Today, with screens dominating our lives, the charm of tangible printed materials isn't diminishing. For educational purposes such as creative projects or simply to add an individual touch to the area, Income Tax Rebate On House Loan Repayment are now a vital source. Through this post, we'll take a dive through the vast world of "Income Tax Rebate On House Loan Repayment," exploring their purpose, where they can be found, and how they can enrich various aspects of your daily life.

Get Latest Income Tax Rebate On House Loan Repayment Below

Income Tax Rebate On House Loan Repayment

Income Tax Rebate On House Loan Repayment - Income Tax Exemption For Housing Loan Repayment, Income Tax Rebate On Home Loan Rules, Maximum Tax Rebate On Home Loan, Home Loan Repayment Income Tax Benefits, Tax Benefit On Home Loan Repayment, How To Calculate Tax Rebate On Home Loan

Web 31 mai 2022 nbsp 0183 32 How to Claim Tax Benefits for Home Loan Repayment You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your

Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal

Income Tax Rebate On House Loan Repayment include a broad assortment of printable materials available online at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and many more. The appeal of printables for free is their versatility and accessibility.

More of Income Tax Rebate On House Loan Repayment

Section 24 Income Tax Benefit Of A Housing Loan OneMint

Section 24 Income Tax Benefit Of A Housing Loan OneMint

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Web Tax Rebate on a Home Loan that Can be Availed u s 80C For self occupied and also let out properties you are allowed to claim up to a maximum of 1 5 lakhs every year from a taxable income on principal

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: This allows you to modify printed materials to meet your requirements be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes them a great source for educators and parents.

-

The convenience of You have instant access many designs and templates can save you time and energy.

Where to Find more Income Tax Rebate On House Loan Repayment

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Web 4 mars 2023 nbsp 0183 32 ITR filing Income tax exemption from long term capital gains is not available in respect of repayment of a home loan A taxpayer can claim deduction under Section

Web 20 f 233 vr 2020 nbsp 0183 32 As the repayment comprises of 2 different components the tax benefit on home loan is governed by different sections of the Income Tax Act and these are claimed as tax deductions under different

We've now piqued your interest in printables for free Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Income Tax Rebate On House Loan Repayment for different needs.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate On House Loan Repayment

Here are some unique ways of making the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets for teaching at-home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Rebate On House Loan Repayment are a treasure trove of practical and imaginative resources that cater to various needs and passions. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection of Income Tax Rebate On House Loan Repayment and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can print and download these documents for free.

-

Can I use free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions in their usage. Check the terms and regulations provided by the author.

-

How do I print Income Tax Rebate On House Loan Repayment?

- You can print them at home using any printer or head to a print shop in your area for premium prints.

-

What software will I need to access printables at no cost?

- Most PDF-based printables are available in the format PDF. This is open with no cost software like Adobe Reader.

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Check more sample of Income Tax Rebate On House Loan Repayment below

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Home Loan Tax Benefit Calculator FrankiSoumya

INCOME TAX REBATE ON HOME LOAN

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

DEDUCTION UNDER SECTION 80C TO 80U PDF

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Home Loan Tax Benefit Calculator FrankiSoumya

DEDUCTION UNDER SECTION 80C TO 80U PDF

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

ING Home Loan Repayment Calculator

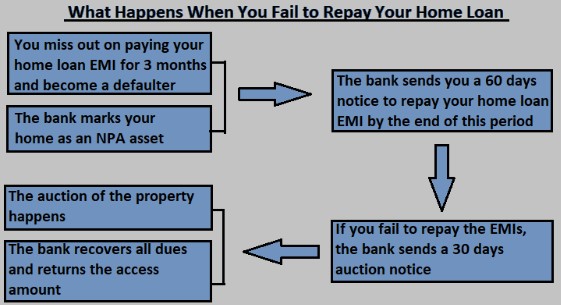

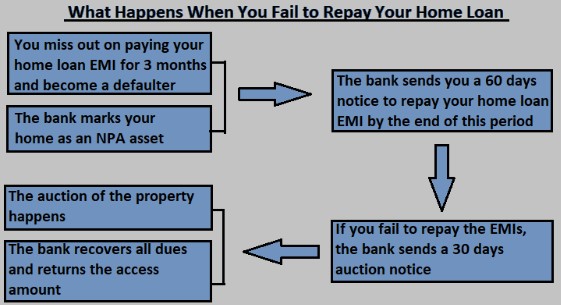

What Happens If You Fail To Repay Your Home Loan Home Loan Repayment

What Happens If You Fail To Repay Your Home Loan Home Loan Repayment

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank