Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply adding an individual touch to the space, Income Tax Rebate Under Various Sections can be an excellent source. The following article is a dive through the vast world of "Income Tax Rebate Under Various Sections," exploring what they are, how to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Income Tax Rebate Under Various Sections Below

Income Tax Rebate Under Various Sections

Income Tax Rebate Under Various Sections - Income Tax Rebate Under Various Sections, Income Tax Deduction Under All Sections Pdf, Income Tax Rebate Under Section 87a, Income Tax Rebate Under Section 80d, Income Tax Rebate Under Section 10, Income Tax Rebate Under Section 89a, Income Tax Rebate Under Section 10(10d), Income Tax Rebate Under Section 80ddb, Income Tax Rebate Under Section 24b, Income Tax Rebate Under Section 80g

Web Income tax deductions under section 80C 80CCD 80D etc not only reduce the tax liability but also encourages savings and investments amongst taxpayers Not only in a

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Income Tax Rebate Under Various Sections encompass a wide variety of printable, downloadable materials online, at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and much more. The appealingness of Income Tax Rebate Under Various Sections lies in their versatility as well as accessibility.

More of Income Tax Rebate Under Various Sections

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Web 28 mars 2019 nbsp 0183 32 Discover the comprehensive list of income tax deductions under Sections 80C to 80U for the FY 2022 23 AY 2023 24 Optimize your tax savings with these

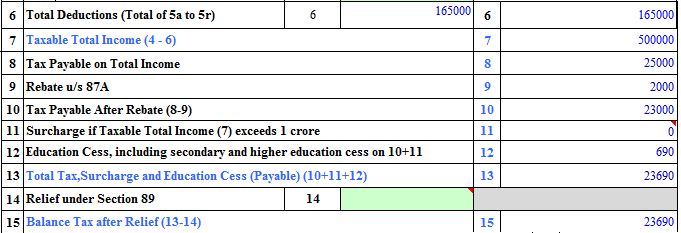

Web Income Tax Deductions Amount Under Section 24 Housing loan interest Rs 2 00 000 Under Section 87A Income tax rebate Rs 2 000 up to Rs 5 00 000 income Under

Income Tax Rebate Under Various Sections have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: You can tailor printables to fit your particular needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Impact: The free educational worksheets provide for students from all ages, making them a valuable source for educators and parents.

-

Affordability: Access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate Under Various Sections

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Web 9 sept 2023 nbsp 0183 32 Income Tax Deductions under Section 80C to 80U Updated On 07 Sep 2023 Individuals can claim tax deduction benefits for payments made towards life insurance policies fixed deposits

Web 27 d 233 c 2022 nbsp 0183 32 How to save income tax under various sections in FY 22 23 5 min read 27 Dec 2022 10 29 PM IST Vipul Das The start of the new fiscal year FY 2022 23

We've now piqued your interest in Income Tax Rebate Under Various Sections Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate Under Various Sections suitable for many reasons.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a broad variety of topics, everything from DIY projects to party planning.

Maximizing Income Tax Rebate Under Various Sections

Here are some ideas to make the most use of Income Tax Rebate Under Various Sections:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate Under Various Sections are a treasure trove of fun and practical tools designed to meet a range of needs and hobbies. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the world that is Income Tax Rebate Under Various Sections today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate Under Various Sections really cost-free?

- Yes they are! You can print and download these resources at no cost.

-

Can I utilize free printables to make commercial products?

- It's based on the conditions of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may contain restrictions regarding their use. Make sure you read the terms and conditions set forth by the author.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in the local print shop for more high-quality prints.

-

What software do I require to view printables free of charge?

- The majority are printed in the format PDF. This can be opened with free software such as Adobe Reader.

Income Tax Rebate Under Section 87A

Education Rebate Income Tested

Check more sample of Income Tax Rebate Under Various Sections below

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Income Tax Rebate Under Section 87A

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Income Tax Rebate Under Section 87A

https://www.bankbazaar.com/tax/tax-rebate.html

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

https://www.deskera.com/blog/80-deductions

Web The government has provided numerous exemptions under various sections of the Income Tax Act that can be advantageous to eligible taxpayers This article covers an in depth

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web The government has provided numerous exemptions under various sections of the Income Tax Act that can be advantageous to eligible taxpayers This article covers an in depth

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Income Tax Rebate Under Section 87A

Tax Rebate For Individual Deductions For Individuals reliefs

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2