In this digital age, where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. Whether it's for educational purposes or creative projects, or simply adding personal touches to your home, printables for free have become an invaluable source. The following article is a take a dive through the vast world of "Income Tax Rebate Under 80ccd," exploring the different types of printables, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Rebate Under 80ccd Below

Income Tax Rebate Under 80ccd

Income Tax Rebate Under 80ccd -

Section 80CCD 1 allows an individual employed in the public or private sector or a self employed person to claim a deduction for the amount contributed towards their National Pension System NPS

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for

Income Tax Rebate Under 80ccd provide a diverse range of printable, free materials online, at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Income Tax Rebate Under 80ccd

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary

Section 80CCD 2 of the Income Tax Act allows employed individuals to claim income tax deductions for employer contributions It is conditional on the following Employees in

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize designs to suit your personal needs when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners from all ages, making them a vital source for educators and parents.

-

Simple: Quick access to numerous designs and templates will save you time and effort.

Where to Find more Income Tax Rebate Under 80ccd

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Under Section 80CCD of the Income Tax Act 1961 deductions can be claimed for contributions made by employees and employers to NPS and APY How do I make a

Tax Benefits under the Corporate Sector Additional Tax Benefit is available to Subscribers under Corporate Sector u s 80CCD 2 of Income Tax Act Employer s NPS contribution

Since we've got your interest in printables for free we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Rebate Under 80ccd for various objectives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate Under 80ccd

Here are some ideas for you to get the best use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home, or even in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate Under 80ccd are a treasure trove of creative and practical resources that can meet the needs of a variety of people and interests. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the many options of Income Tax Rebate Under 80ccd today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can print and download these materials for free.

-

Can I use the free printables to make commercial products?

- It depends on the specific terms of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may come with restrictions regarding their use. Make sure you read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit an area print shop for higher quality prints.

-

What program do I need in order to open Income Tax Rebate Under 80ccd?

- Most printables come in PDF format, which is open with no cost software such as Adobe Reader.

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Check more sample of Income Tax Rebate Under 80ccd below

Deduction Under Income Tax 80CCC And 80CCD

Anything To Everything Income Tax Guide For Individuals Including

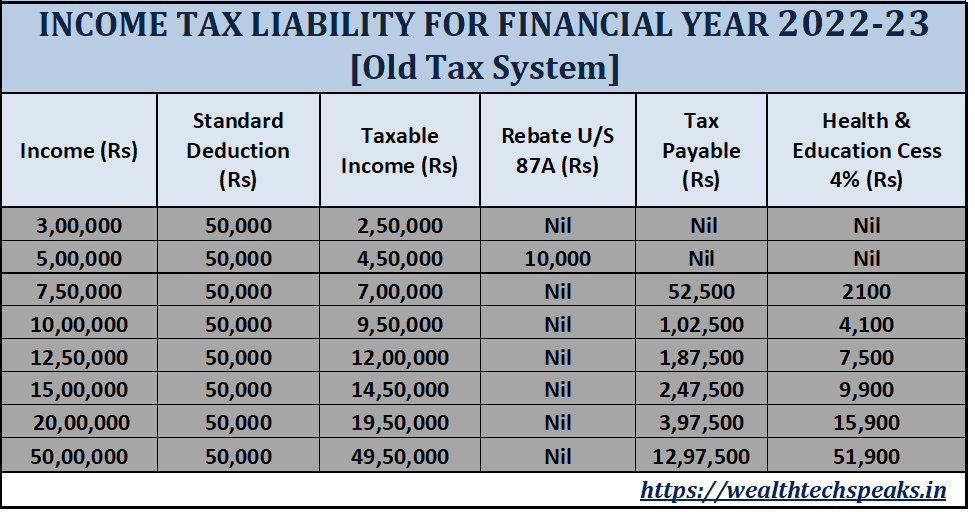

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Exemptions Still Available In New Tax Regime with English Subtitles

How To Save Tax On Additional 50 000 Income Under Section 80CCD 1B

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for

https://tax2win.in/guide/section-80ccd

Section 80CCD of the Income Tax Act Discover the key aspects of deductions under Section 80CCD 1 and 80CCD 2 of the Income Tax Act Learn

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for

Section 80CCD of the Income Tax Act Discover the key aspects of deductions under Section 80CCD 1 and 80CCD 2 of the Income Tax Act Learn

Exemptions Still Available In New Tax Regime with English Subtitles

Anything To Everything Income Tax Guide For Individuals Including

How To Save Tax On Additional 50 000 Income Under Section 80CCD 1B

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

Save Income Tax Under 80C 80D 80DD 80CCD 1B 80DDB 80GG 80EE 80E

REBATE AND RELIEFS UNDER INCOME TAX

REBATE AND RELIEFS UNDER INCOME TAX

Income Tax Rebate Under Section 87A Rebate For Financial Year GST