Today, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply adding an individual touch to the home, printables for free are now an essential resource. We'll take a dive deep into the realm of "Income Tax Rebate Section 80ee," exploring the benefits of them, where they are, and the ways that they can benefit different aspects of your daily life.

Get Latest Income Tax Rebate Section 80ee Below

Income Tax Rebate Section 80ee

Income Tax Rebate Section 80ee - Income Tax Rebate Under Section 80eea, Income Tax Rebate Under Section 80ee, Income Tax Deduction Under Section 80eea, Income Tax Deduction Under Section 80ee, Income Tax Deduction Under Section 80eeb, Income Tax Deduction U/s 80eeb, What Is Deduction Under 80ee, What Is 80ee In Itr, What Is 80ee In Income Tax

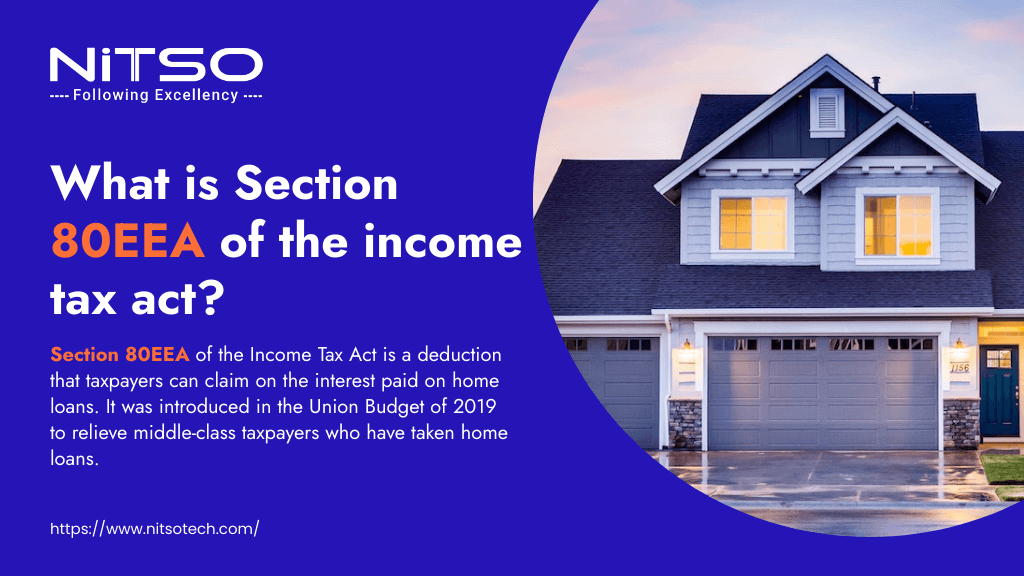

Web 5 sept 2023 nbsp 0183 32 Section 80EE Section 80EEA Property value Up to Rs 50 lakh Up to Rs 45 lakh Loan amount Up to Rs 35 lakh Not specified Loan period covered April 1

