In the digital age, with screens dominating our lives yet the appeal of tangible printed material hasn't diminished. If it's to aid in education for creative projects, simply to add an individual touch to the home, printables for free can be an excellent source. We'll take a dive to the depths of "Income Tax Rebate On Interest Of House Building Advance," exploring the different types of printables, where they can be found, and how they can improve various aspects of your lives.

Get Latest Income Tax Rebate On Interest Of House Building Advance Below

Income Tax Rebate On Interest Of House Building Advance

Income Tax Rebate On Interest Of House Building Advance -

Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get tax benefits

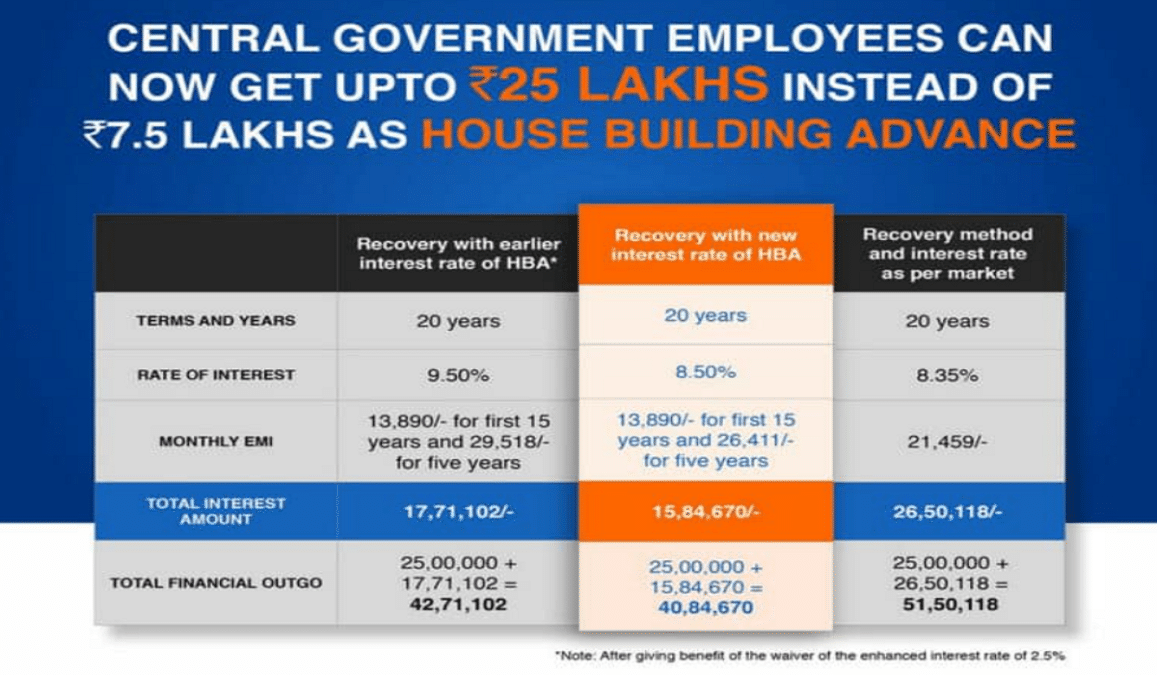

Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

Printables for free include a vast collection of printable materials online, at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages, and more. The appeal of printables for free lies in their versatility and accessibility.

