictions in use. Be sure to read the terms and conditions provided by the author.

-

How can I print Income Tax Return Home Loan Principal And Interest?

- You can print them at home using the printer, or go to an in-store print shop to get premium prints.

-

What software is required to open Income Tax Return Home Loan Principal And Interest?

- Most PDF-based printables are available in PDF format. They is open with no cost programs like Adobe Reader.

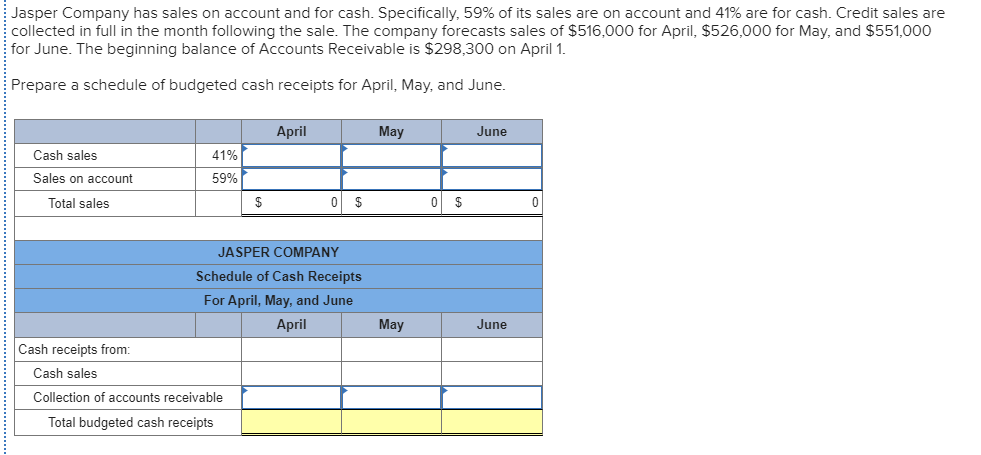

How To Calculate Interest Rate Repayments Haiper

Ministry Of Commerce The Loan Principal And Interest Of Small Medium

Check more sample of Income Tax Return Home Loan Principal And Interest below

Section 24 Of Income Tax Act Deduction For Home Loan Interest

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How Is Mortgage Interest Calculated Mortgages co nz

What Is Loan Principal And How Does It Work

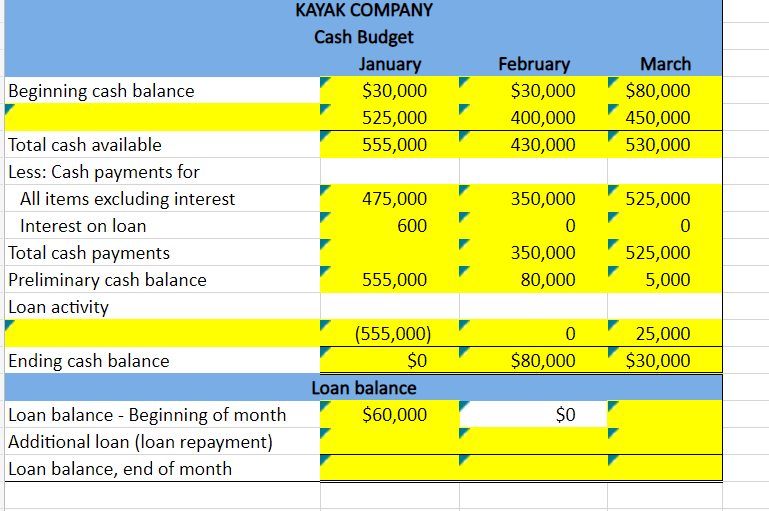

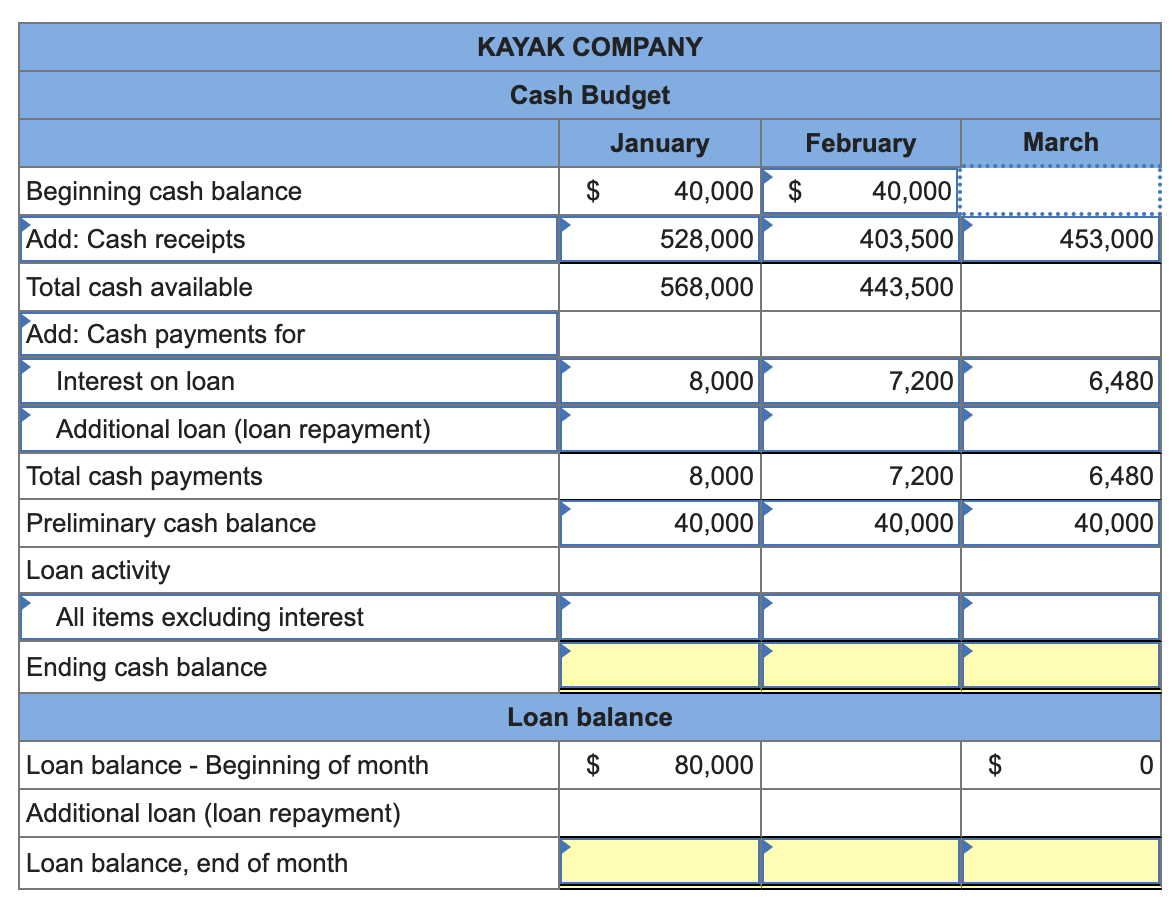

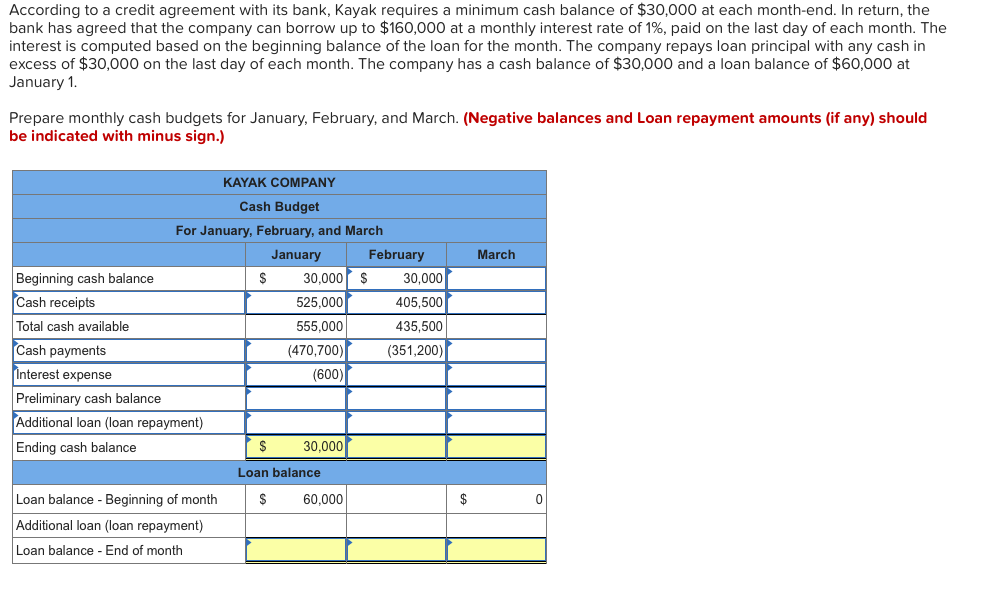

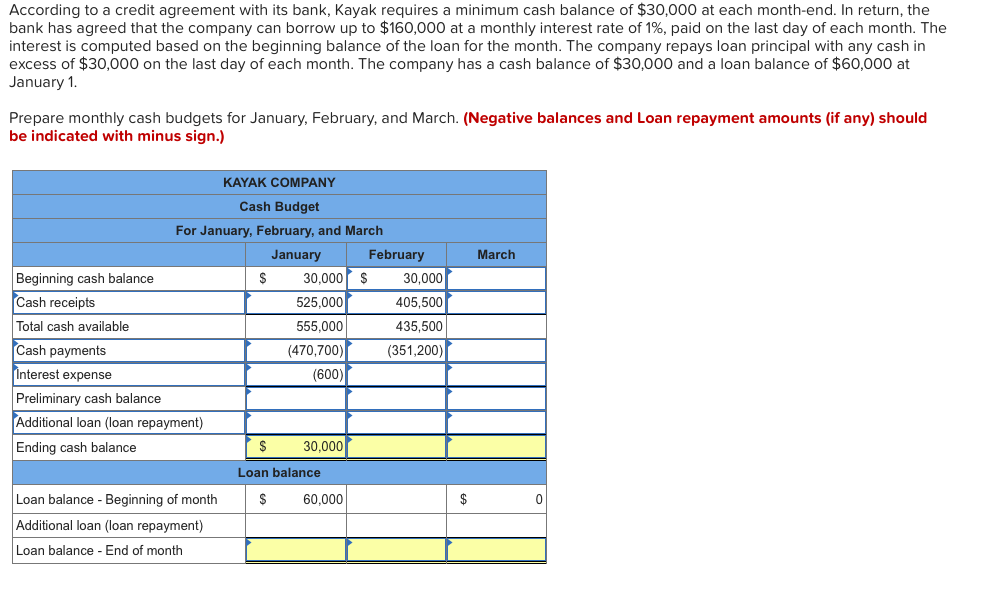

Solved Kayak Company Budgeted The Following Cash Receipts Chegg

Solved Kayak Company Budgeted The Following Cash Receipts Chegg

https://taxguru.in/income-tax/deduction-hom…

Thus the total deduction available to an individual taxpayer on the interest payment on a housing loan taken to buy an affordable house is Rs 3 5 lakh in a financial year This article is for information

https://taxguru.in/income-tax/tax-benefit-ho…

Section 80EEA Income Tax Benefit on Interest on Home Loan First Time Buyers FY 2019 20 onwards Section 80C Tax benefit on Principal amount on Home Loan The maximum tax deduction

Thus the total deduction available to an individual taxpayer on the interest payment on a housing loan taken to buy an affordable house is Rs 3 5 lakh in a financial year This article is for information

Section 80EEA Income Tax Benefit on Interest on Home Loan First Time Buyers FY 2019 20 onwards Section 80C Tax benefit on Principal amount on Home Loan The maximum tax deduction

What Is Loan Principal And How Does It Work

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Solved Kayak Company Budgeted The Following Cash Receipts Chegg

Solved Kayak Company Budgeted The Following Cash Receipts Chegg

Solved Kayak Co Budgeted The Following Cash Receipts Chegg

Solved Kayak Co Budgeted The Following Cash Receipts Chegg

Solved Kayak Co Budgeted The Following Cash Receipts Chegg

Kayak Co Budgeted The Following Cash Receipts excluding Cash Receipts