In this age of technology, where screens rule our lives however, the attraction of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons and creative work, or simply to add an individual touch to the area, Income Tax Rebate For Donations India have become an invaluable resource. This article will dive into the sphere of "Income Tax Rebate For Donations India," exploring the benefits of them, where to get them, as well as how they can add value to various aspects of your daily life.

Get Latest Income Tax Rebate For Donations India Below

Income Tax Rebate For Donations India

Income Tax Rebate For Donations India - Income Tax Deduction For Charitable Donations India, Is Donation To Unicef Tax Deductible In India, Income Tax Relief For Donation

Web 7 sept 2021 nbsp 0183 32 Note that depending on the gross total income of a taxpayer donations made to certain organisations could also be restricted to an upper threshold for claiming

Web 5 juil 2021 nbsp 0183 32 Donation up to Rs 2 000 can be made in cash but any amount above that must be made through cheque bank transfer etc Limits A deduction of 50 or 100 of

The Income Tax Rebate For Donations India are a huge range of printable, free materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages and more. The beauty of Income Tax Rebate For Donations India lies in their versatility as well as accessibility.

More of Income Tax Rebate For Donations India

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

Web 28 d 233 c 2020 nbsp 0183 32 Whenever someone donates to a charity they become eligible for Tax benefits under Section 80G of Income Tax Act However there are a few things one should keep in mind to become eligible for

Web Donations made to World Vision India are eligible for tax deductions under Section 80G of the Income Tax Act It has been granted an 80G certificate by the Indian Income Tax

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printables to your specific needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Printables for education that are free can be used by students of all ages. This makes them a great resource for educators and parents.

-

Accessibility: Fast access a plethora of designs and templates reduces time and effort.

Where to Find more Income Tax Rebate For Donations India

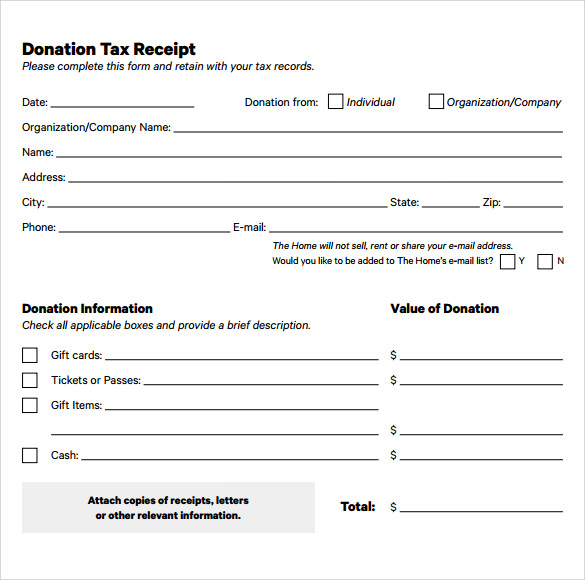

7 Donation Receipt Templates And Their Uses

7 Donation Receipt Templates And Their Uses

Web All donations are not treated equally under Income Tax Act Donations to certain funds and institutions qualify for 100 or 50 deduction without any qualifying limit On the other hand certain donations qualify for 100 or

Web 9 f 233 vr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 is an important section as it allows individuals and organizations to claim a deduction or rebate on the donation which they

If we've already piqued your interest in printables for free and other printables, let's discover where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Income Tax Rebate For Donations India for a variety purposes.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate For Donations India

Here are some creative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate For Donations India are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and passions. Their accessibility and versatility make these printables a useful addition to your professional and personal life. Explore the endless world of Income Tax Rebate For Donations India to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I utilize free templates for commercial use?

- It's based on the rules of usage. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with Income Tax Rebate For Donations India?

- Some printables could have limitations regarding their use. You should read the terms and regulations provided by the creator.

-

How do I print printables for free?

- Print them at home using a printer or visit a print shop in your area for superior prints.

-

What program do I need in order to open printables that are free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software such as Adobe Reader.

Random Thoughts Does Donating Money Actually Save You More Money From

Tax Rebate Digital Tax Filing Taxes Tax Services

Check more sample of Income Tax Rebate For Donations India below

2007 Tax Rebate Tax Deduction Rebates

Donation Receipt Templates Artofit

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

https://economictimes.indiatimes.com/wealth/tax/what-are-income-tax...

Web 5 juil 2021 nbsp 0183 32 Donation up to Rs 2 000 can be made in cash but any amount above that must be made through cheque bank transfer etc Limits A deduction of 50 or 100 of

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Web 5 juil 2021 nbsp 0183 32 Donation up to Rs 2 000 can be made in cash but any amount above that must be made through cheque bank transfer etc Limits A deduction of 50 or 100 of

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Donation Receipt Templates Artofit

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Daily current affairs

Daily current affairs

Free Download Income Tax All In One TDS On Salary For Govt Non Govt