More of Income Tax Rebate On Interest Of House Building Advance

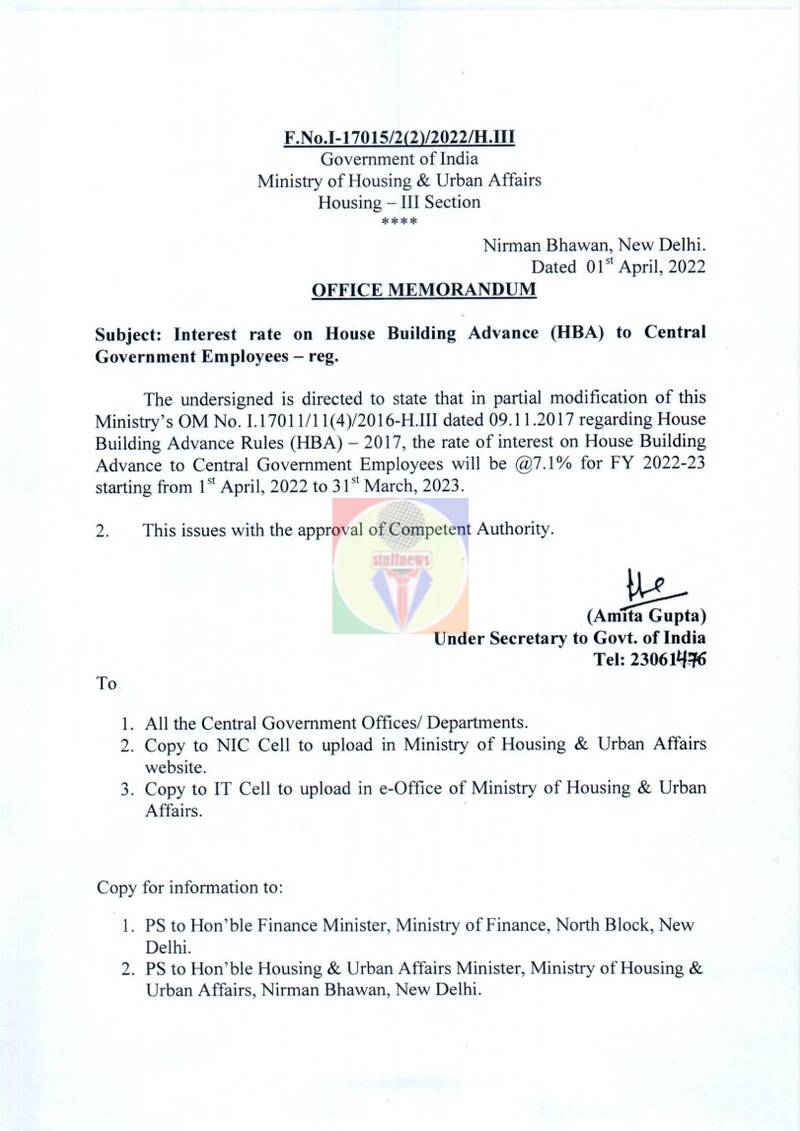

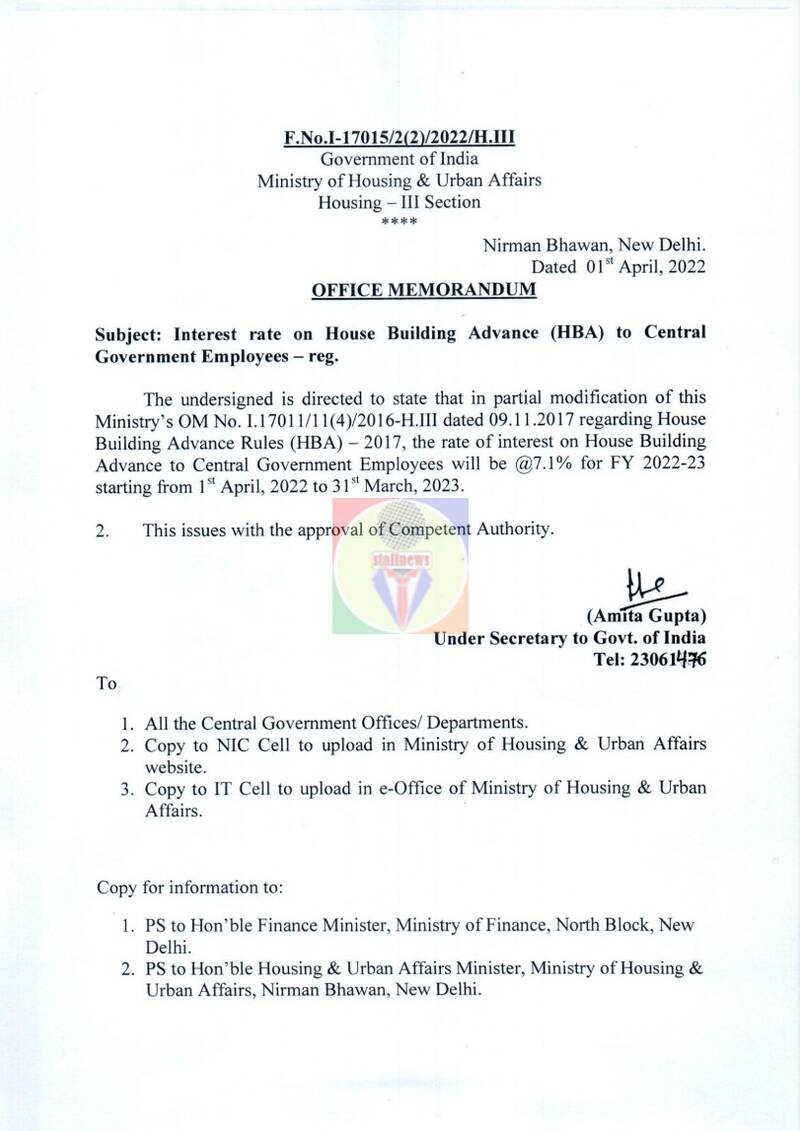

Interest Rate On House Building Advance HBA For FY 2022 23 Starting

Interest Rate On House Building Advance HBA For FY 2022 23 Starting

Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to Rs

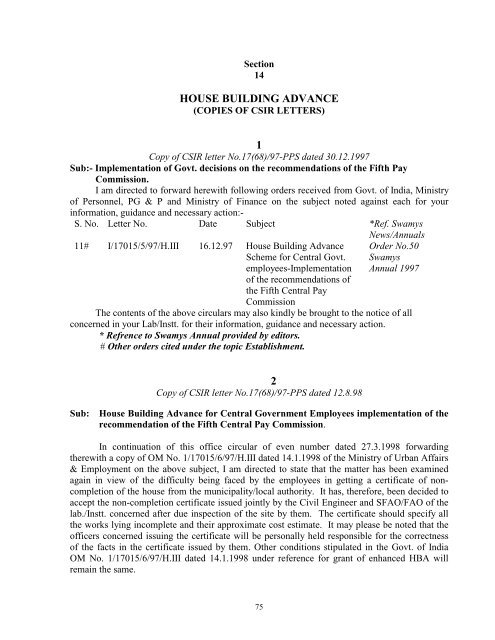

Web g The rates of interest on house building cases sanctioned after 1 6 1981 will be as under i 7 per annum for advances up to Rs 25 000 ii 81 2 per annum for

The Income Tax Rebate On Interest Of House Building Advance have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: You can tailor printables to your specific needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages, making them a vital source for educators and parents.

-

Convenience: immediate access a myriad of designs as well as templates saves time and effort.

Where to Find more Income Tax Rebate On Interest Of House Building Advance

House Building Advance Scheme 2021 For Central Government Employees

House Building Advance Scheme 2021 For Central Government Employees

Web 30 ao 251 t 2022 nbsp 0183 32 For example if you are availing of an interest benefit of Rs 1 80 000 on the home loan amount and also you are paying interest on home improvement loan

Web MEMORANDUM Sub Clarification regarding income tax treatment on interest on House Building Advance taken from Government It has been observed that some DDOs are

Since we've got your interest in Income Tax Rebate On Interest Of House Building Advance We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Income Tax Rebate On Interest Of House Building Advance for a variety needs.

- Explore categories such as interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning tools.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing Income Tax Rebate On Interest Of House Building Advance

Here are some creative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Interest Of House Building Advance are an abundance of fun and practical tools designed to meet a range of needs and pursuits. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the many options of Income Tax Rebate On Interest Of House Building Advance today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes you can! You can print and download these resources at no cost.