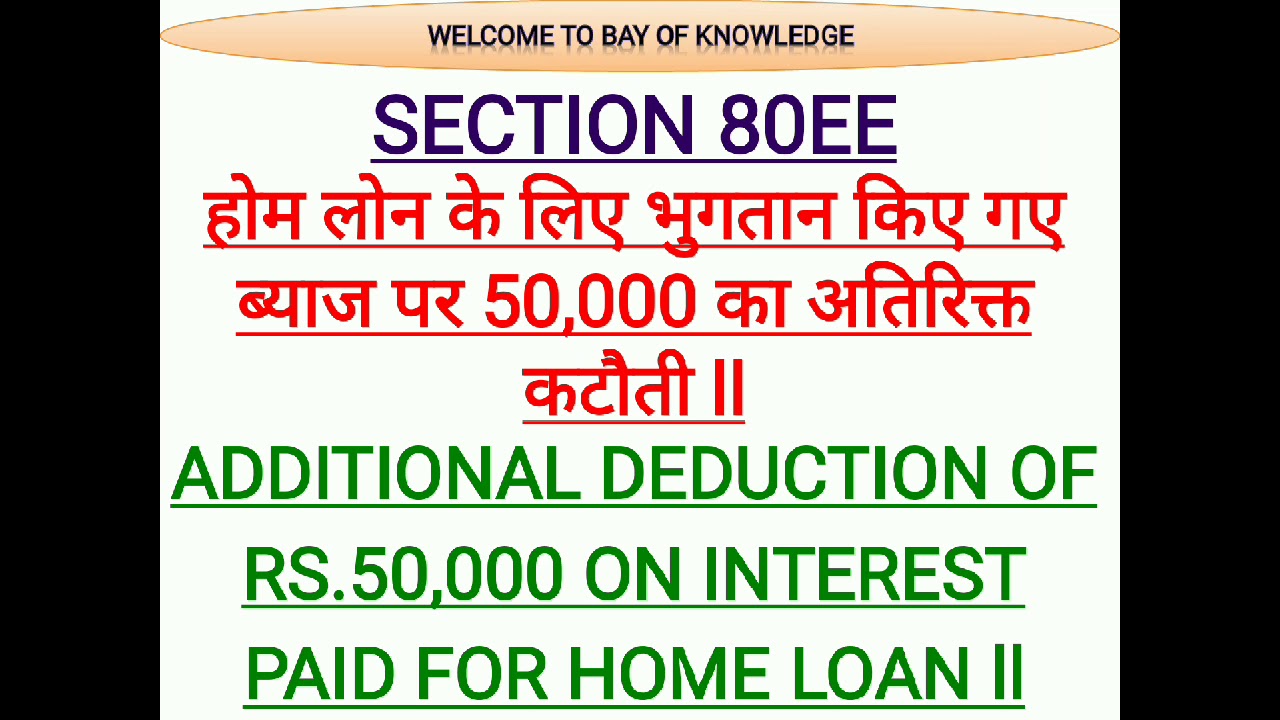

Web 20 juil 2019 nbsp 0183 32 The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year

Income Tax Rebate Section 80ee include a broad collection of printable items that are available online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and much more. One of the advantages of Income Tax Rebate Section 80ee is in their versatility and accessibility.

More of Income Tax Rebate Section 80ee

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Web 9 juil 2019 nbsp 0183 32 Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the

Income Tax Rebate Section 80ee have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the design to meet your needs such as designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge are designed to appeal to students of all ages. This makes these printables a powerful instrument for parents and teachers.

-

The convenience of immediate access many designs and templates helps save time and effort.

Where to Find more Income Tax Rebate Section 80ee

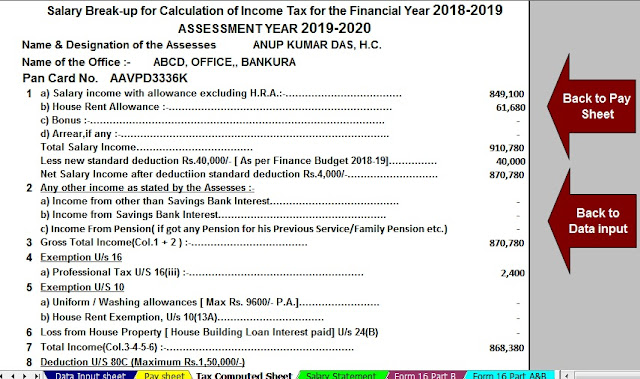

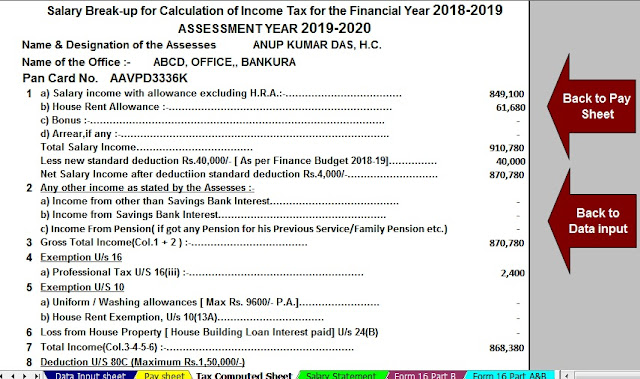

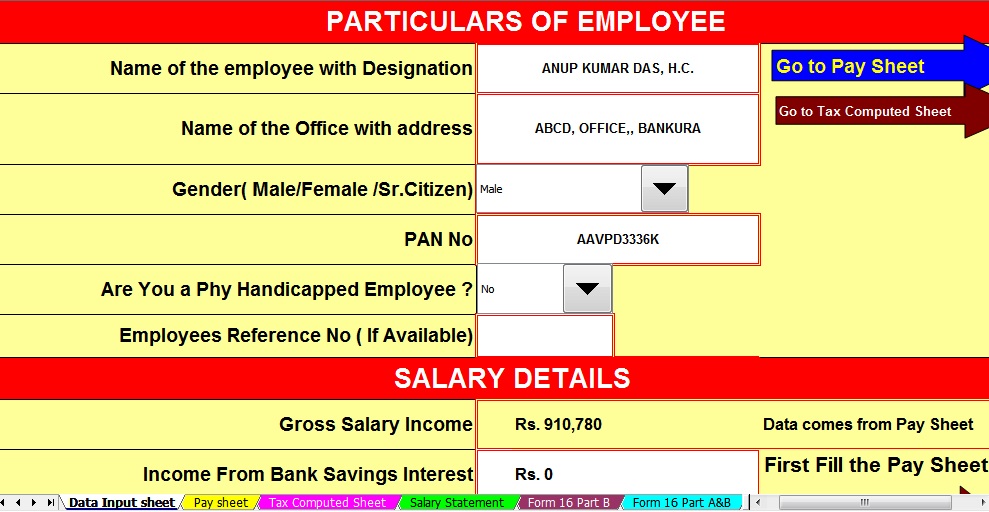

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Web 11 janv 2023 nbsp 0183 32 By Sunita Mishra January 11 2023 Home loan tax benefits in 2023 The government offers various tax rebates especially if the property has been purchased using a home loan to make property purchases

Web Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on home loan The maximum

In the event that we've stirred your interest in Income Tax Rebate Section 80ee, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Rebate Section 80ee for various needs.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate Section 80ee

Here are some inventive ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate Section 80ee are an abundance of practical and imaginative resources designed to meet a range of needs and passions. Their access and versatility makes them a wonderful addition to both professional and personal lives. Explore the many options of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes you can! You can download and print the resources for free.

-

Can I make use of free printables for commercial use?

- It's based on the terms of use. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright concerns with Income Tax Rebate Section 80ee?

- Certain printables could be restricted in their usage. Make sure you read the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- Print them at home with printing equipment or visit an in-store print shop to get high-quality prints.

-

What program do I need in order to open printables at no cost?

- The majority are printed in the format of PDF, which can be opened with free programs like Adobe Reader.

Section 80EE Of The Income Tax Act

Section 80EEA Deduction For Interest Paid On Affordable Home Loan

Check more sample of Income Tax Rebate Section 80ee below

Deduction U s 80C To 80 U Part 10 In Tamil deductionu s80ee

Section 80EE Additional Deduction Upto 50000 Of Home Loan Interest

SECTION 80EE SECTION 80EE OF INCOME TAX ACT DEDUCTION UNDER SECTION

Income Tax Section 80EE Wage Expense Conclusion For Enthusiasm On Home

Deduction Under Section 80EEA Of The Income Tax Act 2019

Section 80DD 80U 80DDB 80E 80EE 80EEA 80EEB 80G Deductions In

https://tax2win.in/guide/section-80ee

Web 20 juil 2019 nbsp 0183 32 The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year

https://housing.com/news/section-80ee-inco…

Web Section 80EE of the Income Tax Act allows additional benefits for first time home buyers in India if they borrow funds from a bank to purchase a

Web 20 juil 2019 nbsp 0183 32 The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year

Web Section 80EE of the Income Tax Act allows additional benefits for first time home buyers in India if they borrow funds from a bank to purchase a

Income Tax Section 80EE Wage Expense Conclusion For Enthusiasm On Home

Section 80EE Additional Deduction Upto 50000 Of Home Loan Interest

Deduction Under Section 80EEA Of The Income Tax Act 2019

Section 80DD 80U 80DDB 80E 80EE 80EEA 80EEB 80G Deductions In

Section 80EE Of Income Tax Act 1961 Know How Can It Help You

Live Fill Section 80EA 80EE In Income Tax Return Claim Deduction

Live Fill Section 80EA 80EE In Income Tax Return Claim Deduction

Income Tax Section 80EE Wage Expense Conclusion For Enthusiasm On Home