-

Can I make use of free printables in commercial projects?

- It is contingent on the specific rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may come with restrictions regarding usage. Be sure to read the terms and conditions offered by the designer.

-

How do I print Income Tax Rebate On Interest Of House Building Advance?

- You can print them at home with any printer or head to a print shop in your area for more high-quality prints.

-

What program will I need to access printables free of charge?

- The majority of printed documents are in the format PDF. This is open with no cost software like Adobe Reader.

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Check more sample of Income Tax Rebate On Interest Of House Building Advance below

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Interest Rate On House Building Advance HBA To Central Government

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate Under Section 87A

Latest Income Tax Rebate On Home Loan 2023

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.bankbazaar.com/tax/7th-cpc-house-building-advance.html

Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

https://www.apteachers.in/2013/12/it-exemptions-house-building-loan.h…

Web 1 avr 1999 nbsp 0183 32 Claiming Exemption for House Building Loan Repayment and Interest on Housing Loan in Income Tax Conditions for Claim of Deduction of Interest on Borrowed

Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

Web 1 avr 1999 nbsp 0183 32 Claiming Exemption for House Building Loan Repayment and Interest on Housing Loan in Income Tax Conditions for Claim of Deduction of Interest on Borrowed

Income Tax Rebate Under Section 87A

Interest Rate On House Building Advance HBA To Central Government

Latest Income Tax Rebate On Home Loan 2023

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

HOUSE BUILDING ADVANCE 1 2 CSIR

Individual Income Tax Rebate

Individual Income Tax Rebate

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood